Travis Perkins PLC Travis Perkins Plc : Q3 Trading Update - Trading On Track Despite A Challenging Market Backdrop

October 19 2017 - 2:00AM

UK Regulatory

TIDMTPK

19 October 2017

Travis Perkins plc

Third quarter 2017 trading update - "Trading on track despite a

challenging market backdrop"

Highlights

-- Third quarter total Group sales growth of 3.5% and like-for-like sales

growth of 4.1%

-- Continued strong growth across all businesses in the Contracts division

-- Significant improvement in sales performance in the Plumbing & Heating

division

John Carter, Chief Executive, commented:

"We have delivered a good like-for-like sales performance across the

Group in the third quarter against a challenging market backdrop of

input cost inflation and market volatility. Volumes were broadly flat

with inflation driven price increases the main component of our

like-for-like growth. Whilst it is relatively early days in the

transformation plan, it is encouraging to see positive progress in the

Plumbing & Heating division.

Trading conditions in our markets continue to be mixed, with consumer

discretionary spending under pressure from rising inflation and on-going

uncertainty in the UK economy. We maintain our confidence in the

long-term fundamental drivers of our markets, and this underpins our

plan to invest in our businesses to improve our customer propositions

and extend our competitive advantage."

Q3 2017 sales General Plumbing &

growth Merchanting(1) Heating(1) Contracts(1) Consumer(2) Group

Like-for-like

sales 2.4% 5.4%* 7.7% 2.4% 4.1%

Net new space

and

acquisitions 0.7% (2.5)% 0.6% 2.6% 0.6%

Trading day

differences** (1.6)% (1.6)% (1.6)% - (1.2)%

Total sales 1.5% 1.3% 6.7% 5.0% 3.5%

Two-year

like-for-like 3.0% 1.1% 13.8% 8.9% 6.2%

YTD 2017 sales General Plumbing &

growth Merchanting(1) Heating(1) Contracts(1) Consumer(2) Group

Like-for-like

sales 0.7% 0.9%* 8.6% 4.6% 3.3%

Net new space

and

acquisitions 0.9% (0.9)% (0.4)% 2.7% 0.7%

Trading day

differences** (0.5)% (0.5)% (0.5)% (0.8)% (0.6)%

Total sales 1.1% (0.5)% 7.7% 6.5% 3.4%

*Plumbing & Heating LFL sales figures exclude sales from branches closed

since 01 July 2017

**Total Group sales growth in Q3 was impacted by one fewer trading day

in 2017 in the merchant businesses: General Merchanting, Plumbing &

Heating and Contracts

Total Group sales grew by 3.5% in the third quarter, with like-for-like

sales growth of 4.1%, in part benefiting from a relatively weak

comparable in 2016. Sales price inflation across the Group in the third

quarter was 3.9%, (3.4% YTD), reflecting pass through of cost price

inflation driven by foreign currency movements since June 2016 and

recent increases in commodity prices, particularly in timber, copper and

some specialist insulation materials. The combined Merchanting divisions

(General Merchanting, Plumbing & Heating and Contracts) delivered

like-for-like sales growth of 4.7% and total sales growth of 2.9%.

General Merchanting like-for-like sales grew by 2.4%. In the period, the

heavyside range centre network was extended to support all Travis

Perkins branches in England and Wales, with this market-leading

proposition now available to a significantly larger customer base.

Plumbing & Heating like-for-like sales growth improved significantly in

the third quarter, with better performance in the City Plumbing and

wholesale businesses partially offset by continued challenging trading

conditions in the contract installer market. The transformation

programme progressed, with 33 branches closed in the quarter, a

transactional website now in place for City Plumbing, and improved

promotional activity in the local trade and wholesale markets delivering

encouraging results.

Strong like-for-like sales growth continued in the Contracts division,

with BSS, CCF and Keyline all demonstrating good growth and

outperforming their markets, supported by the continued strength of new

residential housebuilding and pass through of cost price inflation.

Like-for-like growth in the Consumer division slowed in the third

quarter to 2.4%, primarily due to more subdued growth in Wickes

reflecting very strong comparatives from Q3 2016 and an increasingly

difficult market environment. The roll out of the Toolstation network in

the UK and the Netherlands continued, demonstrating excellent

like-for-like and overall sales growth.

The Group continues to make both capital and operating cost investments

to enhance its propositions to better serve its customers. Work

continued in the third quarter to build the future ERP platform for the

merchant businesses, and to enhance digital capabilities across the

Group. The step-up in operating costs associated with these investments

will deliver a long-term competitive advantage and position the Group to

outperform its markets. The Group remains cautious on the market outlook

and continues to carefully manage its underlying cost base. Despite

these headwinds the Group remains on track to achieve full year

expectations.

Enquiries

Investor / analyst enquiries

Graeme Barnes | +44 7469 401819 | graeme.barnes@travisperkins.co.uk

Zak Newmark | +44 7384 432560 | zak.newmark@travisperkins.co.uk

Media enquiries

David Allchurch | Tulchan Communications | +44 207 353 4200

Footnotes

1. Like-for-like sales growth for the three month period ended 30 September

2017 compared to the three month period ended 30 September 2016 adjusted

for the impact of an extra trading day in the 2016 period. Total sales

growth for the three month period ended 30 September 2017 compared to the

three month period ended 30 September 2016 not adjusted for the impact of

an extra trading day in the 2016 period.

2. Wickes like-for-like growth for the 13 week period ended 30 September

2017 compared to the 13 week period ended 1 October 2016. Wickes total

sales growth for the 92 day period ended 30 September 2017 compared to

the 92 day period ended 1 October 2016.

This announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Travis Perkins PLC via Globenewswire

http://www.travisperkinsplc.co.uk/

(END) Dow Jones Newswires

October 19, 2017 02:00 ET (06:00 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

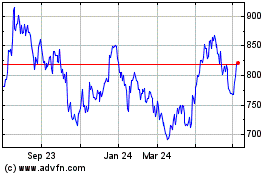

Travis Perkins (LSE:TPK)

Historical Stock Chart

From Mar 2024 to Apr 2024

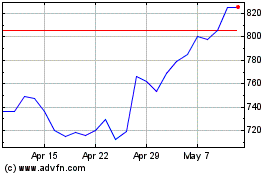

Travis Perkins (LSE:TPK)

Historical Stock Chart

From Apr 2023 to Apr 2024