Trinity Biotech plc (Nasdaq:TRIB), a leading developer and

manufacturer of diagnostic products for the point-of-care and

clinical laboratory markets, today announced results for the

quarter ended September 30, 2016.

Quarter 3

Results

Total revenues for Q3, 2016 were $26.1m which compares to $25.8m in

Q3, 2015, an increase of 1.4%.

Point-of-Care revenues for Q3, 2016 decreased

from $5.4m to $4.9m when compared to Q3, 2015, a decline of 9.5%.

This is within the normal quarterly fluctuation range of HIV sales

in Africa.

Clinical Laboratory revenues increased to

$21.2m, which represents an increase of 4.3% compared to Q3, 2015.

This increase was primarily attributable to increased Premier and

autoimmune revenues.

Unlike in previous quarters, the impact of

foreign exchange on revenues was not significant when compared to

the equivalent quarter last year. When calculated, its impact

was to reduce this quarter’s revenues by less than 0.5% with the

weakness in Sterling being the biggest single factor.

Revenues for Q3, 2016 were as follows:

|

|

2015 Quarter 3

|

2016 Quarter 3

|

Increase/ (decrease)

|

|

|

US$’000 |

US$’000 |

% |

|

Point-of-Care |

5,418 |

4,903 |

(9.5 |

%) |

|

Clinical Laboratory |

20,343 |

21,224 |

4.3 |

% |

|

Total |

25,761 |

26,127 |

1.4 |

% |

| |

|

|

|

|

Gross profit for Q3, 2016 amounted to $11.7m

representing a gross margin of 44.7%, which is lower than the 46.5%

achieved in Q3, 2015. This decrease is largely due to lower sales

of higher margin point-of-care products and the knock-on impact of

past currency movements – primarily the impact of the stronger

dollar on distributor pricing.

Research and Development expenses have remained

in line with the equivalent quarter last year at $1.3m. Meanwhile,

Selling, General and Administrative (SG&A) expenses have

remained at $7.5m for the quarter.

Operating profit for the quarter was $2.7m,

which is lower than the $3.0m achieved in Q3, 2015, and this is

attributable to the impact of higher revenues and lower indirect

costs being more than offset by the lower gross margin.

The net financing expense for the quarter was

$3.1m versus income of $9.6m in the equivalent quarter of 2015.

This financing income/expense can be broken down into its component

parts as follows:

|

Net financing income / (expense) |

Q3 2016 |

Q3 2015 |

|

|

US$’000 |

US$’000 |

|

Financial income |

|

212 |

|

|

204 |

|

|

|

|

|

|

Financial expense – Exchangeable note |

|

(1,150 |

) |

|

(1,064 |

) |

|

Other financial expenses |

|

(29 |

) |

|

(21 |

) |

|

Financial expense (cash) |

|

(1,179 |

) |

|

(1,085 |

) |

|

|

|

|

|

Non-cash financial income / (expense) |

|

(1,940 |

) |

|

10,720 |

|

|

Non-cash financial expense – accretion interest |

|

(180 |

) |

|

(208 |

) |

|

Non-cash financial income / (expense) |

|

(2,120 |

) |

|

10,512 |

|

|

|

|

|

|

Net financial income / (expense) |

|

(3,087 |

) |

|

9,631 |

|

| |

|

|

|

|

|

|

Financial income increased to $212,000 from

$204,000 in the equivalent quarter last year. This was primarily

due to improved interest rates.

Financial expenses primarily consist of the cash

interest payable on the company’s Exchangeable Notes, which amounts

to $1.15m per quarter.

Non-cash financial income represents adjustments

required to the fair value of the derivatives embedded in the

exchangeable notes along with an amount to accrete the fair value

of the debt liability back to its nominal value ($115 million) over

the term of the debt using an effective interest rate methodology.

For Q3, 2016, the fair value adjustment to the value of the

embedded derivatives was a charge to the income statement of

$1.9m.

