TIDMTSTL

RNS Number : 5971X

Tristel PLC

23 February 2017

TRISTEL plc

("Tristel", the "Company" or the "Group")

Half-year Report

Unaudited Interim Results for the six months ended 31 December

2016

Tristel plc (AIM: TSTL), the manufacturer of infection

prevention, contamination control and hygiene products, announces

its interim results for the six months ended 31 December 2016,

ahead of management expectations as stated at the AGM.

Tristel's lead technology is a proprietary chlorine dioxide

formulation and the Company addresses three distinct markets:

-- The Human Healthcare market (hospital infection prevention - via the Tristel brand)

-- The Contamination Control market (control of contamination in

critical environments - via the Crystel brand)

-- The Animal Healthcare market (veterinary practice infection

prevention - via the Anistel brand)

Financial highlights

-- Revenue up 22% to GBP9.75m (2015: GBP8.01m)

-- Overseas sales up 45% to GBP4.2m (2015: GBP2.9m),

representing 43% of total sales (2015: 36%)

-- EBITDA and share based payments up 21% to GBP2.3m (2015: GBP1.9m)

-- Pre-tax profit before share based payments up 15% to GBP1.7m (2015: GBP1.48m)

-- Adjusted EPS before share based payments up 14% to 3.30p (2015: 2.89p)

-- Interim dividend of 1.40p per share (2015: 1.14p), an increase of 23%

-- Cash of GBP3.9m (2015: GBP4.3m) post GBP1.1m for acquisition

Operational highlights

-- Positive profit contribution from Australian acquisition

-- Results benefiting from Sterling weakness since the EU referendum result

-- First meeting with Environmental Protection Agency (EPA) in October 2016

-- Second meeting with Food and Drug Administration (FDA) in February 2017

-- Company is continuing to invest for future growth

Commenting on current trading, Paul Swinney, Chief Executive of

Tristel, said: "We are pleased to report strong half-on-half

revenue growth which has been above our targeted range of 10-15%.

We have also delivered the pre-tax profit margin of 17.5% that we

target, even after costs of GBP0.2m incurred during the half in

pursuit of our North American business plan. Profit before tax and

share based payments has risen by 15% to GBP1.7m and strong cash

generation saw cash of GBP3.9m at 31 December 2016 compared with

GBP5.7m at 30 June last year, despite cash outflows of GBP1.1m for

the Australian acquisition and dividend payments of GBP2.2m during

the period.

"We are progressing satisfactorily with our planned entry into

the North American hospital market."

There will be a webinar for investors at 12.15 today (23

February). If you would like to join the webinar, please register

here https://www.equitydevelopment.co.uk/news-and-events/

Tristel plc www.tristel.com

Paul Swinney, Chief Executive Tel: 01638 721 500

Liz Dixon, Finance Director

finnCap

Geoff Nash / Giles Rolls, Corporate Tel: 020 7220 0500

Finance

Alice Lane, Corporate Broking

Walbrook PR Ltd Tel: 020 7933 8780 or tristel@walbrookpr.com

Paul McManus Mob: 07980 541 893

Lianne Cawthorne Mob: 07584 391 303

Chairman's statement

Results

The Company made excellent progress during the first half, with

sales increasing to GBP9.75m, up 22% on the comparable period last

year.

We are very pleased that sales in the United Kingdom picked up

the pace of growth, rising 9% to GBP5.56m half-on-half. This

performance was flattered by a bulk purchase during the half by our

largest customer, NHS Supply Chain. This purchase enabled the

substitution of a discontinued pack size and contributed

approximately GBP150,000 in sales during the half.

Overseas sales once again rose, up 45% to GBP4.19m. During the

half overseas sales represented 43% of total sales, compared to 36%

during the same period last year. Our Australian subsidiary, which

we acquired on 15 August 2016, represented GBP487,000 of the

overseas sales growth of GBP1.3m.

