Tourmaline Closes the Acquisition of Santonia Energy, Increases Guidance and Updates EP Activities

April 24 2014 - 5:00PM

Marketwired Canada

Tourmaline Oil Corp. (TSX:TOU) ("Tourmaline" or the "Company") is pleased to

announce the completion of its previously announced acquisition of all of the

outstanding common shares of Santonia Energy Inc. ("Santonia") pursuant to an

arrangement (the "Arrangement") under the Business Corporations Act (Alberta).

Under the Arrangement, which was approved by Santonia shareholders by greater

than a 99% majority, Santonia shareholders received 0.03012 of a Tourmaline

common share for each Santonia common share resulting in the issuance of

approximately 3.2 million Tourmaline common shares.

The acquisition of Santonia provides Tourmaline with a large, contiguous

production and land base immediately adjacent to the Company's existing Deep

Basin core area. The acquisition is part of an ongoing strategy to continue to

expand operations in the Deep Basin, one of the premier natural gas and

associated liquid play areas in Canada.

Peters & Co. Limited acted as exclusive financial advisor to Tourmaline with

respect to the Arrangement.

Production Update

Tourmaline reached the 117,000 boepd production level during the third week of

April. The Company has an additional 16,000 boepd of already tied-in production

awaiting facility access or expansions. This 16,000 boepd of additional

production capacity is primarily at Spirit River AB., Sunrise-Dawson B.C., and

Horse-Smoky AB., and is anticipated to come on-stream during the second half of

2014 with the completion of ongoing facility projects in all three areas. With

current daily natural gas production of approximately 585 to 600 mmcfpd,

Tourmaline is now one of the top 5 largest natural gas producers in Canada.

First quarter 2014 estimated average production of 102,600 boepd represents 19%

growth over the prior quarter and the second consecutive quarter where quarterly

production growth is in excess of 15%. Tourmaline remains on track to achieve

average production for 2014 of 120,000 boepd, representing 60% growth over the

average 2013 production of 74,796 boepd. The Company expects daily average

production in Q1 2014 of approximately 102,600 boepd; Q2 2014 average production

of 115,000-120,000 boepd; Q3 2014 average production of 120,000-125,000 boepd;

and Q4 average production of 135,000-140,000 boepd. These estimates are net of

an assumed daily average unscheduled down-time provision of 8,000 boepd for the

remainder of the year. Unscheduled down-time in Q1 2014 was 8,500 boepd,

compared to an average of 5,000 boepd in 2013 with the majority of the increase

attributed to temporary production shut-ins due to offsetting competitor

completion and fracture stimulation operations. Given the improved natural gas

price environment, the Company expects this increased industry activity to

continue in its operated areas after spring break-up.

The Company's facility projects at Spirit River AB., Doe B.C., and Musreau AB.,

remain on schedule for a late Q3/early Q4 2014 start-up and are anticipated to

increase corporate daily production by approximately 25,000 boepd in aggregate.

The Company also expects to complete a large pipeline lateral connecting the

Smoky-Berland complex to the Wild River plant during the third quarter, which

will allow currently shut-in volumes at Smoky to flow to the Tourmaline facility

at Wild River.

Financial Update

The Company is increasing financial estimates for 2014 due to stronger natural

gas prices and providing 2015 preliminary guidance due to the combined effects

of stronger production arising from the Santonia acquisition and anticipated

higher natural gas prices. Estimated 2014 cash flow has been increased 7% to

$1.09 billion, utilizing an AECO natural gas price of $4.64/mcf and WTI oil

price of US $97.40/bbl. This represents 106% growth over 2013 cash flow of

$526.8 million. Cash flow in 2015 is estimated at $1.48 billion, based on

estimated daily average production of 159,500 boepd, an AECO natural gas price

of $4.43/mcf and a WTI oil price of US $93.38/bbl.

Capital spending for 2014 is now estimated at $1.1 billion, with incremental

spending anticipated to be incurred with the addition of one more rig in NEBC,

the Berland to Wild River pipeline lateral, and acceleration of the Wild River

plant expansion.

With the recent increase in natural gas prices, Tourmaline has chosen to put in

place additional hedges resulting in approximately 217.6 mmcfpd hedged

production at an average price of $4.20/mcf or 36% of anticipated full year 2014

natural gas production.

EP Update

Tourmaline is currently operating 2 drilling rigs in NEBC, with the remaining 15

rigs shut down for break-up. The Company is planning to operate 18 drilling rigs

during the second half of 2014, with 12 rigs in the Alberta Deep Basin, 3 rigs

pursuing Montney gas-condensate in NEBC, and 3 rigs pursuing the Triassic

Charlie Lake oil play on the Peace River High.

