TIDMTSTL

RNS Number : 7686F

Tristel PLC

25 February 2015

TRISTEL plc

("Tristel" or the "Company")

Half Yearly Report

Unaudited Interim Results for the six months ended 31 December

2014

Tristel plc (AIM: TSTL), the manufacturer of infection

prevention, contamination control and hygiene products, announces

its interim results for the six months ended 31 December 2014.

Tristel's lead technology is a proprietary Chlorine dioxide

formulation and the Company addresses three distinct markets:

-- The Human Healthcare market (hospital infection prevention - via the Tristel brand)

-- The Contamination Control market (control of contamination in

critical environments - via the Crystel brand)

-- The Animal Healthcare market (veterinary practice infection

prevention - via the Anistel brand)

Financial highlights

-- Revenue up 15% to GBP7.4m (2013: GBP6.4m)

-- International sales up 26% to GBP2.4m (2013: GBP1.9m)

-- Pre-tax profit before share based payments up 57% to GBP1.1m (2013: GBP0.7m)

-- EBITDA up 25% to GBP1.5m (2013: GBP1.2m)

-- Basic EPS up 85% to 1.91p (2013: 1.03p)

-- Interim dividend of 0.585p per share (2013: 0.36p), an increase of 63%

-- Cash generative, with net cash at period end of GBP2.9m (2013: GBP1.5m)

Commenting on current trading, Paul Swinney, Chief Executive of

Tristel, said:

"Tristel has enjoyed another strong performance during the first

half. Encouragingly, this has come from all areas of the business,

both in the UK and overseas. Our operations in Germany, China and

Hong Kong, and Australasia, where we have our own people on the

ground, are developing particularly well.

"The balance sheet and cash flow are very sound and we are well

placed to continue the growth of our business."

Tristel plc www.tristel.com

Paul Swinney, Chief Executive Tel: 01638 721 500

Liz Dixon, Finance Director

finnCap

Geoff Nash / Charlotte Stranner, Tel: 020 7220 0500

Corporate Finance

Stephen Norcross, Corporate Broking

Walbrook PR Ltd Tel: 020 7933 8780 or tristel@walbrookpr.com

Paul McManus Mob: 07980 541 893

Lianne Cawthorne Mob: 07854 391 303

Chairman's statement

This is our tenth year as a public company and I am delighted to

be back at the helm as Chairman, albeit on an interim basis.

The first half has been an excellent one for Tristel. The

business has now achieved record sales in each consecutive six

month period since December 2012. Encouragingly during the first

half the growth has come from all areas of the business, both in

the United Kingdom and overseas.

Investment for future growth

I have been with this business from the start and continue to be

its largest shareholder. I remain convinced, as I was when I first

encountered the investment opportunity some twenty years ago, that

Tristel's chlorine dioxide technology represents a global

opportunity. It addresses neglected areas of infection prevention

within our hospitals and it improves patient safety and the work

environment of hospital staff. Our vision is still to gain global

recognition for our technology as the outstanding biocide for the

decontamination of medical devices used in ambulatory care, and for

critical surfaces within hospitals.

It is important for our Board to make clear the central themes

of our strategy. They are to focus upon healthcare, to sell

consumable products that perform essential functions for users at

attractive margins whilst remaining a high growth business. If we

achieve all these things we will be a profitable business

generating superior net margins and return on capital exceeding

those of our peers.

We have re-calibrated one of our key strategic financial goals

to grow revenue by at least 50% over the next three years from the

base line of GBP13.5m achieved in 2013-14. We have previously

expressed this as a straight-line year-by-year goal. If we achieve

this level of revenue growth and maintain careful control of our

cost base, as we have during the past two years, our pre-tax margin

will exceed our strategic goal of 15%. But by maintaining the

target at 15% over the medium term it affords the Company the

flexibility to invest in new products and markets, including, when

we are ready for the challenge, North America, to secure long term

sustainable growth and achieve our objective of establishing a

global footprint for Tristel's technology.

Management is focussing on establishing a firm foundation for

the next phase of future growth. We are in the process of both

upscaling and upskilling our business.