Overseas sales First half First half Period-on-period Period-on-period Period-on-period

2016-17 2015-16 growth GBP growth % growth % at a

GBP GBP constant currency

---------------------- ------------ ------------ --------------------- --------------------- --------------------

China & Hong Kong

(subsidiaries) 649,000 486,000 163,000 34% 31%

---------------------- ------------ ------------ --------------------- --------------------- --------------------

Germany (subsidiary) 1,526,000 794,000 732,000 92% 62%

---------------------- ------------ ------------ --------------------- --------------------- --------------------

New Zealand

(subsidiary) 299,000 202,000 97,000 48% 18%

---------------------- ------------ ------------ --------------------- --------------------- --------------------

Overseas

distributors

(managed by UK) 1 943,000 1,122,000 (179,000) -16% -16%

---------------------- ------------ ------------ --------------------- --------------------- --------------------

Overseas sales

excluding impact of

acquisition 3,417,000 2,604,000 813,000 31% 19%

---------------------- ------------ ------------ --------------------- --------------------- --------------------

Australia

(subsidiary) 2 776,000 289,000 487,000 169% 113%

---------------------- ------------ ------------ --------------------- --------------------- --------------------

Total overseas sales 4,193,000 2,893,000 1,300,000 45% 29%

---------------------- ------------ ------------ --------------------- --------------------- --------------------

1 Certain distributors have been absorbed into direct

operations.

2 Distributor acquired during the period - included within New

Zealand subsidiary sales in last year's Interim Statement.

The weakness of Sterling since the EU Referendum result has

benefited Group sales. Stated at constant currency, overseas sales

growth would have been reported at 29% rather than 45%.

Overseas sales are now approaching 50% of the total and reflect

the Company's strategic goal of becoming a global force in the

infection prevention industry. We expect the contribution to Group

sales from overseas markets to exceed 50% during the course of our

current strategic plan which takes us to 30 June 2019.

Progress of our investments to improve efficiency and for future

growth

This time last year I explained how the business was investing

in plant and process in order to improve efficiency. During the

period we increased sales by GBP1.7m, gross margin from 71% to 74%,

whilst headcount increased by only six people (five of whom joined

with our Australian acquisition).

During the period we have made significant investments towards

future growth, including GBP200,000 spent on our North American

market entry plan, and GBP54,000 in relation to other potential

markets.

Our pre-tax profit margin of 17.5% is in line with our strategic

target, and represents profit before tax and share based payments

of GBP1.7m, which is an increase of 15% half-on-half.

We are pursuing a broadly based plan to enter the United States

and Canadian markets and this programme includes eight products for

which we will require a combination of FDA and EPA approvals. We

have held two meetings with the FDA and one with the EPA, we have

attended a number of clinical conferences and trade exhibitions

during the half and are in the process of piecing together our

market entry plan. I am satisfied that we are progressing well

towards our strategic objective of entering the North American

market in the financial year 2018-19.

Dividend

The business continues to convert profit to cash. During the

half to 31 December 2016 a special dividend of 3 pence per share

and a final dividend of 2.19 pence per share were paid, aggregating

GBP2.2m. In addition, we completed upon an acquisition of our

Australian distributor's business, at a cost of GBP1.1m. At the

period end cash was GBP3.9m. We will pay an interim dividend of

1.40 pence per share on 13 April to shareholders on the register on

24 March 2017, with an ex-dividend date of 23 March 2017. Our

historic dividend policy is to cover the standard dividend two

times and in the past was paid 25% as an interim dividend and 75%

as a final. Last year, given the increase in dividend tax effective

from 6 April 2016, we paid 40% as an interim and brought forward

the payment to March. Going forward we will continue to cover the

standard dividend two times and we will pay 40% as an interim in

April and 60% as a final dividend in December.

Outlook

We outlined in October 2016 our strategic targets:

-- to grow sales by 10-15% on average over the next three years

-- to attain a profit before tax and share based payments margin

of at least 17.5%, whilst investing in future growth

-- to return cash that is surplus to the operational and

investment needs of the business in the form of special

dividends

These targets continue to guide us and remain achievable.

I believe the business is in good shape and shareholders can

confidently look forward to their Company's further progress and

growth in the years ahead.