The loss before tax for the period was $0.4m,

though this was largely impacted by non-cash charges related to the

Exchangeable Notes. Excluding these non-cash items, the

profit before tax for the quarter was $1.8m.

The tax charge for Q3, 2016 was $0.1m, an

effective tax rate of 8.5% on the profit for the quarter excluding

non-cash charges.

The loss after tax for the period was $0.5m.

However, excluding the non-cash elements of the Exchangeable Notes,

this would have been a profit of $1.6m, which equates to an

adjusted EPS of 7.0 cents. This compares to $1.8m and an adjusted

EPS of 7.5 cents in Q3, 2015. Diluted EPS for the quarter amounted

to 9.7 cents, which is consistent with the equivalent quarter in

2015.

The above results do not reflect the impact of

the decisions to withdraw the Meritas Troponin submission from the

FDA and to close the company’s facility in Uppsala, Sweden as both

of these events occurred after the quarter end. It is expected that

the company will record an impairment charge of in excess of $50m

in relation to the costs incurred on the Meritas project as well as

a provision for closure costs associated with the Swedish facility.

Both of these will be reflected in the company’s Q4 income

statement.

Cash generated from operations during the

quarter was $5.6m, though this was offset by capital expenditure of

$5.6m and interest and tax payments of $0.2m, resulting in a net

cash outflow for the quarter of under $0.2m. This resulted in a

cash balance at the end of the quarter of $84.8m.

Earnings before interest, tax, depreciation,

amortisation and share option expense for the quarter was

$4.6m.

Meritas – withdrawal of FDA

submission

On October 4, 2016 Trinity Biotech announced

that it was withdrawing its 510(k) premarket notification

submission for the Meritas Troponin-I Test and Meritas

Point-of-Care Analyzer. This followed a meeting with the FDA, where

they asked Trinity to consider withdrawing its submission due to

their concerns about clinical performance. These concerns focussed

on the analyzer’s operating temperature range and the inconsistency

of the test’s performance with the most recently cleared laboratory

Troponin test.

Given these concerns, the company decided to

withdraw the submission and to cease development of its Troponin

product for the U.S. market. It was felt that, even after

carrying out additional development work on the product, which

would be both lengthy and likely to cost an additional $20-30m,

there was insufficient certainty that its performance could ever

match a recently approved laboratory Troponin test. As a

consequence of this, the company also decided not to submit its

Meritas BNP test for heart failure to the FDA, as this was being

developed as a sister product for Troponin.

The Meritas platform has many potential

applications in the point-of-care arena, and thus the company has

embarked on an internal review process to determine the best future

opportunity for this technically excellent platform. This process

is expected to take between 9 and 12 months. In conjunction with

this, the Company will close its facility in Uppsala, Sweden and

transfer the technology to its headquarters in Bray, Ireland.

In its Q4 income statement, the company expects

to recognise an impairment charge in excess of $50m reflecting the

costs incurred on the Meritas platform to date plus an additional

provision for closure costs in relation to the Swedish

facility.

Comments

Commenting on the results, Kevin Tansley, Chief

Financial Officer, said “Operating profit this quarter was $2.7m,

which whilst lower than the equivalent quarter last year, did

represent an improvement compared to our more recent

quarters. This was driven by improved top line

performance. Whilst our gross margin remains under pressure,

mainly due to product mix and carry over currency factors, higher

revenues combined with control over indirect costs has resulted in

an operating margin of over 10%. Meanwhile, our diluted EPS for the

quarter remained consistent at 9.7 cents per ADR.”

Ronan O’Caoimh, CEO of Trinity said “The last

few weeks have been difficult for the company. We had

invested considerable time and effort in developing our Troponin

test on the Meritas platform and it was extremely frustrating that,

even with its clear performance advantages over its competitors,

FDA approval was not forthcoming. Following this we have taken

decisive action. We are closing our facility in Sweden, resulting

in 40 redundancies and transferring the technology to our Bray

facility. Once all closure costs have been incurred, this will

result in a reduction in expenditure on the platform from $9m p.a.

to $1.5m p.a. thus returning the company to a near break-even cash

flow position.

