By David Benoit, Dana Mattioli and Nicole Friedman

Warren Buffett's battle for control of a Texas power company

took a turn Friday as a new mystery bidder emerged to challenge

Berkshire Hathaway Inc.'s $9 billion offer.

The bidder is the third entity currently seeking to buy Oncor, a

Texas-based power-transmission company. Mr. Buffett's bid is also

being challenged by hedge fund Elliott Management Corp., a big

debtholder of Energy Future Holdings Corp., the bankrupt firm that

owns most of Oncor.

The bidder's existence materialized in a late-scheduled hearing

in bankruptcy court in Wilmington, Del., but its identity wasn't

revealed. Keith Wofford, lawyer for Elliott, identified the new

contender at the hearing as "a large investment grade utility."

The energy unit of Berkshire struck a deal to buy Oncor for $9

billion in cash last month. The move would further cement

electricity as one of the conglomerate's largest businesses and

partly satiate Mr. Buffett's desire to spend some of Berkshire's

$99.7 billion of cash on acquisitions.

But Elliott, which is run by billionaire Paul Singer, was

assembling a deal of its own that it says would be worth hundreds

of millions of dollars more for creditors. The details of where

that bid stands are unknown.

Mr. Wofford, the Elliott lawyer, said at the hearing that on

Wednesday, Energy Future called Elliott to test its reaction to a

"firm bid for $9.3 billion that has emerged."

At the time, he said, Energy Future was considering breaking

from the Berkshire agreement, to pursue talks with the new

contender.

Energy Future lawyer Mark McKane said at the hearing on Friday

that the company's board is still considering the potential deal,

as well as amendments to the Berkshire deal. The board met Friday

and will meet again Sunday, he said.

"We are still evaluating the situation, but no decisions have

been made, " Mr. McKane said.

Elliott has amassed the largest position in Energy Future's debt

and this week strategically bought a certain slice of notes that

would ensure its ability to block a deal, people familiar with the

matter said.

On Wednesday after the Elliott move, Mr. Buffett did what he

usually does when confronted with tumult in his deal making

process: He stood pat.

Berkshire issued a statement that said it wouldn't be raising

its bid for Oncor. Mr. Buffett, Berkshire's chairman and chief

executive, has a history of sticking to his initial offer: "I'm a

'one-price' guy," he wrote in a 2007 letter to shareholders.

Berkshire also has said it would walk away if its buyout offer

wasn't approved in court next week.

Now, with the emergence of a third bidder, it is possible

neither Mr. Buffett nor Mr. Singer will emerge with Oncor, though

Berkshire still stands to reap a paycheck if the deal is squashed.

As part of the deal, it would receive a breakup fee of $270

million, though that fee would have to be approved by the

bankruptcy court.

Berkshire has earned breakup fees from failed deals in the past,

including $175 million after it withdrew its offer to buy

Constellation Energy Group Inc. in 2008.

But a $270 million consolation prize would only add to

Berkshire's swollen cash coffers, which are approaching $100

billion. Berkshire has made some smaller investments in recent

months and expanded its large stake in Apple Inc. But it hasn't

done a megadeal since August 2015, when it announced its purchase

of Precision Castparts Corp. for more than $32 billion, its biggest

acquisition ever.

"The question is, are we going to be able to deploy it?" Mr.

Buffett said of Berkshire's cash holdings at the company's annual

meeting in May. "At a point the burden of proof really shifts to

us, big time. And there's no way I can come back here three years

from now and tell you that we hold $150 billion or so in cash or

more, and we think we're doing something brilliant by doing

it."

Kraft Heinz Co., which is partly owned by Berkshire and

Brazilian private-equity firm 3G Capital, made a $143 billion

approach to take over Unilever PLC in February but backed away

after Unilever declined. Berkshire would have invested $15 billion

if the deal were reached, Mr. Buffett said at the annual

meeting.

A new offer for Oncor would be the latest twist in the

long-running saga of the fate of Energy Future, formerly known as

TXU, which has been under chapter 11 bankruptcy protection since

2014. The news of the new bidder came out as Elliott was attempting

to learn more about the bid in its efforts to block the Berkshire

deal.

Elliott's purchase of more debt caught some Oncor customers and

stakeholders who were following the case by surprise, a person

familiar with the matter said.

The fight for Oncor could come to a head on Monday, as a judge

is scheduled to decide whether to green light Berkshire's $9

billion takeover offer.

Groups of major Oncor customers and other market participants

have publicly supported Berkshire's bid. Late Friday, five

stakeholder groups announced an agreement with Berkshire that

"resolves all issues" and asked Texas regulators to approve the

deal, Berkshire said in a news release.

With potential other bids, said Geoffrey Gay, counsel for a

coalition of cities served by Oncor, "I can't put my clients' name

on any document, like we did with Berkshire, without knowing who

we're going to be dealing with."

Obtaining regulatory clearance will be key to any successful

bid. Two earlier attempts to sell Oncor -- to Hunt Consolidated

Inc. of Texas and Florida's NextEra Energy Inc. -- foundered due to

action by Texas energy regulators. With money running short, Energy

Future can't afford another failed deal for the business, its crown

jewel.

Regulators have heard little from bidders besides Berkshire,

said Brian Lloyd, the executive director of the Texas Public

Utility Commission, at a meeting in Austin, Texas, on Thursday.

"There have been plenty of meetings, but at this point that list

of details as to ... who the investors are, what the debt levels

are, what the governance rights are, we have not received a

complete list of those things," he said. "Some of the details we

have received, I think, in many of the parties' minds will raise

some questions."

If Berkshire's bid succeeds, Oncor would become part of

Berkshire Hathaway Energy, a collection of energy and utility

businesses run by 55-year-old Greg Abel. Mr. Abel, who became chief

executive of the energy subsidiary in 2008, is widely considered

one of the top candidates to succeed Mr. Buffett as chief executive

of Berkshire.

If Mr. Buffett loses the deal, it wouldn't be the first time his

attempts to wade into Energy Future didn't go his way. Berkshire

spent $2.1 billion in 2007 on high-yielding Energy Future Holdings

bonds. It sold the bonds in 2013 and lost $873 million pretax on

the investment, Mr. Buffett said in his 2013 letter to

shareholders.

"Most of you have never heard of Energy Future Holdings.

Consider yourselves lucky; I certainly wish I hadn't," he wrote in

the letter. In a prior letter, he said he had "totally

miscalculated the gain/loss probabilities when I purchased the

bonds."

--Peg Brickley contributed to this article.

Write to David Benoit at david.benoit@wsj.com, Dana Mattioli at

dana.mattioli@wsj.com and Nicole Friedman at

nicole.friedman@wsj.com

(END) Dow Jones Newswires

August 18, 2017 19:33 ET (23:33 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

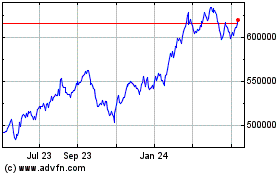

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

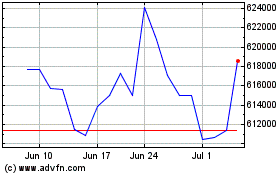

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Apr 2023 to Apr 2024