TIDMTRAK

RNS Number : 0661D

Trakm8 Holdings PLC

04 July 2016

4 July 2016

TRAKM8 HOLDINGS PLC

('Trakm8' or 'the Group' or 'the Company')

Preliminary Results

for the year ended 31 March 2016

Trakm8, the AIM quoted telematics and data provider to the

global market place, is pleased to announce its unaudited

preliminary results for the year ended 31 March 2016.

Financial highlights:

2016 2015 Change

--------------------- ---------- ---------- -------

Revenues GBP25.65m GBP17.85m +44%

--------------------- ---------- ---------- -------

Operating Profit GBP3.11m GBP1.76m +77%

--------------------- ---------- ---------- -------

Adjusted operating

profit* GBP3.92m GBP1.88m +109%

--------------------- ---------- ---------- -------

Cash generated from

operations GBP4.45m GBP1.19m +274%

--------------------- ---------- ---------- -------

Profit before tax GBP3.00m GBP1.70m +76%

--------------------- ---------- ---------- -------

Adjusted earnings

per share* 13.44p 6.24p +115%

--------------------- ---------- ---------- -------

Basic earnings per

share 11.15p 5.84p +91%

--------------------- ---------- ---------- -------

Dividend per share 2p nil n/a

(proposed)

--------------------- ---------- ---------- -------

-- Revenues up 44% year on year included:

o Strong organic growth of 28%

o First time contributions from the trade and assets of DCS

Systems Ltd ("DCS") and Route Monkey Holdings Ltd ("RML") which

were acquired in the year

o Recurring revenues up 49% to GBP8.31m

-- Orders received up 29% year on year (organic basis)

-- Net debt(+) of GBP1.09m (2015: net cash GBP0.60m), following

GBP10.4m acquisition cash spend, GBP6.0m equity placing and strong

cash flow and conversion

-- Maiden final dividend of 2 pence per share to be proposed

Operating highlights:

-- 151,000 units now reporting to our servers (2015: 102,000)

-- Two acquisitions, DCS and RML completed in the year;

integrations proceeding to plan. Both are profitable, cash

generative and earnings enhancing

-- Substantial contract wins for both fleet and insurance customers:

o during the year: with Iceland Foods, Kubota UK, and the AA

o post year end: with Scottish Power, BT Fleet, Allianz and

Shell

-- Significant investment in R&D and sales and marketing resources to drive growth

(*) before exceptional costs and share based payments (+) total borrowings less cash

Outlook

-- Continuation of a strong order pipeline and increase in sales opportunities

-- Good visibility of revenue and cash flow due to recurring revenues and new contract wins

John Watkins, Executive Chairman said:

"This has been a rewarding year for the Group with revenues up

by 44% and adjusted operating profit up by 109% despite a

significant increase in overheads as we invested as planned in the

future growth of the business. We have achieved strong organic

growth, good first time contributions from acquisitions as well as

robust cash flow and cash conversion. This strong financial

performance is enabling the payment of a proposed maiden

dividend.

The Group has had a successful start to the new financial year

consistent with its expectations for the year as whole,

notwithstanding the new uncertainties created due to the Brexit

vote. The latest contract win with Allianz together with our strong

pipeline of further opportunities provide additional visibility in

our outlook for this year. Therefore the Board remains optimistic

of a positive outlook for the year as a whole."

We expect to have our audited Annual Report and Financial

Statements for the year ended 31 March 2016 available on our

website on 11 July 2016.

A presentation for analysts is being hosted today (4 July 2016)

at 9.15am for 9.30am at MHP's offices. For further information,

please contact MHP Communications on trakm8@mhpc.com.

-ends-

For further information please contact:

Trakm8 Holdings plc 01747 858444

John Watkins, Executive Chairman

James Hedges, Finance Director

MHP Communications (Financial

PR to Trakm8) 020 3128 8100

Reg Hoare / Jade Neal

finnCap (Nomad & Broker to

Trakm8) 020 7220 0500

Ed Frisby / Simon Hicks -

corporate finance

Joanna Weaving - corporate

broking

J.P. Morgan Cazenove (Financial

Adviser) 020 7742 4000

Robert Constant

Wendy Hohmann

Notes to Editors

About Trakm8

Trakm8 Group is a UK based Big Data company utilising telematics

as their primary enabler. Through IP owned technology, over two

billion miles worth of data is collected annually through their

fleet management solutions to create and fine tune algorithms used

to score driver behaviour, monitor vehicle health and continuously

improve the security and operational efficiencies of customers'

vehicles.

With its headquarters in Dorset and a manufacturing facility in

the West Midlands, the Group supplies a number of well-known

customers in the fleet management and insurance sectors across the

UK and further afield including customers such as the AA, Saint

Gobain, EON, Direct Line Group and Young Marmalade.

The Group's portfolio offers complete telematics solutions,

which since the acquisition of the assets of DCS Systems, includes

dashboard cameras that enable customers to record driving incidents

and mitigate the risk from "crash to cash" accidents. This is

complemented through a comprehensive hardware range, which includes

a self-install unit that is one of the smallest available on the

global market.

Recently, the Group acquired Route Monkey, significantly

enhancing the Group's Logistics solution which offers both route

scheduling and optimisation, including routing for Electric

Vehicles.

