TIDMTRAK

RNS Number : 5184X

Trakm8 Holdings PLC

27 November 2017

27 November 2017

TRAKM8 HOLDINGS PLC

("Trakm8" or the "Group")

Half Year Results

Organic growth strategy delivering enhanced earnings and debt

reduction

Trakm8 Holdings plc (AIM: TRAK), the global telematics and data

insight provider, announces its unaudited results for the six

months ended 30 September 2017:

Financial Highlights

6 months 6 months Year to Change

to to 30 31 March

30 Sept Sept 2016 2017

2017 Unaudited Audited

Unaudited GBP'000 GBP'000

GBP'000

Revenue 14,752 13,181 26,759 12%

of which, recurring

revenue(1) 5,482 4,687 9,842 17%

Operating profit 806 362 858 123%

Adjusted operating

profit(2) 1,049 589 1,321 78%

Cash generated from

operating activities 3,574 128 668 2,692%

Profit before tax 726 282 693 157%

Adjusted basic earnings

per share(2) 3.56p 1.58p 5.81p 125%

Basic earnings per

share 2.97p 0.88p 4.51p 238%

-- 29% Solutions revenue growth (core telematics business)

-- 17% growth in recurring revenues

-- 35% Products revenue decline as planned exit from Contract

electronic manufacturing (CEM) progressed

-- Net debt(3) reduced to GBP2.32m (2016: GBP4.40m) (FY2017: GBP3.87m)

(1) Fees from service, support and data

(2) Adjustment for exceptional costs of operational

restructuring and share based payments

(3) Total borrowings less cash

Operating highlights

-- Continuation of underlying organic growth:

o New contract awards with major clients Intelematics Europe,

Calor Gas and Mecalac and extensions with Iceland Foods, Shell, and

DLG

o Installed base continues to grow strongly from existing and

new customers:

-- approximately 217,000 connections (Sept 2016: 177,000

connections), an increase of 27,000 connections (14%) in the six

month period since last year end

-- A year of planned investment for future growth:

o Continued additional investment in engineering, sales and

marketing resource totalling c.GBP1.2m in the period

o Roll out of highly innovative new technologies to major

customers

-- Cessation of contract electronic manufacturing to provide

capacity for more in house product build in support of solution

sales and business simplification

-- Operational costs reduced further by c.GBP0.8m for the six month period

John Watkins, Executive Chairman of Trakm8 said:

"Trakm8 has had a period of good organic growth from existing

and new customers. The installed base of devices continues to

increase resulting in growing recurring revenues which are the core

of Trakm8's long term growth and predictability."

"First half profitability has been very much in line with

expectations and is a positive improvement on last year's

result."

"The GBP1.55m reduction of net debt since the start of the

financial year provides the improved balance sheet to support

growth."

"We anticipate a stronger second half as usual. With our strong

range of substantial new contracts in place, and as a result of

increased sales and marketing activity, we have visibility to

support our second half expectations."

"The outcome for the full year is less dependent on securing

contracts from new customers than in previous years. The outcome is

dependent on existing customer contracts where there is a level of

uncertainty of end user demand. The Board remains confident that

the market expectations will be met for the full year."

For further information, please visit www.trakm8.com or

contact:

Trakm8 Holdings plc

John Watkins, Executive Chairman +44 (0) 1747 858

Jon Furber, Finance Director 444

Buchanan Communications

Henry Harrison-Topham / Victoria Hayns +44 (0) 20 7466 5000

finnCap (Nominated Adviser and Broker)

Ed Frisby / Simon Hicks - Corporate finance

Tim Redfern / Richard Chambers - Corporate

broking +44 (0) 20 7220 0500

A meeting for analysts will be held at Buchanan, 107 Cheapside,

London, EC2V 6DN today, Monday 27 November 2017, commencing at

9:30a.m. Trakm8's Half Year Results 2018 are available at

www.trakm8.com

About Trakm8

Trakm8 is a UK based technology leader in fleet management,

insurance telematics, optimisation and dashboard camera systems.