We also believe that the excellent technical

performance of Meritas still makes this a valuable platform. In the

months ahead we will look closely at a wide range of alternatives

with a view to maximising this value. This will include looking at

alternative menus and/or collaborations with third parties.

In the meantime, we will focus on expanding our

core business which has a number of growth drivers. In particular,

we will continue to place large numbers of Premier instruments in

an ever increasing number of countries, thus building market share.

We will also increase our penetration of the haemoglobin variant

market with our newly launched Premier Resolution instrument. We

will continue to grow our autoimmune business, building on our

growth of product sales and reference laboratory services. We are

also determined to expand our HIV franchise in Africa. Having

already conquered the confirmatory market, we will now look to

enter the higher volume screening market.

Whilst we will continue to look for highly

synergistic and earnings accretive acquisitions, I believe that at

our current share price, buying back our own shares represents the

best deployment of capital at this juncture. This, coupled

with the growth opportunities inherent in our existing business,

will enhance our earnings capacity and drive shareholder value.”

Forward-looking statements in this release are

made pursuant to the "safe harbor" provision of the Private

Securities Litigation Reform Act of 1995. Investors are

cautioned that such forward-looking statements involve risks and

uncertainties including, but not limited to, the results of

research and development efforts, the effect of regulation by the

United States Food and Drug Administration and other agencies, the

impact of competitive products, product development

commercialisation and technological difficulties, and other0 risks

detailed in the Company's periodic reports filed with the

Securities and Exchange Commission.

Trinity Biotech develops, acquires, manufactures

and markets diagnostic systems, including both reagents and

instrumentation, for the point-of-care and clinical laboratory

segments of the diagnostic market. The products are used to detect

infectious diseases and to quantify the level of Haemoglobin A1c

and other chemistry parameters in serum, plasma and whole blood.

Trinity Biotech sells direct in the United States, Germany, France

and the U.K. and through a network of international distributors

and strategic partners in over 75 countries worldwide. For further

information please see the Company's website:

www.trinitybiotech.com.