Over the last 18 months we have invested GBP400,000 in creating

20,000 sq ft of new factory, office and warehouse space. The new

facility was completed by the end of September 2014 and officially

opened on 2October 2014. The investment programme for this

expansion is now complete. During the first half of this year we

have invested in the acquisition and implementation of a new

enterprise resource planning information system. The capital and

revenue investment will total GBP160,000 by the time it is

completed. The first implementation has successfully taken place in

our German operation and will have been rolled out across the Group

by the end of the financial year. The investment in this programme

will then be complete. Investment is also being made in our

business development teams in the United Kingdom and in our

overseas direct operations, recruiting the next generation of

highly qualified individuals to help our senior management team

drive the future development of the business.

Regulatory environment in Europe

The regulatory environment within Europe's biocides industry is

going through a period of significant change. The Biocidal Products

Regulation (BPR) is seeking to harmonise the European market for

biocidal active substances and products containing them. The

investment required by us over the next three to five years to meet

the new regulations will be substantial and will be charged against

our profits, but we are a well-resourced business, both in terms of

our balance sheet and our skill-base, and we can meet the upcoming

challenge. The same is probably not true of many of our smaller

competitors and as such there is a significant opportunity for

Tristel to gain market share over the coming years.

We are mid-stream in an extensive review of the Group's entire

product portfolio so that we can establish where our investment in

active substances is best placed. We do not formulate and

manufacture products using only our proprietary chlorine dioxide

chemistry and we have to evaluate where our involvement in other

biocidal (non-chlorine dioxide) actives will make future economic

sense. A rationalisation of our portfolio of chemistries may be the

result. The objective will be to minimise the investment required

to comply with regulations, whilst maintaining revenues via the

substitution of non-chlorine dioxide with chlorine dioxide

products. Our industry expects the BPR process to take many years

to complete. We will report upon progress at the time of our

preliminary results in October.

Results

Turnover has increased by 15% from the same period last year to

GBP7.4m (2013: GBP6.4m). EBITDA has increased by 25% to GBP1.5m

(2013: GBP1.2m) and profit before tax and share based payments has

increased 57% to GBP1.1m (2013: GBP0.7m). Our conversion of profit

to cash remained strong during the period and net cash increased

from GBP2.6m at 30 June 2014 to GBP2.9m at 31 December 2014, after

capital expenditure of GBP0.5m and payment of dividends amounting

to GBP0.5m.

Dividends

In October 2011, when we were in the midst of the re-shaping of

our product portfolio that was essential to survive the decline in

our legacy endoscopy business, we stated that our dividend policy

would be two times cover after profits returned to GBP1.5m, which

they now have. We also stated that the interim dividend would be

one-quarter of our expectation for the full year pay-out.

The cash generative nature of our business is clearly

demonstrated by these interim results and those of last year. My

philosophy is that the business should return to shareholders cash

which is not required for future earnings enhancing investment. For

now we will maintain our policy and we are declaring an interim

dividend of 0.585 pence, payable on 13 April 2015 to shareholders

on the register at 27 March 2015. The corresponding ex-dividend

date is 26 March 2015. This compares to the interim dividend of

0.36 pence last year, and represents an increase of 63%. We will

review both our policy and cash requirements of the business at the

time of our preliminary results in October.

Outlook

Tristel has a resilient business model based upon repeat use

consumable product sales. The business has a good geographical

spread which will only expand further as we establish

distributorships in more countries. We have a proprietary

technology that is supported by widespread patent protection with

nearly 100 patents granted (and many more pending) in countries

representing two-thirds of the world's population. We have a strong

balance sheet and remain both profitable and cash generative.

Finally, we have the people, experience of our industry and

physical resources to make further progress this year and into the

foreseeable future.

Francisco Soler

25 February 2015

CONDENSED CONSOLIDATED INCOME STATEMENT

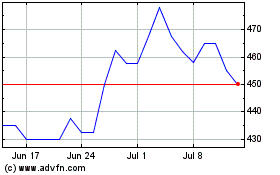

Tristel (LSE:TSTL)

Historical Stock Chart

From Mar 2024 to Apr 2024

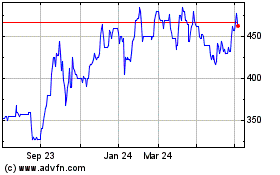

Tristel (LSE:TSTL)

Historical Stock Chart

From Apr 2023 to Apr 2024