Through IP owned technology, the Group analyses data collected by

its installed base of telematics units to fine tune the algorithms

that are used to produce its telematics based solutions; these

score driver behavior, monitor vehicle health and continuously

improve the security and operational efficiency of both private

drivers and company fleets.

The Group's product portfolio includes cameras (including the

recently launched integrated telematics camera), self-installed

telematics units and technology to eliminate distracted driving due

to mobile phones, and it has over 217,000 installed units reporting

to its servers.

Headquartered in Coleshill near Birmingham alongside its

manufacturing facility, the Group supplies to the Fleet,

Optimisation, Insurance and Automotive sectors, to many well-known

customers in the UK and internationally including the AA, Saint

Gobain, EON, Direct Line Group and Young Marmalade.

Trakm8 has been listed on the AIM market of the London Stock

Exchange since 2005.

www.trakm8.com / @Trakm8

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

Executive Chairman's Statement

Results

I am pleased to report Trakm8's results for the six months ended

30 September 2017, in line with expectations for the full year.

There has been continued progress for the Group as it migrates

into a pure telematics data solutions provider, with ongoing

reductions in hardware sales to other telematics companies and

contract electronic manufacturing (CEM) activities. This has the

effect in the short term of reducing the headline growth of the

Group but ensures focus on the long term higher quality of earnings

from data solutions. Increased engineering and sales &

marketing investments have borne fruit in new contracts and

revenues. Optimisation sales combined with telematics has gained

momentum. Integrated telematics and camera technology is generating

increased revenues and unit service fees.

Revenues grew 12% in the period to GBP14.75m (2016: GBP13.18m).

This includes 29% growth in Trakm8's core Solutions business to

GBP12.48m (2016: GBP9.69m). As planned, products sales reduced by

35% to GBP2.27m (2016: GBP3.49m) reflecting the policy to eliminate

the low margin CEM activity.

Total recurring revenues increased by 17% during the period to

GBP5.48m (2016: GBP4.69m), which are generated from increased

numbers of connections (units reporting to our servers). There is

an ongoing trend of lower service fees per unit for the same

functionality. This is a necessary trend as it widens the market

opportunity. Margins are protected with lower costs and overall the

Gross Margin was maintained. Higher service fees are generated from

the higher value added camera systems as a partial offset.

Recurring revenues remain the core of the Group's business model

and financial security.

As reported previously Brexit had a GBP0.6m adverse impact on

our gross margins, primarily in the second half of our 2017

financial year mainly through adverse currency movements on raw

materials purchases. This impact has continued through the first

half of this financial year, but we have taken certain steps to

reduce the effect with the result that gross profit margin has been

maintained at 48% (2016: 48%).

Financial year 2017 represented a year of significant investment

in which we made a deliberate decision to increase investment for

future growth given the potential opportunities we saw ahead. We

also implemented a streamlining of activities to reduce operating

costs offset by increased investment in sales and engineering.

During the current year we have maintained our investment in sales

and marketing, and as a result in this first half engineering,

sales and marketing expenditure has increased year on year by

GBP1.2m, of which GBP0.3m was capitalised R&D, resulting in a

net increase in operating expense of GBP0.9m.

Total overhead costs, excluding exceptional costs and a GBP0.3m

increase in depreciation and amortisation, increased by only

GBP0.1m year on year to GBP5.46m (2016: GBP5.34m). The GBP0.9m

increase in engineering, sales and marketing overhead expenditure

was offset by a reduction in other overhead costs of GBP0.8m as a

result of our efficiency and streamlining projects. Both these

projects are continuing in the second half of the year.

Adjusted operating profit increased by 78% to GBP1.05m (2016:

GBP0.59m). Adjusted operating profit excludes the share based

payment charge of GBP0.08m and exceptional costs of GBP0.16m. The

exceptional costs relate to the integration and streamlining of

operations which includes the consolidation of further resources in

Coleshill and costs relating to the exit from contract electronic

manufacturing. Adjusted basic earnings per share has increased by

125% to 3.56p (2016: 1.58p).