Francisco Soler

Chairman

23 February 2017

CONDENSED CONSOLIDATED INCOME STATEMENT

RESULTS FOR THE SIX MONTHSED 31 DECEMBER 2016

6 months 6 months

ended ended Year ended

31-Dec-16 31-Dec-15 30-Jun-16

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Note

Revenue 3 9,748 8,010 17,104

Cost of sales (2,496) (2,289) (4,549)

Gross profit 7,252 5,721 12,555

Administrative expenses

- share based payments (5) (1,015) (674)

Administrative expenses

- depreciation & amortisation (595) (401) (1,071)

Administrative expenses

- other (4,959) (3,850) (8,242)

------------- ------------- ------------

Total administrative expenses (5,559) (5,266) (9,987)

Operating profit 1,693 455 2,568

Finance income 2 4 12

Results from equity accounted

associate 6 6 13

Profit before taxation 1,701 465 2,593

Taxation (312) (273) (491)

Profit for the period 1,389 192 2,102

============= ============= ============

Attributable to:

Equity holders of the parent 1,389 192 2,102

1,389 192 2,102

============= ============= ============

Earnings per share from

continuing operations

attributable to equity holders Note

of the parent 4

Basic (pence) 3.30 0.46 5.01

============= ============= ============

Diluted (pence) 3.14 0.45 4.81

============= ============= ============

All amounts relate to continuing operations.

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 31 DECEMBER 2016

6 months 6 months

ended ended Year ended

31-Dec-16 31-Dec-15 30-Jun-16

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Profit for the period 1,389 192 2,102

Items that will be reclassified

subsequently to Profit and loss

Exchange differences on translation

of foreign operations 81 13 146

------------- ------------- ------------

Other comprehensive income for

the period 81 13 146

Total comprehensive income for

the period 1,470 205 2,248

============= ============= ============

Attributable to:

Equity holders of the parent 1,470 205 2,248

1,470 205 2,248

============= ============= ============

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 31 DECEMBER 2016

Share Share Merger Foreign Retained Total Non- Total

earnings attributable controlling equity

to owners of interests

the parent

capital premium reserve exchange

account reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

30 June 2015 414 9,920 478 (147) 3,493 14,158 7 14,165

Transactions with owners

Dividends paid - - - - (2,141) (2,141) - (2,141)

Shares issued 7 535 - - - 542 - 542

Adjustment for

change of

controlling

interests - - - - - - - -

Share-based

payments - - - - 1,015 1,015 - 1,015

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Total

transactions

with owners 7 535 - - (1,126) (584) - (584)

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Profit for the

period ended

31 Dec 2015 - - - - 192 192 - 192

Other

comprehensive

income:-

Exchange

differences

on

translation

of foreign

operations - - - 13 - 13 - 13

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Total

comprehensive

income - - - 13 192 205 - 205

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

31 December

2015 421 10,455 478 (134) 2,559 13,779 7 13,786

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Transactions with owners

Dividends paid - - - - (480) (480) - (480)

Shares issued - (44) - - - (44) - (44)

Share-based

payments - - - - (341) (341) - (341)

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Total

transactions

with owners - (44) - - (821) (865) - (865)

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Profit for the

period ended

30 Jun 2016 - - - - 1,910 1,910 - 1,910

Other

comprehensive

income:-

Exchange

differences

on

translation

of foreign

operations - - - 133 - 133 - 133

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Total

comprehensive

income - - - 133 1,910 2,043 - 2,043

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

30 Jun 2016 421 10,411 478 (1) 3,648 14,957 7 14,964

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Transactions with owners

Dividends paid - - - - (2,193) (2,193) - (2,193)

Shares issued 3 32 - - - 35 - 35

Share-based

payments - - - - 5 5 - 5

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Total

transactions

with owners 3 32 - - (2,188) (2,153) - (2,153)

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Profit for the

period ended

31 Dec 2016 - - - - 1,389 1,389 (2) 1,387

Other

comprehensive

income:-

Exchange

differences

on

translation

of foreign

operations - - - 81 - 81 - 81

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Total

comprehensive

income - - - 81 1,389 1,470 (2) 1,468

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

31 Dec 2016 424 10,443 478 80 2,849 14,274 5 14,279

========= ========= ========= ========== =========== ============== ============= ===========

