By Kosaku Narioka, Takashi Mochizuki and Peter Landers

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 28, 2017).

TOKYO -- A number of creditors and others involved in Toshiba

Corp.'s restructuring are pushing for a Toshiba bankruptcy filing

as the best path to rebirth after its effort to raise money through

a chip-unit sale stalled.

People involved in talks over Toshiba's workout, including

business partners, lawyers and people with ties to the company's

main bankers, said bankruptcy is worth serious study. Some of them

said it is the best available option and that they are advocating

it in discussions with Toshiba or creditors. They said a bankruptcy

filing by Toshiba, the core of an industrial conglomerate, could

free it of burdens that include lingering liabilities from the

March bankruptcy of its Westinghouse Electric Co. nuclear unit in

the U.S.

Toshiba's chief executive, Satoshi Tsunakawa, said at a recent

news conference that seeking debt relief through the courts isn't

an option. A Toshiba spokesman reiterated this week that the

company has "no specific plan" to seek bankruptcy protection.

A person familiar with deliberations at one of Toshiba's main

lenders compared the conglomerate to a hole that might have

treasure at the bottom but also lurking snakes. Bankruptcy, this

person said, could kill any snakes and let the lenders access the

treasure.

A filing would be among the largest in Japan's history and carry

drawbacks including possible political backlash in the U.S. Toshiba

has committed $3.68 billion to nuclear-plant operator Southern Co.

to cover its Westinghouse-related obligations from an unfinished

project in Georgia. On Thursday, it reached a deal with Scana Corp.

and a partner to pay $2.17 billion to cover obligations on a second

half-completed U.S. nuclear project Westinghouse was building, in

South Carolina.

Japanese government officials and Toshiba executives are aware

of those drawbacks and may be deterred from a bankruptcy filing,

people involved in the discussions said.

Toshiba in June estimated that its liabilities exceeded assets

by more than $5 billion as of March 31. That followed its warning

in April that it had " substantial doubt" about being able to

continue as a going concern because of losses connected to

Westinghouse.

Toshiba has said it plans to recover financial health by selling

its memory-chip business, which has been booming recently thanks to

demand for chips in smartphones and servers. On June 21, Toshiba

designated a consortium led by a Japanese government-backed

investment fund as the preferred bidder for the unit.

But the sale talks have bogged down since The Wall Street

Journal reported earlier this month that the consortium's bid could

include an equity stake for SK Hynix Inc. of South Korea. A role

for SK Hynix could raise antitrust issues and contradict the

government's stance that Toshiba's technology shouldn't fall into

foreign rivals' hands. Also, Toshiba's joint-venture partner in the

chip business, Western Digital Corp., has filed suit in California

to block the sale , arguing that its joint-venture contract with

Toshiba gives it veto power over any sale. Toshiba, which rejects

that interpretation, is contesting the suit; a hearing is scheduled

for Friday in San Francisco.

The stalemate and Toshiba's long battle with its auditors -- who

have refused to approve financial statements this year -- are

eroding trust among creditors. Japan's three largest banks have

taken reserves for a portion of their Toshiba loans, according to

bank officials.

Japan has far fewer bankruptcies annually than the U.S.,

especially among major corporations, in part because of the stigma

attached to failure.

Nonetheless, people involved in the discussions described

Toshiba as a classic case of a company burdened by obligations with

large and uncertain costs that could be lessened under bankruptcy

protection. Those obligations include a multibillion-dollar 20-year

contract involving liquefied natural gas in the U.S.

One person directly involved in a portion of the Toshiba

recovery plan said "everyone thinks" bankruptcy has to be looked at

-- but it is difficult to say so publicly.

Two other people familiar with deliberations at one of Toshiba's

main lenders said that even if the memory-chip sale were completed,

the company would still be likely to run short of funds.

The Toshiba spokesman rejected that view, saying that if the

company can sell its chip unit in line with current expectations,

"We believe we will be able to secure sufficient funds."

Mitsubishi UFJ Morgan Stanley Securities credit analyst Nobuhiko

Ambiru wrote in a July 12 report, "We cannot entirely rule out the

possibility that financial institutions will retreat from their

supportive position and [Toshiba's] ability to raise funds will be

severely impacted, propelling a decision to seek a workout through

the courts."

Still, Mr. Ambiru said he expects Toshiba's lenders to continue

their support for now. Since it has thousands of suppliers, any

halt in payments by Toshiba could have broader economic

effects.

There are other potential downsides to a filing for bankruptcy

protection.

Southern Co., the U.S. utility for which Westinghouse has been

building two nuclear reactors, is counting on the $3.68 billion

Toshiba pledged. A Southern spokesman said, "We continue to monitor

Toshiba's financial position." The company says it is reviewing

whether to go ahead with the reactors.

A Japanese government official said a Toshiba bankruptcy is an

option but not a leading choice because of fears Japan would be

criticized for breaking its promises over U.S. nuclear

projects.

Several people also expressed fears about possible delays at the

Fukushima Daiichi nuclear plant because Toshiba's technology is

needed to clean up reactors that suffered meltdowns after Japan's

2011 earthquake and tsunami.

--Russell Gold contributed to this article.

Write to Kosaku Narioka at kosaku.narioka@wsj.com, Takashi

Mochizuki at takashi.mochizuki@wsj.com and Peter Landers at

peter.landers@wsj.com

(END) Dow Jones Newswires

July 28, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

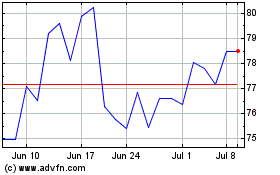

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

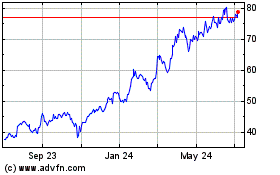

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Apr 2023 to Apr 2024