TIDMTRP

RNS Number : 4051N

Tower Resources PLC

18 May 2015

18 May 2015

Tower Resources plc

Preliminary Results to 31 December 2014

Tower Resources plc (the "Company" or "Tower" (TRP.L, TRP LN)),

the AIM listed Africa focussed oil and gas exploration company,

announces its preliminary results for the 12 months ended 31

December 2014.

Highlights:

-- Placing raised gross GBP19.3 million (US$32.0 million)

-- Portfolio diversified into Kenya, South Africa and Zambia

-- Drilling of the Welwitschia-1/1A well, offshore Namibia,

completed with remaining Albian Carbonate potential untested

-- Cash balance at year-end of US$7.9 million (2013: US$17.5 million)

Graeme Thomson, Chief Executive Officer of Tower Resources,

said:

"2014 was a very active year for Tower with a focus on

de-risking and further diversifying our African portfolio into

South Africa, Zambia and Kenya. We were all extremely disappointed

with the result of the Welwitschia well offshore Namibia and,

post-period, the onshore Badada-1 in Kenya. Both wells, however,

had enormous potential for Tower, had been validated by first class

partners, and have provided valuable information about the blocks

which remain prospective.

We currently have limited commitments, and are exploring several

opportunities to develop our portfolio further including our

anticipated entry into the Dissoni Block, offshore Cameroon. Tower

will also continue to seek potential partners to share its

exploration costs where desirable or necessary to move our most

exciting prospects along faster."

Contacts

Tower Resources plc

Graeme Thomson (CEO)

Andrew Matharu (VP - Corporate Affairs)

+44 20 7253 6639

Peel Hunt LLP (Nominated Adviser and Joint Broker)

Richard Crichton/Ross Allister

+44 20 7418 8900

GMP Securities Europe LLP (Joint Broker)

Rob Collins/Emily Morris

+44 20 7647 2800

Vigo Communications

Chris McMahon/ Patrick d'Ancona

+44 20 7016 9570

Chairman and Chief Executive's Joint Statement

The last year has been a difficult period for the oil and gas

industry, with prices falling and exploration losing favour with

investors. Tower has suffered along with everyone else, but we

nevertheless find ourselves with an attractive portfolio of

exploration blocks in which our current work obligations are

largely met, which puts us in a better position than most to

weather the current storm and prepare for better times.

2014 began with a great deal of commercial activity. In addition

to the fundraising for the Welwitschia well in Namibia operated by

Repsol, we acquired Rift Petroleum which brought us several

attractive exploration blocks in South Africa (working together

with New Age) and also Zambia as operator, and we farmed into Block

2B in Kenya, working together with Taipan Resources and Premier

Oil. In addition we were already negotiating as the preferred

bidder for the Dissoni Block, offshore Cameroon.

We drilled two wells in frontier areas in Namibia and Kenya,

both of which had offered material upside and had been validated by

the presence of highly experienced farminees, Repsol and Premier

Oil.

We were all deeply disappointed with the result of the

Welwitschia well offshore Namibia, which we completed in June, not

merely because of the lack of reservoir in the Maastrichtian and

Palaeocene targets, but also due to the well's failure to test the

deeper targets, notably the Albian carbonates. Nevertheless, we

reached an amicable agreement with the operator Repsol regarding

the cost of the well, our share of which was a little below budget,

and the prospectivity of the deeper section remains. We are in

discussions regarding next steps, but our current thinking is to

wait for other operators to be ready to begin a fresh drilling

campaign in the area before committing to a further well. We have

taken the conservative course in writing down our Namibian assets

in the meantime, but we continue to believe that Namibia will

become a significant oil and gas province in the future, and we

still intend to play a role in that.

The onshore Badada-1 well on Block 2B in Kenya, which was

drilled after the year-end and in which we have a 15% interest,

confirmed our geological model of the basin, but also failed to

find a commercial discovery. We have written off the cost of the

well, but in practice we are now reviewing the further

prospectivity on the block with the benefit of the data we have now

obtained.

We are excited by the potential of our operated blocks in

Zambia, where our geological fieldwork has been very promising.

This has shown us that the ingredients for a working petroleum

system appear to exist on our blocks. We are progressing into a new

phase of the licence, which now consists of three one-year periods,

and will be looking for a farminee to assist in the exploration of

this area.