Alberta Deep Basin

First quarter 2014 drilling results in the Alberta Deep Basin were the best in

the Company's history. The Company drilled and completed 30 horizontal wells

targeting the Wilrich, Notikewin and Falher formations in the Deep Basin tying

in 28 of these wells during the first quarter. Of the 17 wells that have been on

production for greater than one month, 16 of them have 30-day IP rates in excess

of the Company's production/economic template of 5.0 mmcfpd. The actual 30-day

IP average of these 17 wells is 10.4 mmcfpd. As longer term production

performance data becomes available on the remaining wells, the Company will

consider updating its internal economic template to reflect revised average

production rates. The future horizontal drilling inventory has been increased

substantially thus far in 2014 through both additions at crown land sales and

the Santonia acquisition.

One of the Deep Basin rigs will focus on a series of high potential locations

already identified on the Santonia land base during the second half of 2014.

NEBC Montney Gas/Condensate

Production in NEBC reached a record 35,000 boepd in mid-April, with an

additional 6,000 boepd shut-in awaiting the planned third quarter facility

expansions at Doe and Sundown. The Company has drilled two successful follow-up

wells to its previously announced Q4 2013 Lower Montney gas-condensate discovery

and will disclose further information once these wells are brought on-stream.

The Company is adding an additional rig in NEBC to pursue this expanding, new

opportunity. Tourmaline has also drilled an extended reach horizontal in the

Doig formation at Sundown, and will complete this well after break-up.

Peace River High Charlie Lake Oil

Production from the overall Peace River High complex is expected to reach the

13,000 boepd level with the start-up next week of the initial battery at

Mulligan. Drilling operations are expected to recommence in June with an

additional 30 horizontal wells planned to be drilled, completed and on-stream by

year-end. The Company's new sour gas injection gas plant at Sprit River remains

on schedule for an early October 2014 start-up allowing Tourmaline to bring on

stream approximately 5,000 boepd of production that is currently shut-in.

Exploration Program

Completion operations on the Company's two potential Paleozoic gas discoveries

will commence as soon as access is possible after break-up. There are a total of

7 prospective new pay zones in the Paleozoic to complete between the two, cased

exploration wells.

Forward-Looking Information

This press release contains forward-looking information within the meaning of

applicable securities laws. The use of any of the words "forecast", "expect",

"anticipate", "continue", "estimate", "objective", "ongoing", "may", "will",

"project", "should", "believe", "plans", "intends" and similar expressions are

intended to identify forward-looking information. More particularly and without

limitation, this press release contains forward-looking information concerning

Tourmaline's plans and other aspects of its anticipated future operations,

management focus, objectives, strategies, financial, operating and production

results and business opportunities, including anticipated petroleum and natural

gas production for various periods, cash flows, capital spending, projected

operating and drilling costs, the timing for facility expansions and facility

start-up dates, as well as Tourmaline's future drilling prospects and plans,

business strategy, future development and growth opportunities, prospects and

asset base. The forward-looking information is based on certain key expectations

and assumptions made by Tourmaline, including expectations and assumptions

concerning: prevailing commodity prices and exchange rates; applicable royalty

rates and tax laws; interest rates; future well production rates and reserve

volumes; operating costs the timing of receipt of regulatory approvals; the

performance of existing wells; the success obtained in drilling new wells;

anticipated timing and results of capital expenditures; the sufficiency of

budgeted capital expenditures in carrying out planned activities; the timing,

location and extent of future drilling operations; the successful completion of

acquisitions and dispositions; the availability and cost of labour and services;

the state of the economy and the exploration and production business; the

availability and cost of financing, labor and services; and ability to market

oil and natural gas successfully.

Statements relating to "reserves" are also deemed to be forward looking

statements, as they involve the implied assessment, based on certain estimates

and assumptions, that the reserves described exist in the quantities predicted

or estimated and that the reserves can be profitably produced in the future.

Although Tourmaline believes that the expectations and assumptions on which such

forward-looking information is based are reasonable, undue reliance should not

be placed on the forward-looking information because Tourmaline can give no

assurances that they will prove to be correct. Since forward-looking information

addresses future events and conditions, by its very nature it involves inherent

risks and uncertainties. Actual results could differ materially from those

currently anticipated due to a number of factors and risks. These include, but

are not limited to: the risks associated with the oil and gas industry in

general such as operational risks in development, exploration and production;

delays or changes in plans with respect to exploration or development projects

or capital expenditures; the uncertainty of estimates and projections relating

to reserves, production, costs and expenses; health, safety and environmental

risks; commodity price and exchange rate fluctuations; interest rate

fluctuations; marketing and transportation; loss of markets; environmental

risks; competition; incorrect assessment of the value of acquisitions; failure

to complete or realize the anticipated benefits of acquisitions or dispositions;

ability to access sufficient capital from internal and external sources; failure

to obtain required regulatory and other approvals; and changes in legislation,

including but not limited to tax laws, royalties and environmental regulations.

Readers are cautioned that the foregoing list of factors is not exhaustive.