Financial position

Net cash generated from operating activities was GBP3.57m (2016:

GBP0.13m), which included R&D tax credit cash receipts of

GBP1.64m (2016: GBP0.14m). The cash generation, removing the impact

of the R&D tax cash is still GBP1.92m. There was a significant

reduction in inventory but this was offset by an increase in

debtors following good revenue months towards period end.

The transition of more customers to monthly payment models

(including SaaS) has continued to take place which impacts up front

cash generation, but this has been offset in part by monthly

payment deals of previous years and some deals with new customers

being financed by third parties.

Our net debt as at 30 September 2017 was reduced to GBP2.32m

(2016: GBP4.40m) (FY17: GBP3.87m) including GBP2.72m of cash (2016:

GBP1.44m) (FY17: GBP1.99m). In addition, the Group at 30 September

2017 held an increased undrawn credit facility of GBP3.70m at

HSBC.

We previously reported our revenues in two ways, Solution Sales

and Product Sales, and we report the summary analysis below for the

six months to 30 September 2017. As already highlighted we are

exiting Product Sales. In future we will only report Solution

Sales.

Solution Sales

This area of sales comprises Fleet Management, Optimisation,

Insurance and Automotive Solution revenues including associated

engineering services. This is the core activity for the Group.

Recurring revenues from this base have grown by 17% to GBP5.48m

(2016: GBP4.69m) and represent 37% of Group revenues (2016: 36%).

At the period end we had approximately 217,000 units (Sept 2016:

177,000 units) reporting to our servers, being an increase of 23%

over the last twelve months. This is an increase of 27,000 units

(14%) since 31 March 2017.

Since March 2017 Fleet units installed have increased by 4,000

units to 70,000, whilst Insurance & Automotive increased by

23,000 to 147,000.

Overall, Solution sales were 29% greater than the same period of

2016 at GBP12.48m (2016: GBP9.69m) and represent 85% of Group

revenue (2016: 74%).

We continue to have a high level of significant opportunities in

the pipeline as a result of the expansion of the sales teams. We

anticipate that revenues will continue to grow strongly in this

area.

Product Sales

This area of sales comprises all the hardware revenues from

sales to other telematics integrators, camera unit sales and sales

to our contract electronic manufacturing customers. As has been

previously announced we took the strategic decision to exit from

the contract electronic manufacturing activities undertaken at BOX

Telematics. The run out of this work extended into the first half

of this year but is now virtually eliminated.

Total Product revenues amounted to GBP2.27m (2016: GBP3.49m)

representing 15% of the Group total and a reduction of 35% on last

year.

Change of Registered Office

The Group advises that its registered office, with effect from

24 November 2017, has been changed to Trakm8 Holdings plc, Roman

Way, Roman Park, Coleshill, North Warwickshire, B46 1HG.

Board Changes

James Hedges resigned from the Board in August following over

eight years as Finance Director of the Group. This was as a result

of the relocation of the Group Finance function to Coleshill where

the Group has the manufacturing operations. We thank James for the

part he has played in the growth of the Group.

We were delighted to appoint Jon Furber as Group Finance

Director during September 2017.

Strategy

The Group has been following the strategy outlined in the 2017

Annual Report. Our focus is to provide ever more meaningful

insights to our customers using the data generated by our installed

devices so that they can run their operations more efficiently and

safely.

We continue to seek to increase the number of installed devices

reporting to our servers in order to generate long term, recurring

revenues. We will continue to own the majority of IP in our value

chain and are investing heavily in our technology to ensure we

remain at the leading edge of the telematics industry, seeking out

complimentary acquisitions to enhance capabilities, where

appropriate.

We continue to focus on streamlining the operations of the Group

to further increase the efficiency of our operations, maintaining

the already increased levels of engineering spend, whilst deploying

increasing sales and marketing resources to drive growth. During

the year the remaining Finance function was relocated from

Shaftesbury, Dorset to the centralised operations in Coleshill near

Birmingham and today we have announced that the Head Office has

relocated from Shaftesbury to Coleshill.

Outlook

We anticipate a stronger second half as usual. With our strong

range of substantial new contracts in place, and as a result of

increased sales and marketing activity, we have visibility to

support our second half expectations.

