This Week's Market Movers - Analyst Blog

March 26 2012 - 4:39AM

Zacks

The market appeared to lose its momentum last week for the first

time this year as global growth worries overtook optimism about the

U.S. economic scene. Even so, the pullback is modest relative to

the gains thus far this year, and could easily get reversed given

this week’s potentially market-moving releases. The more likely

course for the market is a period of consolidation over the coming

days ahead of the coming earnings season that is now only a couple

weeks away.

This week’s releases start with Pending Home sales that come out

after the open today and is expected to show an improvement over

the preceding month. Last week’s New Home Sales and Housing Starts

misses aside, the housing sector is showing unmistakable signs of

stabilization. The most important driver of this favorable trend is

the ongoing labor market improvement and the enhanced buying power

that comes with it.

We should see the impact of the labor market developments in

Tuesday’s Consumer Confidence reading from Conference Board and

Friday’s measure from the University of Michigan. Wednesday’s

Durable Goods report is expected to show a significant improvement

from January’s decline.

Friday’s Personal Income & Outlays report has the potential

to cause positive revisions to current quarter GDP estimates. The

final read on the fourth quarter 2011 GDP report on Thursday could

be significant for the same reason as it could cause upward

revisions to the current quarter growth estimates.

The key component in the Thursday GDP report will be Personal

Consumption Expenditures or consumer spending. Upward revision to

fourth quarter consumer spending would show greater momentum coming

into the current quarter than initially expected, likely causing

growth expectations to go up.

In corporate news, shares of Lions Gate

Entertainment (LGF) will be in the spotlight following the

weekend success of its ‘Hunger Games’ movie. Cal-Mine

Foods (CALM), the producer and marketer of eggs, came

ahead of EPS expectations but missed on revenue and indicated

continued feedstock cost pressures. In other news,

Hewlett-Packard (HPQ) announced a 10% increase in

quarterly dividend.

CAL-MAINE FOODS (CALM): Free Stock Analysis Report

HEWLETT PACKARD (HPQ): Free Stock Analysis Report

LIONS GATE ETMT (LGF): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

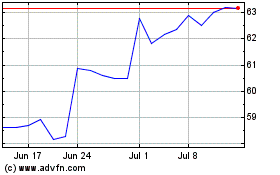

Cal Maine Foods (NASDAQ:CALM)

Historical Stock Chart

From Mar 2024 to Apr 2024

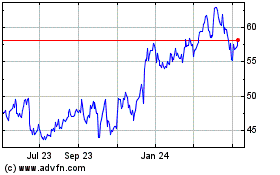

Cal Maine Foods (NASDAQ:CALM)

Historical Stock Chart

From Apr 2023 to Apr 2024