Trading Update

September 26 2007 - 3:00AM

UK Regulatory

26 September 2007

UNITED UTILITIES TRADING UPDATE

Introduction

United Utilities PLC today issues an update on trading for the six months

ending 30 September 2007. The company will announce its interim results on 29

November 2007.

Commenting on the group's trading position, Philip Green, Chief Executive,

said:

"The group is on track to deliver results in line with our expectations for the

six months ending 30 September 2007.

"In United Utilities Water, we are building on the operational and customer

service improvements recently achieved. Having met the economic level of

leakage rolling target for the first time in five years in 2006/07, I am

pleased to report that we are also on course to meet the target for 2007/08.

"Earlier in the year, we announced our intention to restructure our management

organisation, in order to sharpen its commercial focus, by creating an asset

owner function and an asset operator function. This new structure has now been

successfully implemented.

"We announced the initiation of a sale process for our electricity distribution

assets on 5 June 2007 and the sale process is progressing well."

Regulated activities

The business is expected to deliver good underlying operating profit growth in

its regulated activities for the six months ending 30 September 2007. United

Utilities continues to improve services for customers underpinned by its

substantial capital investment programmes. This expenditure is serving to grow

the asset base and the regulatory price increases reflect this investment for

customers.

Capital expenditure is expected to increase this financial year, compared with

the previous year, reflecting the company's planned re-phasing of the

investment programmes. Water service cumulative capital expenditure is expected

to match regulatory assumptions by the end of 2008 and wastewater service

cumulative capital expenditure by the end of 2009. With this investment to

improve essential infrastructure, the business remains confident of achieving

its regulatory outputs over the 2005-10 price control period.

United Utilities Water continues to focus on delivering further improvements in

operational performance and maintaining a robust supply and demand balance. The

business is on course to meet its 2007/08 economic level of leakage rolling

target of 465 megalitres per day and there have been no water restrictions in

the year.

United Utilities Water has made good progress in delivering its business

improvement initiatives and is on track to achieve the operating and capital

efficiency targets set by the regulator.

Non-regulated activities

Underlying operating profit in the first half is expected to show a modest

decrease compared with last year's underlying figure. As previously indicated,

this reflects an anticipated reduction in the contribution from the contract

with Southern Water, which runs through to 2010, due to the planned capital

investment profile, offset by the first time inclusion of contribution from the

group's operating activities with United Utilities Electricity.

Performance across the contract portfolio is in line with management's

expectations. Whilst new opportunities have been limited, the business

continues to benefit from a strong order book and secured revenue streams.

Other activities

United Utilities Property Solutions is performing well and operating profit for

the six months to 30 September 2007 is expected to be broadly in line with the

corresponding period last year.

Other financial

The group continues to benefit from a robust liquidity position, enhanced by

long-dated index-linked funding. United Utilities Water has in place around �

1.5 billion of this funding, with an average real interest rate of

approximately 1.8%, representing around 21% of its regulatory capital value.

Around two fifths of this funding has 50-year maturities.

Borrowings, net of cash and short term deposits, at the half year are expected

to show a modest increase compared with the position at 31 March 2007,

excluding the impact of IAS 39. This principally reflects expenditure on the

regulatory capital investment programmes and payment of the 2006/07 final

dividend, partly offset by operational cash flows and proceeds from the sale of

the group's 22.63% stake in THUS Group plc, from which a one-off loss on

disposal in the order of �10 million is expected.

The overall tax charge at the half year is expected to be around 30%. This

reflects the full provision for deferred tax and is before adjusting for the

impact of the reduction in corporation tax rate from 30% to 28% with effect

from April 2008. After adjusting deferred tax for this rate reduction, the

overall tax charge is expected to be around 10%.

Reclassifications

The regulated activities segment previously included the contribution from

United Utilities Electricity. Following the announcement made on 5 June 2007,

that the Board had taken the decision to initiate a sale process for the

group's electricity distribution assets, the contribution from these assets is

now treated as discontinued and is not included in the regulated activities

segment. The sale process is progressing well and an update will be provided in

due course.