Also included in this press release are estimates of Tourmaline's 2014 annual

cash flow and capital spending as well as, preliminary guidance on 2015

anticipated cash flows, which are based on the various assumptions as to

production levels, including estimated average production of 120,000 boepd for

2014 and 159,500 boepd for 2015, capital expenditures, and other assumptions

disclosed in this press release and including commodity price assumptions for

natural gas (AECO - $4.64 /mcf for 2014 and $4.43/mcf for 2015), and crude oil

(WTI (US) - $97.40/bbl for 2014 and $93.38/bbl for 2015) and an exchange rate

assumption of (US/CAD) $0.92 for 2014 and $0.90 for 2015. To the extent any such

estimate constitutes a financial outlook, it was approved by management and the

Board of Directors of Tourmaline on April 24, 2014 and is included to provide

readers with an understanding of Tourmaline's anticipated cash flows based on

the capital expenditure and other assumptions described herein and readers are

cautioned that the information may not be appropriate for other purposes.

Additional information on these and other factors that could affect Tourmaline,

or its operations or financial results, are included in the Company's most

recently filed Management's Discussion and Analysis (See "Forward-Looking

Statements" therein), Annual Information Form (See "Risk Factors" and

"Forward-Looking Statements" therein) and other reports on file with applicable

securities regulatory authorities and may be accessed through the SEDAR website

(www.sedar.com) or Tourmaline's website (www.tourmalineoil.com).

The forward-looking information contained in this press release is made as of

the date hereof and Tourmaline undertakes no obligation to update publicly or

revise any forward-looking information, whether as a result of new information,

future events or otherwise, unless expressly required by applicable securities

laws.

Additional Reader Advisories

Boe Conversions

Boes may be misleading, particularly if used in isolation. A boe conversion

ratio of 6 mcf:1 bbl is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a value

equivalency at the wellhead. As the value ratio between natural gas and crude

oil based on the current prices of natural gas and crude oil is significantly

different from the energy equivalency of 6:1, utilizing a 6:1 conversion basis

may be misleading as an indication of value.

Production Tests

Any references in this release to IP rates are useful in confirming the presence

of hydrocarbons, however, such rates are not determinative of the rates at which

such wells will continue to produce and decline thereafter and are not

necessarily indicative of long-term performance or ultimate recovery. While

encouraging, readers are cautioned not to place reliance on such rates in

calculating the aggregate production for the Company. Such rates are based on

field estimates and may be based on limited data available at this time.

Non-GAAP Financial Measures

This press release includes references to a financial measure commonly used in

the oil and gas industry, "cash flow" which does not have a standardized meaning

prescribed by International Financial Reporting Standards ("GAAP"). Management

believes that in addition to net income and cash flow from operating activities

cash flow is a useful supplemental measure in assessing Tourmaline's ability to

generate the cash necessary to repay debt or fund future growth through capital

investment. Readers are cautioned, however, that this measure should not be

construed as an alternative to net income or cash flow from operating activities

determined in accordance with GAAP as an indication of Tourmaline's performance.

Tourmaline's method of calculating cash flow may differ from other companies and

accordingly, it may not be comparable to measures used by other companies. For

these purposes, Tourmaline defines "cash flow" as cash flow from operating

activities before changes in non-cash operating working capital.

Certain Definitions

bbls barrels

boe barrel of oil equivalent

boepd barrel of oil equivalent per day

bopd barrel of oil, condensate or liquids per day

gjsd gigajoules per day

mmboe millions of barrels of oil equivalent

mbbls thousand barrels

mmcf million cubic feet

mcf thousand cubic feet

mmcfpd million cubic feet per day

mmcfpde million cubic feet per day equivalent

mcfe thousand cubic feet equivalent

mmbtu million British thermal units

mstboe thousand stock tank barrels of oil equivalent

About Tourmaline Oil Corp.

Tourmaline is a Canadian intermediate crude oil and natural gas exploration and

production company focused on long-term growth through an aggressive

exploration, development, production and acquisition program in the Western

Canadian Sedimentary Basin.

FOR FURTHER INFORMATION PLEASE CONTACT:

Tourmaline Oil Corp.

Michael Rose

Chairman, President and Chief Executive Officer

(403) 266-5992

Tourmaline Oil Corp.

Brian Robinson

Vice President, Finance and Chief Financial Officer

(403) 767-3587

robinson@tourmalineoil.com

Tourmaline Oil Corp.

Scott Kirker

Secretary and General Counsel

(403) 767-3593

kirker@tourmalineoil.com

Tourmaline Oil Corp.

Suite 3700, 250 - 6th Avenue S.W.

Calgary, Alberta T2P 3H7

(403) 266-5992

(403) 266-5952 (FAX)

www.tourmalineoil.com

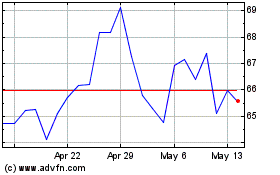

Tourmaline Oil (TSX:TOU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tourmaline Oil (TSX:TOU)

Historical Stock Chart

From Apr 2023 to Apr 2024