CONDENSED CONSOLIDATED BALANCE SHEET

AS AT 31 DECEMBER 2016

31-Dec-16 31-Dec-15 30-Jun-16

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill & other Intangible assets 6,882 6,253 6,047

Property, plant and equipment 1,381 1,330 1,416

Deferred tax 68 37 -

8,331 7,620 7,463

------------- ------------- -----------

Current assets

Inventories 1,753 1,589 1,875

Trade and other receivables 3,776 3,319 3,735

Cash and cash equivalents 3,854 4,264 5,715

9,383 9,172 11,325

Total assets 17,714 16,792 18,788

============= ============= ===========

Capital and reserves attributable to the

Company's equity holders

Called up share capital 424 421 421

Share premium account 10,443 10,455 10,411

Merger reserve 478 478 478

Foreign exchange reserves 80 (134) (1)

Retained earnings 2,849 2,559 3,648

Equity attributable to equity

holders of parent 14,274 13,779 14,957

------------- ------------- -----------

Minority interest 5 7 7

Total Equity 14,279 13,786 14,964

------------- ------------- -----------

Current liabilities

Trade and other payables 2,583 2,444 3,256

Interest bearing loans and borrowings - - -

Current tax liabilities 649 403 432

Total current liabilities 3,232 2,847 3,688

------------- ------------- -----------

Non-current liabilities

Deferred tax 203 159 136

------------- ------------- -----------

Total liabilities 3,435 3,006 3,824

Total equity and liabilities 17,714 16,792 18,788

============= ============= ===========

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

FOR THE SIX MONTHSED 31 DECEMBER 2016

6 months 6 months

ended ended Year ended

31-Dec-16 31-Dec-15 30-Jun-16

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Cash flows generated from

operating activities

Cash generated from operating Note

activities 6 1,701 2,231 4,819

Corporation tax (94) (96) (269)

1,607 2,135 4,550

------------- ------------- ------------

Cash flows used in investing

activities

Interest received 2 4 12

Purchase of intangible assets (204) (147) (406)

Note

Consideration for acquisition 7 (959)

Purchase of property, plant

and equipment (244) (203) (499)

Proceeds on sale of property,

plant and equipment 14 16 16

(1,391) (330) (877)

------------- ------------- ------------

Cash flows used in financing

activities

Loans repaid - - -

Share issues 35 542 498

Equity dividends paid (2,193) (2,141) (2,621)

(2,158) (1,599) (2,123)

------------- ------------- ------------

(Decrease)/increase in cash

and cash equivalents (1,942) 206 1,550

Cash and cash equivalents

at the beginning of the

period 5,715 4,045 4,045

Exchange difference on cash

and cash equivalents 81 13 120

Cash and cash equivalents

at the end of the period 3,854 4,264 5,715

============= ============= ============

NOTES TO THE ACCOUNTS

FOR THE SIX MONTHSED 31 DECEMBER 2016

1 PRINCIPal ACCOUNTING POLICIES

Basis of Preparation

For the year ended 30 June 2016, the Group prepared consolidated

financial statements under International Financial Reporting

Standards ('IFRS') as adopted by the European Commission. These

will be those International Accounting Standards, International

Financial Reporting Standards and related interpretations

(SIC-IFRIC interpretations), subsequent amendments to those

standards and related interpretations, future standards and related

interpretations issued or adopted by the IASB that have been

endorsed by the European Commission. This process is ongoing and

the Commission has yet to endorse certain standards issued by the

IASB.

These condensed consolidated interim financial statements (the

interim financial statements) have been prepared under the

historical cost convention. They are based on the recognition and

measurement principles of IFRS in issue as adopted by the European

Union (EU) and which are, or are expected to be, effective at 30

June 2017. They do not include all of the information required for

full annual financial statements, and should be read in conjunction

with the consolidated financial statements of the Group for the

year ended 30 June 2016. The interim financial statements have been

prepared in accordance with the accounting policies adopted in the

last annual financial statements for the year to 30 June 2016. The

accounting policies have been applied consistently throughout the

Group for the purposes of preparation of these condensed

consolidated interim financial statements.

Accounting Policies

The interim report is unaudited and has been prepared on the

basis of IFRS accounting policies.