We have negotiated a detailed work programme with the Government

of Cameroon for the Dissoni Block, and now expect to be ready to

sign a final PSC in mid-2015. During 2014 and the past few months

we have already completed a significant amount of further

preparatory work on this licence, and we intend to acquire 3D

seismic during the next twelve months, probably with a partner.

We have other licences now in our pipeline, but we are not

seeking to rush any of these discussions given the current funding

climate.

STRATEGY

Our strategy for the year ahead is as follows:

-- To maintain and to develop our high-impact exploration

portfolio while minimising our forward commitments and costs where

appropriate

-- To farm-out some or all of the costs of future commitments

where it is desirable or necessary to move our most exciting

prospects along faster

-- To seek opportunities through further asset or corporate

transactions in order to optimize the portfolio

MOVING FORWARD

We are exploring several opportunities and will continue to do

so until we find the right ones to execute, at the right time. In

the meantime, we already have a good inventory of prospects, and we

look forward to telling you more about these later in the year.

Setbacks are inevitable in the exploration business, but

successful wells are usually achieved with the help of the data

obtained from unsuccessful ones. We cannot expect every well we

drill to succeed; but we do believe that we are building valuable

data sets and relationships in several basins and countries, and

that this effort will bear fruit in time.

The 2014 Annual Report is being printed and is expected to be

posted to shareholders at the end of this week.

PRELIMINARY RESULTS FOR THE YEAR ENDED 31 DECEMBER 2014

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 31 DECEMBER 2014

2014 2013

Note $ $

------------------------------------------------- ----- ------------- ------------

Revenue - -

Cost of sales - -

Gross profit - -

------------------------------------------------- ----- ------------- ------------

Other administrative expenses (1,447,548) (2,442,106)

Pre-licence expenditures (4,584,545) (1,284,554)

Impairment of exploration and evaluation assets 2 (50,569,455) -

------------------------------------------------- ----- ------------- ------------

Total administrative expenses (56,601,548) (3,726,660)

Group operating loss (56,601,548) (3,726,660)

Finance income 10,066 27,413

Finance expense (12,007) (121,506)

Gain on acquisition of subsidiary - 484,625

Loss for the year before taxation (56,603,489) (3,336,128)

Taxation - -

Loss for the year after taxation (56,603,489) (3,336,128)

Other comprehensive income - -

Total comprehensive expense for the year (56,603,489) (3,336,128)

------------------------------------------------- ----- ------------- ------------

Basic loss per share (USc) (1.64c) (0.16c)

------------------------------------------------- ----- ------------- ------------

Diluted loss per share (USc) (1.64c) (0.16c)

------------------------------------------------- ----- ------------- ------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 DECEMBER 2014

Share-based

Share Share payments Retained

capital premium reserve (1) losses Total

$ $ $ $ $

At 1 January 2013 2,837,320 58,272,549 1,740,739 (47,790,465) 15,060,143

----------------------------------------------- ---------- ------------ ------------ -------------- -------------

Shares issued for cash net of costs 1,362,116 13,184,577 - - 14,546,693

Shares issued on acquisition of subsidiary 194,460 2,430,750 - - 2,625,210

Shares issued on settlement of third party

fees 5,037 66,454 - - 71,491

Total comprehensive income for the year - - 627,340 (3,336,128) (2,708,788)

At 31 December 2013 4,398,933 73,954,330 2,368,079 (51,126,593) 29,594,749

----------------------------------------------- ---------- ------------ ------------ -------------- -------------

Shares issued for cash net of costs 949,602 31,066,041 - - 32,015,643

Shares issued on acquisition of subsidiary 920,700 31,295,880 - - 32,216,580

Shares issued on settlement of third party

fees 60,177 841,944 - - 902,121

Shares issued on exercise of options/warrants 17,126 396,397 - - 413,523

Total comprehensive income for the year - - 1,664,731 (56,603,489) (54,938,758)

Transfers between reserves - - (456,128) 456,128 -

At 31 December 2014 6,346,538 137,554,592 3,576,682 (107,273,954) 40,203,858

----------------------------------------------- ---------- ------------ ------------ -------------- -------------

(1) The share-based payment reserve has been included within the

retained loss reserve and is a non-distributable reserve.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2014

