Today's Top Supply Chain and Logistics News From WSJ

January 11 2017 - 7:17AM

Dow Jones News

By Paul Page

Sign up:With one click, get this newsletter delivered to your

inbox.

The incoming Donald Trump presidential administration has

already united the trucking and rail industries . Often at odds in

Washington, the two biggest groups representing trucking companies

and railroads are teaming up to press the administration to reverse

Obama-era regulations and slow the process for writing new rules,

the WSJ reports. The effort is part of a big push lobbying groups

are making in Washington as they prepare for expected

business-friendly policy changes with Mr. Trump in the White House

and Republicans in control of both chambers of Congress. In this

case, the WSJ reports the leaders of the American Trucking

Associations and Association of American Railroads want to unite

airline, automobile and other transport groups behind the plan.

Their idea is to create specific guidelines for how transportation

agencies write rules and operating guidelines, including laying out

data for scrutiny well ahead of time and working with businesses on

goals and solutions.

E-commerce companies seem to be learning to love stores. Alibaba

Group Holding Ltd. is the latest online business to step up its

physical presence, the WSJ's Liza Lin and Nathan Becker report, as

it takes a controlling stake in China's Intime Retail (Group) Co.

and works with the company's founder to take the department-store

chain private. At $2.6 billion, it's an expensive deal for Alibaba,

but it advances the company's push to deepen links between online

operations, brick-and-mortar stores and logistics. Amazon.com Inc.

and several smaller rivals in the U.S. have started opening

storefronts with similar goals -- they give the companies a place

to tout wares that consumers can size up in the real world.

Alibaba's effort appears to be bigger, taking in department stores

and shopping malls, and that may push more goods through the

company's distribution channels and help expand the industrial side

of the company's logistics operation.

Whirlpool Corp. won its trade battle but may not have won its

larger goal to sell more washing machines. U.S. trade regulators

ruled that Whirlpool's South Korean rivals unfairly harmed the

appliance maker by selling washing machines in the U.S. at

artificially low prices, WSJ's Andrew Tangel reports. That will

allow anti-dumping tariffs to go forward against large residential

washing machines that Samsung Electronics Co. and LG Electronics

Inc. make in China, appliances that Whirlpool says compete unfairly

with its own machines. The victory for Whirlpool will likely have a

limited impact on the market because Samsung and LG have already

moved production of the appliances from China to Vietnam and

Thailand, which are not covered by the tariffs. That illustrates

the difficulty of using tariffs as a tool when global supply chains

can shift gears so easily across borders.

INFRASTRUCTURE

While public-private partnerships appear set to come to the

forefront in U.S. infrastructure debates, use of the tactic is

coming under increasingly harsh scrutiny on the other side of the

world. Australia has become a magnet for global investors from

Canadian pension funds to Chinese train operators, but the WSJ's

Vera Sprothen reports that concerns are growing that the country is

giving too much control and profit from transportation projects to

private investors. Australia's public investment in roads, rail,

waterways, seaports and airports stands at 1.6% of gross domestic

product, the highest level among major world economies but that it

is losing the value of its investment as private developers claim

the benefits. Companies including Consolidated Land and Rail

Australia, a consortium backed by former U.S. Secretary of

Transportation Ray LaHood, are working on new funding and

cooperation plans that could provide models for as U.S. lawmakers

and policy planners consider how to bring more money into

transportation.

QUOTABLE

IN OTHER NEWS

The World Bank lowered its global economic growth forecast for

this year slightly to 2.7%. (WSJ)

Oil prices sank to a one-month low with investors still

questioning the impact of an OPEC deal to cut production. (WSJ)

Growing volatility in currency markets has analysts concerned

the turbulence will affect other trading markets. (WSJ)

The Port Authority of New York and New Jersey admitted

wrongdoing and agreed to pay a $400,000 fine to settle charges the

agency misled investors about risks associated with $2.3 billion in

bonds to fund projects. (WSJ)

Wal-Mart Stores Inc. is preparing another round of job cuts at

its headquarters before the end of the month. (WSJ)

Earnings at Cargill Inc. climbed 80% from a year ago after

one-off events as the agriculture giant revamped its business amid

falling commodity prices. (WSJ)

General Motors Co. said pretax earnings this year should beat

the record profit the auto maker expects to post for 2016.

(WSJ)

Gildan Activewear Inc. won a court-supervised auction to buy

American Apparel LLC's brand and other assets out of bankruptcy for

$88 million. (WSJ)

The retail industry Global Port Tracker estimates imports to

major U.S. ports grew 7% year-over-year in December. (DC

Velocity)

Global air freight demand grew 6.8% year-over-year in November,

according to the International Air Transport Association.

(Reuters)

China's Port of Ningbo-Zhoushan will spend $18.3 billion on

projects aimed at improving cargo handling. (Port Technology)

Hong Kong-based Kerry Logistics acquired German forwarder Multi

Logistics. (The Loadstar)

The U.K. post office is closing 37 branches in its ongoing

cost-cutting effort. (The Telegraph)

Xerox Corp. will close a distribution center in Groveport, Ohio,

as it advances a global restructuring effort. (Business

Journals)

Phoenix-based freight broker GlobalTranz Enterprises Inc. bought

Wisconsin-based Global Freight Source Inc. (Business Journals)

Texas furniture maker KLN Manufacturing will shut its San

Antonio manufacturing operation. (San Antonio Express-News)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin, @jensmithWSJ and @EEPhillips_WSJ and follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Subscribe to this email newsletter by clicking here:

http://on.wsj.com/Logisticsnewsletter .

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

January 11, 2017 07:02 ET (12:02 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

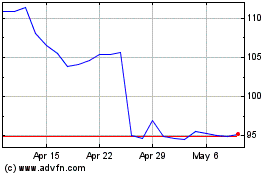

Whirlpool (NYSE:WHR)

Historical Stock Chart

From Mar 2024 to Apr 2024

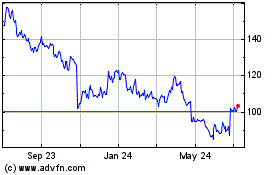

Whirlpool (NYSE:WHR)

Historical Stock Chart

From Apr 2023 to Apr 2024