The accounting policies adopted in the preparation of this

unaudited interim financial report are consistent with the most

recent annual financial statements being those for the year ended

30 June 2016.

2 Publication of non-statutory accounts

The financial information for the six months ended 31 December

2016 and 31 December 2015 have not been audited and does not

constitute full financial statements within the meaning of Section

434 of the Companies Act 2006.

The financial information relating to the year ended 30 June

2016 does not constitute full financial statements within the

meaning of Section 434 of the Companies Act 2006. This information

is based on the Group's statutory accounts for that period. The

statutory accounts were prepared in accordance with International

Financial Reporting Standards ("IFRS") and received an unqualified

audit report and did not contain statements under Section 498(2) or

(3) of the Companies Act 2006. These financial statements have been

filed with the Registrar of Companies.

3 SEGMENTAL ANALYSIS

The Board considers the Group's revenue lines to be split into

three operating segments, which span the different Group entities.

The operating segments consider the nature of the product sold, the

nature of production, the class of customer and the method of

distribution. The Group's operating segments are identified from

the information which is reported to the chief operating decision

maker.

The first segment concerns the manufacture, development and sale

of infection control and hygiene products which incorporate the

Company's chlorine dioxide chemistry, and are used primarily for

infection control in hospitals ("Human Health"). This segment

generates approximately 90% of Group revenues.

The second segment, which constitutes 4% of the business

activity, relates to manufacture and sale of disinfection and

cleaning products, principally into veterinary and animal welfare

sectors ("Animal Health").

The third segment addresses the pharmaceutical and personal care

manufacturing industries ("Contamination Control"). This activity

has generated 6% of the Group's revenue for the period.

The operation is monitored and measured on the basis of the key

performance indicators of each segment, these being revenue and

gross profit; strategic decisions are made on the basis of revenue

and gross profit generating from each segment.

The Group's centrally incurred administrative expenses and

operating income are not attributable to individual segments.

3 SEGMENTAL ANALYSIS - continued

6 months ended 6 months ended Year ended

31 December 2016 31 December 2015 30 June 2016

(unaudited) (unaudited) (audited)

Human Animal Cont'n Total Human Animal Cont'n Total Human Animal Cont'n Total

Health Health Control Health Health Control Health Health Control

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 8,730 440 578 9,748 6,740 500 770 8,010 14,599 1,015 1,490 17,104

Cost

of

material (2,170) (106) (220) (2,496) (1,762) (156) (371) (2,289) (3,574) (333) (642) (4,549)

------------ ------------ --------- --------- ------------ ------------ ---------- --------- ------------ ------------ --------- ---------

Gross

profit 6,562 332 358 7,252 4,978 344 399 5,721 11,025 682 848 12,555

============ ============ ========= ============ ============ ========== ============ ============ =========

Centrally incurred income

and expenditure not attributable

to individual segments:

-

Dep'n & amort'n of

non- financial assets (595) (401) (1,071)

Other administrative

expenses (4,959) (3,850) (8,242)

Share based payments (5) (1,015) (674)

--------- --------- ---------

Segment operating profit 1,693 455 2,568

--------- --------- ---------

Segment operating profit

can be reconciled to Group

profit before tax as follows:

-

Segment operating profit 1,693 455 2,568

Results from equity

accounted associate 6 6 12

Finance income 2 4 13

Finance costs - - -

Group profit 1,701 465 2,593

========= ========= =========

The Group's revenues from external customers are divided into the following

geographical areas:

6 months ended 6 months ended Year ended

31 December 2016 31 December 2015 30 June 2016

(unaudited) (unaudited) (audited)

Human Animal Cont'n Total Human Animal Cont'n Total Human Animal Cont'n Total

healthcare healthcare control healthcare healthcare control healthcare healthcare Control

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

United

Kingdom 4,739 314 502 5,555 4,155 373 589 5,117 8,547 679 1,140 10,366

Germany 1,523 3 - 1,526 791 3 - 794 1,778 - - 1,778

Rest

of the

World 2,468 123 76 2,667 1,794 124 181 2,099 4,274 336 350 4,960

------------ ------------ --------- --------- ------------ ------------ ---------- --------- ------------ ------------ --------- ---------