Trakm8 has been listed on the AIM market of the London Stock

Exchange since 2005.

www.trakm8.com / @Trakm8

Trakm8 Holdings PLC

EXECUTIVE CHAIRMAN'S STATEMENT

Introduction

I am very pleased to present our results for the year ended 31

March 2016. This has been a rewarding year for the Group with

revenues up by 44% to GBP25.65m and adjusted operating profit up by

109% to GBP3.92m despite a significant increase in overhead costs

as we invested as planned in the future growth of the business. Our

profit before tax increased to GBP3.00m (2015: GBP1.70m).

Our sales of new fleet management solutions and insurance

products have culminated in growth in all areas and provide us with

a solid base of recurring revenues from which we can continue to

expand. Furthermore the range and breadth of the data we are now

able to provide gives us an overwhelming proposition for all the

business sectors we touch.

The revenue growth of 44% was made up of organic growth of 28%

with the addition of first time contributions from the acquisitions

we made during the year. Orders received are also up by 29% like

for like.

Trakm8's business model is strongly cash generative now that it

is a profitable business and given the robust core of recurring

revenues, although this tends to be substantially skewed to the

second half due to the timing of contract renewals. This year we

have reported cash generation from operating activities of GBP4.45m

(2015: GBP1.19m), with significantly improved free cashflow

conversion(*) , after capex and capitalised development costs, of

51% (2015: -1%). The improved cash conversion is expected to

continue as revenues increase and development spending as a

percentage of revenues reduces.

(*) (Free cashflow conversion being net cash from operating

activities / adjusted operating profit)

Acquisitions

During the financial year we completed two acquisitions. We

acquired the trade and assets of DCS Systems Ltd ("DCS") in June

2015 giving us vital knowledge and experience of digital camera

systems and included the Dogcam, RoadHawk and Lawmate brands. The

purchase consideration was GBP3.28 million.

In December 2015 we acquired the Route Monkey Group ("RML")

which provides routing and scheduling optimisation solutions. The

purchase consideration was for a value of GBP5.04m, together with

further contingent consideration of up to a GBP2.0m maximum.

However, despite an earnings enhancing performance and encouraging

prospects, it is unlikely that RML will achieve its target to

trigger the payment of the contingent consideration (which has

therefore not been provided for).

These two acquisitions complement our vehicle telematics

solutions and are enabling us to develop the more integrated

solutions that our customers are demanding, providing richer and

more refined data. The integration of both of these acquisitions is

on track and they have been earnings enhancing and cash generative

since their acquisition dates.

Solutions

Solutions sales are the core of our telematics offerings and

comprise revenues from customers where they pay for service fees in

addition to the cost of the hardware, installation and other

bespoke services. Sales increased by 57% to GBP17.21m (2015:

GBP10.98m) and more importantly within this growth our recurring

revenues grew by 49% to GBP8.31m (2015: GBP5.58m). Growing these

service revenues is a key focus as it provides increasing

confidence and predictability to future periods. In total we had

151,000 units (2015: 102,000) reporting to our servers at the year

end.

Our solutions sales cover both the fleet management and

insurance market sectors. The total fleet management units only

increased marginally over the year to 58,522 (2015: 57,763) due to

the loss of circa 5,000 units from our South African distributor

who struggled with the weakness of the rand. Telematics for

insurance is a newer market and is currently experiencing high

levels of growth. At the year end we had 92,025 insurance solution

units reporting to our servers (2015: 44,468). Market forecasts are

predicting growth rates in excess of 42% and we have certainly seen

an increased level of interest from established insurance

businesses. As a result the lifetime cost of an installed unit has

dropped significantly over the last couple of years with a growing

appetite from customers for richer data.

We have invested in our First Notification of Loss ("FNOL")

algorithms and are now able to identify the majority of crashes -

particularly at speeds below 40 mph which are notoriously difficult

to detect. According to the US National Highway Traffic Safety

Administration in excess 90% of insurance claims are due to driver

error and the ability to offer black box data in conjunction with

video footage of events leading up to an accident is proving to be

a powerful driver to enable insurance companies to reduce the cost

and management of policyholder's claims.

We have accelerated the development of our Fleet management

solutions and believe we offer one of the widest ranges of

solutions available in addition to camera and optimisation

capabilities. We are now able to download and report on vehicle

diagnostic data from in excess of 95% of all vehicles since 2006

and this is providing valuable information in particular for fleet

managers and our road side assistance customers. New contracts won

during the year included Bibby Distribution and Kubota together

with the contract extension we announced last December with the AA

whereby our telematics solutions will be offered to the AA business

customers. We were also delighted that Route Monkey secured a three

year contract extension with Iceland for their optimisation

software.

In addition since the year end we have announced a new contract

with Scottish Power to provide our telematics solution with driver

feedback devices to 1,600 vehicles and a contract with BT Fleet to

market our telematics solutions to their business customers. We

have also secured a 12 month contract extension from Shell, which

has been Route Monkey's largest customer in recent years.

Furthermore, we have been awarded two initial contracts by Allianz,

the global insurance company, to supply devices with specifically

developed software to Allianz's Global Telematics business. The

initial supply contract comes with a launch order of 5,000 devices

to start the pipe filling for Allianz Insurance telematics in

China.

