Today's Top Supply Chain and Logistics News From WSJ

October 17 2016 - 6:54AM

Dow Jones News

By Paul Page Sign up:With one click, get this newsletter delivered to your inbox.

The jungle-clad provinces of eastern Congo are becoming some of

the most important, and dangerous, sites in the global coffee

supply chain. Congo is attracting some of the biggest names in

coffee, including a $1 million investment from brewing giant

Starbucks Corp., the WSJ's Alexandra Wexler reports, even as a war

that's claimed more than five million lives in the past 20 years

rages in the shadows of agriculture suppliers. The companies are

responding to growing demand for specialty coffee, which accounts

for one of every two cups sold in the U.S., encouraging exporters,

roasters and retailers to go where the potential is huge -- and so

are the risks. The many challenges of doing business in Congo

include death threats, extortion and kidnappings, many of which

occur near where specialty coffee is grown. Congo's

specialty-coffee production has surged to as much as 960 tons a

year from almost nothing in 2008, and foreign-based roasters are

spending big money to pool farmers, teach them best practices and

finance next season's crop. That's bringing some prosperity to the

country while testing the limits of supply chains in one of the

world's most unstable regions.

Hanjin Shipping Co.'s latest sale may be a matter of survival

for the debt-ridden ocean carrier . Hanjin is reaching out to major

European shipping companies as it looks for a buyer for at least

five of its vessels, the WSJ's Costas Paris reports. The effort is

part of the South Korean operator's bid to raise funds to finish

unloading stranded cargo, pay off creditors and restructure its

operations. The ships are among the biggest that Hanjin owns and

are among the remnants of a fleet that has been withering as ship

owners reclaim chartered vessels. A South Korean bankruptcy court

also plans to dispose of the firm's sales and marketing network for

Asia-U.S. routes and some ships. The sales are coming in a tough

market where vessel values have been hurt by excess container

shipping capacity. But Hanjin executives hope the sales bring

enough cash for the company to remake itself into a regional Asian

carrier.

Chinese parcel delivery carrier ZTO Express will test the

investment world's appetite for e-commerce logistics. The

seven-year-old, Shanghai-based company begins its investor road

show this week for a planned initial public offering that would

sell 72.1 million shares at $16.50 to $18.50 apiece. At the top end

of the range, and the WSJ's Alec Macfarlane reports that would

bring $1.3 billion and signal confidence in a Chinese e-commerce

market that counted $609 billion in online sales last year. ZTO

would beat trucker Schneider National Inc. to the market with its

planned public offering and break a six-year drought in IPOs in the

logistics and cargo transportation arena. With major parcel

business for Chinese e-commerce giants Alibaba Group Holding Ltd.

and JD.com Inc. and an operating profit margin of 25.1%, the

company has big numbers behind its target price.

SUPPLY CHAIN STRATEGIES

Indonesia may have the bigger foothold in the smartphone supply

chain it's been looking for. BlackBerry Ltd.'s decision to license

software and outsource handset production globally represents a win

for Indonesia, which is also the biggest market for the Canadian

company's handheld devices. The WSJ's Resty Woro Yuniar reports

that Blackberry's pact with an affiliate of the country's biggest

wireless carrier will have the Indonesian partner produce, promote

and distribute all Blackberry-brand devices in the country. The

plan helps Blackberry meet Jakarta's rules for local content and to

focus on its plan to focus on software rather than making

smartphones. Indonesia has loosened those rules somewhat, and

Blackberry's decision suggests other smartphone companies and their

critical components makers may find the country a more attractive

node in electronics manufacturing and distribution channels.

QUOTABLE

IN OTHER NEWS

The U.S. producer-price index, a gauge of U.S. business pricing,

rose 0.3% in September. (WSJ)

The Obama administration took new steps to loosen U.S. sanctions

against Cuba and allow for greater trade between the nations.

(WSJ)

The U.S. Treasury Department sharply toned down its criticism of

China and other Asian exporters in its latest currency report to

Congress. (WSJ)

Delta Air Lines Inc. cargo revenue fell 15%, or $29 million, in

the third quarter and was off 20% in the first nine months of the

year. (WSJ)

Tesla Motors Inc. and Panasonic Inc. are extending their

cooperation with an agreement to produce photovoltaic cells and

modules in Buffalo, N.Y. (Associated Press)

Japan's government wants the Parliament to ratify the

Trans-Pacific Partnership trade agreement quickly to keep the pact

alive amid opposition in the U.S. (WSJ)

U.K. auto parts suppliers fear the impact of new tariffs

following Brexit may force them to relocate overseas. (Financial

Times)

Southern California ports and the U.S. Department of Commerce

will work together to study new information technology for ports at

the University of Southern California. (Long Beach Press

Telegram)

A U.S. coal company is exporting to Asia through a Canadian

terminal after failing to gain port access in the U.S. Pacific

Northwest. (Associated Press)

Canadian Pacific Railway Ltd. plans to release a "supply chain

scorecard" on the railroad's handling of Canada's grain harvest.

(Progressive Railroading)

An alliance including the humanitarian Vaccine Alliance and

United Parcel Service Inc. began drone delivery of medical supplies

in Rwanda. (Lloyd's Loading List)

The city of Seattle, private retailers and parcel carriers are

backing a University of Washington study on improving e-commerce

order delivery in cities. (Seattle Daily Journal of Commerce)

Indian officials say they are working with Germany on having

German companies help improve the country's infrastructure,

including improved rail-port connections. (Economic Times)

The Port of Oakland's Trapac LLC cargo terminal plans to double

the size of its container handling operation. (East Bay Times)

A survey shows 75% of Americans believe commercial parcel

delivery by drone will be a reality within five years. (IoT

Daily)

Oil tanker operator Frontline Ltd. canceled an order for four

large vessels from South Korean carrier STX Offshore &

Shipbuilding. (Splash 24/7)

The U.S. military's logistics effort to provide relief in

hurricane-hit Haiti involves tough negotiations to move supplies

inland. (Stars and Stripes)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin, @lorettachao, @RWhelanWSJ and @EEPhillips_WSJ, and

follow the WSJ Logistics Report on Twitter at @WSJLogistics.

Subscribe to this email newsletter by clicking here:

http://on.wsj.com/Logisticsnewsletter .

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

October 17, 2016 06:39 ET (10:39 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

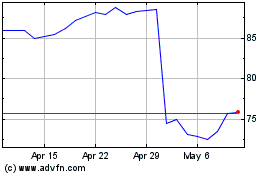

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

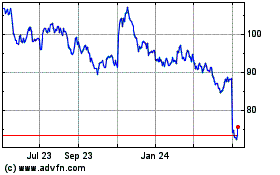

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Apr 2023 to Apr 2024