Trading Tough For UK Pubs, Restaurants - Study

March 13 2012 - 7:49AM

Dow Jones News

Trading remains tough for pubs and restaurants across the U.K.,

as economic weakness, below-inflation pay rises and unemployment

crimp consumer spending in the country, according a study released

Tuesday.

The Coffer Peach Business Tracker reported that comparable sales

in February fell 3.7%, a more rapid decline than the 2.1% fall

recorded in January. The tracker monitors trends in the eating and

drinking-out market by collecting monthly performance data from 23

companies, including Whitbread PLC (WTB.LN), Mitchells &

Butlers PLC (MAB.LN), Spirit Pub Co. PLC (SPRT.LN) and Marston's

PLC (MARS.LN).

Total sales rose a modest 0.6% from a year earlier, and 8.4%

compared with the previous month.

Analyst Peter Martin of Peach Factory, a market intelligence

group that produces the report in partnership with KPMG, UBS AG

(UBS) and investment advisory service The Coffer Group, called the

figures "disappointing."

"Over the past two years the informal eating and drinking-out

market has generally kept its head above water despite everything

the economy has thrown at it," he said.

The figures may indicate "a prolonged hangover after bumper

trading over Christmas and the New Year," or the onset of a new

spending squeeze, he said.

The tracker recorded comparable sales growth of 9.9% in

December, with total sales up 14%.

"The market will do well to remain cautious, but also focused on

giving customers, who may be looking for something new, a

compelling reason to go out.

"We are still predicting another essentially flat trading year,"

Martin said.

Jonathan Leinster, European leisure research analyst at UBS,

said: "Trading across the sector appears to have worsened, after a

strong December."

"Concerns over U.K. consumer spending are not new, but are

likely to linger given the weakness reported today."

-By Simon Zekaria, Dow Jones Newswires; +44 207 842-9410;

simon.zekaria@dowjones.com

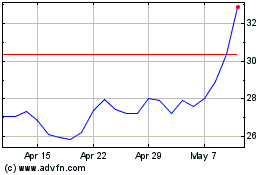

Marston's (LSE:MARS)

Historical Stock Chart

From Mar 2024 to Apr 2024

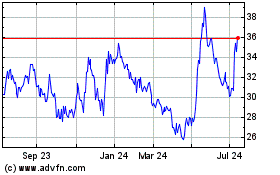

Marston's (LSE:MARS)

Historical Stock Chart

From Apr 2023 to Apr 2024