TIDMTRAK

RNS Number : 4961Y

Trakm8 Holdings PLC

03 March 2017

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH

AFRICA OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION

OR DISTRIBUTION WOULD BE UNLAWFUL.

TRAKM8 HOLDINGS PLC

("Trakm8", the "Group" or the "Company")

Completion of Capital Raising

Trakm8, the AIM-listed telematics and data insight provider, is

pleased to confirm that, further to the announcement made earlier

today, the Company has now raised an increased total of

approximately GBP2.1 million (the "Capital Raising") through the

issue of an aggregate of 3,230,770 new ordinary shares of one penny

each in the capital of the Company ("Ordinary Shares") at a price

of 65 pence per Ordinary Share (the "Issue Price").

The Capital Raising comprises a placing (the "Placing") of

2,044,620 new Ordinary Shares (the "Placing Shares") and

subscriptions (the "Subscription") of 1,186,150 new Ordinary Shares

(the "Subscription Shares") (the Subscription Shares and the

Placing Shares, together the "New Ordinary Shares"), in each case

at the Issue Price, by certain directors (the "Directors") and

senior management of the Company and other investors.

Executive Chairman of Trakm8, John Watkins, commented:

"Today's Capital Raising reduces debt whilst providing working

capital to support day to day operations. Together with our

existing bank facilities, the Group is funded for the future. With

this strengthened financial position, we expect to take advantage

of the significant pipeline of new potential orders and exploit the

potential of our new products, in which we have invested.

The significant participation of the Board in the Capital

Raising demonstrates our confidence in the Group's prospects and

that we expect to improve financial performance in FY2017/18."

The Capital Raising

The New Ordinary Shares represent approximately 9.94 per cent.

of the existing issued share capital of the Company and the Issue

Price represents a discount of approximately 17.2 per cent. to the

closing mid-market price of 78.5 pence per Ordinary Share on 2

March 2017, being the last practicable date prior to the

publication of this announcement and a discount of approximately

9.7 per cent. to the average closing mid-market price of an

Ordinary Share for the five business days to 2 March 2017. The

following Directors participated in the Capital Raising:

Current On Admission

Name Number % Voting Number of Number % Enlarged

of Ordinary Rights New Ordinary of Ordinary Voting

Shares Shares Shares Rights

held subscribed held

for in the

Capital Raising

John Watkins* 5,839,398 17.97% 338,461 6,177,859 17.31%

James Hedges* 2,142,626 6.60% 107,692 2,250,318 6.30%

Tim Cowley 1,857,638 5.72% 92,307 1,949,945 5.46%

Matt Cowley 1,590,357 4.90% 153,846 1,744,203 4.89%

Bill Duffy 40,000 0.12% 100,000 140,000 0.39%

Keith Evans - - 153,846 153,846 0.43%

* the interests of these Directors includes the interests of

their immediate families and any persons connected with them

(within the meaning of section 252 of the Companies Act 2006).

Related Party Transactions

The participations in the Capital Raising by the Directors are

related party transactions under Rule 13 of the AIM Rules for

Companies (the "AIM Rules"). With the exception of John Watkins,

James Hedges, Tim Cowley, Matt Cowley, Bill Duffy and Keith Evans

(together the "Participating Directors"), who are treated as

related parties due to their participation in the Capital Raising,

the independent Directors, being those Directors who did not

participate in the Capital Raising, having consulted with finnCap

Ltd ("finnCap") in its capacity as the Company's nominated adviser

for the purposes of the AIM Rules, consider the terms on which the

Participating Directors will participate in the Capital Raising to

be fair and reasonable insofar as the Company's shareholders are

concerned.

Admission

Application will be made for the New Ordinary Shares to be

admitted to trading on the AIM market ("AIM") of the London Stock

Exchange ("Admission"). Settlement for the New Ordinary Shares and

Admission is expected to take place on 8.00 a.m. on 10 March 2017.

The Capital Raising is conditional, among other things, upon

Admission becoming effective and the placing agreement between the

Company and finnCap (the "Placing Agreement") not being terminated

in accordance with its terms.

On Admission the Company's issued share capital will comprise

35,723,254 Ordinary Shares, of which 29,000 are held in treasury.

