TIDMTLPR

RNS Number : 3712J

Tullett Prebon PLC

02 April 2015

2 April 2015

Tullett Prebon plc 2014 Annual Report

Tullett Prebon plc ("the Company") has today published its 2014

Annual Report and circular to shareholders incorporating the Notice

of the 2015 Annual General Meeting. Both documents can be viewed at

or downloaded from www.tullettprebon.com.

Copies of both these documents, together with the Form of Proxy,

have been submitted to the UK Listing Authority's Document Viewing

Facility via the National Storage Mechanism and will shortly be

available for inspection at www.Hemscott.com/nsm.do.

The following disclosures comply with Disclosure and

Transparency Rule 6.3.5. The Company's full year results

announcement of 3 March 2015 contained a management report and

condensed financial information derived from the Group's audited

statutory accounts. A description of risks and uncertainties,

details of related party transactions and the Directors'

Responsibility Statement, extracted in full unedited text from the

2014 Annual Report, are set out below. This information should be

read in conjunction with, and not as a substitute for, reading the

full 2014 Annual Report. Page numbers and notes in the following

appendices refer to page numbers and notes in the Company's 2014

Annual Report.

Principal Risks

The Group's Risk Assessment Framework categorises the risks

faced by the Group into nine risk categories: Market Risk, Credit

Risk, Operational Risk, Strategic and Business Risk, Governance

Risk, Regulatory, Legal and Human Resources Risk, Reputational

Risk, Liquidity Risk and Other Financial Risks.

MarketRisk

Market risk is the vulnerability of the Group to movements in

the value of financial instruments. The Group does not take trading

risk and does not hold proprietary trading positions. Consequently,

the Group is exposed to Market Risk only in relation to incidental

positions in financial instruments arising as a result of the

Group's failure to match clients' orders precisely. Such positions

are valued and measured from trade date on a daily mark-to-market

basis.

The Group's risk management policies reduce the likelihood of

such trade mismatches and, in the event that they arise, the

Group's policy is to close out such balances immediately. All

Market Risk arising across the Group is identified and monitored on

a daily basis.

Credit Risk

The Credit Risk faced by the Group consists of counterparty

credit risk (as opposed to issuer risk), and principally arises

from the following:

-- pre-settlement risk arising from Matched Principal broking;

-- settlement risk arising from Matched Principal broking;

-- cash deposits held at banks and money market instruments; and

-- Name Passing brokerage receivables.

In addition to each individual element of counterparty risk

identified above, the Group is also exposed to concentration risk.

This is where the Group becomes overly exposed to these credit

exposures in the aggregate either to an individual counterparty or

to a group of linked counterparties.

Pre-settlement risk

Pre-settlement risk arises in the Matched Principal broking

business in which Group subsidiaries interpose themselves as

principal between two (or more) contracting parties to a Matched

Principal transaction and as a result the Group is at risk of loss

should one of the parties to a transaction default on its

obligations prior to settlement date. In the event of default, the

Group would have to replace the defaulted contract in the market.

This is a contingent risk in that the Group will only suffer loss

if the market price of the securities has moved adversely to the

original trade price.

Counterparty exposures are kept under constant review and the

Group takes steps to reduce counterparty risk where market

conditions require. Particular attention is paid to more illiquid

markets where the price movement is more volatile, such as broking

in GDR, ADR and emerging markets instruments.

The Group is also exposed to short term pre-settlement risk

where it acts as an executing broker on an exchange, during the

period between the execution of the trade and the client claiming

the trade. This exposure is minimal as under the terms of the

'give-up' agreements the Group has in place with its clients,

trades must be claimed by the end of trade day. Once the trade has

been claimed, the Group's only exposure to the client is for the

invoiced receivables.

Settlement risk

Settlement risk is the risk that on settlement date a

counterparty defaults on its contractual obligation to make payment

for a securities transaction after the corresponding value has been

paid away by the Group. Unlike pre-settlement risk, the exposure is

to the full principal value of the transaction.

In practice the Group is not exposed to this risk as settlement

is almost invariably effected on a Delivery versus Payment basis.

Free of payment deliveries (where an immediate exposure arises due

to the Group's settling its side of the transaction without

simultaneous receipt of the counter-value) occur very infrequently

and only under the application of stringent controls.

Cash deposits

The Group is exposed to counterparty Credit Risk in respect of

cash deposits held with financial institutions. The vast majority

of the Group's cash deposits are held with highly rated clearing

banks and settlement organisations (as set out in the Credit Risk

analysis in Note 25 to the Consolidated Financial Statements).

As with trading counterparties, cash deposit counterparty

exposures and limits are kept under review and steps are taken to

reduce counterparty risk where market conditions require.

Name Passing brokerage receivables

The majority of transactions brokered by the Group are on a Name

Passing basis, where the Group acts as agent in arranging the trade

and is not a counterparty to the transaction. Whilst the Group does

not suffer any exposure in relation to the underlying instrument

brokered (given that the Group is not a principal to the trade), it

is exposed to the risk that the client fails to pay the brokerage

it is charged.

Receivables arising from Name Passing brokerage are closely

monitored by senior management.