Products

Product sales are the sales of our hardware mainly to other

telematics service providers and integrators. In addition the sales

of the DCS camera products are now included together with the

revenues from our contract electronic manufacturing facility in

Coleshill, Birmingham. Total product revenues increased by 23% to

GBP8.44m (2015: GBP6.87m) with GBP1.85m of this growth being

accounted for by sales of camera products. Organic product sales

reduced by GBP0.3m as we continue to focus on solutions sales to

our own customers rather than lower margin product sales to third

parties.

Reflecting this strategy, during the year our manufacturing

facility made in excess of 138,000 telematics units and it is

anticipated this growth will continue. Manufacturing our own

telematics units gives the Group a lower overall unit cost together

with a much shorter time to market for introducing new products.

For example after only two years of marketing the smallest self fit

telematics device, we are now developing our 4(th) version as we

continue to refine the product and enhance the insights that can be

gained from the richness of the data.

Research and Development

We operate in a competitive market where hardware costs are

reducing, along with the costs of sending data over the mobile

networks. At the same time customers are becoming increasingly

aware of the variety and volumes of data that can be made available

from telematics solutions and this is driving the market towards

providing "more for less". We also exist in a fragmented market

where there are many competitors with few barriers to entry. Trakm8

has always focussed on owning the intellectual property ("IP") we

use in our products and solutions and we see this as one of our key

competitive advantages. Telematics systems are complex but because

we own all the elements that encompass a solution (with the

exception of the mobile networks) we have the ability to understand

and resolve problems more easily than our competitors.

The Group has invested in a 44% increase in the average number

of Engineers in our research & development teams to 59 (2015:

41) during the year. We have rolled out our battery health

monitoring algorithm and submitted an associated patent

application. Our self fit telematics device continues to be the

smallest on the market and is now auto-configurable when plugged

into a new vehicle. We have also reduced the time our installers

require to fit our fixed wired devices. Our hosting architecture

has also been developed so that we can now manage much larger

quantities of devices using Amazon Web Services.

We have continued to enhance our algorithms for the risk scoring

of drivers for insurance companies so that their premiums can be

more accurately calculated to match the level of risk. Our

acquisition of the DCS assets in June 2015 has given us a valuable

insight into dash cams and later this year we will be launching an

integrated telematics and camera product. This will enable users to

receive an instant summary of events leading up to a crash incident

including visual data from the camera and vehicle data from our

telematics unit.

During the year the Group initiated a data security audit by a

third party to understand the strengths and weaknesses in our

system for collecting, transferring, storing and presenting the

growing volumes of data we are now managing. Data security is very

important to us and to all of our customers and we were pleased to

gain accreditation with ISO 27001 - the standard for Information

Security Management.

Board Changes

During the year we made significant changes to our Board

reflecting the need to strengthen and focus it as a result of our

strong growth. First, Bill Duffy joined as an independent

Non-Executive Director. Bill has considerable commercial experience

having been CEO of Andrew Page, Halfords Autocentres and a number

of other leading automotive aftermarket companies. He has also been

a consultant to the Board over the past 12 months.

In addition Trakm8 appointed two of its executives to be

Directors of the Group: Sean Morris, as Group Engineering Director

and Mark Watkins as Group Operations Director. Sean joined the

Group following senior engineering positions at Continental UK, RAC

and Aston Martin. Mark joined the Group following a successful

career in IT and operations at Continental UK and Ford Motor

Co.

Paul Wilson resigned from the Board in December but remains a

senior executive of the Group and we wish to thank him for his

contribution over the past six years. He is now concentrating his

efforts on supporting the AA Fleet Intelligence reseller

opportunity.

Advisors

We were pleased to announce in April 2016 the appointment of JP

Morgan Cazenove as financial adviser to the Company. finnCap remain

the Company's Broker and Nominated Adviser. This appointment

reflected the Board's belief that it is appropriate to broaden its

advisory relationships given the evolution of the business and the

telematics industry as a whole and to help us take the next steps

in the Company's development.

Dividend

In April 2016 we announced that the Board had considered the

payment of a dividend in light of the Group's strong financial

performance and its confidence in Trakm8's prospects. As a

consequence the Board is proposing to pay a maiden dividend of 2

pence per share subject to shareholder approval at our Annual

General Meeting in September 2016. The dividend timetable will be

confirmed in due course.

People

The number of people we employ has grown rapidly as we have

continued to invest strongly in our customer service, sales and

marketing and engineering teams. In total our organic staff numbers

have grown by 24% over the year and in addition we have welcomed 24

new colleagues from the DCS and Route Monkey acquisitions. It has

been a demanding year as the Group has experienced rapid growth and

I would like to thank everyone for their hard work, dedication and

contribution to the ongoing success of the business

Outlook

The Group has had a successful start to the new financial year

consistent with its expectations for the year as whole. The first

two months have continued with the strong organic growth of

previous years with orders received 57% greater than the

corresponding period last year (organic 44%). Following the high

level of investment in the business last year, we anticipate costs

growing more slowly this year. We will also benefit from full year

contributions from our two recent acquisitions.

The referendum decision to leave the European Union will

inevitably lead to uncertainty both politically and commercially

for some time. Uncertainty is always unwelcome and may lead to

potential customers choosing to delay their investment decisions

until the outlook becomes clearer. In addition recent currency

movements may lead to additional costs for many of our components

which are not priced in sterling but equally our solutions will

become more attractive to overseas customers.

We have also recently announced two contracts with Allianz, the

global insurance company to provide the next generation of our self

fit telematics device together with the development of specific

software to meet their requirements. These important contracts

together with our strong pipeline of further opportunities provide

additional visibility in our outlook for this year.