Therefore the total number of Ordinary Shares in the Company with

voting rights will be 35,694,254. This figure may be used by

shareholders in the Company as the denominator for the calculations

by which they will determine if they are required to notify their

interest in, or a change to their interest in, the share capital of

the Company under the FCA's Disclosure Guidance and Transparency

Rules.

The New Ordinary Shares, when issued, will be fully paid and

will rank pari passu in all respects with the existing Ordinary

Shares, including the right to receive all dividends and other

distributions declared, made or paid after the date of issue.

This Announcement should be read in its entirety. In particular,

you should read and understand the information provided in the

"Important Notices" section of this Announcement.

For further information please contact:

Trakm8 Holdings plc +44 (0) 174 785 8444

John Watkins, Executive Chairman

James Hedges, Finance Director

finnCap (Nomad & broker) +44 (0) 20 7220 0500

Ed Frisby / Simon Hicks - corporate finance

Tim Redfern / Richard Chambers - corporate broking

MHP Communications +44 (0) 20 3128 8100

Reg Hoare

Charlie Barker

About Trakm8

Trakm8 is a UK based Big Data company utilising telematics as

its primary enabler. Through IP owned technology, over three

billion miles worth of data is collected annually through its fleet

management solutions to create and fine tune algorithms used to

score driver behaviour, monitor vehicle health and continuously

improve the security and operational efficiencies of customers'

vehicles.

With its headquarters in Dorset and a manufacturing facility in

the West Midlands, the Group supplies a number of well-known

customers in the fleet management and insurance sectors across the

UK and further afield including customers such as the AA, Saint

Gobain, EON, Direct Line Group and Young Marmalade.

The Group's portfolio offers complete telematics solutions

including dashboard cameras that enable customers to record driving

incidents and mitigate the risk from "crash to cash" accidents.

This is complemented through a comprehensive hardware range, which

includes a self-install unit that is one of the smallest available

on the global market.

The Group has recently acquired both Route Monkey and Roadsense

Technologies Ltd. Route Monkey has enhanced Trakm8's logistics

solution offering route scheduling and optimisation, including

routing for electric vehicles. Roadsense has been acquired to

strengthen the Group's presence in the SME fleet management

market.

Trakm8 has been listed on the AIM market of the London Stock

Exchange since 2005.

www.trakm8.com / @Trakm8

IMPORTANT NOTICES

MEMBERS OF THE PUBLIC ARE NOT ELIGIBLE TO TAKE PART IN THE

PLACING. THIS ANNOUNCEMENT AND THE TERMS AND CONDITIONS SET OUT

HEREIN (TOGETHER, THIS "ANNOUNCEMENT") ARE DIRECTED ONLY AT PERSONS

WHOSE ORDINARY ACTIVITIES INVOLVE THEM IN ACQUIRING, HOLDING,

MANAGING AND DISPOSING OF INVESTMENTS (AS PRINCIPAL OR AGENT) FOR

THE PURPOSES OF THEIR BUSINESS AND WHO HAVE PROFESSIONAL EXPERIENCE

IN MATTERS RELATING TO INVESTMENTS AND ARE: (1) IF IN A MEMBER

STATE OF THE EUROPEAN ECONOMIC AREA ("EEA"), QUALIFIED INVESTORS AS

DEFINED IN ARTICLE 2(1)(e) OF DIRECTIVE 2003/71/EC AS AMED,

INCLUDING BY THE 2010 PROSPECTUS DIRECTIVE AMING DIRECTIVE

(DIRECTIVE 2010/73/EC) AND TO THE EXTENT IMPLEMENTED IN THE

RELEVANT MEMBER STATE (THE "PROSPECTUS DIRECTIVE"); (2) IF IN THE

UNITED KINGDOM, QUALIFIED INVESTORS WHO (A) FALL WITHIN ARTICLE

19(5) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL

PROMOTION) ORDER 2005, AS AMED (THE "ORDER") (INVESTMENT

PROFESSIONALS) OR (B) FALL WITHIN ARTICLE 49(2)(a) TO (d) (HIGH NET

WORTH COMPANIES, UNINCORPORATED ASSOCIATIONS, ETC.) OF THE ORDER

(ALL SUCH PERSONS TOGETHER BEING REFERRED TO AS "RELEVANT

PERSONS").