As part of the group's strategy of focusing on its core skills, the decision

has been taken to sell its facilities management activities and industrial

liquid waste activities, which are very small in the context of the group.

Consequently, these non-regulated activities are also treated as discontinued.

In addition, the other activities segment previously included some residual

activities associated with United Utilities Electricity, but not related to

regulated electricity distribution. These residual activities are therefore

treated as discontinued and no longer included in the other activities segment.

The tables below show the impact on the prior half year and full year published

segmental analysis of these reclassifications.

Prior half year

reclassification

Continuing operations Six months ended 30 September 2006

As reported* Discontinued Reclassification Reclassified

Operations** of interest***

�m �m �m �m

Regulated activities 390.5 (71.5) (9.8) 309.2

Non-regulated 25.3 (1.4) (1.8) 22.1

activities

Other activities 8.6 (6.8) (0.7) 1.1

-------- -------- -------- --------

Operating profit 424.4 (79.7) (12.3) 332.4

Restructuring costs 4.0 - - 4.0

(regulated activities)

Restructuring costs 0.5 - - 0.5

(non-regulated

activities)

Settlement of claims (15.0) - - (15.0)

(regulated activities)

-------- -------- -------- --------

Underlying operating 413.9 (79.7) (12.3) 321.9****

profit

-------- -------- -------- --------

-------- -------- -------- --------

* As reported in the group's 2006/07 interim results announced on 5 December

2006

** As explained in the Reclassifications section of this trading update

*** This reclassification was detailed in the group's 2006/07 preliminary

results announced on 5 June 2007 (on a full year basis)

**** Comprises �298.2m from regulated activities, �22.6m from non-regulated

activities and �1.1m from other activities

Prior full year reclassification

Continuing operations

Year ended 31 March 2007

As reported* Discontinued Reclassified

operations**

�m �m �m

Regulated activities 750.1 (169.1) 581.0

Non-regulated 69.1 (6.5) 62.6

activities

Other activities 8.3 (9.8) (1.5)

-------- -------- --------

Operating profit 827.5 (185.4) 642.1

Restructuring costs 5.3 - 5.3

(regulated activities)

Restructuring costs 0.3 - 0.3

(non-regulated

activities)

Restructuring costs 5.0 - 5.0

(other activities)

Settlement of claims (27.6) - (27.6)

(regulated activities)

Settlement of claims (3.0) - (3.0)

(non-regulated

activities)

Ofwat transfer pricing 8.5 - 8.5

fine

(regulated activities)

-------- -------- --------

Underlying operating 816.0 (185.4) 630.6***

profit

-------- -------- --------

-------- -------- --------

* As reported in the group's 2006/07 preliminary results announced on 5 June

2007

** As explained in the Reclassifications section of this trading update

*** Comprises �567.2m from regulated activities, �59.9m from non-regulated

activities and �3.5m from other activities

United Utilities' contacts:

Philip Green, Chief Executive +44 (0)1925 237000

Tim Weller, Chief Financial Officer +44 (0)1925 237000

Gaynor Kenyon, Communications Director +44 (0)7753 622282

Darren Jameson, Head of Investor Relations +44 (0)7733 127707

Tulchan Communications

Dominic Fry and Peter Hewer +44 (0) 20 7353 4200

United Utilities' ordinary trade on the London Stock Exchange and its ADRs,

each equal to two ordinary shares, trade OTC in the USA under the Trading

Symbol "UUPLY".

END

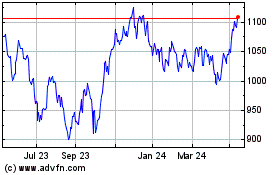

United Utilities (LSE:UU.)

Historical Stock Chart

From Mar 2024 to Apr 2024

United Utilities (LSE:UU.)

Historical Stock Chart

From Apr 2023 to Apr 2024