The outcome for the full year is less dependent on securing

contracts from new customers than in previous years. The outcome is

dependent on existing customer contracts where there is a level of

uncertainty of end user demand. The Board remains confident that

the market expectations will be met for the full year.

We continue to believe that subsequent years will benefit from

improved operational efficiency, investments in growth initiatives

and the growth in the telematics market both in the UK and

internationally to deliver long term value for shareholders.

JOHN WATKINS

Executive Chairman

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the six months to 30

September 2017

Six months

Six months to 30 Year to

to 30 September September 31 March

2017 2016 2017

Unaudited Unaudited Audited

Note

Continuing operations GBP'000 GBP'000 GBP'000

Revenue 14,752 13,181 26,759

Cost of sales (7,676) (6,888) (13,550)

Gross profit 7,076 6,293 13,209

Other income 264 148 325

Administrative expenses excluding

exceptional costs (6,369) (5,983) (12,462)

Exceptional administrative

costs 6 (165) (96) (214)

Total administrative costs (6,534) (6,079) (12,676)

Operating Profit 806 362 858

Finance income 14 - -

Finance costs (94) (80) (165)

Profit before taxation 726 282 693

Income tax 335 - 777

Profit attributable to the

owners of the parent 4 1,061 282 1,470

Other Comprehensive Income

Items that may be subsequently

reclassified to profit or

loss:

Currency translation

differences - - -

Total other comprehensive

income - - -

--------------------- ------------------- -------------------

Total Comprehensive Income

for the period attributable

to owners of the parent 1,061 282 1,470

--------------------- ------------------- -------------------

Adjusted Operating Profit 5 1,049 589 1,321

------------------------------------ ----- --------------------- ------------------- -------------------

Basic earnings per share

(pence) 7 2.97 0.88 4.51

Diluted earnings per share

(pence) 7 2.92 0.84 4.36

Adjusted basic earnings per

share (pence) 7 3.56 1.58 5.81

Adjusted diluted earnings

per share (pence) 7 3.50 1.51 5.61

------------------------------ ---- ----- --------------------- ------------------- -------------------

CONSOLIDATED STATEMENT OF

CHANGES IN EQUITY

for the six months

to 30 September 2017

Share Share Merger Translation Treasury Retained Total

capital Premium reserve reserve reserve earnings equity

attributable

to owners

of the

parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance as at

1 April 2016 320 9,641 1,122 200 (5) 5,797 17,075

--------- --------- --------- ------------------ --------- ------------------ ------------------

Comprehensive

income

Profit for the

period - - - - - 282 282

--------- --------- --------- ------------------ --------- ------------------ ------------------

Total

comprehensive

income - - - - - 282 282

Transactions

with owners

Shares issued 5 90 - - - - 95

Share placing

fees - - - - - (649) (649)

IFRS 2 Share

based

payments - - - - - 131 131

--------- --------- --------- ------------------ --------- ------------------ ------------------

Transactions

with owners 5 90 - - - (518) (423)

--------- --------- --------- ------------------ --------- ------------------ ------------------

Balance as at

30 Sept 2016 325 9,731 1,122 200 (5) 5,561 16,934

--------- --------- --------- ------------------ --------- ------------------ ------------------

Comprehensive

income

Profit for the

period - - - - - 1,188 1,188

Other

comprehensive

income

Exchange

differences

on

translation

of overseas

operations - - - (1) - - (1)

--------- --------- --------- ------------------ --------- ------------------ ------------------

Total

comprehensive

income - - - (1) - 1,188 1,187

--------- --------- --------- ------------------ --------- ------------------ ------------------

Transactions

with owners

Shares issued 32 2,052 16 - - - 2,100

Share placing

fees - (109) - - - - (109)

IFRS2 Share

based

payments - - - - - 118 118

--------- --------- --------- ------------------ --------- ------------------ ------------------

Transactions

with owners 32 1,943 16 - - 118 2,109

--------- --------- --------- ------------------ --------- ------------------ ------------------

Balance as at

31 March 2017 357 11,674 1,138 199 (5) 6,867 20,230

--------- --------- --------- ------------------ --------- ------------------ ------------------

