Trinity Mirror PLC Trading Update (4688Z)

December 15 2017 - 2:00AM

UK Regulatory

TIDMTNI

RNS Number : 4688Z

Trinity Mirror PLC

15 December 2017

15 December 2017

Trinity Mirror plc

Trading Update

We continue to make progress against our strategic initiatives

whilst supporting profits and delivering strong cash flows which

will contribute to a further fall in net debt. The Board expects

performance* for the year to be in line with expectations.

Group revenue** on a like for like basis is expected to fall by

9% in the fourth quarter. We experienced improving trends in

publishing digital display and transactional revenues which are

expected to grow by 20% in the final quarter, which is offset by

expected declines in print advertising and circulation revenue of

21% and 7% respectively. Classified publishing digital revenue,

which is substantially jointly sold with print, remains under

pressure reducing expected publishing digital revenue growth for

the quarter to 10%.

Share buyback

During November 2017, the Group completed the GBP10 million

share repurchase programme announced in August 2016. The Group

acquired a total of 10 million shares.

Triennial Pension Funding Valuations

The 31 December 2016 triennial pension funding valuations have

progressed well during the year and we expect these to be finalised

ahead of the statutory deadline of 31 March 2018. We have agreed

with the Trustees that annual contributions to the three pension

schemes will increase by GBP8 million to GBP44 million per annum

for a period of 10 years commencing 2018. The increase in annual

contributions reflects the increase in deficits since the last

valuation which has been largely driven by the fall in long term

interest rates.

Proposed acquisition of 100% of the publishing assets of

Northern & Shell

Further to the update on 9 October 2017, we continue to make

good progress with the proposed acquisition of 100% of the

publishing assets of Northern & Shell. Further updates will be

provided as and when appropriate.

Enquiries

Trinity Mirror Brunswick

020 7293 3553 020 7404 5959

Simon Fox, Chief Executive Nick Cosgrove, Partner

Vijay Vaghela, Group Finance William Medvei, Director

Director

The statement on future performance is given as at the date of

this announcement and is subject to a number of risks and

uncertainties and actual results and events could differ materially

from those currently being anticipated as reflected in the

statement. The Company undertakes no obligation to update this

forward-looking statement.

-- On an adjusted basis excluding non-recurring items,

restructuring charges in respect of cost reduction measures, the

amortisation of intangible assets, the pension administrative

expenses, the retranslation of foreign currency borrowings, the

impact of fair value changes on derivative financial instruments,

the pension finance charge and the impact of tax legislation

changes.

** The like for like trends for 2017 exclude from the 2016

comparative: the extra week of trading in 2016, the Independent

print and distribution contract which ceased in April 2016,

Rippleffect which was sold in August 2016, the four Metros handed

back to DMGT and other portfolio changes.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTOKPDNABDKDBD

(END) Dow Jones Newswires

December 15, 2017 02:00 ET (07:00 GMT)

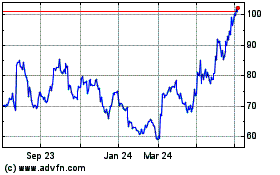

Reach (LSE:RCH)

Historical Stock Chart

From Mar 2024 to Apr 2024

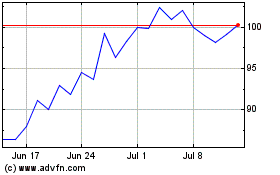

Reach (LSE:RCH)

Historical Stock Chart

From Apr 2023 to Apr 2024