Triumph Group, Inc. (NYSE:TGI) today

reported that, for the fiscal year ended March 31, 2010, net sales

totaled $1.295 billion, a four percent increase from fiscal year

2009 net sales of $1.240 billion. Income from continuing operations

for fiscal year 2010 was $85.3 million, or $5.12 per diluted share,

versus $92.7 million, or $5.59 per diluted share, for fiscal year

2009. Net income for fiscal year 2010 was $67.8 million, or $4.07

per diluted share, versus $88.0 million, or $5.30 per diluted

share, for the prior fiscal year. The number of shares used in

computing diluted earnings per share for fiscal year 2010 was 16.7

million shares. During the fiscal year, the company generated

$169.6 million of cash flow from operations. The results for the

fiscal year included $6.1 million of incremental non-cash interest

expense associated with the adoption of ASC 470-20 (formerly FSP

APB 14-1), which required a change in accounting method for

convertible debt interest, and approximately $5.3 million of

interest expense associated with the senior subordinated notes

issued during the third quarter of fiscal year 2010. Approximately

$4.1 million of start up costs related to the Mexican facility were

included in the results for the fiscal year. Prior year results

were restated to reflect the adoption of ASC 470-20, resulting in

an incremental $6.2 million of interest expense over the previously

reported amount.

For the fourth quarter ended March 31, 2010, net sales were

$352.0 million, a thirteen percent increase from last year’s fourth

quarter net sales of $311.2 million. Income from continuing

operations for the fourth quarter of fiscal year 2010 increased

eleven percent to $25.0 million, or $1.49 per diluted share, versus

$22.6 million, or $1.36 per diluted share, for the fourth quarter

of the prior fiscal year. Net income for the fourth quarter of

fiscal year 2010 increased eighteen percent to $24.7 million, or

$1.47 per diluted share, versus $20.9 million, or $1.26 per diluted

share, for the fourth quarter of the prior fiscal year. The number

of shares used in computing diluted earnings per share for the

fourth quarter of fiscal year 2010 was 16.8 million shares. During

the quarter, the company generated $43.2 million of cash flow from

operations. The results for the quarter included $1.6 million of

incremental non-cash interest expense associated with the adoption

of ASC 470-20 and approximately $3.6 million of interest expense

associated with the senior subordinated notes issued in November,

2009. Approximately $1.25 million of start up costs related to the

Mexican facility were also included in the results for the quarter.

Prior year fourth quarter results were restated to reflect the

adoption of ASC 470-20, resulting in an incremental $1.5 million of

interest expense over the previously reported amount.

Richard C. Ill, Triumph’s Chairman and Chief Executive Officer,

said, “We are proud of the results we achieved during the fourth

quarter. In particular, we were able to deliver organic sales

growth within our Aerospace Systems Group, increase operating

income and improve our underlying margin on both a year over year

and sequential basis. In addition, we saw our backlog grow during

the fourth quarter. During the year, we managed our company

conservatively, focusing on reducing costs, improving operations

and maximizing cash flow. The impact of these efforts is reflected

in our fourth quarter results as well as the strong cash flow

generated throughout the year.”

Aerospace Systems

The Aerospace Systems segment reported net sales for fiscal year

2010 of $1.073 billion, compared to $988.4 million for the prior

fiscal year, an increase of nine percent. For the fourth quarter of

fiscal year 2010, net sales increased eighteen percent to $294.2

million from $249.8 million for the prior fiscal year period.

Organic sales growth for the quarter was three percent. Operating

income for fiscal year 2010 was $170.5 million, compared to $168.0

million for the prior fiscal year, an increase of two percent. For

the fourth quarter, operating income increased twenty-three percent

to $50.4 million versus $41.2 million for the prior fiscal year

quarter. Operating margin for the quarter increased to seventeen

percent, a four percent year over year improvement and a fifteen

percent sequential improvement. Operating income for the quarter

included $1.1 million of legal expenses associated with the

previously disclosed trade secret litigation resulting in total

associated legal expenses for the full fiscal year of $4.6

million.

Aftermarket Services

The Aftermarket Services segment reported net sales for fiscal

year 2010 of $225.0 million, compared to $254.6 million for the

prior fiscal year, a decrease of twelve percent. For the fourth

quarter of fiscal year 2010, net sales decreased six percent to

$58.5 million from $62.1 million for the prior fiscal year period.

Operating income for fiscal year 2010 was $11.1 million, compared

to $10.9 million for the prior fiscal year, an increase of two

percent. For the fourth quarter, operating income increased 104

percent to $3.8 million versus $1.9 million for the prior fiscal

year quarter. Operating margin for the quarter increased to seven

percent, a 116 percent year over year improvement and a 141 percent

sequential improvement.

