Trinity Biotech plc (Nasdaq:TRIB), a leading developer and

manufacturer of diagnostic products for the point-of-care and

clinical laboratory markets, today announced results for the

quarter ended September 30, 2015.

Quarter 3 Results

Total revenues for Q3, 2015 were $25.8m which

compares to $27.2m in Q3, 2014, a decrease of 5.2%. However, when

the impact of foreign exchange movements, due to the strength of

the US dollar against a range of other currencies is removed,

revenues on a like-for-like basis would have been $27.6m this

quarter, thus representing an increase of almost 2% versus the

equivalent quarter in 2014.

Point-of-Care revenues for Q3, 2015 increased

slightly when compared to Q3, 2014. This increase was attributable

to increased rapid syphilis sales offset by slightly lower HIV

revenues.

Clinical Laboratory revenues increased to

$22.1m, which represents an increase of over 2% compared to Q3,

2014. This increase was primarily attributable to increased Premier

reagent and Immco revenues partly offset by lower Premier

instrument and Lyme revenues.

Revenues for Q3, 2015 were as follows:

|

|

2014Quarter 3 |

2015Quarter 3 |

2015Quarter

3FXadjusted* |

Increase/(decrease) |

|

|

US$’000 |

US$’000 |

US$’000 |

% |

|

Point-of-Care |

5,463 |

5,418 |

5,472 |

|

0.2 |

% |

|

Clinical Laboratory |

21,698 |

20,343 |

22,148 |

|

2.1 |

% |

|

Total |

27,161 |

25,761 |

27,620 |

|

1.7 |

% |

* Q3, 2015 revenues have been recalculated on a

constant currency basis using the exchange rates prevailing in Q3,

2014

Gross profit for Q3, 2015 amounted to $12.0m

representing a gross margin of 46.5%, which is lower than the 47.9%

achieved in Q3, 2014, though similar to that reported in Q2, 2014.

This decrease is due to the impact of a lower level of higher

margin Lyme revenues and the impact of foreign currency

movements.

Research and Development expenses have increased

to $1.3m from $1.1m when compared to the equivalent quarter last

year. Meanwhile, Selling, General and Administrative (SG&A)

expenses have increased from $7.0m to $7.5m over the same period.

This increase is attributable to higher sales and marketing costs,

largely due to expenditure on Meritas.

Operating profit for the quarter has decreased

from $4.6m to $3.0m, thus reflecting the lower gross margin and

higher indirect costs incurred this quarter.

Financial income for the quarter was $0.2m, an

increase of $0.2m versus Q3, 2014 due to the higher level of funds

on deposit following the issuance of the 30 Year Exchangeable Loan

Notes (“the Loan Notes”) in Q2, 2015. Meanwhile, financial expenses

increased to $1.1m mainly relating to the cash element of interest

associated with these notes. The non-cash elements of the Loan

Notes represented income of $10.5m which is attributable to

revaluation gains on the derivatives embedded in the Loan Notes of

$10.7m, partly offset by non-cash interest charges of

$0.2m.

The following table summarises the impact of the

Exchangeable Loan Notes on the Income Statement for Q3, 2015.

|

Exchangeable Loan Notes – Income Statement

impact |

Q3 2015US$’000 |

|

Cash element |

|

|

Cash based interest charge* |

|

(1,064 |

) |

|

|

|

|

Non-cash element |

|

|

Non-cash interest charge |

|

(208 |

) |

|

Revaluation gains on embedded derivatives |

|

10,720 |

|

|

Total non-cash items |

|

10,512 |

|

|

|

|

|

Net financing income relating to the Exchangeable Loan

notes |

|

9,448 |

|

* this is included in financial expenses in the

Income Statement – the remaining element ($21,000) arises on

items not related to the exchangeable note.

Profit before tax for the period was $12.6m

though this was largely impacted by non-cash gains related to the

Loan Notes. Excluding the non-cash elements of the Loan Notes, the

profit before tax for the quarter was $2.1m.