Therefore the Board remains optimistic of a positive outlook for

the year as a whole.

John Watkins

EXECUTIVE CHAIRMAN

1 July 2016

Trakm8 Holdings PLC

FINANCIAL REVIEW

Trading Results

Revenues for the year were up by 44% at GBP25.65m (2015:

GBP17.85m). Organic growth was 28% and this was supplemented by a

GBP1.85m contribution from our acquisition of the DCS assets in

June 2015 and a further GBP0.86m from the acquisition of Route

Monkey at the end of December 2015. Sales of digital cameras have

performed broadly in line with our expectations and Route Monkey

revenues benefited from the contract renewal with Iceland in

January 2016. Particularly pleasing was the 49% increase in our

recurring revenues to GBP8.31m (2015: GBP5.58m). Our recurring

revenues are reported as fees from service and data feeds only and

do not include any amortised hardware costs for contracts which

have been offered at a fixed monthly fee for a specific term.

Our gross margin percentage increased by 3.1% to 48.3% (2015:

45.2%). We would anticipate our gross margin percentage to increase

in future years as the proportion of our recurring revenues

increases and as we concentrate our manufacturing facility on

making a more focussed range of products. This however will be

tempered by the increasing price pressure that exists in the

telematics market towards lower cost hardware and richer data.

Trakm8 is strongly placed to manage these demands through owning

all of the intellectual property in its telematics solutions.

Adjusted Operating Profit

One of our key performance indicators is Adjusted Operating

Profit (Operating Profit before exceptional costs and share based

payments). The growth in our Adjusted Operating Profit was 109% to

GBP3.92m (2015: GBP1.88m).

Overheads

Our overheads before exceptional costs increased by 39% to

GBP8.76m (2015: GBP6.30m) reflecting a significant ramp up in

expensed research and development, customer service, sales and

marketing activities during the year. This led to a substantial

increase in our average staff numbers over the year from 157 in

2014/15 to 224 in 2015/16. In total 24 staff members joined us as a

result of the acquisitions of DCS and RML. The increase in our

investment in new products and research and development over the

year resulted in the capitalisation of development costs of

GBP1.85m (2015: GBP0.86m) and the expensing of GBP1.00m (2015:

GBP0.35m) in line with the accounting standards.

Profit before tax

Profit before tax has increased by 76% to GBP3.00m (2015:

GBP1.70m). The tax credit for the year is GBP0.34m (2015: tax

charge GBP0.0m). Profit before tax includes exceptional costs of

GBP0.61m (2015: nil) which were incurred in relation to the

acquisition and integration costs of the trade and assets of DCS

and RML.

The Group has tax losses of GBP6.3m to utilise in future

periods.

Earnings per share

Basic earnings per share increased by 91% to 11.15 pence (2015:

5.84 pence). Our adjusted earnings per share which is before

exceptional costs and share based payments, increased by 115% to

13.44 pence (2015: 6.24 pence).

Balance Sheet, Financing and Cash Flow

Our intangible non current assets grew by GBP10.34m as a result

of the two acquisitions we completed during the year together with

our increased investment in development costs. Goodwill arising

from the DCS acquisition was GBP2.18m with a further GBP0.32m

intangibles relating to acquired development costs. The acquisition

of Route Monkey created GBP5.59m of goodwill and in addition we

acquired GBP0.98m of algorithms and related software.

A new five year bank facility was taken out with HSBC in

December to replace existing facilities and to complete the

acquisition of Route Monkey. In addition a new GBP5m revolving

credit facility was granted by HSBC and this facility has yet to be

drawn down.

In addition to this facility, to fund the Route Monkey

acquisition 1,801,802 new ordinary shares were placed with

institutional investors at a price of 333 pence, to raise GBP6m.

184,441 new ordinary shares were also issued as part of the

consideration to the senior management shareholders of Route

Monkey.

Total cash generated from operations during the year was an

excellent GBP4.45m (2015: GBP1.19m) representing 114% of adjusted

operating profit (2015: 63%). Free cashflow conversion, after capex

and capitalised development costs, was 51% (2015: -1%). As a result

we ended the year with total cash of GBP3.87m set against total

borrowings of GBP4.96m, giving overall a net debt of GBP1.09m

(2015: net cash GBP0.60m).

James Hedges

Finance Director

1 July 2016

Trakm8 Holdings PLC

UNAUDITED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the year ended 31 March 2016

Note Unaudited Audited

Year Year

ended ended

31 March 31 March

2016 2015

GBP GBP

REVENUE 3 25,649,188 17,853,436

Cost of sales (13,251,581) (9,791,655)

------------- ------------------

Gross profit 12,397,607 8,061,781

Other income 81,443 -

Administrative expenses excluding

exceptional costs (8,756,085) (6,301,424)

Exceptional administrative costs 5 (612,559) -

------------- ------------------

Total administrative costs (9,368,644) (6,301,424)

OPERATING PROFIT 4 3,110,406 1,760,357

Finance income 874 388

Finance costs 6 (108,208) (58,439)

------------- ------------------

PROFIT BEFORE TAXATION 3,003,072 1,702,306

Income tax 340,678 (13,241)

------------- ------------------

PROFIT FOR THE YEAR ATTRIBUTABLE

TO THE OWNERS OF THE PARENT 3,343,750 1,689,065

OTHER COMPREHENSIVE INCOME /

(EXPENSE)

