Tullett Prebon PLC AGM Statement and Trading Update (2753M)

May 06 2015 - 2:02AM

UK Regulatory

TIDMTLPR

RNS Number : 2753M

Tullett Prebon PLC

06 May 2015

6 May 2015

Tullett Prebon plc

AGM Statement and Trading Update

Tullett Prebon plc (the "Company") is today issuing a trading

update in relation to the period from 1 January 2015. This

statement will be delivered to those attending the Annual General

Meeting today.

Business Update

Although the level of activity in the wholesale OTC financial

markets in which we predominantly operate has continued to be

subdued, it has been more stable. There has been higher volatility

in some financial markets in 2015 compared with a year ago,

particularly currencies, but volatility in most product areas has

continued to be sporadic. The level of activity in Asia Pacific and

in some product areas in the Americas has picked up compared with a

year ago. The level of activity in Europe and the Middle East has

reflected the effect of further flattening and lowering of yield

curves which continues to dampen trading activity in the

region.

Revenue in the four months to April of GBP284m was 15% higher

than the GBP248m reported for the same period last year. Excluding

PVM, revenue in the first four months of 2015 was unchanged

compared with the same period last year (2% lower at constant

exchange rates).

The performance of PVM Oil Associates Limited and its

subsidiaries ("PVM") since the completion of the acquisition in

November last year has been ahead of our expectations. The

business's main activities are in crude oil and petroleum products,

and it is continuing to benefit from the higher level of activity

in the oil and related products markets due to the significant

changes in the oil price experienced since the start of the second

half of 2014.

Action was taken during 2014 to reduce headcount and other fixed

costs in order to preserve the variable nature of broker

compensation and to reduce it as a percentage of broking revenue,

and to generally reduce fixed costs throughout the business to

better align the cost base with the lower level of revenue. The

benefits of this action have been reflected in an improvement in

the business's contribution margin in the first part of 2015

compared with the same period a year ago. We are continuing to

invest in the development of the business, and in the

implementation of our cultural framework to deliver on our

commitment to instil the highest standards of conduct in the

business by embedding our values, principles and behaviours in all

our systems and processes.

As previously announced, the Company entered into an agreement

with BGC in January under which BGC would pay $100m to the Company

to settle the litigation in the New Jersey Superior Court. The

first $25m of the $100m settlement was paid to the Company in

January 2015 and the remaining $75m was paid to the Company at the

end of March. Net of the GBP2.7m of costs that have been incurred

this year in relation to the legal action the year to date

exceptional credit relating to major legal actions is GBP64.4m.

On 2 April the Company entered into a new three year GBP150m

revolving credit facility replacing the previous GBP150m facility.

The financial terms of the new facility are unchanged from the

previous facility. Both the new and previous facilities have

remained undrawn throughout the year to date.

The Company's financial position remains strong.

The Company will be hosting a capital markets day for

institutional shareholders and analysts on 12 June.

Enquiries:

Stephen Breslin, Head of Communications

Tullett Prebon plc

Direct +44 (0)20 7200 7750

Email: sbreslin@tullettprebon.com

Craig Breheny, Director

Brunswick Group LLP

Direct +44 (0)20 7396 7429

Email: cbreheny@brunswickgroup.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCAAMPTMBIMBMA

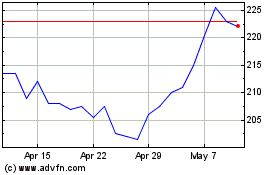

Tp Icap (LSE:TCAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

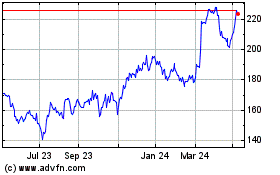

Tp Icap (LSE:TCAP)

Historical Stock Chart

From Apr 2023 to Apr 2024