The tax charge for Q3, 2015 was $0.3m, largely

in line with the equivalent quarter in 2014.

Profit after tax for the period was $12.3m.

However, excluding the non-cash elements of the Loan Notes, this

would have been $1.8m, which equates to an adjusted EPS of 7.5

cents. Diluted EPS for the quarter amounted to 9.7 cents.

Cash generated from operations during the

quarter was $3.7m, though this was offset by capital expenditure of

$4.3m and interest and tax payments of $0.1m, resulting in a net

cash outflow for the quarter of $0.7m. In addition, the company

made dividend payments amounting to $5.1m with the result that the

cash balance at the end of the quarter was $104.3m.

Earnings before interest, tax, depreciation,

amortisation and share option expense for the quarter was

$4.7m.

Other Recent Developments

Cardiac Update

The following is an update on the three main components of the

Meritas Troponin-I Clinical Program:

- The most substantial component of this clinical program is the

Acute Coronary Syndrome (ACS) Study for the evaluation of subjects

presenting to the Emergency Departments with symptoms suggestive of

ACS. As reported on the Q2 earnings call, enrolment for this study

was completed in late July with the next step being the

adjudication of each result by a panel of Emergency and Cardiology

physicians. Thus far, this adjudication process, which conforms to

the Third Universal Definition of Myocardial Infarction guidance

document, has been more involved and time consuming than initially

expected. Whilst an adjudication of clear positives or negatives

can be performed in a relatively short time frame, some more

complex or borderline cases are taking significantly longer – in

some cases as long as 2 weeks. The adjudication process is now

expected to conclude by the end of November.Based on our review of

the data which has been adjudicated so far, we are pleased to

report that the data is significantly better than observed in our

own CE Marking trial and is closer to the superior results

contained in the independent study carried out at Hennepin County

Emergency Department by Dr. Fred Apple.

- Enrolment for the URL (99th Percentile Upper Reference Limit)

Study, was completed in July and since then the data collected has

been used to determined the URL or “normal level” of Troponin for

inclusion in the FDA submission. We were very pleased to observe

that the results of this study at three US trial sites show

excellent correlation with the URL determinations from our European

CE-marking clinical studies.

- The Precision Study is currently in the process of being

completed at 3 trial sites and will be completed in the coming

weeks.

From a timing perspective, the completion of the

adjudication analysis of the ACS Study will be the final component

to be completed and based on the timelines outlined above, we

expect to submit to the FDA during December 2015.

Dividend

During Q3, following approval at the company’s AGM in June 2015,

an annual dividend payment of 22 US cents per ADR was made, which

resulted in a total payment of $5.1m.

Comments

Commenting on the results, Kevin Tansley, Chief

Financial Officer, said “The profit this quarter was $12.3m.

However, this was impacted by significant non-cash gains related to

the company’s Loan Notes. Consequently, a better way of

assessing the performance this quarter is to look at operating

profit, which decreased from $4.6m to $3m compared to the

equivalent quarter last year. Our gross margins continue to

remain under pressure due to lower Lyme revenues and currency

factors. Meanwhile, indirect costs have increased due increased

sales and marketing costs including continued investment in

Meritas. Also, for the first time, overall profitability has been

adversely impacted by exchange rate movements. Prior to this

quarter, the impact of exchange rate movements had been neutral on

the income statement as each of the currencies in which the company

operates tended to move in tandem with each other versus the US

dollar. However, in Q3 this was no longer the case with the

significant weakening of the Brazilian Real and to a lesser extent

the Canadian Dollar having an adverse impact on overall

profitability.”

Ronan O’Caoimh, CEO of Trinity said “Completion

of our Meritas Troponin trial constitutes an extremely important

milestone for the company. We are confident that cardiologist

adjudication will be completed within the next four weeks and that

will enable FDA submission by the middle of December. Although the

adjudication process is not yet completed, based on the results to

date, we are extremely pleased with the performance of the product

and in particular with its high sensitivity and specificity

levels.”