| |

|

|

|

|

|

| Trinity Biotech plcConsolidated

Income Statements |

| |

|

|

|

|

|

| (US$000’s except

share data) |

|

Three

MonthsEndedSeptember

30,2016(unaudited) |

|

|

|

|

Three

MonthsEndedSeptember

30,2015(unaudited) |

|

|

|

Nine

MonthsEndedSeptember

30,2016(unaudited) |

|

|

|

Nine

MonthsEndedSeptember

30,2015(unaudited) |

|

|

|

|

|

|

|

|

|

Revenues |

|

26,127 |

|

|

|

|

25,761 |

|

|

|

75,931 |

|

|

|

75,258 |

|

|

|

|

|

|

|

|

| Cost of sales |

|

(14,460 |

) |

|

|

|

(13,776 |

) |

|

|

(42,316 |

) |

|

|

(39,780 |

) |

| |

|

|

|

|

|

| Gross

profit |

|

11,667 |

|

|

|

|

11,985 |

|

|

|

33,615 |

|

|

|

35,478 |

|

| Gross profit % |

|

44.7 |

% |

|

|

|

46.5 |

% |

|

|

44.3 |

% |

|

|

47.1 |

% |

| |

|

|

|

|

|

| Other operating

income |

|

70 |

|

|

|

|

73 |

|

|

|

211 |

|

|

|

222 |

|

| |

|

|

|

|

|

| Research

& development expenses |

|

(1,296 |

) |

|

|

|

(1,293 |

) |

|

|

(3,711 |

) |

|

|

(3,560 |

) |

| Selling, general and

administrative expenses |

|

(7,487 |

) |

|

|

|

(7,467 |

) |

|

|

(22,245 |

) |

|

|

(20,467 |

) |

| Indirect share based

payments |

|

(236 |

) |

|

|

|

(327 |

) |

|

|

(971 |

) |

|

|

(1,357 |

) |

| |

|

|

|

|

|

| Operating

profit |

|

2,718 |

|

|

|

|

2,971 |

|

|

|

6,899 |

|

|

|

10,316 |

|

| |

|

|

|

|

|

| Financial income |

|

212 |

|

|

|

|

204 |

|

|

|

657 |

|

|

|

299 |

|

| Financial expenses |

|

(1,179 |

) |

|

|

|

(1,085 |

) |

|

|

(3,545 |

) |

|

|

(2,279 |

) |

| Non-cash financial income

/ (expense) |

|

(2,120 |

) |

|

|

|

10,512 |

|

|

|

(3,308 |

) |

|

|

11,490 |

|

| Net financing

income / (expense) |

|

(3,087 |

) |

|

|

|

9,631 |

|

|

|

(6,196 |

) |

|

|

9,510 |

|

|

|

|

|

|

|

|

| Profit / (loss)

before tax |

|

(369 |

) |

|

|

|

12,602 |

|

|

|

703 |

|

|

|

19,826 |

|

| |

|

|

|

|

|

| Income tax expense |

|

(148 |

) |

|

|

|

(339 |

) |

|

|

(462 |

) |

|

|

(858 |

) |

|

Profit / (loss) for the period

|

|

(517 |

) |

|

|

|

12,263 |

|

|

|

241 |

|

|

|

18,968 |

|

| |

|

|

|

|

|

| Earnings per ADR (US

cents) |

|

(2.3 |

) |

|

|

|

52.9 |

|

|

|

1.0 |

|

|

|

82.0 |

|

| |

|

|

|

|

|

| Earnings per ADR excluding

non-cash financial income (US cents) |

|

7.0 |

|

|

|

|

7.5 |

|

|

|

15.4 |

|

|

|

32.3 |

|

| |

|

|

|

|

|

| Diluted earnings per ADR

(US cents) |

|

9.7* |

|

|

|

|

9.7 |

|

|

|

24.6* |

|

|

|

35.7 |

|

| Weighted average no. of

ADRs used in computing basic earnings per ADR |

|

22,797,208 |

|

|

|

|

23,202,228 |

|

|

|

23,032,885 |

|

|

|

23,128,287 |

|

| |

|

|

|

|

|

| Weighted average no. of

ADRs used in computing diluted earnings per ADR |

|

28,379,444 |

|

|

|

|

28,766,691 |

|

|

|

28,452,580 |

|

|

|

27,059,058 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Under IAS 33 Earnings per Share, diluted earnings per share

cannot be anti-dilutive. Therefore, diluted earnings per ADR in

accordance with IFRS would be 1.0 cents for the year to date, and a

loss of 2.3 cents for the quarter (i.e. equal to basic earnings per

ADR).

The above financial statements have been prepared in accordance

with the principles of International Financial Reporting Standards

and the Company’s accounting policies but do not constitute an

interim financial report as defined in IAS 34 (Interim Financial

Reporting).