Outlook

In commenting on the outlook for fiscal year 2011, Mr. Ill said,

“We are entering our new fiscal year with a strong backlog and a

very solid balance sheet. Based on current aircraft production

rates, we project sales in the range of $1.3 to $1.4 billion and

earnings per share from continuing operations for the fiscal year

of approximately $4.65 per diluted share, excluding transaction and

integration costs from the recently announced agreement to acquire

Vought Aircraft Industries, Inc. This guidance does not reflect the

earnings and associated accretion which we expect from the Vought

acquisition. The number of shares used in computing diluted

earnings per share was 17.2 million shares. Included in this

guidance is approximately $5.0 million of legal expenses associated

with the trade secret litigation, the full year effect of the

November, 2009 high yield debt offering and approximately $2.5

million of start up costs related to the Mexican facility, which is

in addition to our investment in capital and infrastructure.”

Mr. Ill further stated, “Our acquisition of Vought remains on

track for a late June/early July close. We are working our way

through the various regulatory requirements leading up to a

shareholder vote. We are focusing a significant amount of our time

on the integration of our two companies and we remain excited about

what the acquisition will mean to our combined business, our

employees, our customers and our shareholders. We will update our

fiscal year 2011 guidance for the inclusion of Vought upon the

closing of the acquisition.”

As previously announced, Triumph Group will hold a conference

call tomorrow at 8:30 a.m. (ET) to discuss the fiscal year 2010

fourth quarter and year-end results. The conference call will be

available live and archived on the company’s website at

http://www.triumphgroup.com. A slide presentation will be included

with the audio portion of the webcast. An audio replay will be

available from April 29th until May 6th by calling (888)266-2081

(Domestic) or (703)925-2533 (International), passcode #1449287.

Triumph Group, Inc., headquartered in Wayne, Pennsylvania,

designs, engineers, manufactures, repairs and overhauls aircraft

components and accessories. The company serves a broad, worldwide

spectrum of the aviation industry, including original equipment

manufacturers of commercial, regional, business and military

aircraft and aircraft components, as well as commercial and

regional airlines and air cargo carriers.

More information about Triumph can be found on the company’s

website at http://www.triumphgroup.com.

Statements in this release which are not historical facts are

forward-looking statements under the provisions of the Private

Securities Litigation Reform Act of 1995, including expectations of

future aerospace market conditions, aircraft production rates,

financial and operational performance, revenue and earnings growth,

sales and earnings results for fiscal 2011 and the closing of the

Vought acquisition and its impact. All forward-looking statements

involve risks and uncertainties which could affect the company’s

actual results and could cause its actual results to differ

materially from those expressed in any forward looking statements

made by, or on behalf of, the company. Further information

regarding the important factors that could cause actual results to

differ from projected results can be found in Triumph’s reports

filed with the SEC, including our Annual Report on Form 10-K for

the fiscal year ended March 31, 2009.

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES (in

thousands, except per share data) Three Months

Ended Twelve Months Ended March 31, March

31, CONDENSED STATEMENTS OF INCOME 2010

2009 2010 2009 Net sales

$351,982 $311,188 $1,294,780 $1,240,378 Operating income

47,345 35,441 155,281 151,914 Interest expense and other

10,270 2,663 28,865 16,929 Gain on early extinguishment of debt 0

(299 ) (39 ) (880 ) Income tax expense 12,079 10,508

41,167 43,124 Income from continuing

operations 24,996 22,569 85,288 92,741 Loss from discontinued

operations, net of tax (324 ) (1,631 ) (17,526 ) (4,745 )

Net income $24,672 $20,938 $67,762 $87,996

Earnings per share - basic: Income from

continuing operations $1.52 $1.38 $5.18 $5.66 Loss from

discontinued operations ($0.02 ) ($0.10 ) ($1.06 ) ($0.29 ) Net

income $1.50 $1.28 $4.12 $5.37

Weighted average common shares outstanding - basic 16,474

16,392 16,459 16,384 Earnings per share

- diluted: Income from continuing operations $1.49 $1.36

$5.12 $5.59 Loss from discontinued operations ($0.02 ) ($0.10 )

