Trinity Biotech plc (Nasdaq:TRIB), a leading developer and

manufacturer of diagnostic products for the point-of-care and

clinical laboratory markets, announced today that Trinity Biotech

Investment Limited, its wholly-owned subsidiary (the "Issuer"),

closed its offering of $115 million aggregate principal amount of

Exchangeable Senior Notes due 2045 in a private offering to

qualified institutional buyers pursuant to Rule 144A under the

Securities Act of 1933, as amended (the "Securities Act"). The

closing included the exercise in full of the initial purchasers'

option to purchase up to an additional $15 million aggregate

principal amount of the notes. The notes will mature on April 1,

2045, unless earlier purchased, redeemed or exchanged.

The Issuer expects that the net proceeds from the offering will

be approximately $110.9 million, after deducting underwriting

discounts and estimated expenses of the offering. Trinity Biotech

plc (the "Company") currently expects to use the net proceeds from

the offering for potential future acquisitions and for general

corporate purposes, which may include continued product development

and commercialization.

The notes are senior unsecured obligations of the Issuer and

accrue interest at an annual rate of 4.00% from the date on which

the notes are originally issued, payable semi-annually in arrears

on April 1 and October 1 of each year, beginning on October 1,

2015. The Issuer's obligations under the notes are fully and

unconditionally guaranteed on a senior unsecured basis by the

Company.

The notes are exchangeable, at the applicable exchange rate, at

any time prior to the close of business on the second business day

immediately preceding the maturity date for, and the Issuer will

settle exchanges of the notes by delivering, American depositary

shares ("ADSs") of the Company (each representing, as of the date

hereof, four "A" ordinary shares of the Company). The exchange rate

is initially equal 45.1488 ADSs of the Company per $1,000 principal

amount of notes, equivalent to an initial exchange price of

approximately $22.15 per ADS, which is a 15% premium to the last

reported sale price per ADS on April 1, 2015. The exchange rate is

subject to adjustment upon the occurrence of certain events, but

will not be adjusted for any accrued and unpaid interest. In

addition, following the occurrence of certain corporate events that

occur prior to the maturity date, the Issuer will, in certain

circumstances, increase the exchange rate for a holder who elects

to exchange its notes in connection with such a corporate

event.

The Issuer may not redeem the notes prior to April 1, 2020. On

or after April 1, 2020, until, but excluding, April 1, 2022, the

Issuer may from time to time redeem for cash all or part of the

notes, but only if the last reported sale price per ADS for at

least 20 trading days (whether or not consecutive) during the

period of 30 consecutive trading days ending on the trading day

immediately preceding the date on which the Issuer provides the

notice of redemption exceeds 130% of the applicable exchange price

for the notes on each applicable trading day. On or after April 1,

2022, the Issuer may from time to time redeem for cash all or part

of the notes, regardless of the last reported sale price per ADS.

In the above cases, the redemption price will equal 100% of the

principal amount of the notes being redeemed, plus accrued and

unpaid interest to, but excluding, the redemption date, plus, for

all notes redeemed by the Issuer prior to April 1, 2022, a

"make-whole premium" payment payable in cash, ADSs or a combination

of cash and ADSs, at the Issuer's option, equal to the sum of the

remaining scheduled payments of interest on these notes through

April 1, 2022 (without duplication of the interest accrued to, but

excluding, the redemption date). If the Issuer elects to pay some

or all of the make-whole premium in ADSs, then the number of ADSs a

holder will receive will be that number of ADSs that have a value

equal to the amount of the make-whole premium payment to be paid to

such holder in ADSs, divided by the product of (i) the average of

the last reported sale price per ADS for the five trading days

immediately preceding and including the third day prior to the

redemption date and (ii) 0.97.

Holders may require the Issuer to repurchase the notes on April

1, 2022, April 1, 2025, April 1, 2030, April 1, 2035 or April 1,

2040 at a price equal to 100% of the principal amount of the notes

being repurchased, plus accrued and unpaid interest up to, but

excluding, the repurchase date. The Issuer will pay cash for all

notes so repurchased.

Neither the notes nor the ADSs issuable upon exchange of the

notes have been or are expected to be registered under the

Securities Act or under any state securities laws and, unless so

registered, may not be offered or sold in the United States or to

U.S. persons except pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act and applicable state securities laws. This press

release does not constitute an offer to sell or the solicitation of

an offer to buy any securities, nor shall it constitute an offer,

solicitation or sale in any jurisdiction in which such offer,

solicitation or sale is unlawful. Trinity Biotech plc is advised by

William Fry Solicitors, Ireland and Carter Ledyard & Milburn

LLP, New York.

About Trinity Biotech plc

Trinity Biotech develops, acquires, manufactures and markets

diagnostic systems, including both reagents and instrumentation,

for the point-of-care and clinical laboratory segments of the

diagnostic market. The products are used to detect infectious

diseases and to quantify the level of Haemoglobin A1c and other

chemistry parameters in serum, plasma and whole blood. Trinity

Biotech sells direct in the United States, Germany, France and the

U.K. and through a network of international distributors and

strategic partners in over 75 countries worldwide.

Forward-Looking Statements

This press release includes forward-looking statements regarding

Trinity Biotech's financing plans, including statements related to

the offering of the notes, the terms of the notes and the intended

use of net proceeds of the offering. Such statements are subject to

certain risks and uncertainties including, without limitation,

risks related to whether the Company and the Issuer will consummate

the offering of the notes on the expected terms, or at all, market

and other general economic conditions, whether the Company and the

Issuer will be able to satisfy the conditions required to close any

sale of the notes, and the fact that the Company's management will

have broad discretion in the use of the proceeds from any sale of

the notes. Trinity Biotech's forward-looking statements also

involve assumptions that, if they never materialize or prove

correct, could cause its results to differ materially from those

expressed or implied by such forward-looking statements. Although

Trinity Biotech's forward-looking statements reflect the good faith

judgment of its management, these statements are based only on

facts and factors currently known by Trinity Biotech. As a result,

you are cautioned not to rely on these forward-looking statements.

These and other risks concerning Trinity Biotech are described in

additional detail in Trinity Biotech plc's annual report on Form

20-F for the year ended December 31, 2014, which is on file with

the Securities and Exchange Commission.

CONTACT: Trinity Biotech plc

Kevin Tansley

(353)-1-2769800

E-mail: kevin.tansley@trinitybiotech.com

Lytham Partners LLC

Joe Diaz, Joe Dorame & Robert Blum

602-889-9700

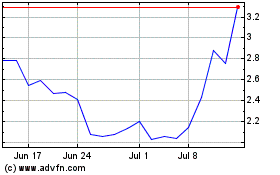

Trinity Biotech (NASDAQ:TRIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trinity Biotech (NASDAQ:TRIB)

Historical Stock Chart

From Apr 2023 to Apr 2024