Litigation Reform Act of 1995. Investors are

cautioned that such forward-looking statements involve risks and

uncertainties including, but not limited to, the results of

research and development efforts, the effect of regulation by the

United States Food and Drug Administration and other agencies, the

impact of competitive products, product development

commercialisation and technological difficulties, and other risks

detailed in the Company's periodic reports filed with the

Securities and Exchange Commission.

Trinity Biotech develops, acquires, manufactures

and markets diagnostic systems, including both reagents and

instrumentation, for the point-of-care and clinical laboratory

segments of the diagnostic market. The products are used to detect

infectious diseases and to quantify the level of Haemoglobin A1c

and other chemistry parameters in serum, plasma and whole blood.

Trinity Biotech sells direct in the United States, Germany, France

and the U.K. and through a network of international distributors

and strategic partners in over 75 countries worldwide. For further

information please see the Company's website:

www.trinitybiotech.com.

| |

| Trinity Biotech plc |

| Consolidated Income Statements |

| |

|

|

|

|

| (US$000’s except

share data) |

Three

MonthsEndedSeptember

30,2015(unaudited) |

Three

MonthsEndedSeptember

30,2014(unaudited) |

Nine

MonthsEndedSeptember

30,2015(unaudited) |

Nine

MonthsEndedSeptember

30,2014 (unaudited) |

|

|

|

|

|

|

|

Revenues |

|

25,761 |

|

|

27,161 |

|

|

75,258 |

|

|

78,191 |

|

|

|

|

|

|

|

| Cost of sales |

|

(13,776 |

) |

|

(14,150 |

) |

|

(39,780 |

) |

|

(40,510 |

) |

| |

|

|

|

|

| Gross

profit |

|

11,985 |

|

|

13,011 |

|

|

35,478 |

|

|

37,681 |

|

| Gross profit % |

|

46.5 |

% |

|

47.9 |

% |

|

47.1 |

% |

|

48.2 |

% |

| |

|

|

|

|

| Other operating

income |

|

73 |

|

|

91 |

|

|

222 |

|

|

339 |

|

| |

|

|

|

|

| Research

& development expenses |

|

(1,293 |

) |

|

(1,138 |

) |

|

(3,560 |

) |

|

(3,329 |

) |

| Selling, general and

administrative expenses |

|

(7,467 |

) |

|

(6,995 |

) |

|

(20,467 |

) |

|

(19,726 |

) |

| Indirect share based

payments |

|

(327 |

) |

|

(326 |

) |

|

(1,357 |

) |

|

(1,223 |

) |

| |

|

|

|

|

| Operating

profit |

|

2,971 |

|

|

4,643 |

|

|

10,316 |

|

|

13,742 |

|

| |

|

|

|

|

| Financial income |

|

204 |

|

|

9 |

|

|

299 |

|

|

93 |

|

| Financial expenses |

|

(1,085 |

) |

|

(15 |

) |

|

(2,279 |

) |

|

(79 |

) |

| Non-cash financial

income |

|

10,512 |

|

|

- |

|

|

11,490 |

|

|

- |

|

| Net financing

income / (expense) |

|

9,631 |

|

|

(6 |

) |

|

9,510 |

|

|

14 |

|

|

|

|

|

|

|

| Profit before

tax |

|

12,602 |

|

|

4,637 |

|

|

19,826 |

|

|

13,756 |

|

| |

|

|

|

|

| Income tax expense |

|

(339 |

) |

|

(276 |

) |

|

(858 |

) |

|

(667 |

) |

|

Profit for the period |

|

12,263 |

|

|

4,361 |

|

|

18,968 |

|

|

13,089 |

|

| |

|

|

|

|

| Earnings per ADR (US

cents) |

|

52.9 |

|

|

19.0 |

|

|

82.0 |

|

|

57.7 |

|

| |

|

|

|

|

| Earnings per ADR excluding

non-cash financial income (US cents) |

|

7.5 |

|

|

19.0 |

|

|

32.3 |

|

|

57.7 |

|

| |

|

|

|

|

| Diluted earnings per ADR

(US cents) |

|

9.7 |

|

|

18.4 |

|

|

35.7 |

|

|

55.2 |

|

| Weighted average

no. of ADRs used in computing basic earnings per ADR |

|

23,202,228 |

|

|

22,907,333 |

|

|

23,128,287 |

|

|

22,693,552 |

|

| |

|

|

|

|

| Weighted average no. of

ADRs used in computing diluted earnings per ADR |

|

28,766,691 |

|

|

23,674,859 |

|

|

27,059,058 |

|

|

23,719,930 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

The above financial statements have been prepared in accordance

with the principles of International Financial Reporting Standards

and the Company’s accounting policies but do not constitute an

interim financial report as defined in IAS 34 (Interim Financial

Reporting).