Items that may be subsequently

reclassified to profit or loss:

Currency translation differences 3,811 (4,460)

------------- ------------------

TOTAL OTHER COMPREHENSIVE INCOME

/ (EXPENSE) 3,811 (4,460)

TOTAL COMPREHENSIVE INCOME FOR

THE YEAR ATTRIBUTABLE TO OWNERS

OF THE PARENT 3,347,561 1,684,605

------------- ------------------

Adjusted Operating profit 4 3,921,044 1,877,289

----------------------------------- ----- ------------- ------------------

EARNINGS PER ORDINARY SHARE

(PENCE) ATTRIBUTABLE TO OWNERS

OF THE PARENT

Basic 7 11.15p 5.84p

Diluted 7 10.27p 5.48p

There were no discontinued operations in 2016

or 2015. Accordingly the results relate to continuing

operations.

Trakm8 Holdings PLC

UNAUDITED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the year ended 31 March 2016

----------------------------------------------------------------------------------------------------------------------------------

Share Share Merger Translation Treasury Retained Total

capital premium reserve reserve reserve earnings equity

attributable

to owners

of the

parent

GBP GBP GBP GBP GBP GBP GBP

Balance as at

1 April 2014 288,738 3,641,561 509,837 200,063 - 491,877 5,132,076

Comprehensive

income

Profit for the

year - - - - - 1,689,065 1,689,065

Other

comprehensive

expense

Exchange

differences

on translation

of overseas

operations - - - (4,460) - - (4,460)

Total

comprehensive

(expense) /

income - - - (4,460) - 1,689,065 1,684,605

-------------- ---------------- -------------- --------------- -------------- ---------- -------------

Transactions with

owners

Shares issued 1,000 11,500 - - - - 12,500

Reclassification

of previous

Treasury

share

transactions - 67,076 - - (23,250) (43,826) -

Sale of own

shares - 37,263 - - 11,625 - 48,888

IFRS2 Share based

payments - - - - - 116,932 116,932

Transactions with

owners 1,000 115,839 - - (11,625) 73,106 178,320

-------------- ---------------- -------------- --------------- -------------- ---------- -------------

Balance as at

1 April 2015

(Audited) 289,738 3,757,400 509,837 195,603 (11,625) 2,254,048 6,995,001

-------------- ---------------- -------------- --------------- -------------- ---------- -------------

Comprehensive

income

Profit for the

year - - - - - 3,343,750 3,343,750

Other

comprehensive

income

Exchange

differences

on translation

of overseas

operations - - - 3,811 - - 3,811

Total

comprehensive

income - - - 3,811 - 3,343,750 3,347,561

-------------- ---------------- -------------- --------------- -------------- ---------- -------------

Transactions with

owners

Shares issued 30,612 6,110,982 612,344 - - - 6,753,938

Share placing

fees - (300,000) - - - - (300,000)

Sale of own

shares - 72,680 - - 7,130 - 79,810

IFRS2 Share based

payments - - - - - 198,079 198,079

-------------- ---------------- -------------- --------------- -------------- ---------- -------------

Transactions with

owners 30,612 5,883,662 612,344 - 7,130 198,079 6,731,827

-------------- ---------------- -------------- --------------- -------------- ---------- -------------

Balance as at

31 March 2016

(Unaudited) 320,350 9,641,062 1,122,181 199,414 (4,495) 5,795,877 17,074,389

-------------- ---------------- -------------- --------------- -------------- ---------- -------------

Trakm8 Holdings PLC

UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

as at 31 March 2016

--------------------------------------------------------------------------

Note Unaudited Audited

As at As at

31 March 31 March

2016 2015

ASSETS GBP GBP

NON CURRENT ASSETS

Intangible assets 13,996,240 3,652,203

Property and equipment 1,572,613 1,246,669

Deferred income tax asset 801,365 665,688

16,370,218 5,564,560

------------ -------------

CURRENT ASSETS

Inventories 2,258,882 1,493,417

Trade and other receivables 7,620,001 4,911,525

Cash and cash equivalents 3,871,110 3,407,959

13,749,993 9,812,901

------------ -------------

LIABILITIES

CURRENT LIABILITIES

Trade and other payables (7,541,122) (5,124,668)

Borrowings (981,182) (575,644)

Provisions (92,208) (92,193)

(8,614,512) (5,792,505)

------------ -------------

CURRENT ASSETS LESS CURRENT LIABILITIES 5,135,481 4,020,396

TOTAL ASSETS LESS CURRENT LIABILITIES 21,505,699 9,584,956

NON CURRENT LIABILITIES

Trade and other payables (395,313) (306,034)

Borrowings (3,976,336) (2,236,001)

Provisions (59,661) (47,920)

NET ASSETS 17,074,389 6,995,001

============ =============

EQUITY

Share capital 8 320,350 289,738

Share premium 9,641,062 3,757,400

Merger reserve 1,122,181 509,837

Translation reserve 199,414 195,603

Treasury reserve (4,495) (11,625)