THIS ANNOUNCEMENT AND THE INFORMATION IN IT MUST NOT BE ACTED ON

OR RELIED ON BY PERSONS WHO ARE NOT RELEVANT PERSONS. PERSONS

DISTRIBUTING THIS ANNOUNCEMENT MUST SATISFY THEMSELVES THAT IT IS

LAWFUL TO DO SO. ANY INVESTMENT OR INVESTMENT ACTIVITY TO WHICH

THIS ANNOUNCEMENT RELATES IS AVAILABLE ONLY TO RELEVANT PERSONS AND

WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS. THIS ANNOUNCEMENT

DOES NOT ITSELF CONSTITUTE AN OFFER FOR SALE OR SUBSCRIPTION OF ANY

SECURITIES IN TRAKM8 HOLDINGS PLC.

THE PLACING SHARES HAVE NOT BEEN AND WILL NOT BE REGISTERED

UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE

"SECURITIES ACT") OR WITH ANY SECURITIES REGULATORY AUTHORITY OF

ANY STATE OR JURISDICTION OF THE UNITED STATES, AND MAY NOT BE

OFFERED, SOLD OR TRANSFERRED, DIRECTLY OR INDIRECTLY, IN THE UNITED

STATES EXCEPT PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION

NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT

AND IN COMPLIANCE WITH ANY APPLICABLE SECURITIES LAWS OF ANY STATE

OR OTHER JURISDICTION OF THE UNITED STATES. THE PLACING SHARES ARE

BEING OFFERED AND SOLD ONLY (I) OUTSIDE OF THE UNITED STATES IN

"OFFSHORE TRANSACTIONS" WITHIN THE MEANING OF, AND IN ACCORDANCE

WITH, REGULATION S UNDER THE SECURITIES ACT AND OTHERWISE IN

ACCORDANCE WITH APPLICABLE LAWS, AND (II) IN THE UNITED STATES TO A

LIMITED NUMBER OF "QUALIFIED INSTITUTIONAL BUYERS" (AS DEFINED IN

RULE 144A UNDER THE SECURITIES ACT) IN TRANSACTIONS EXEMPT FROM

REGISTRATION UNDER THE SECURITIES ACT. NO PUBLIC OFFERING OF THE

PLACING SHARES IS BEING MADE IN THE UNITED STATES OR ELSEWHERE.

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH

AFRICA OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION

OR DISTRIBUTION WOULD BE UNLAWFUL.

The distribution of this Announcement and/or the Placing and/or

issue of the Placing Shares in certain jurisdictions may be

restricted by law. No action has been taken by the Company, finnCap

or any of their respective affiliates, agents, directors, officers

or employees that would permit an offer of the Placing Shares or

possession or distribution of this Announcement or any other

offering or publicity material relating to such Placing Shares in

any jurisdiction where action for that purpose is required. Persons

into whose possession this Announcement comes are required by the

Company and finnCap to inform themselves about and to observe any

such restrictions.

This Announcement or any part of it does not constitute or form

part of any offer to issue or sell, or the solicitation of an offer

to acquire, purchase or subscribe for, any securities in the United

States (including its territories and possessions, any state of the

United States and the District of Columbia (the "United States" or

the "US")), Australia, Canada, Japan or the Republic of South

Africa or any other jurisdiction in which the same would be

unlawful. No public offering of the Placing Shares is being made in

any such jurisdiction.

All offers of the Placing Shares will be made pursuant to an

exemption under the Prospectus Directive from the requirement to

produce a prospectus. In the United Kingdom, this Announcement is

being directed solely at persons in circumstances in which section

21(1) of the Financial Services and Markets Act 2000 (as amended)

does not apply.