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Trinity Biotech

plcConsolidated Balance

Sheets |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,2016US$

‘000(unaudited) |

|

|

|

June 30,2016US$

‘000(unaudited) |

|

|

|

March 31,2016US$

‘000(unaudited) |

|

|

|

Dec 31,2015US$

‘000(audited) |

|

|

ASSETS |

|

|

|

|

| Non-current

assets |

|

|

|

|

| Property, plant and

equipment |

|

21,495 |

|

|

|

|

21,760 |

|

|

|

|

21,460 |

|

|

|

|

20,659 |

|

| Goodwill and intangible

assets |

|

173,240 |

|

|

|

|

169,049 |

|

|

|

|

165,157 |

|

|

|

|

161,324 |

|

| Deferred tax assets |

|

13,531 |

|

|

|

|

13,312 |

|

|

|

|

13,096 |

|

|

|

|

12,792 |

|

| Other assets |

|

849 |

|

|

|

|

932 |

|

|

|

|

860 |

|

|

|

|

954 |

|

| Total non-current

assets |

|

209,115 |

|

|

|

|

205,053 |

|

|

|

|

200,573 |

|

|

|

|

195,729 |

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

| Inventories |

|

39,989 |

|

|

|

|

39,253 |

|

|

|

|

35,709 |

|

|

|

|

35,125 |

|

| Trade and other

receivables |

|

25,802 |

|

|

|

|

27,832 |

|

|

|

|

26,260 |

|

|

|

|

25,602 |

|

| Income tax receivable |

|

811 |

|

|

|

|

712 |

|

|

|

|

664 |

|

|

|

|

550 |

|

| Cash and cash

equivalents |

|

84,751 |

|

|

|

|

84,920 |

|

|

|

|

96,829 |

|

|

|

|

101,953 |

|

| Total current

assets |

|

151,353 |

|

|

|

|

152,717 |

|

|

|

|

159,462 |

|

|

|

|

163,230 |

|

| |

|

|

|

|

| TOTAL

ASSETS |

|

360,468 |

|

|

|

|

357,770 |

|

|

|

|

360,035 |

|

|

|

|

358,959 |

|

| |

|

|

|

|

| EQUITY AND

LIABILITIES |

|

|

|

|

| Equity

attributable to the equity holders of the parent |

|

|

|

|

| Share capital |

|

1,222 |

|

|

|

|

1,221 |

|

|

|

|

1,220 |

|

|

|

|

1,220 |

|

| Share premium |

|

15,801 |

|

|

|

|

15,575 |

|

|

|

|

15,521 |

|

|

|

|

15,526 |

|

| Accumulated surplus |

|

197,379 |

|

|

|

|

197,588 |

|

|

|

|

199,453 |

|

|

|

|

201,951 |

|

| Other reserves |

|

(4,002 |

) |

|

|

|

(3,721 |

) |

|

|

|

(3,723 |

) |

|

|

|

(4,809 |

) |

| Total

equity |

|

210,400 |

|

|

|

|

210,663 |

|

|

|

|

212,471 |

|

|

|

|

213,888 |

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

| Income tax payable |

|

772 |

|

|

|

|

657 |

|

|

|

|

1,026 |

|

|

|

|

1,163 |

|

| Trade and other

payables |

|

19,976 |

|

|

|

|

19,384 |

|

|

|

|

19,195 |

|

|

|

|

18,874 |

|

| Provisions |

|

75 |

|

|

|

|

75 |

|

|

|

|

75 |

|

|

|

|

75 |

|

| Total current

liabilities |

|

20,823 |

|

|

|

|

20,116 |

|

|

|

|

20,296 |

|

|

|

|

20,112 |

|

| |

|

|

|

|

| Non-current

liabilities |

|

|

|

|

| Exchangeable senior note

payable |

|

101,351 |

|

|

|

|

99,232 |

|

|

|

|

100,073 |

|

|

|

|

98,044 |

|

| Other payables |

|

1,939 |

|

|

|

|

1,986 |

|

|

|

|

2,057 |

|

|

|

|

2,096 |

|

| Deferred tax

liabilities |

|

25,955 |

|

|

|

|

25,773 |

|

|

|

|

25,138 |

|

|

|

|

24,819 |

|

| Total non-current

liabilities |

|

129,245 |

|

|

|

|

126,991 |

|

|

|

|

127,268 |

|

|

|

|

124,959 |

|

|

|

|

|

|

|

| TOTAL

LIABILITIES |

|

150,068 |

|

|

|

|

147,107 |

|

|

|

|

147,564 |

|

|

|

|

145,071 |

|

| |

|

|

|

|

| TOTAL EQUITY AND

LIABILITIES |

|

360,468 |

|

|

|

|

357,770 |

|

|

|

|

360,035 |

|

|

|

|

358,959 |

|

The above financial statements have been prepared in accordance

with the principles of International Financial Reporting Standards

and the Company’s accounting policies but do not constitute an

interim financial report as defined in IAS 34 (Interim Financial

Reporting).