($1.05 ) ($0.29 ) Net income $1.47 $1.26 $4.07

$5.30 Weighted average common shares outstanding -

diluted 16,792 16,587 16,666 16,584

Dividends declared and paid per common share $0.04

$0.04 $0.16 $0.16

FINANCIAL DATA (UNAUDITED) TRIUMPH GROUP, INC. AND

SUBSIDIARIES (dollars in thousands, except per share

data) BALANCE SHEET March 31, March

31, 2010 2009 Assets Cash and cash

equivalents $157,218 $14,478 Accounts receivable, net 214,497

209,463 Inventory 363,925 389,348 Rotable assets 25,587 25,652

Deferred income taxes 7,616 1,727 Assets held for sale 5,051 27,695

Prepaid income taxes 947 4,434 Prepaid expenses and other 8,834

6,021 Current assets 783,675 678,818 Property

and equipment, net 327,634 332,467 Goodwill 502,074 459,541

Intangible assets, net 79,844 108,350 Other 18,392 12,031

Total assets $1,711,619 $1,591,207

Liabilities & Stockholders' Equity

Accounts payable $92,859 $103,711 Accrued expenses 111,158 109,580

Liabilities related to assets held for sale 899 4,283 Current

portion of long-term debt 91,929 89,085 Current

liabilities 296,845 306,659 Long-term debt, less current

portion 424,351 370,311 Income taxes payable, non-current 3,290

2,917 Deferred income taxes, non-current 113,640 108,413 Other

non-current liabilities 12,807 14,344 Stockholders' Equity:

Common stock, $.001 par value,

100,000,000 shares authorized, 16,817,931 and 16,763,984 shares

issued

17 16 Capital in excess of par value 314,870 311,434 Treasury

stock, at cost, 144,677 and 174,417 shares (7,921 ) (9,785 )

Accumulated other comprehensive income (loss) 705 (2,233 ) Retained

earnings 553,015 489,131 Total stockholders' equity

860,686 788,563 Total liabilities and

stockholders' equity $1,711,619 $1,591,207

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES (dollars in

thousands) SEGMENT DATA Three

Months Ended Twelve Months Ended March 31,

March 31, 2010 2009 2010

2009 Net sales: Aerospace Systems $294,218 $249,807

$1,073,494 $988,359 Aftermarket Services 58,486 62,082 224,991

254,638 Elimination of inter-segment sales (722 ) (701 ) (3,705 )

(2,619 ) $351,982 $311,188 $1,294,780

$1,240,378 Operating income (loss): Aerospace Systems

$50,436 $41,152 $170,457 $168,006 Aftermarket Services 3,815 1,874

11,109 10,876 Corporate (6,906 ) (7,585 ) (26,285 ) (26,968 )

$47,345 $35,441 $155,281 $151,914

Depreciation and amortization: Aerospace Systems $10,116

$8,896 $40,789 $34,784 Aftermarket Services 3,244 3,309 12,894

13,515 Corporate 200 121 735 312

$13,560 $12,326 $54,418 $48,611

Capital expenditures: Aerospace Systems $8,816 $10,610

$26,013 $34,618 Aftermarket Services 661 2,128 3,895 8,804

Corporate 421 1,431 1,757 1,999 $9,898

$14,169 $31,665 $45,421

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND

SUBSIDIARIES(dollars in thousands)

Non-GAAP Financial Measure Disclosures

We prepare and publicly release quarterly unaudited financial

statements prepared in accordance with GAAP. In accordance with

recent Securities and Exchange Commission (the “SEC”) guidance on

Compliance and Disclosure Interpretations, we also disclose and

discuss certain non-GAAP financial measures in our public releases.

Currently, the non-GAAP financial measure that we disclose is

EBITDA, which is our income from continuing operations before

interest, income taxes, depreciation and amortization. We disclose

EBITDA on a consolidated and an operating segment basis in our

earnings releases, investor conference calls and filings with the

SEC. The non-GAAP financial measures that we use may not be

comparable to similarly titled measures reported by other

companies. Also, in the future, we may disclose different non-GAAP

financial measures in order to help our investors more meaningfully

evaluate and compare our future results of operations to our

previously reported results of operations.

We view EBITDA as an operating performance measure and as such

we believe that the GAAP financial measure most directly comparable

to it is income from continuing operations. In calculating EBITDA,

we exclude from income from continuing operations the financial

items that we believe should be separately identified to provide

additional analysis of the financial components of the day-to-day

operation of our business. We have outlined below the type and

scope of these exclusions and the material limitations on the use

of these non-GAAP financial measures as a result of these

exclusions. EBITDA is not a measurement of financial performance

under GAAP and should not be considered as a measure of liquidity,

as an alternative to net income (loss), income from continuing

operations, or as an indicator of any other measure of performance

derived in accordance with GAAP. Investors and potential investors

in our securities should not rely on EBITDA as a substitute for any

GAAP financial measure, including net income (loss) or income from

continuing operations. In addition, we urge investors and potential

investors in our securities to carefully review the reconciliation

of EBITDA to income from continuing operations set forth below, in

our earnings releases and in other filings with the SEC and to

carefully review the GAAP financial information included as part of

our Quarterly Reports on Form 10-Q and our Annual Reports on Form

10-K that are filed with the SEC, as well as our quarterly earnings

releases, and compare the GAAP financial information with our

EBITDA.