Retained earnings 5,795,877 2,254,048

TOTAL EQUITY ATTRIBUTABLE TO OWNERS

OF THE PARENT 17,074,389 6,995,001

============ =============

Trakm8 Holdings PLC

UNAUDITED CONSOLIDATED STATEMENT OF CASH FLOWS

for the year ended 31 March 2016

Notes Unaudited Audited

Year Year

ended ended

31 March 31 March

2016 2015

GBP GBP

NET CASH GENERATED FROM OPERATING

ACTIVITIES 9 4,447,310 1,186,080

CASH FLOWS FROM INVESTING ACTIVITIES

Interest received 874 388

Acquisition of subsidiary undertaking

(net of cash acquired) (7,697,532) (5,175)

Purchases of property, plant

and equipment (528,596) (355,087)

Purchases of software (79,134) -

Proceeds from sale of plant

and equipment - 9,888

Capitalised development costs (1,852,639) (861,849)

NET CASH USED IN INVESTING

ACTIVITIES (10,157,027) (1,211,835)

------------- ------------------

CASH FLOWS FROM FINANCING ACTIVITIES

Issue of new shares 5,839,751 12,500

Sale of Treasury shares 79,810 48,888

New bank loan 6,000,000 3,000,000

New HP agreement 126,242 -

Interest paid (108,208) (58,439)

Repayment of loans (5,751,888) (2,480,021)

Repayment of obligations under (12,839) -

hire purchase agreements

NET CASH GENERATED FROM FINANCING

ACTIVITIES 6,172,868 522,928

------------- ------------------

NET INCREASE IN CASH AND CASH

EQUIVALENTS 463,151 497,173

------------- ------------------

CASH AND CASH EQUIVALENTS AT

BEGINNING OF YEAR 3,407,959 2,910,786

------------- ------------------

CASH AND CASH EQUIVALENTS AT OF YEAR 3,871,110 3,407,959

------------- ------------------

Trakm8 Holdings PLC

NOTES TO THE FINANCIAL STATEMENTS

for the year ended 31 March 2016

1. GENERAL INFORMATION

Trakm8 Holdings PLC ("Company") and its subsidiaries (together

the "Group") manufacture, distribute and sell telematics devices

and services.

Trakm8 Holdings PLC is a public limited company incorporated in

the United Kingdom (registration number 05452547). The Company is

domiciled in the United Kingdom and its registered office address

is Lydden House, Wincombe Business Park, Shaftesbury, Dorset, SP7

9QJ. The Company's Ordinary shares are traded on the AIM market of

the London Stock Exchange.

The Group's principal activity is the manufacture, marketing and

distribution of vehicle telematics equipment and services.

2. BASIS OF PREPARATION

The unaudited financial information included in this preliminary

results announcement for the year ended 31 March 2016 and audited

financial information for the year ended 31 March 2015 does not

comprise statutory accounts within the meaning of section 434 of

the Companies Act 2006. The information has been extracted from the

unaudited statutory financial statements for the year ended 31

March 2016 which will be delivered to the Registrar of Companies in

due course. Statutory financial statements for the year ended 31

March 2015 were approved by the Board of directors and have been

delivered to the Registrar of Companies. The report of the auditors

on these financial statements was unqualified and did not include

an emphasis of matter paragraph.

These financial statements are presented on a going concern

basis. The Group has cash balances of GBP3,871,110 at 31 March 2016

and the Directors have a reasonable expectation that the Group will

have adequate financial resources to continue in operation for the

foreseeable future.

The financial statements have been prepared in accordance with

International Financial Reporting Standards (IFRSs) as adopted by

the European Union, the interpretations of International Financial

Reporting Interpretations Committee (IFRIC) and the Companies Act

2006 applicable to companies reporting under IFRS.

Whilst the financial information included in this preliminary

announcement has been prepared in accordance with International

Financial Reporting Standards (IFRS), this announcement does not

contain sufficient information to comply with IFRS. The accounting

policies used in the preparation of these unaudited financial

statements are consistent with those used in the preparation of the

audited financial statements for the year ended 31 March 2015.

3. SEGMENTAL ANALYSIS

The chief operating decision maker ("CODM") is identified as the

Board. It continues to define all the Group's trading under the

single Integrated Telematics Technology segment and therefore

review the results of the group as a whole. Consequently all of the

Group's revenue, expenses, results, assets and liabilities are in

respect of one Integrated Telematics Technology segment.

The board as the CODM review the revenue streams of Integrated

Fleet Management and Insurance Solutions (Solutions) and Hardware

as Discrete Devices (Products) as part of their internal reporting.

Products is the sale of hardware through the Group's distributors.

Solutions represents the sale of the Group's full vehicle

telematics service to customers, engineering services, professional

services and mapping solutions.

A breakdown of revenues within these

streams are as follows:

Unaudited Audited

Year Year

ended ended

31 March 31 March

2016 2015

GBP GBP

Solutions 17,208,779 10,981,695

Products 8,440,409 6,871,741

25,649,188 17,853,436

----------- -----------

A geographical analysis of revenue

by destination is as follows:

Unaudited Audited

Year ended 31 March Year ended 31 March

2016 2015

Solutions Products Total Solutions Products Total

GBP GBP GBP GBP GBP GBP

United Kingdom 16,769,774 8,048,848 24,818,622 10,268,761 6,174,260 16,443,021

USA - 168,652 168,652 98,534 191,744 290,278

Canada 390 46,592 46,982 360 226,146 226,506

Norway 117,527 - 117,527 377,043 - 377,043

Rest of

Europe 224,078 7,784 231,862 132,040 46,760 178,800

UAE - 136,819 136,819 - 175,880 175,880

Rest of

World 97,010 31,714 128,724 104,957 56,951 161,908

17,208,779 8,440,409 25,649,188 10,981,695 6,871,741 17,853,436

=========== ========== =========== =========== =========== ===========

All non-current assets are located in the UK with the exception

of GBP7,004 (2015: GBP5,023) which are held in Europe.