Comprehensive

income

Profit for the

period - - - - - 1,061 1,061

--------- --------- --------- ------------------ --------- ------------------ ------------------

Total

comprehensive

income - - - - - 1,061 1,061

--------- --------- --------- ------------------ --------- ------------------ ------------------

Transactions

with owners

IFRS2 Share

based

payments - - - - - 78 78

--------- --------- --------- ------------------ --------- ------------------ ------------------

Transactions

with owners - - - - - 78 78

--------- --------- --------- ------------------ --------- ------------------ ------------------

Balance as at

30 Sept 2017 357 11,674 1,138 199 (5) 8,006 21,369

--------- --------- --------- ------------------ --------- ------------------ ------------------

CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

as at 30 September 2017

30 September 30 September 31 March

2017 2016 2017

Unaudited Unaudited Audited

Note

GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 18,138 15,990 17,108

Plant, property and equipment 1,847 1,839 1,855

Deferred income tax asset 295 801 297

Amounts receivable under

finance leases 418 - 499

20,698 18,630 19,759

-------------------- ------------------ ------------

Current assets

Inventories 2,579 2,542 3,674

Trade and other receivables 7,836 7,593 6,076

Corporation tax receivable 339 - 1,645

Cash and cash equivalents 2,720 1,439 1,990

13,474 11,574 13,385

-------------------- ------------------ ------------

Current liabilities

Trade and other payables (7,207) (6,827) (6,471)

Borrowings (1,094) (1,017) (1,051)

Provisions (62) (92) (62)

(8,363) (7,936) (7,584)

-------------------- ------------------ ------------

Current assets less current

liabilities 5,111 3,638 5,801

-------------------- ------------------ ------------

Total assets less current

liabilities 25,809 22,268 25,560

-------------------- ------------------ ------------

Non-current liabilities

Trade and other payables (455) (448) (480)

Borrowings (3,941) (4,826) (4,806)

Provisions (44) (60) (44)

(4,440) (5,334) (5,330)

-------------------- ------------------ ------------

Net assets 21,369 16,934 20,230

-------------------- ------------------ ------------

Equity

Share capital 7 357 325 357

Share premium 11,674 9,731 11,674

Merger reserve 1,138 1,122 1,138

Translation reserve 199 200 199

Treasury reserve (5) (5) (5)

Retained earnings 8,006 5,561 6,867

Total equity attributable to

owners of the parent 21,369 16,934 20,230

-------------------- ------------------ ------------

CONSOLIDATED CASH FLOW

STATEMENT

for the six months to

30 September 2017

Six months Six months Year

to to to

30 September 30 September 31 March

2017 2016 2017

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

Net cash generated from operating

activities 8 3,574 128 668

-------------------- ------------------- --------------

Cashflows from investing

activities

Acquisition of subsidiary undertaking

(net of cash) - (763) (763)

Purchases of property,

plant and equipment (75) (324) (181)

Purchases of software (3) (255) (262)

Proceeds from sale of

plant - - -

Capitalised Development

costs (1,756) (1,455) (3,241)

Net cash used in investing

activities (1,834) (2,797) (4,447)

-------------------- ------------------- --------------

Cashflows from financing

activities

Issue of new shares - 80 2,070

New bank loan 1,100 1,200 2,700

Repayment of bank loans (1,972) (474) (1,954)

New hire purchase contract - 177 -

Repayment of obligations under

hire purchase agreements (44) (17) (104)

Interest paid (94) (80) (165)

Dividend paid - (649) (649)

Net cash generated from financing

activities (1,010) 237 1,898

-------------------- ------------------- --------------

Net increase/ (decrease) in

cash and cash equivalents 730 (2,432) (1,881)

Cash and cash equivalents at

beginning of period 1,990 3,871 3,871

Cash and cash equivalents at

end of period 2,720 1,439 1,990

-------------------- ------------------- --------------

Notes to the financial information

(unaudited)

1. The financial information contained in this interim

statement has not been audited or reviewed by the Group's

auditor and does not constitute statutory accounts as

defined in Section 434 of the Companies Act 2006. The

Directors approved and authorised this interim statement

on 24 November 2017. The financial information for the

preceding full year is extracted from the statutory

accounts for the financial year ended 31 March 2017.