The Placing Shares have not been approved or disapproved by the

US Securities and Exchange Commission, any state securities

commission or other regulatory authority in the United States, nor

have any of the foregoing authorities passed upon or endorsed the

merits of the Placing or the accuracy or adequacy of this

Announcement. Any representation to the contrary is a criminal

offence in the United States. The relevant clearances have not

been, nor will they be, obtained from the securities commission of

any province or territory of Canada, no prospectus has been lodged

with, or registered by, the Australian Securities and Investments

Commission or the Japanese Ministry of Finance; the relevant

clearances have not been, and will not be, obtained for the South

Africa Reserve Bank or any other applicable body in the Republic of

South Africa in relation to the Placing Shares and the Placing

Shares have not been, nor will they be, registered under or offered

in compliance with the securities laws of any state, province or

territory of Australia, Canada, Japan or the Republic of South

Africa. Accordingly, the Placing Shares may not (unless an

exemption under the relevant securities laws is applicable) be

offered, sold, resold or delivered, directly or indirectly, in or

into Australia, Canada, Japan or the Republic of South Africa or

any other jurisdiction outside the United Kingdom.

Persons (including, without limitation, nominees and trustees)

who have a contractual right or other legal obligations to forward

a copy of this Announcement should seek appropriate advice before

taking any action.

This Announcement may contain and the Company may make verbal

statements containing "forward-looking statements" with respect to

certain of the Company's plans and its current goals and

expectations relating to its future financial condition,

performance, strategic initiatives, objectives and results.

Forward-looking statements sometimes use words such as "aim",

"anticipate", "target", "expect", "estimate", "intend", "plan",

"goal", "believe", "seek", "may", "could", "outlook" or other words

of similar meaning. By their nature, all forward-looking statements

involve risk and uncertainty because they relate to future events

and circumstances which are beyond the control of the Company,

including amongst other things, United Kingdom domestic and global

economic business conditions, market-related risks such as

fluctuations in interest rates and exchange rates, the policies and

actions of governmental and regulatory authorities, the effect of

competition, inflation, deflation, the timing effect and other

uncertainties of future acquisitions or combinations within

relevant industries, the effect of tax and other legislation and

other regulations in the jurisdictions in which the Company and its

respective affiliates operate, the effect of volatility in the

equity, capital and credit markets on the Company's profitability

and ability to access capital and credit, a decline in the

Company's credit ratings; the effect of operational risks; and the

loss of key personnel. As a result, the actual future financial

condition, performance and results of the Company may differ

materially from the plans, goals and expectations set forth in any

forward-looking statements. Any forward-looking statements made in

this Announcement by or on behalf of the Company speak only as of

the date they are made. Except as required by applicable law or

regulation, the Company expressly disclaims any obligation or

undertaking to publish any updates or revisions to any

forward-looking statements contained in this Announcement to

reflect any changes in the Company's expectations with regard

thereto or any changes in events, conditions or circumstances on

which any such statement is based.

finnCap is authorised and regulated by the Financial Conduct

Authority (the "FCA") in the United Kingdom and is acting

exclusively for the Company and no one else in connection with the

Placing, and finnCap will not be responsible to anyone (including

any Placees) other than the Company for providing the protections

afforded to its clients or for providing advice in relation to the

Placing or any other matters referred to in this Announcement.

No representation or warranty, express or implied, is or will be

made as to, or in relation to, and no responsibility or liability

is or will be accepted by finnCap or by any of its affiliates or

agents as to, or in relation to, the accuracy or completeness of

this Announcement or any other written or oral information made

available to or publicly available to any interested party or its

advisers, and any liability therefor is expressly disclaimed.

No statement in this Announcement is intended to be a profit

forecast or estimate, and no statement in this Announcement should

be interpreted to mean that earnings per share of the Company for

the current or future financial years would necessarily match or

exceed the historical published earnings per share of the

Company.

The price of shares and any income expected from them may go

down as well as up and investors may not get back the full amount

invested upon disposal of the shares. Past performance is no guide

to future performance, and persons needing advice should consult an

independent financial adviser.

The Placing Shares to be issued pursuant to the Placing will not

be admitted to trading on any stock exchange other than the AIM

market of the London Stock Exchange.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this Announcement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUGUQAWUPMGPW

(END) Dow Jones Newswires

March 03, 2017 07:58 ET (12:58 GMT)

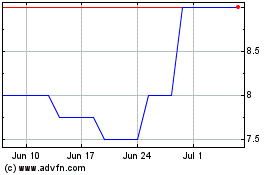

Trakm8 (LSE:TRAK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trakm8 (LSE:TRAK)

Historical Stock Chart

From Apr 2023 to Apr 2024