TIDMTRAK

RNS Number : 6820J

Trakm8 Holdings PLC

21 December 2015

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT IS NOT FOR

RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN

WHOLE OR IN PART, IN OR INTO OR FROM ANY JURISDICTION WHERE TO DO

SO MIGHT CONSTITUTE A VIOLATION OF LOCAL APPLICABLE SECURITIES LAWS

OR REGULATIONS.

21 December 2015

TRAKM8 HOLDINGS PLC

("Trakm8", the "Group" or the "Company")

Proposed acquisition of Route Monkey Holdings Limited and GBP6

million placing

Adds fleet routing optimisation capability

Trakm8 Holdings Plc, the AIM listed telematics and data provider

to the global market place, is pleased to announce that it has

conditionally agreed to acquire the entire issued share capital of

Route Monkey Holdings Limited ("Route Monkey"), a provider of

technology solutions that optimise fleet routing, for a

consideration of up to GBP9.1 million, including maximum deferred

consideration of GBP2.0 million (the "Acquisition").

The Acquisition will be funded through a combination of a

drawdown of new Trakm8 debt facilities, a placing of 1,801,802 new

ordinary shares of one pence each in the Company ("Ordinary

Shares") ("Placing Shares") at a price of 333 pence per Placing

Share (the "Issue Price") to raise GBP6 million (the "Placing") and

184,441 new Ordinary Shares being issued as part of the

consideration to the senior management shareholders of Route Monkey

("Consideration Shares").

The Placing with new and existing institutional investors,

conducted by finnCap, was oversubscribed. The Placing adds new

blue-chip institutions to the share register. The Acquisition is

expected to complete ("Completion") on admission of the Placing

Shares to trading on AIM ("Admission").

The Acquisition is in line with Trakm8's strategy of augmenting

its organic growth with selective acquisitions that expand its

telematics offering to both insurance and fleet customers. The

Acquisition is expected to be immediately earnings enhancing.

Transaction Highlights

-- Trakm8 to acquire Route Monkey for a consideration of up to

GBP9.1 million, including a maximum of GBP2 million deferred cash

consideration;

-- Initial consideration of GBP5.4 million is payable on

Completion, in addition to a repayment of a company loan valued at

GBP1.7 million(1) ;

-- The initial consideration will be funded as follows:

GBP0.5m Debt draw down on new banking

facilities

GBP6.0m The Placing

GBP0.6m Consideration Shares

--------

GBP7.1m Total

Strategic Highlights

The Acquisition brings the following strategic benefits for

Trakm8:

-- Route Monkey adds new and complementary technology capability

to Trakm8 in the field of fleet route planning including a strong

capability for electric vehicles;

-- Trakm8 will integrate Route Monkey's algorithms and related

software into Trakm8's telematics and camera solutions to provide

an enhanced service offering;

-- Trakm8's existing Logistics solution is highly effective in

the organisation of orders, jobs and deliveries but will benefit

from a dynamic optimisation enhancement which Route Monkey

provides, and;

-- Trakm8 provides Route Monkey with access to its larger customer base and sales force.

John Watkins, Executive Chairman of Trakm8 commented:

"The acquisition of Route Monkey is highly complementary to

Trakm8 as it adds route planning and optimisation capability to our

existing technology, a key to enabling us to offer integrated

solutions to customers in line with the development of market

requirements.

"We look forward to welcoming the Route Monkey team into the

growing Trakm8 group and expect the business will add another

source of organic sales growth and recurring revenues.

"Together the acquisitions of Route Monkey and DCS (completed in

June 2015) significantly enhance Trakm8's competitive advantage,

add substantial growth opportunities, and are expected to be

earnings enhancing."

For further information please contact:

Trakm8 Holdings plc +44 1747 858444

John Watkins, Executive Chairman

James Hedges, Finance Director

MHP Communications (Financial

PR to Trakm8) +44 20 3128 8100

Reg Hoare / Jade Neal / Charlotte

Coulson

finnCap (Nomad & Broker to

Trakm8) +44 20 7220 0500

Ed Frisby / Simon Hicks -

corporate finance

Joanna Scott - corporate broking

Background on Route Monkey and Integration Plans

Route Monkey is a software provider which specialises in

solutions that optimise fleet route planning, for both conventional

and electric vehicles. Its software generates savings and

efficiencies for organisations by optimising their fleet, resources

and infrastructure. Its main products include mathematical

algorithms, software and consultancy. Customers include Shell, BMW,

Yodel and Iceland.

The business was founded in 2009, and will continue to be based

in Livingston, Scotland whilst retaining its small offices in

Gateshead and Amsterdam; it currently has 23 employees (including

six engineers and five sales people). Senior management are being

retained and incentivised.