| |

| Trinity Biotech plc |

| Consolidated Balance Sheets |

| |

|

|

|

|

|

|

September 30,2015US$

‘000(unaudited) |

June 30,2015US$

‘000(unaudited) |

March 31,2015US$

‘000(unaudited) |

Dec 31,2014US$

‘000(audited) |

|

ASSETS |

|

|

|

|

| Non-current

assets |

|

|

|

|

| Property, plant and

equipment |

|

19,198 |

|

|

19,212 |

|

|

17,760 |

|

|

17,877 |

|

| Goodwill and intangible

assets |

|

156,326 |

|

|

152,338 |

|

|

147,568 |

|

|

145,024 |

|

| Deferred tax assets |

|

10,370 |

|

|

10,117 |

|

|

9,528 |

|

|

9,798 |

|

| Other assets |

|

1,040 |

|

|

1,091 |

|

|

1,249 |

|

|

1,194 |

|

| Total non-current

assets |

|

186,934 |

|

|

182,758 |

|

|

176,105 |

|

|

173,893 |

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

| Inventories |

|

36,882 |

|

|

38,193 |

|

|

37,064 |

|

|

33,516 |

|

| Trade and other

receivables |

|

27,153 |

|

|

28,344 |

|

|

27,640 |

|

|

25,976 |

|

| Income tax receivable |

|

119 |

|

|

212 |

|

|

221 |

|

|

351 |

|

| Cash and cash

equivalents |

|

104,289 |

|

|

110,257 |

|

|

5,745 |

|

|

9,102 |

|

| Total current

assets |

|

168,443 |

|

|

177,006 |

|

|

70,670 |

|

|

68,945 |

|

| |

|

|

|

|

| TOTAL

ASSETS |

|

355,377 |

|

|

359,764 |

|

|

246,775 |

|

|

242,838 |

|

| |

|

|

|

|

| EQUITY AND

LIABILITIES |

|

|

|

|

| Equity

attributable to the equity holders of the parent |

|

|

|

|

| Share capital |

|

1,216 |

|

|

1,216 |

|

|

1,215 |

|

|

1,204 |

|

| Share premium |

|

14,560 |

|

|

14,533 |

|

|

14,393 |

|

|

12,422 |

|

| Accumulated surplus |

|

198,882 |

|

|

191,368 |

|

|

188,094 |

|

|

183,375 |

|

| Other reserves |

|

(3,661 |

) |

|

(2,056 |

) |

|

(2,463 |

) |

|

(29 |

) |

| Total

equity |

|

210,997 |

|

|

205,061 |

|

|

201,239 |

|

|

196,972 |

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

| Income tax payable |

|

951 |

|

|

497 |

|

|

467 |

|

|

785 |

|

| Trade and other

payables |

|

18,694 |

|

|

19,756 |

|

|

20,116 |

|

|

21,197 |

|

| Provisions |

|

75 |

|

|

75 |

|

|

75 |

|

|

75 |

|

| Total current

liabilities |

|

19,720 |

|

|

20,328 |

|

|

20,658 |

|

|

22,057 |

|

| |

|

|

|

|

| Non-current

liabilities |

|

|

|

|

| Exchangeable senior note

payable |

|

99,069 |

|

|

109,124 |

|

|

- |

|

|

- |

|

| Other payables |

|

3,569 |

|

|

3,180 |

|

|

3,205 |

|

|

2,370 |

|

| Deferred tax

liabilities |

|

22,022 |

|

|

22,071 |

|

|

21,673 |

|

|

21,439 |

|

| Total non-current

liabilities |

|

124,660 |

|

|

134,375 |

|

|

24,878 |

|

|

23,809 |