EBITDA is used by management to internally measure our operating

and management performance and by investors as a supplemental

financial measure to evaluate the performance of our business that,

when viewed with our GAAP results and the accompanying

reconciliation, we believe provides additional information that is

useful to gain an understanding of the factors and trends affecting

our business. We have spent more than 15 years expanding our

product and service capabilities partially through acquisitions of

complementary businesses. Due to the expansion of our operations,

which included acquisitions, our income from continuing operations

has included significant charges for depreciation and amortization.

EBITDA excludes these charges and provides meaningful information

about the operating performance of our business, apart from charges

for depreciation and amortization. We believe the disclosure of

EBITDA helps investors meaningfully evaluate and compare our

performance from quarter to quarter and from year to year. We also

believe EBITDA is a measure of our ongoing operating performance

because the isolation of non-cash charges, such as depreciation and

amortization, and non-operating items, such as interest and income

taxes, provides additional information about our cost structure,

and, over time, helps track our operating progress. In addition,

investors, securities analysts and others have regularly relied on

EBITDA to provide a financial measure by which to compare our

operating performance against that of other companies in our

industry.

Set forth below are descriptions of the financial items that

have been excluded from our income from continuing operations to

calculate EBITDA and the material limitations associated with using

this non-GAAP financial measure as compared to income from

continuing operations:

- Amortization expenses may be

useful for investors to consider because it represents the

estimated attrition of our acquired customer base and the

diminishing value of product rights and licenses. We do not believe

these charges necessarily reflect the current and ongoing cash

charges related to our operating cost structure.

- Depreciation may be useful for

investors to consider because they generally represent the wear and

tear on our property and equipment used in our operations. We do

not believe these charges necessarily reflect the current and

ongoing cash charges related to our operating cost structure.

- The amount of interest expense

and other we incur may be useful for investors to consider and may

result in current cash inflows or outflows. However, we do not

consider the amount of interest expense and other to be a

representative component of the day-to-day operating performance of

our business.

- Income tax expense may be useful

for investors to consider because it generally represents the taxes

which may be payable for the period and the change in deferred

income taxes during the period and may reduce the amount of funds

otherwise available for use in our business. However, we do not

consider the amount of income tax expense to be a representative

component of the day-to-day operating performance of our

business.

FINANCIAL DATA (UNAUDITED) TRIUMPH GROUP,

INC. AND SUBSIDIARIES (dollars in thousands)

Non-GAAP Financial Measure Disclosures, continued

Management compensates for the above-described limitations of using

non-GAAP measures by using a non-GAAP measure only to supplement

our GAAP results and to provide additional information that is

useful to gain an understanding of the factors and trends affecting

our business. The following table shows our EBITDA

reconciled to our income from continuing operations for the

indicated periods (in thousands):

Three Months

Ended Twelve Months Ended March 31, March

31, 2010 2009 2010

2009 Earnings before Interest, Taxes, Depreciation and

Amortization (EBITDA): Income from Continuing Operations

$24,996 $22,569 $85,288 $92,741 Add-back: Income Tax Expense

12,079 10,508 41,167 43,124 Gain on Early Extinguishment of Debt 0

(299 ) (39 ) (880 ) Interest Expense and Other 10,270 2,663 28,865

16,929 Depreciation and Amortization 13,560 12,326

54,418 48,611

Earnings before Interest, Taxes,

Depreciation and Amortization ("EBITDA")

$60,905 $47,767 $209,699 $200,525

Net Sales $351,982 $311,188 $1,294,780

$1,240,378 EBITDA Margin 17.3 % 15.3 % 16.2 % 16.2 %

FINANCIAL DATA

(UNAUDITED) TRIUMPH GROUP, INC. AND SUBSIDIARIES

(dollars in thousands) Non-GAAP Financial Measure

Disclosures (continued) Earnings before Interest,

Taxes, Depreciation and Amortization (EBITDA): Three Months

Ended March 31, 2010 Segment Data Total

AerospaceSystems

AftermarketServices

Corporate

/Eliminations

Income from Continuing Operations $24,996 Add-back:

Income Tax Expense 12,079 Gain on Early Extinguishment of Debt 0

Interest Expense and Other 10,270 Operating Income

(Expense) $47,345 $50,436 $3,815 ($6,906 ) Depreciation and

Amortization 13,560 10,116 3,244 200

Earnings (Losses) before Interest,

Taxes, Depreciation and Amortization ("EBITDA")

$60,905 $60,552 $7,059 ($6,706 ) Net

Sales $351,982 $294,218 $58,486 ($722 )

EBITDA Margin 17.3 % 20.6 % 12.1 % n/a

Earnings before Interest, Taxes, Depreciation and Amortization

(EBITDA): Twelve Months Ended March 31, 2010 Segment

Data Total

AerospaceSystems

AftermarketServices

Corporate

/Eliminations

Income from Continuing Operations $85,288 Add-back:

Income Tax Expense 41,167 Gain on Early Extinguishment of Debt (39

) Interest Expense and Other 28,865 Operating Income

(Expense) $155,281 $170,457 $11,109 ($26,285 ) Depreciation

and Amortization 54,418 40,789 12,894 735

Earnings (Losses) before Interest,

Taxes, Depreciation and Amortization ("EBITDA")

$209,699 $211,246 $24,003 ($25,550 )

Net Sales $1,294,780 $1,073,494 $224,991

($3,705 ) EBITDA Margin 16.2 % 19.7 % 10.7 % n/a

FINANCIAL DATA

(UNAUDITED) TRIUMPH GROUP, INC. AND SUBSIDIARIES

(dollars in thousands) Non-GAAP Financial Measure

Disclosures (continued)

Earnings before Interest,

Taxes, Depreciation and Amortization (EBITDA):

Three Months Ended March 31,

2009

Segment Data Total

AerospaceSystems

AftermarketServices

Corporate

/Eliminations

Income from Continuing Operations $22,569 Add-back:

Income Tax Expense 10,508 Gain on Early Extinguishment of Debt (299

) Interest Expense and Other 2,663 Operating Income

(Expense) $35,441 $41,152 $1,874 ($7,585 ) Depreciation and

Amortization 12,326 8,896 3,309 121

Earnings (Losses) before Interest,

Taxes, Depreciation and Amortization ("EBITDA")

$47,767 $50,048 $5,183 ($7,464 ) Net

Sales $311,188 $249,807 $62,082 ($701 )

EBITDA Margin 15.3 % 20.0 % 8.3 % n/a

Earnings before Interest, Taxes, Depreciation and Amortization

(EBITDA): Twelve Months Ended March 31, 2009 Segment

Data Total

AerospaceSystems

AftermarketServices

Corporate

/Eliminations

Income from Continuing Operations $92,741 Add-back:

Income Tax Expense 43,124 Gain on Early Extinguishment of Debt (880

) Interest Expense and Other 16,929 Operating Income

(Expense) $151,914 $168,006 $10,876 ($26,968 ) Depreciation

and Amortization 48,611 34,784 13,515 312

Earnings (Losses) before Interest,

Taxes, Depreciation and Amortization ("EBITDA")

$200,525 $202,790 $24,391 ($26,656 )

Net Sales $1,240,378 $988,359 $254,638 ($2,619

) EBITDA Margin 16.2 % 20.5 % 9.6 % n/a

FINANCIAL DATA (UNAUDITED) TRIUMPH GROUP,

INC. AND SUBSIDIARIES (dollars in thousands)

Non-GAAP Financial Measure Disclosures

We use "Net Debt to Capital" as a

measure of financial leverage. The following table sets forth the

computation of Net Debt to Capital:

March 31, March 31, 2010 2009

Calculation of Net Debt

Current portion $ 91,929 $ 89,085 Long-term debt 424,351

370,311 Total debt 516,280 459,396 Less: Cash and cash

equivalents 157,218 14,478 Net debt $ 359,062 $

444,918

Calculation of Capital

Net debt $ 359,062 $ 444,918 Stockholders' equity 860,686

788,563 Total capital $ 1,219,748 $ 1,233,481 Percent

of net debt to capital 29.4% 36.1%

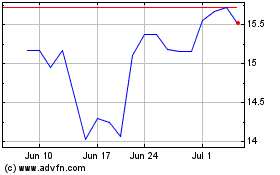

Triumph (NYSE:TGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

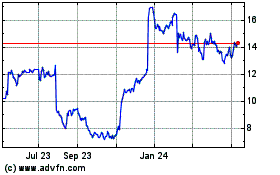

Triumph (NYSE:TGI)

Historical Stock Chart

From Apr 2023 to Apr 2024