2014 2013

Note $ $

----------------------------------- ----- -------------- -------------

Non-current assets

Property, plant and equipment 2,611 966

Exploration and evaluation assets 2 34,004,145 12,927,367

34,006,756 12,928,333

----------------------------------- ----- -------------- -------------

Current assets

Trade and other receivables 2,313,714 2,285,381

Cash and cash equivalents (1) 7,941,833 17,454,712

10,255,547 19,740,093

----------------------------------- ----- -------------- -------------

Total assets 44,262,303 32,668,426

----------------------------------- ----- -------------- -------------

Current liabilities

Trade and other payables 4,058,445 3,073,677

Total liabilities 4,058,445 3,073,677

----------------------------------- ----- -------------- -------------

Net assets 40,203,858 29,594,749

----------------------------------- ----- -------------- -------------

Equity

Share capital 3 6,346,538 4,398,933

Share premium 137,554,592 73,954,330

Retained losses (103,697,272) (48,758,514)

Total shareholders' equity 40,203,858 29,594,749

----------------------------------- ----- -------------- -------------

(1) Includes restricted cash of $693k (2013: $nil).

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED 31 DECEMBER 2014

2014 2013

Note $ $

----------------------------------------------------------------------- ----- ------------- ------------

Cash outflow from operating activities

Group operating loss for the year (56,601,548) (3,726,660)

Depreciation of property, plant and equipment 563 112

Share-based payments 5 1,664,731 627,340

Impairment of intangible exploration and evaluation assets 2 50,569,455 -

Operating cash flow before changes in working capital (4,366,799) (3,099,208)

Increase in receivables and prepayments (28,333) (1,054,133)

Increase in trade and other payables 984,768 526,714

Cash used in operations (3,410,364) (3,626,627)

Interest received 10,066 27,414

----------------------------------------------------------------------- ----- ------------- ------------

Cash used in operating activities (3,400,298) (3,599,213)

----------------------------------------------------------------------- ----- ------------- ------------

Investing activities

Exploration and evaluation costs (39,429,653) (7,658,658)

Purchase of property, plant and equipment (2,208) (1,078)

Release of restricted cash held in escrow - 5,600,000

Acquisition of subsidiary (net of cash acquired) - 4,210,099

Net cash used in investing activities (39,431,861) 2,150,363

----------------------------------------------------------------------- ----- ------------- ------------

Financing activities

Cash proceeds from issue of ordinary share capital net of issue costs 3 33,331,287 14,546,693

Finance costs (12,007) (121,506)

Net cash from financing activities 33,319,280 14,425,187

----------------------------------------------------------------------- ----- ------------- ------------

(Decrease)/increase in cash and cash equivalents (9,512,879) 12,976,337

Cash and cash equivalents at beginning of year 17,454,712 4,478,375

Cash and cash equivalents at end of year (1) 7,941,833 17,454,712

----------------------------------------------------------------------- ----- ------------- ------------

(1) Includes restricted cash of $693k (2013: $nil).

NOTES TO THE FINANCIAL STATEMENTS

1. Basis of preparation

Tower Resources plc is quoted on the AIM market of the London

Stock Exchange. It has the TIDM code TRP and is incorporated in

England.

The Group's consolidated financial statements for the year ended

31 December 2014, from which this financial information has been

extracted, and for the comparative year ended 31 December 2013 are

prepared on a going concern basis and in accordance with IFRS as

adopted by the EU ("IFRS"), and in accordance with those parts of

the Companies Act 2006 applicable to companies reporting under

IFRS.

The financial information for the year ended 31 December 2014

set out in this preliminary announcement does not constitute

statutory accounts as defined in section 434 of the Companies Act

2006 but it is derived from those accounts. The financial

information for the year ended 31 December 2013 is derived from the

statutory accounts for that year which have been delivered to the

Registrar of Companies. The Consolidated Statement of Financial

Position at 31 December 2014, the Consolidated Statement of

Comprehensive Income, the Consolidated Statement of Changes in

Equity, the Consolidated Statement of Cash Flows and the related

notes for the year then ended have been extracted from the Group's

2014 statutory financial statements upon which the auditor's

opinion is unqualified and includes a going concern 'emphasis of

matter' statement. The announcement has been agreed with the

company's auditor for release.

The Group's business activities, future development, financial

performance and position are discussed in the Strategic Report. The

Group's capital management policy is to raise sufficient funding to

finance the Group's near term exploration and development

objectives.