Those accounts, upon which the auditor issued an unqualified

opinion and did not include a statement under Section

498(2) or (3) of the Companies Act 2006, have been delivered

to the Registrar of Companies.

2. Trakm8 Holdings plc ("Trakm8") is a public limited

company incorporated in the United Kingdom under the

Companies Act 2006. Trakm8 is domiciled in the United

Kingdom and its ordinary shares are traded on AIM, the

market operated by the London Stock Exchange plc.

3. As permitted this Interim Report has been prepared

in accordance with the AIM Rules for Companies and not

in accordance with IAS 34 "Interim Financial Reporting"

and therefore is not fully in compliance with IFRS.

The Interim results have been prepared in a manner consistent

with the accounting policies set out in the statutory

accounts for the financial year ending 31 March 2017.

4. Profit per ordinary share attributable to

the owners of the parent

Six months Six months

to to Year to

30 September 30 September 31 March

2017 2016 2017

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Profit attributable to the

owners of the parent 1,061 282 1,470

-------------------- ------------------- ------------------

5. Adjusted operating profit

Adjusted Operating Profit is monitored by the

Board and measured as follows:

Six months Six months

to to Year to

30 September 30 September 31 March

2017 2016 2017

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Operating profit 806 362 858

Exceptional administrative

costs 165 96 214

Share based payments 78 131 249

Adjusted Operating Profit 1,049 589 1,321

-------------------- ------------------- ------------------

6. Exceptional costs

Six months Six months

to to Year to

30 September 30 September 31 March

2017 2016 2017

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Integration and business operations

streamlining costs (165) (96) (214)

------------------ ----------------- -----------------

Exceptional costs in the six months to 30 September

2017 relate to the integration and streamlining of operations,

which includes the exit from contract electronic manufacturing.

7. Shares in issue

Weighted average number of

ordinary shares in issue:

Six months Six months Year

to to to

30 September 30 September 31 March

2017 2016 2017

Unaudited Unaudited Audited

No. No. No.

'000 '000 '000

Basic 35,723 32,315 32,595

Diluted 36,321 33,714 33,709

------------------ ----------------- ---------------

Adjusted basic earnings

per share

Adjusted diluted earnings 3.56p 1.58p 5.81p

per share 3.50p 1.51p 5.61p

adjusted for effects of Exceptional costs and

Share based payments

8. Reconciliation of cash flows from

operating activities:

Six months Six months Year

to to to

30 September 30 September 31 March

2017 2016 2017

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Net profit before taxation 726 282 693

Adjustments for:

Depreciation 178 158 304

Amortisation of intangible

assets 729 481 1,157

Interest received (14) - -

Bank and other interest

charges 94 80 165

Share based payments 78 131 249

Operating cashflows before movement

in working capital 1,791 1,132 2,568

Movement in inventories 1,095 (245) (1,377)

Movement in trade and

other receivables (1,680) (35) 498

Movement in trade and

other payables 711 (867) (1,105)

Movement in provisions - - (46)

Cash generated from

operations 1,917 (15) 538

Interest received 14 - -

Income taxes received 1,643 143 129

Net cash inflow from

operating activities 3,574 128 667

-------------------- ------------------- ------------------

9. Copies of the report are available on the Group's

website www.trakm8.com and also from the registered

office of Trakm8 Holdings plc. The address of the registered

office is: Roman Way, Roman Park, Coleshill, North Warwickshire,

B46 1HG.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BRBDBXBDBGRS

(END) Dow Jones Newswires

November 27, 2017 02:00 ET (07:00 GMT)

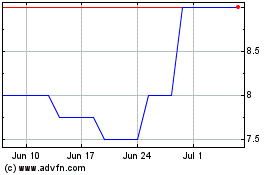

Trakm8 (LSE:TRAK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trakm8 (LSE:TRAK)

Historical Stock Chart

From Apr 2023 to Apr 2024