| |

|

|

|

|

| Trinity Biotech

plcConsolidated Statement of Cash

Flows |

| |

|

|

|

|

| (US$000’s) |

Three

MonthsEndedSeptember

30,2016(unaudited) |

|

|

|

Three

MonthsEndedSeptember

30,2015(unaudited) |

|

|

|

Nine

MonthsEndedSeptember

30,2016(unaudited) |

|

|

|

Nine

MonthsEndedSeptember

30,2015(unaudited) |

|

|

|

|

|

|

|

| Cash and cash

equivalents at beginning of period |

|

84,920 |

|

|

|

|

110,257 |

|

|

|

|

101,953 |

|

|

|

|

9,102 |

|

| |

|

|

|

|

| Operating cash flows

before changes in working capital |

|

5,164 |

|

|

|

|

3,851 |

|

|

|

|

12,950 |

|

|

|

|

14,279 |

|

| Changes in working

capital |

|

393 |

|

|

|

|

(166 |

) |

|

|

|

(3,469 |

) |

|

|

|

(8,504 |

) |

| Cash generated from

operations |

|

5,557 |

|

|

|

|

3,685 |

|

|

|

|

9,481 |

|

|

|

|

5,775 |

|

| |

|

|

|

|

| Net Interest and Income

taxes paid |

|

(171 |

) |

|

|

|

(108 |

) |

|

|

|

(263 |

) |

|

|

|

(440 |

) |

| |

|

|

|

|

| Capital Expenditure &

Financing (net) |

|

(5,555 |

) |

|

|

|

(4,290 |

) |

|

|

|

(16,982 |

) |

|

|

|

(15,623 |

) |

| |

|

|

|

|

| Free cash flow |

|

(169 |

) |

|

|

|

(713 |

) |

|

|

|

(7,764 |

) |

|

|

|

(10,288 |

) |

| |

|

|

|

|

| Share buyback |

|

- |

|

|

|

|

- |

|

|

|

|

(6,026 |

) |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Payment of HIV-2 licence

fee |

|

- |

|

|

|

|

- |

|

|

|

|

(1,112 |

) |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 30 year Convertible Note

interest payment |

|

- |

|

|

|

|

- |

|

|

|

|

(2,300 |

) |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 30 year Convertible Note

proceeds, net of fees |

|

- |

|

|

|

|

(156 |

) |

|

|

|

- |

|

|

|

|

110,574 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividend payment |

|

- |

|

|

|

|

(5,099 |

) |

|

|

|

- |

|

|

|

|

(5,099 |

) |

| |

|

|

|

|

| Cash and cash

equivalents at end of period |

|

84,751 |

|

|

|

|

104,289 |

|

|

|

|

84,751 |

|

|

|

|

104,289 |

|

| |

|

|

|

|

The above financial statements have been prepared in accordance

with the principles of International Financial Reporting Standards

and the Company’s accounting policies but do not constitute an

interim financial report as defined in IAS 34 (Interim Financial

Reporting).

Contact:

Trinity Biotech plc

Kevin Tansley

(353)-1-2769800

E-mail: kevin.tansley@trinitybiotech.com

Lytham Partners LLC

Joe Diaz, Joe Dorame & Robert Blum

602-889-9700

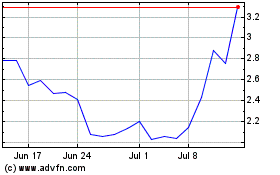

Trinity Biotech (NASDAQ:TRIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trinity Biotech (NASDAQ:TRIB)

Historical Stock Chart

From Apr 2023 to Apr 2024