Concentration risk

The possibility of concentration risk exists in the level of

exposure to counterparties. The Group controls its credit exposure

to counterparties and groups of linked counterparties through the

application of a system of counterparty credit limits based on the

mark-to-market exposure for Matched Principal trades, outstanding

brokerage receivables for Name Passing trades, and amount on

deposit for cash deposit exposure. Credit departments also monitor

exposures across country groupings, credit rating, and types of

counterparty.

Operational Risk

Operational Risk is the risk of loss resulting from inadequate

or failed internal processes, people activities, systems or

external events. Operational Risk covers a wide and diverse range

of risk types, and the overall objective of the Group's approach to

Operational Risk management is not to attempt to avoid all

potential risks, but to proactively identify and assess risks and

risk situations in order to manage them in an efficient and

informed manner. Examples of Operational Risk include:

-- IT systems failures, breakdown in security or loss of data integrity;

-- failure or disruption of a critical business process, through

internal or external error or event;

-- failure or withdrawal of settlement and clearing systems,

-- events preventing access to premises, telecommunications

failures or loss of power supply which interrupt business

activities; and

-- broker errors.

Strategic and Business Risk

The Group operates in an environment characterised by intense

competition, rapid technological change and a continually evolving

regulatory framework. Failure to adapt to changing market dynamics,

customer requirements or the way OTC markets and their participants

are regulated constitutes a significant long term risk. The Group

has identified four principal categories of Strategic and Business

Risk:

-- direct regulatory risk;

-- indirect regulatory risk;

-- lower market activity risk; and

-- commercial risk.

Direct regulatory risk

The risk of new regulations imposing a fundamental change to the

structure or activity of financial markets, resulting in a reduced

role for IDBs. Specific issues could include an inability of the

business to provide electronic platforms or market facilities which

are compliant with new regulations or the obligation to hold

punitive levels of regulatory capital.

Indirect regulatory risk

The risk of a fundamental change to the commercial environment

due to the impact on clients of changes to their regulatory

environment causing significantly reduced trade volumes. This could

include increased execution and clearing costs, onerous collateral

requirements or increases in regulatory capital requirements, or a

prohibition on certain types of trading activity.

Lower market activity risk

The risk that the Group experiences a sustained period of low

market activity leading to reduced revenues. This could arise as a

result of adverse macro-economic conditions, reduced levels of

general banking activity, market uncertainty or lack of

volatility.

Commercial risk

The risk of significant or fundamental changes to the commercial

or competitive environment, whether due to client requirements or

competitor activity.

The markets in which the Group competes are characterised by

rapidly changing technology, evolving customer demand and uses of

services, and the potential emergence of new industry standards and

practices. Such changes may increase the risk that the Group faces

additional costs or barriers to entry to markets that its

competitors do not experience. New entrants or new methods of

delivering broking services may gain first mover advantage that the

Group may not be able to respond to in a timely manner.

The Group competes with other interdealer brokers for staff. The

costs of employing front office broking staff is currently the

largest cost faced by the Group. The effect of the competition for

broking staff can result in an increase in staff costs, or if staff

leave the Group, can result in the loss of capability, customer

relationships and expertise.

Consolidation within the industry or integration with adjacent

sectors may provide competing firms or platforms with advantages of

scale, access to wider pools of liquidity, or service capability

that may put the Group at a competitive disadvantage.

The Group seeks to manage and mitigate its commercial risk by

following a clearly defined business development strategy,

geographic and product diversification and strong client

relationship management.

Commercial risk also includes the risk that the Group is unable

to respond to market demand for electronic broking solutions and

loses market share as a result. The Group seeks to address this

risk through continued development and enhancement of its

electronic broking capability, to ensure that it can offer a

competitive solution for all major asset classes.

Governance Risk

Governance Risk is the risk of loss or damage to the business

arising as a result of a failure of management structures or

processes. This includes failure to adhere to applicable corporate

governance requirements (such as those recommended by the UK

Corporate Governance Code), a failure to ensure adequate succession

to key management positions, or the inappropriate use of authority

and influence by current or former senior members of staff.

The risk of accounting error or fraud is mitigated by the strong

control environment which exists within the Group, in particular

the involvement of the Audit Committee, the Internal Audit function

and the Group Treasury and Risk Committee. Succession planning

within the Group is overseen by the Board.

Regulatory, Legal and Human Resource Risk

This risk concerns the potential loss of value due to regulatory

enforcement action (such as for breaches of conduct of business

requirements or market abuse provisions); the possible costs and

penalties associated with litigation; and the possibility of a

failure to retain and motivate key members of staff. The Group also

faces the risk that changes in applicable laws and regulations

could have a serious adverse impact on the business.

The Group's lead regulator is the FCA, but the Group is also

subject to the requirements imposed by the regulatory framework of

the other jurisdictions in which the Group operates. The Group's

compliance officers monitor compliance with applicable regulations

and report regularly to the Board. The Group's Legal department

oversees contracts entered into by Group companies, and manages

litigation which arises from time to time.