Trakm8's strategy is to integrate Route Monkey's algorithms and

related software into Trakm8's telematics solutions. Trakm8 will

also consolidate Route Monkey's legal, accounting and HR functions

into its own. Route Monkey's sales force will be boosted by the

existing Trakm8 sales force and customer opportunities. Trakm8 will

continue to develop the Route Monkey brand and will undertake an

integration plan for both the product and engineering to combine

the best of both companies.

In the year ended 31 December 2014, Route Monkey recorded

revenues (including a proportion of recurring revenues) of GBP1.7

million and profit before tax of GBP0.7 million. Net debt was

GBP0.5 million at the year end, with net assets of GBP1.2

million.

Reasons For and Benefits of the Acquisition

The board of Directors of Trakm8 considers the opportunities

represented by the Acquisition to be:

-- Route Monkey's core technologies complement Trakm8's existing

Fleet Management solutions. Combining Route Monkey's optimisation

with Trakm8's telematics and camera solutions will provide an

enhanced service offering;

-- Route Monkey provides demonstrable expertise in the

increasingly important electric vehicle market;

-- Route Monkey software provides a dynamic optimisation

enhancement to Trakm8's existing Logistics solution which is highly

effective in the organisation of orders, jobs and deliveries;

-- Trakm8 provides Route Monkey with access to its larger customer base and sales force;

-- Significantly enhances Trakm8's competitive advantage, and;

-- Together with the acquisition of DCS (completed in June 2015)

adds growth opportunities for the combined Group.

The Directors expect the Acquisition to be immediately earnings

enhancing for the Group. This statement does not constitute a

profit forecast nor should it be interpreted to mean that the

future earnings per Ordinary Share of the Group following

Completion will necessarily match or exceed historical earnings per

Ordinary Share.

Terms of the Acquisition and New Banking Facilities

Trakm8 is acquiring Route Monkey from its senior management and

The North East Technology Fund L.P. and Northern I.T. Research Ltd

for a total maximum consideration of up to GBP9.1 million (on a

debt free cash free basis). The consideration is payable as

follows:

-- Initial consideration of GBP5.4 million (GBP4.8 million cash

and GBP0.6 million in Consideration Shares) payable on Completion,

subject to any adjustments against a targeted level of working

capital in Route Monkey on Completion(1) ;

-- Repayment of GBP1.7 million company loan payable in cash on Completion(1) ; and

-- Up to GBP2.0 million of deferred conditional cash

consideration payable on 1 April 2017 (based on performance in the

year to 31 December 2016).

In addition, following Completion new options over a total of

300,000 Ordinary Shares will be allocated amongst key Route Monkey

staff with an exercise price equal to the Issue Price.

To part fund the Acquisition and provide additional future

headroom, Trakm8 has increased its total banking facilities on

Completion to GBP10 million, comprised of:

-- GBP5 million term loan facility (1.95% + HSBC base rate); and

-- GBP5 million RCF facility (1.5% + LIBOR on drawn, 0.75% on undrawn).

The RCF facility will be undrawn following Completion. The

Acquisition remains subject to completion of the Placing and is

expected to complete on Admission.

(1) Initial cash consideration and repayment of a company loan

to equal GBP6.5 million. The loan is currently estimated at GBP1.7

million and the final quantum of the loan will be confirmed on

Completion.

Details of the Placing and Total Voting Rights

Pursuant to the Placing, the Company will issue 1,801,802 new

Ordinary Shares (the "Placing Shares") at the Issue Price.

Application will be made to the London Stock Exchange for the

Placing Shares to be admitted to trading on AIM and Admission is

expected to occur on 30 December 2015. The Placing Shares will rank

pari passu in all respects with the existing Ordinary Shares.

The Placing is conditional, inter alia, upon the placing

agreement not having been terminated, and admission of the Placing

shares having occurred by no later than 30 December 2015 (or such

time and date as the Company and finnCap may agree, being not later

than 29 January 2016). The Placing is not being underwritten.

Pursuant to the Acquisition Agreement, the Company will issue

184,441 Consideration Shares at the Issue Price. Application will

be made to the London Stock Exchange for the Consideration Shares

to be admitted to trading on AIM and Admission is expected to occur

on 30 December 2015. The Consideration Shares will rank pari passu

in all respects with the existing Ordinary Shares.

(MORE TO FOLLOW) Dow Jones Newswires

December 21, 2015 02:00 ET (07:00 GMT)

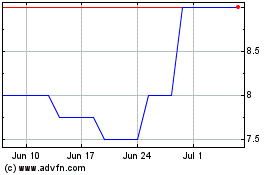

Trakm8 (LSE:TRAK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trakm8 (LSE:TRAK)

Historical Stock Chart

From Apr 2023 to Apr 2024