Tullett Prebon PLC Business Update (3764N)

January 29 2016 - 2:00AM

UK Regulatory

TIDMTLPR

RNS Number : 3764N

Tullett Prebon PLC

29 January 2016

29 January 2016

Tullett Prebon plc

Business Update

Tullett Prebon plc (the "Company") is today issuing a business

update in relation to November and December 2015 and the full year

ended 31 December 2015.

In the last two months of 2015 market activity in some

traditional interdealer product areas was higher than experienced

in the same period a year ago. The increased level of activity

experienced throughout the year in the oil and related products

markets has continued, and market volumes in equity products has

also picked up relative to the prior year.

The performance of PVM Oil Associates Limited and its

subsidiaries ("PVM"), which was acquired in November 2014, has

continued to be strong. PVM's main activities are in crude oil and

petroleum products, and the business has continued to benefit from

the pick-up in the level of activity in the oil and related

products markets reflecting the significant changes in the oil

price experienced since the start of the second half of 2014.

Revenue in the two months of November and December of GBP125m

was 14% higher than reported for the same period in 2014. Excluding

PVM, revenue in the two months of November and December was 4%

higher at constant exchange rates than in the same period in

2014.

Full year revenue of GBP796m in 2015 was 13% higher than the

GBP704m reported for 2014. Excluding PVM, full year revenue in 2015

was 2% lower at constant exchange rates than in 2014, and was 1%

lower than the GBP696m reported for 2014.

The 2015 full year underlying operating profit margin is now

expected to be higher than previously indicated, at around

13.5%.

As previously announced, actions have been taken to reduce

headcount and fixed costs in the product areas most affected by the

reduction in market volumes experienced during the year. These

actions are expected to result in a reduction of around 7.5% in the

front office headcount in the traditional interdealer product areas

in Europe and North America. The cost of the actions taken in 2015

is estimated to be around GBP25m which will be charged as an

exceptional item in the 2015 accounts. A further charge of less

than GBP10m is expected to be made in the first half of 2016

relating to actions that will be taken as part of this

programme.

The 2015 figures included above are unaudited. As previously

announced, the Company will issue its preliminary results for the

year ended 31 December 2015 on Tuesday, 1 March 2016.

Enquiries:

Paul Mainwaring

Finance Director, Tullett Prebon plc

Direct: +44 (0)20 7200 7995

Email: pmainwaring@tullettprebon.com

Stephen Breslin

Group Head of Communications, Tullett Prebon plc

Direct: +44(0)20 7200 7750

Email: sbreslin@tullettprebon.com

Craig Breheny

Brunswick Group LLP

Direct: +44(0)20 7396 7429

Email: cbreheny@brunswickgroup.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCSEMFUAFMSEEF

(END) Dow Jones Newswires

January 29, 2016 02:00 ET (07:00 GMT)

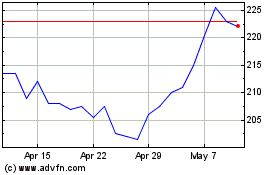

Tp Icap (LSE:TCAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

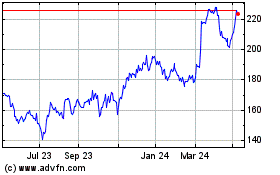

Tp Icap (LSE:TCAP)

Historical Stock Chart

From Apr 2023 to Apr 2024