At 31 December 2014 the Group had cash balances of $7.9 million

and the Group is expected to need to raise additional funds,

possibly in 2015 in order to maintain sufficient cash resources for

its working capital needs and its committed capital expenditure

programmes for the next twelve months. The Directors are confident

that they can raise sufficient funds from either capital markets,

private investment or existing facilities and as a consequence,

believe that both the Group and Company are well placed to manage

their business risks successfully despite the current uncertain

economic outlook.

The Directors have a reasonable expectation that the Group has

adequate access to resources to continue in operational existence

for the foreseeable future and continue to meet, as and when they

fall due, its planned and committed exploration and development

activities and other liabilities for at least the next twelve

months from the date of approval of these financial statements. For

this reason the Directors continue to adopt the going concern basis

in preparing these financial statements.

However, there can be no guarantee that the required funds will

be raised within the necessary timeframe, consequently a material

uncertainty exists that may cast doubt on the Group's ability to

continue to operate as planned and to be able to meet its

commitments and discharge its liabilities in the normal course of

business for a period not less than twelve months from the date of

this report. The financial statements do not include the

adjustments that would result if the Group was unable to continue

in operation.

2. Intangible Exploration and Evaluation (E&E) assets

Exploration and evaluation assets Goodwill Total

$ $ $

---------------------------------- ------------ -------------

Cost

At 1 January 2014 42,533,925 8,023,292 50,557,217

Additions during the year (1) 71,646,233 - 71,646,233

At 31 December 2014 114,180,158 8,023,292 122,203,450

-------------------------------- ---------------------------------- ------------ -------------

Amortisation and impairment

At 1 January 2014 (33,640,099) (3,989,751) (37,629,850)

Impairment during the year (46,579,704) (3,989,751) (50,569,455)

At 31 December 2014 (80,219,803) (7,979,502) (88,199,305)

-------------------------------- ---------------------------------- ------------ -------------

Net book value

At 31 December 2014 33,960,355 43,790 34,004,145

At 31 December 2013 8,893,826 4,033,541 12,927,367

-------------------------------- ---------------------------------- ------------ -------------

(1) Additions during the year of $71.6 million comprise

consideration on acquisition of the Rift group of $32.2 million and

other net additions of $39.4 million.

In April 2014 the Company acquired 100% of the issued share

capital of Rift Petroleum Holdings Limited and its subsidiary

companies. The consideration totalled 550 million Tower shares with

a fair value of $32.2 million. The book value of the assets

acquired totalled $11.8 million generating a fair value adjustment

on acquisition of $20.4 million.

Also in April 2014 the Company farmed-in to Block 2B in Kenya.

The Company paid $4.5 million and issued 9 million Tower shares to

Taipan Resources in exchange for a 15% interest in the exploration

licence.

During the year the Company impaired assets totalling $50.6

million in accordance with IAS 36 "Impairment of Assets" following

the drilling of exploration wells in Namibia and Kenya. The

Directors believe that, whilst both licences evidence prospective

potential it is prudent to make a full provision against their

costs given the near-term nature of the licence renewal dates and

that the relevant joint ventures have not made any formal

application decisions in relation thereto. The carrying values will

be reviewed annually.

In June 2014 the Company announced that the Welwitschia-1A well

in Namibia did not encounter commercial accumulations of

hydrocarbons and was to be plugged and abandoned. Amounts of $38.4

million of capitalised E&E costs and $4.0 million of Goodwill

were impaired during the period with respect to Namibian

operations. At 31 December 2014 the carrying value of the Namibian

asset was $nil (2013: $12.6 million).

In February 2015 the Company announced that the Badada-1 well in

Kenya did not encounter commercial accumulations of hydrocarbons

and was to be plugged and abandoned. An amount of $8.2 million

comprising capitalised E&E costs has been impaired with respect

to the Badada-1 well at the year-end. At 31 December 2014 the

carrying value of the Kenyan asset was $nil (2013: $nil).