Reputational Risk

Reputational Risk is the risk that the Group's ability to do

business might be damaged as a result of its reputation being

tarnished. Clients rely on the Group's integrity and probity. The

Group has policies and procedures in place to manage this risk to

the extent possible, which include conduct of business rules,

procedures for employee hiring and the taking on of new

business.

Liquidity Risk

The Group seeks to ensure that it has access to an appropriate

level of cash, other forms of marketable securities and facilities

to enable it to finance its ongoing operations on cost effective

terms. Cash and cash equivalent balances are held with the primary

objective of capital security and availability, with a secondary

objective of generating returns. Funding requirements are monitored

by the GTRC.

As a normal part of its operations, the Group faces liquidity

risk through the risk of being required to fund transactions that

fail to settle on the due date. From a risk perspective, the most

problematic scenario concerns 'fail to deliver' transactions, where

the business has received a security from the selling counterparty

(and has paid cash in settlement of the same) but is unable to

effect onward delivery of the security to the buying counterparty.

Such settlement 'fails' give rise to a funding requirement, namely

the cost of funding the security which we have 'failed to deliver'

until such time as the delivery leg is finally settled and we have

received the associated cash.

The Group has addressed this funding risk by arranging overdraft

facilities to cover any 'failed to deliver' trades, either with the

relevant settlement agent/depository or with a clearing bank. Under

such arrangements, the facility provider will fund the value of any

'failed to deliver' trades until delivery of the security is

effected. Certain facility providers require collateral (such as a

cash deposit or parent company guarantee) to protect them from any

adverse mark-to-market movement and some also charge a funding fee

for providing the facility.

The Group is also exposed to potential margin calls from

clearing houses and correspondent clearers, both in the UK and the

United States.

In the event of a liquidity issue arising, the firm has recourse

to existing global cash resources, after which it could draw down

on a GBP150m committed revolving credit line as additional

contingency funding. This facility remained undrawn throughout

2014.

Further details of the Group's borrowings and cash are provided

in Notes 22, 25 and 31 to the Consolidated Financial

Statements.

Other Financial Risks

The nature and scope of the Group's operations mean that it is

exposed to a number of other financial risks including interest

rate risk, currency risk, taxation risks, and pension obligation

risk.

Interest rate risk

The Group is exposed to interest rate risk on its cash deposits

and on borrowings under bank facilities. The Group's Sterling Notes

carry interest at fixed rates. Cash deposits are typically held at

maturities of less than three months.

The GTRC periodically considers the Group's exposure to interest

rate volatility.

Analysis of the Group's sensitivity to movements in interest

rates is set out in Note 25 to the Consolidated Financial

Statements.

Currency risk

The Group trades in a number of currencies around the world, but

reports its results in sterling. The Group therefore has

translation exposure to foreign currency exchange rate movements in

these currencies, principally the US dollar and the Euro, and

transaction exposure within individual operations which undertake

transactions in one currency and report in another.

Analysis of the Group's sensitivity to movements in foreign

currency exchange rates is set out in Note 25 to the Consolidated

Financial Statements.

Taxation risk

The risk of financial loss or misstatement as a result of

non-compliance with regulations relating to direct, indirect or

employee taxation. The Group employs experienced qualified staff in

key jurisdictions to manage this risk and in addition uses

professional advisers, as appropriate.

Pension obligation risk

The risk that the Group is required, in the short and medium

term, to fund a deficit in the Group's defined benefit pension

scheme.

Appendix B: Related party transactions

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation and are not

disclosed in this note.

The total amount owed to and from related parties and associates

at 31 December 2014 are set out below:

Amounts owed by Amounts owed to

related parties related parties

------------------ ------------------- -------------------

2014 2013 2014 2013

GBPm GBPm GBPm GBPm

------------------ ---------- ------- ---------- -------

Associates 0.5 0.4 - -

Related parties - - - -

------------------ ---------- ------- ---------- -------

The amounts outstanding are unsecured and will be settled in

cash. No guarantees have been given or received. No provisions have

been made for doubtful debts in respect of the amounts owed by

related parties.

Appendix C: Directors' Responsibility Statement

The Directors confirm that to the best of their knowledge:

-- the financial statements, prepared in accordance with the

relevant financial reporting framework, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the Company and the undertakings included in the consolidation

taken as a whole;

-- the Strategic Report includes a fair review of the

development and performance of the business and the position of the

Company and the undertakings included in the consolidation taken as

a whole, together with a description of the principal risks and

uncertainties that they face; and

-- the Annual Report and financial statements, taken as a whole,

is fair, balanced and understandable and provides the information

necessary for shareholders to assess the Company's performance,

business model and strategy.

- Ends -

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACSUUSSRVUASRAR

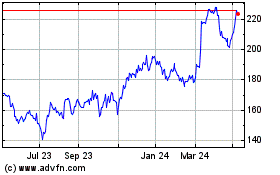

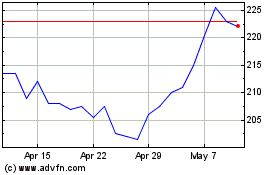

Tp Icap (LSE:TCAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tp Icap (LSE:TCAP)

Historical Stock Chart

From Apr 2023 to Apr 2024