Group

Revenues 8,730 440 578 9,748 6,740 500 770 8,010 14,599 1,015 1,490 17,104

============ ============ ========= ========= ============ ============ ========== ========= ============ ============ ========= =========

4 EARNINGS PER SHARE

The calculations of earnings per share are based on the

following profits and number of shares:

6 months ended 6 months Year ended

31 December ended 30 June 2016

2016 31 December

2015

(unaudited) (unaudited) (audited)

Retained profit for the

period attributable to equity

holders of the parent 1,389 192 2,102

================ ============== ===============

Retained profit for the

period attributable to equity

holders of the parent adjusted

for share based payments 1,394 1,207 2,776

================ ============== ===============

Shares '000 Shares '000 Shares '000

Number Number Number

Weighted average number

of ordinary shares for the

purpose of basic earnings

per share 42,056 41,753 41,945

Share options 2,198 1,040 1,747

Weighted average number

of ordinary shares for the

purpose of diluted earnings

per share 44,254 42,793 43,692

================ ============== ===============

Earnings per ordinary share

Basic (pence) 3.30 0.46 5.01

Diluted (pence) 3.14 0.45 4.81

Before share based payments

(pence) 3.30 2.89 6.62

================ ============== ===============

5 Dividends

6 months ended 6 months ended Year ended

31 December 31 December 30 June 2016

2016 2015

(unaudited) (unaudited) (audited)

Amounts recognised as distributions GBP'000 GBP'000 GBP'000

to equity holders in the

period:

Ordinary shares of 1p each

Special dividend for the

year ended 30 June 2016 of

3.00p per share (2015: 3.00p) 1,265 1,242 1,242

Final dividend for the year

ended 30 June 2016 of 2.19p

(2015: 2.14p) per share 928 899 899

Interim dividend for the

year ended 30 June 2016 of

1.14p - - 480

2,193 2,141 2,621

================ ================ ===============

Proposed interim dividend

for the year ending 30 June

2017 of 1.40p (2016: 1.14p)

per share 594 480 -

================ ================ ===============

The proposed interim dividend has not been included as a

liability in the financial statements.

6 RECONCILIATION OF PROFIT BEFORE TAX to cash GENERATED from operations

6 months 6 months

ended ended Year ended

31-Dec-16 31-Dec-15 30-Jun-16

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Profit before taxation 1,701 465 2,593

Adjustments for:

Depreciation 270 208 442

Amortisation of intangibles 325 193 524

Impairment - - 125

Results from associates - (6) -

Share based payments expense

(IFRS2) 5 1,015 674

(Profit)/Loss on disposal

of property plant and equipment (6) 3 (2)

Loss on disposal of intangible

asset - - 8

Finance costs - - -

Finance income (2) (4) (12)

Operating cash flows before

movement in working capital 2,293 1,874 4,352

Decrease in inventories 122 472 186

Increase in trade and other

receivables (41) (125) (541)

(Decrease)/increase in trade

and other payables (673) 10 822

Cash generated from operating

activities 1,701 2,231 4,819

============= ============= ============

7 Australian acquisition

On 15 August 2016 the Group acquired from the Australian company

Ashmed PTY Ltd, its customer base, stock, fixed assets and staff,

for a total consideration of GBP1.1m in cash. The customer base and

staff were purchased for a consideration of GBP959k, the amount

will be recognised within intangible assets. Stock was acquired for

GBP119k.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR DMGZZVZVGNZM

(END) Dow Jones Newswires

February 23, 2017 02:00 ET (07:00 GMT)

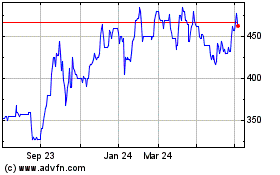

Tristel (LSE:TSTL)

Historical Stock Chart

From Mar 2024 to Apr 2024

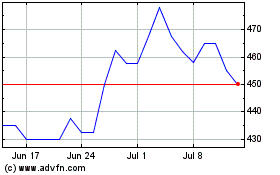

Tristel (LSE:TSTL)

Historical Stock Chart

From Apr 2023 to Apr 2024