|

|

|

|

|

|

|

| TOTAL

LIABILITIES |

|

144,380 |

|

|

154,703 |

|

|

45,536 |

|

|

45,866 |

|

| |

|

|

|

|

| TOTAL EQUITY AND

LIABILITIES |

|

355,377 |

|

|

359,764 |

|

|

246,775 |

|

|

242,838 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

The above financial statements have been prepared in accordance

with the principles of International Financial Reporting Standards

and the Company’s accounting policies but do not constitute an

interim financial report as defined in IAS 34 (Interim Financial

Reporting).

| |

| Trinity Biotech plc |

| Consolidated Statement of Cash Flows |

| |

|

|

|

|

| (US$000’s) |

Three

MonthsEndedSeptember

30,2015(unaudited) |

Three

MonthsEndedSeptember

30,2014(unaudited) |

Nine

MonthsEndedSeptember

30,2015(unaudited) |

Nine

MonthsEndedSeptember

30,2014(unaudited) |

|

|

|

|

|

|

| Cash and cash

equivalents at beginning of period |

|

110,257 |

|

|

15,153 |

|

|

9,102 |

|

|

22,317 |

|

| |

|

|

|

|

| Operating cash flows

before changes in working capital |

|

3,851 |

|

|

6,068 |

|

|

14,279 |

|

|

16,979 |

|

| Changes in working

capital |

|

(166 |

) |

|

(538 |

) |

|

(8,504 |

) |

|

(10,108 |

) |

| Cash generated from

operations |

|

3,685 |

|

|

5,530 |

|

|

5,775 |

|

|

6,871 |

|

| |

|

|

|

|

| Net Interest and Income

taxes received/(paid) |

|

(108 |

) |

|

(324 |

) |

|

(440 |

) |

|

290 |

|

| |

|

|

|

|

| Capital Expenditure &

Financing (net) |

|

(4,290 |

) |

|

(6,380 |

) |

|

(15,623 |

) |

|

(15,499 |

) |

| |

|

|

|

|

| Free cash flow |

|

(713 |

) |

|

(1,174 |

) |

|

(10,288 |

) |

|

(8,338 |

) |

| |

|

|

|

|

| 30 year Convertible Note

proceeds, net of fees |

|

(156 |

) |

|

- |

|

|

110,574 |

|

|

- |

|

| Dividend payment |

|

(5,099 |

) |

|

(5,030 |

) |

|

(5,099 |

) |

|

(5,030 |

) |

| |

|

|

|

|

| Cash and cash

equivalents at end of period |

|

104,289 |

|

|

8,949 |

|

|

104,289 |

|

|

8,949 |

|

| |

|

|

|

|

The above financial statements have been prepared in accordance

with the principles of International Financial Reporting Standards

and the Company’s accounting policies but do not constitute an

interim financial report as defined in IAS 34 (Interim Financial

Reporting).

Contact:

Trinity Biotech plc

Kevin Tansley

353)-1-2769800

E-mail: kevin.tansley@trinitybiotech.com

Lytham Partners LLC

Joe Diaz, Joe Dorame & Robert Blum

602-889-9700

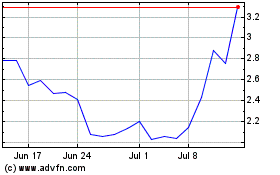

Trinity Biotech (NASDAQ:TRIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trinity Biotech (NASDAQ:TRIB)

Historical Stock Chart

From Apr 2023 to Apr 2024