3. Share capital

2014 2013

$ $

------------------------------------------------------------- ---------- ----------

Authorised, called up, allotted and fully paid

3,804,900,944 (2013: 2,638,318,217) ordinary shares of 0.1p 6,346,538 4,398,933

-------------------------------------------------------------- ---------- ----------

The share capital issues during 2014 are summarised as

follows:

Number of shares Share capital at nominal value Share premium

$ $

-------------------------------------------- ----------------- ------------------------------- --------------

At 1 January 2014 2,638,318,217 4,398,933 73,954,330

Shares issued for cash 579,475,280 966,727 31,462,438

Shares issued in lieu of fees payable 28,107,447 45,231 537,336

Shares issued on acquisition of subsidiary

undertakings and as farm-in consideration 559,000,000 935,647 31,600,488

At 31 December 2014 3,804,900,944 6,346,538 137,554,592

---------------------------------------------- ----------------- ------------------------------- --------------

4. Exploration expenditure commitments

The Group is committed to funding the following exploration

expenditure commitments as at 31 December 2014:

Country Interest Net commitment

PEL0010 (1) Namibia 30% 741,300

Block 2B (2) Kenya 15% 1,800,530

Imlili (3) SADR 50% -

Guelta (3) SADR 50% -

Bojador (3) SADR 50% -

Block 40 (4) Zambia 80% -

Block 41 (4) Zambia 80% -

Algoa-Gamtoos (4) South Africa 50% -

Orange basin (3) South Africa 50% -

2,541,830

-------------------------------------------------------------------------------------- --------- ---------------

(1) Budget for extension period expiring August 2015.

(2) Commitment to fund remaining budgeted Badada-1 well costs at 31 December 2014.

(3) PSC pending formal award.

(4) Formal submissions made to enter next phase of exploration period.

5. Share-based payments

In its Statement of Comprehensive Income the Company recognised

share-based payment charges of $1.7 million (2013: $627k)

In compliance with the requirements of IFRS 2 on share-based

payments, the fair value of options or warrants granted during the

year is calculated using the Black Scholes option pricing model.

For this purpose the volatility applied in calculating the above

charge varied between 82% and 140% (2013: 54% and 66%), depending

upon the date of grant, and the risk free interest rate was

0.50%.

The Company's share price ranged between 0.54p and 6.62p (2013:

1.15p and 4.85p) during the year. The closing price on 31 December

2014 was 0.65p per share. The weighted average exercise price of

the share options was 2.05p (2013: 2.97p) with a weighted average

contractual life of 4.28 years (2013: 3.12 years). The total number

of options vested at the end of the year was 45.3 million (2013:

19.2 million).

6. Acquisitions

In April 2014, the Group acquired 100% of the ordinary share

capital in Rift Petroleum Holdings Limited, an Isle of Man company

whose principal activity is as an investment holding company for

its oil and gas exploration subsidiaries in South Africa and

Zambia.

Details of the fair value of the identifiable assets and

liabilities acquired and the purchase consideration are as

follows:

Book value of assets (1) Fair value of assets

acquired Fair value adjustment acquired

$ $ $

----------------------------- ----------------------------- ---------------------- -----------------------------

Intangible exploration and

evaluation assets 11,862,849 20,353,731 32,216,580

Trade and other receivables 693,519 - 693,519

Cash 579,748 - 579,748

Trade and other payables (1,273,267) - (1,273,267)

11,862,849 20,353,731 32,216,580

----------------------------- ----------------------------- ---------------------- -----------------------------

Consideration paid (550 million ordinary shares with a fair

value of 3.5p per share) 32,216,580

------------------------------------------------------------- ---------------------- -----------------------------

(1) The fair value of the consideration paid for Rift is

considered to be the same as the fair value of the assets

acquired.

7. Subsequent events

On 7 January 2015, Tower announced the spud of the Badada-1 well

on Block 2B, onshore Kenya.

On 23 February 2015, Tower announced that the Badada-1 well had

not encountered commercial accumulations of hydrocarbons and was to

be plugged and abandoned.

On 19 March 2015, Tower announced that the GBP20.0 million EFF

funding facility with Darwin Strategic Limited was due to expire on

23 March 2015 and that Tower had decided not to renew this

facility.

On 24 March 2015, Tower announced the issue of 15.0 million

ordinary shares under contractual arrangements as part payment for

services provided in the fourth quarter of 2014.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR GGUWUAUPAGUM

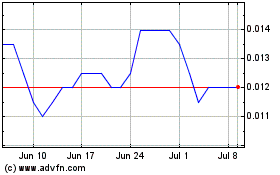

Tower Resources (LSE:TRP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tower Resources (LSE:TRP)

Historical Stock Chart

From Apr 2023 to Apr 2024