Tristel PLC Directors dealing/grant of options (3213V)

November 02 2017 - 3:00AM

UK Regulatory

TIDMTSTL

RNS Number : 3213V

Tristel PLC

02 November 2017

Tristel plc

("Tristel" or "the Company")

Directors dealing/grant of options

Tristel plc (AIM: TSTL), the manufacturer of infection

prevention and contamination control products, intends, subject to

shareholder approval, to implement a Performance Share Plan to

commence in 2018 (the "2018 Scheme").

Paul Swinney (CEO), Elizabeth Dixon (Finance Director), Paul

Barnes (Non-Executive Director), and David Orr (Non-Executive

Director) will be eligible to participate in the Scheme. These

individuals will be granted options over an aggregate of 990,000

ordinary shares and the exercise price will be 1 penny. This

proposal will be presented as an Ordinary Resolution to the

Company's Annual General Meeting. This is to be held at 10am on 12

December 2017 at the Company's headquarters in Snailwell,

Suffolk.

Background

In August 2015, ten members of Tristel's management team,

including Paul Swinney and Elizabeth Dixon, participated in the

Tristel plc Performance Share Plan 2015 (the "2015 Scheme"). The

2015 Scheme granted an aggregate of 1,201,017 options with a 1

penny exercise price to the participants. On 4 August 2015, the

date the 2015 Scheme was announced, the Company's share price was

96 pence. The objectives of the 2015 Scheme were to grow the

Company's profits and share price over the three-year period to

June 2018. The vesting conditions were linked to certain profit

objectives being met, or the share price of the Company being equal

to or greater than 134 pence for a period of 30 consecutive dealing

days. The latter condition was achieved on 6 January 2016, and the

options vested on that date.

As at 1 November2017, 984,635 of the options vested under the

2015 Scheme remain unexercised which includes those held by Paul

Swinney and Elizabeth Dixon.

Between 4 August 2015 and 1 November 2017, the Company's share

price has increased from 96 pence to 275 pence, and the Company's

market capitalisation has increased from GBP40 million to GBP118

million. The Board considers that the 2015 Scheme has successfully

met its objectives.

The 2018 Scheme

The 2018 Scheme will be put forward for approval by shareholders

at the Company's Annual General Meeting. If the 2018 Scheme is

approved 990,000 share options will be granted on 1 January 2018 as

follows:

-- Paul Swinney 500,000 options;

-- Elizabeth Dixon 400,000 options;

-- Paul Barnes 45,000 options;

-- David Orr 45,000 options.

The options will be exercisable at 1 penny per share and will

vest in three equal tranches as follows:

-- One-third will vest upon the achievement of a share price of GBP3.50;

-- One-third will vest upon the achievement of a share price of GBP4.25;

-- One-third will vest upon the achievement of a share price of GBP5.00.

To vest, the average share price of Tristel plc must be above

the hurdle rate for a minimum three-month period

In the event of a change of control of the Company all options

will vest. Any vested but unexercised options will expire on 30

June 2021. As an additional condition, the options will only be

exercisable if the holder commits to hold the resulting ordinary

shares until 30 June 2021 or, if sooner, until a change of control

of the Company occurs.

Following the award, the equity interests of the directors being

granted options will be:

Ordinary Options Options Total options Percentage

shares over ordinary over ordinary held post interest

currently shares currently shares proposed grant in fully

held held diluted

share capital

-------------- ----------- ------------------ ----------------- -------------- ---------------

Paul Swinney 483,129 1,156,679 500,000 1,656,679 4.6%

-------------- ----------- ------------------ ----------------- -------------- ---------------

Elizabeth

Dixon 45,000 449,888 400,000 849,888 1.9%

-------------- ----------- ------------------ ----------------- -------------- ---------------

Paul Barnes 590,180 87,500 45,000 132,500 1.5%

-------------- ----------- ------------------ ----------------- -------------- ---------------

David Orr 12,511 - 45,000 45,000 0.1%

-------------- ----------- ------------------ ----------------- -------------- ---------------

If the 2018 Scheme is approved, the aggregate number of options

outstanding will be 4,020,585, representing 9.4% of the Company's

existing issued share capital.

For further information please contact:

Tristel plc Tel: 01638 721 500

Paul Swinney, Chief Executive

Officer

Liz Dixon, Finance Director

Walbrook PR Ltd Tel: 020 7933 8780 or tristel@walbrookpr.com

Paul McManus Mob: 07980 541 893

Lianne Cawthorne Mob: 07584 391 303

finnCap Tel: 020 7220 0500

Geoff Nash/ Giles Rolls (Corporate

Finance)

Alice Lane (Corporate Broking)

This information is provided by RNS

The company news service from the London Stock Exchange

END

DSHDFLFBDFFLFBE

(END) Dow Jones Newswires

November 02, 2017 03:00 ET (07:00 GMT)

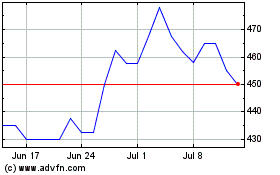

Tristel (LSE:TSTL)

Historical Stock Chart

From Mar 2024 to Apr 2024

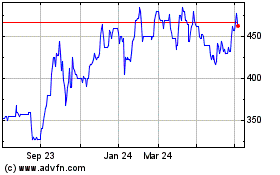

Tristel (LSE:TSTL)

Historical Stock Chart

From Apr 2023 to Apr 2024