4. OPERATING PROFIT

The following items have been included in arriving at operating

profit:

Unaudited Audited

Year ended Year ended

31 March 31 March

2016 2015

GBP GBP

Depreciation

- owned fixed

assets 227,194 176,571

- assets on hire 5,075 -

purchase

Amortisation of intangible

assets 655,528 542,713

Operating lease

rentals

Land and buildings 92,173 51,862

Other 219,625 142,838

Research and development

expenditure 1,002,096 350,177

Loss on foreign exchange

transactions 46,212 18,227

Staff costs 6,036,138 4,479,252

GBP GBP

Auditors' remuneration

Fees payable to the Company's

auditors for the audit of

the parent

company and consolidated

financial statements 57,000 10,000

Fees payable to the Company's

auditors for other services:

The audit of the Company's

subsidiaries 40,000 30,000

Tax compliance 12,500 -

services

Tax advisory services 12,450 7,500

------------ ------------

Adjusted Operating profit is monitored by the Board and measured

as follows:

Unaudited Audited

Year ended Year ended

31 March 31 March

2016 2015

GBP GBP

Operating Profit 3,110,406 1,760,357

Exceptional administrative 612,559 -

costs

Share based payments 198,079 116,932

Adjusted Operating

profit 3,921,044 1,877,289

------------ ------------

5. EXCEPTIONAL COSTS

Unaudited Audited

Year ended Year ended

31 March 31 March

2016 2015

GBP GBP

Acquisition costs 578,943 -

Integration costs 33,616 -

612,559 -

------------ ------------

The acquisition costs related to the purchase of the trade and

assets of DCS Systems Ltd in June 2015 and 100% of the share

capital of Route Monkey Holdings Ltd in December 2015. The

integration costs related to the reorganisation of management and

integration of business systems and processes following the

acquisitions. These costs have been included as part of

Administration costs.

6. FINANCE COSTS

Unaudited Audited

Year ended Year ended

31 March 31 March

2016 2015

GBP GBP

Interest on bank loans 108,208 58,439

------------ ------------

7. EARNINGS PER ORDINARY SHARE

The earnings per Ordinary share have been calculated using the

profit for the year and the weighted average number of Ordinary

shares in issue during the year as follows:

Unaudited Audited

Year ended Year ended

31 March 31 March

2016 2015

GBP GBP

Profit for the year after

taxation 3,343,750 1,689,065

Exceptional administrative 612,559 -

costs

Share based payments 198,079 116,932

Tax effect of adjustments (122,512) -

------------ -----------------

Adjusted Profit for the

year after taxation 4,031,876 1,805,997

------------ -----------------

No. No.

Number of Ordinary shares

of 1p each 32,035,064 28,973,821

Basic weighted average number

of Ordinary shares of 1p each 30,000,972 28,944,151

Basic weighted average number

of Ordinary shares of 1p each

(diluted) 32,571,617 30,823,153

Earnings per share 11.15p 5.84p

Adjust for effects of:

Exceptional costs 1.63p -

Share based payments 0.66p 0.40p

Adjusted earnings per

share 13.44p 6.24p

Diluted earnings per

share 10.27p 5.48p

Adjusted diluted earnings

per share 12.38p 5.88p

Adjusted diluted earnings per share is based on the Adjusted

Profit for the year after taxation and the same number of shares

used in the calculation of Diluted earnings per share.

8. SHARE CAPITAL

Unaudited Audited

As at 31 March As at 31 March

2016 2015

No's GBP No's GBP

'000's '000's

Authorised

Ordinary shares

of 1p each 200,000 2,000,000 200,000 2,000,000

Allotted, issued

and fully paid

Ordinary shares

of 1p each 32,035 320,350 28,974 289,738

Movement in share

capital:

As at As at

31 March 31 March

2016 2015

GBP GBP

As at 1 April 289,738 288,738

New shares issued 30,612 1,000

As at 31 March 320,350 289,738

---------- ----------

The Company currently holds 29,000 Ordinary shares in treasury

representing 0.10% of the Company's issued share capital. The

number of 1 pence Ordinary shares that the Company has in issue

less the total number of Treasury shares is 32,006,064.

During the year the following shares were issued:

Date Description Shares Consideration Premium

number GBP GBP

Exercise of options

over Ordinary Shares

by Directors and an

04/09/2015 employee of the Company 975,000 126,750 117,000

Exercise of options

over Ordinary Shares

by an employee of the

15/09/2015 Company 100,000 13,000 12,000

Share placing to fund

acquisition of Route

21/12/2015 Monkey 1,801,802 6,000,000 5,981,982

Share issue to senior

management shareholders

21/12/2015 of Route Monkey 184,441 614,189 612,344

3,061,243 6,753,938 6,723,326

---------- -------------- ----------

The shares issued to senior management shareholders of Route

Monkey were issued at a premium which was subject to merger relief

and has been taken to the Merger reserve.

9. CASH GENERATED FROM OPERATIONS

Unaudited Audited

Year ended Year ended

31 March 31 March

2016 2015

GBP GBP

Reconciliation of profit before

tax to net cash flow from operating

activities:

Profit before tax 3,003,072 1,702,306

Depreciation 232,269 202,159

Bank and other interest 107,334 58,051

Amortisation of intangible

assets 655,528 517,125

Share based payments 198,079 116,932

---------------- ------------

Operating cash flows before

movement in working capital 4,196,282 2,596,573

Movement on retranslation

of overseas operations 3,190 (3,764)

Movement in inventories (39,011) (212,808)

Movement in trade and

other receivables (1,211,259) (1,641,882)

Movement in trade and

other payables 1,486,354 394,829

Movement in provisions 11,754 (21,073)

---------------- ------------

Cash generated from operations 4,447,310 1,111,875

Income taxes received - 74,205

Net cash inflow from

operating activities 4,447,310 1,186,080

---------------- ------------

10. BUSINESS COMBINATIONS

Route Monkey Holdings Limited

On 30 December 2015 the Company acquired the entire share

capital of Route Monkey Holdings Ltd and its wholly owned

subsidiary, Route Monkey Ltd "Route Monkey" for a total

consideration of GBP5,036,584.

Route Monkey provides technology solutions that optimise fleet

routing. The company was acquired to bring new and complimentary

route planning and optimisation technology capability to the Group.

The assets and liabilities as at 30 December 2015 arising from the

acquisition were as follows:

Unaudited

Fair value

GBP

Intangible assets 979,891

Property and

equipment 24,995

Trade receivables 1,380,632

Trade and other

payables (975,479)

Deferred tax (181,000)

Borrowings (1,784,357)

------------

Net liabilities

acquired (555,318)

Goodwill 5,591,902

Total consideration 5,036,584

------------

Satisfied by:

Cash 4,422,395

Fair value of shares

in the Company 614,189

5,036,584

------------

The acquisition was settled in cash of GBP4,422,395 and by

issuing 184,441 shares in Trakm8 holdings PLC. The fair value of

the equity shares issued was based on the market value of Trakm8

holdings PLC's traded shares with a fair value of GBP614,189 on the

acquisition date. Merger relief has been applied, leading to the

addition of GBP612,344 to the merger reserve rather than share

premium.

The revenue included in the consolidated statement of

comprehensive income since 30 December 2015 contributed by Route

Monkey was GBP855,823. Route Monkey also contributed operating

profit of GBP585,404 over the same period. The Directors have

concluded that it is impractical to provide disclosure of the

revenues and profit that Route Monkey would have contributed to the

Group had it been consolidated from 1 April 2015. This is due to a

combination of the fact that Route Monkey previously had a

different year end and audited accounts are not available for the

period 1 April 2015 to 31 December 2015, and significant

adjustments have been required to Route Monkey's accounting

policies in respect of revenue recognition to align with the

requirements of IFRS and Trakm8's accounting policies and it is

impractical to recalculate revenues for the period 1 April 2015 to

31 December 2015.

Acquisition related costs amounting to GBP404,743 have been

recognised as an exceptional administrative expense in the

consolidated statement of comprehensive income.

Under the purchase agreement to acquire Route Monkey, contingent

consideration of up to GBP2,000,000 is payable subject to the

business achieving certain performance targets during the year to

31 December 2016. No provision in relation to this consideration

has been recognised in these consolidated financial statements, as

the Directors consider the likelihood of any contingent amounts

being payable under the agreement to be highly unlikely.

The goodwill arising on the acquisition represents the

significant value of the software analytics acquired will bring

when integrated principally into Trakm8's existing telematics

offering, as well as further synergies.

DCS Systems Limited

On 16 June 2015 Trakm8 Limited acquired the business and assets

of DCS Systems Limited "DCS" for a consideration of GBP3,275,136.

DCS specialises in the design and distribution of camera systems

for the motor vehicle, bicycle and security markets.

The fair values of the identifiable assets of the business as at

the date of acquisition were:

Unaudited

Fair value

GBP

Intangible assets 320,000

Property and equipment 4,000

Inventories 726,454

Trade receivables 92,583

Trade and other

payables (43,901)

------------

Net assets acquired 1,099,136

Goodwill 2,176,000

Total consideration 3,275,136

------------

Satisfied by:

Cash 3,275,136

------------

The revenue included in the consolidated statement of

comprehensive income since 15 6 2015 contributed by DCS was

GBP1,851,789. DCS also contributed operating profit of GBP312,015

over the same period.

Had DCS been consolidated from 1 April 2015, the consolidated

statement of comprehensive income would show revenue of

GBP2,330,700 and operating profit of GBP392,709 in relation to this

entity.

Acquisition related costs amounting to GBP174,200 have

recognised as an exceptional administrative expense in the

consolidated statement of comprehensive income.

The goodwill arising on the acquisition represents the value of

the camera technology acquired. The value of which is considerably

enhanced when combined with Trakm8's existing product range and

further synergies.

The information communicated in this announcement is inside

information for the purposes of Article 7 of Regulation

596/2014.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR AKNDBOBKDNOK

(END) Dow Jones Newswires

July 04, 2016 02:00 ET (06:00 GMT)

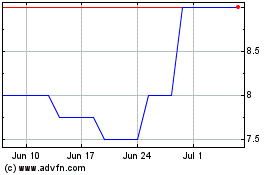

Trakm8 (LSE:TRAK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trakm8 (LSE:TRAK)

Historical Stock Chart

From Apr 2023 to Apr 2024