– Pipeline of two late-stage product candidates

advancing towards commercialization, with launch of TX-004HR

expected in fourth quarter 2017 pending regulatory approval –

– Management to host conference call today at

8:00 a.m. EST –

TherapeuticsMD, Inc. (NYSE MKT: TXMD), an innovative women’s

healthcare company, today announced its fourth quarter and

full-year financial results for 2016.

2016 and Recent Developments

- Net revenue for the company’s

prescription prenatal vitamin business was approximately $19.4

million in 2016 compared with approximately $20.1 million for the

prior year.

- Net loss was approximately $89.9

million in 2016, compared with approximately $85.1 million for the

prior year, reflecting investment in clinical development for the

company’s two phase 3 hormone therapy drug candidates.

- Ended the year with approximately

$131.5 million in cash and no debt.

- Reported positive topline data from the

Replenish Trial, a phase 3 clinical trial of TX-001HR, the

company’s bio-identical hormone therapy combination of estradiol

and progesterone in a single, oral softgel, for the treatment of

moderate-to-severe vasomotor symptoms due to menopause. Topline

results from the trial in 1,835 post-menopausal women demonstrated

that multiple doses of TX-001HR resulted in a statistically

significant reduction from baseline in both the frequency and

severity of hot flashes compared to placebo. In addition,

endometrial safety was established with an incidence rate of

endometrial hyperplasia or malignancy of 0% across all doses. The

company plans to submit a New Drug Application (NDA) for TX-001HR

to the U.S. Food and Drug Administration (FDA) in the third quarter

of 2017.

- Submitted an NDA for TX-004HR, the

company’s applicator-free estradiol vaginal softgel capsule drug

candidate for the treatment of moderate-to-severe vaginal pain

during sexual intercourse (dyspareunia), a symptom of vulvar and

vaginal atrophy (VVA) due to menopause. The NDA is supported by the

complete TX-004HR clinical program, including positive results from

all three doses of TX-004HR (4 mcg, 10 mcg and 25 mcg) that were

evaluated in the phase 3 Rejoice Trial. The FDA’s Prescription Drug

User Fee Act (PDUFA) target action date for the NDA is May 7,

2017.

- Published three manuscripts with

detailed results of the TX-004HR phase 3 Rejoice Trial in the

peer-reviewed journal Menopause. The manuscripts review the

positive results of TX-004HR across pre-specified co-primary and

secondary endpoints in the Rejoice Trial, data from a

pharmacokinetic (PK) substudy demonstrating the low systemic

absorption of TX-004HR, as well as data from a patient

acceptability and satisfaction survey demonstrating a high level of

product acceptability, ease of use, and patient satisfaction with

TX-004HR.

- The company’s intellectual property

portfolio grew to a current total of 144 patent filings, including

74 international filings, with one allowed and 17 issued U.S.

patents.

- Strengthened relationships with key

medical, pharmacy, patient and industry organizations worldwide.

This includes the recent launch of the company’s BIO-IGNITE™

program, an outreach program to quantify the number of compounded

bio-identical estradiol and progesterone prescriptions currently

dispensed by the 3,000-3,500 high-volume compounding pharmacies and

qualify their interests in distributing the company’s bio-identical

hormone product candidates, if approved.

“During 2016, we made significant advancements with our two

late-stage pipeline candidates while we pursued our goal to bring

new healthcare solutions to women to help manage their menopause

symptoms,” said TherapeuticsMD CEO Robert G. Finizio. “As we look

forward to 2017, we are planning the launch of TX-004HR, pending

regulatory approval, as a highly differentiated new treatment for

moderate-to-severe dyspareunia, a symptom of VVA due to menopause.

We also intend to file an NDA for TX-001HR, which, if approved,

would be the first and only FDA-approved bio-identical combination

of estradiol and progesterone for the treatment of

moderate-to-severe vasomotor symptoms due to menopause.”

Summary of 2016 Financial Results

For the year ended December 31, 2016, net revenue was

approximately $19.4 million compared with approximately $20.1

million for the prior year. Net revenue for the fourth quarter of

2016 was approximately $4.5 million compared with net revenue of

approximately $5.6 million for the prior year’s quarter. These

changes were primarily due to a decrease in the average net sales

price of our products, partially offset by an increase in the

number of units sold.

Total operating expenses for the fourth quarter and full-year

2016 included research and development (R&D) expenses and

sales, general and administrative expenses (SG&A). R&D

expenses for the full-year 2016 were approximately $53.9 million

compared with approximately $72.0 million for the prior year.

R&D expenses for the fourth quarter of 2016 were approximately

$10.3 million compared to approximately $13.3 million during the

prior year’s quarter. The decreases in R&D were primarily due

to lower clinical trial costs as the company completed its phase 3

clinical trials for TX-001HR and TX-004HR. SG&A expenses for

the full-year 2016 were approximately $51.3 million compared with

approximately $28.7 million for the prior year. SG&A expenses

for the fourth quarter of 2016 were approximately $16.3 million

compared with approximately $8.6 million for the prior year’s

quarter. The increases in SG&A were primarily due to higher

sales, marketing, regulatory expenditures, and personnel costs to

support future commercialization.

Net loss for the full-year 2016 was approximately $89.9 million,

or $0.46 per basic and diluted share, compared with approximately

$85.1 million, or $0.49 per basic and diluted share, for the

full-year 2015. Net loss in the fourth quarter of 2016 was

approximately $22.8 million, or $0.12 per basic and diluted share,

compared with approximately $17.5 million, or $0.10 per basic and

diluted share, for the fourth quarter of 2015.

At December 31, 2016, cash on hand was approximately $131.5

million, compared with approximately $64.7 million at December 31,

2015.

Conference Call Today

As previously announced, TherapeuticsMD will host a conference

call today to discuss these financial results and provide a

business update. Details for the call are:

Date:

Thursday, February 23, 2017

Time:

8:00 a.m. EST

Telephone Access (US):

866-665-9531

Telephone Access

(International):

724-987-6977

Access Code for All Callers:

68412683

Additionally, a live webcast can be accessed on the company’s

website, www.therapeuticsmd.com, on the Home Page or under the

“Investors & Media” section. A digital recording of the

conference call will be available for replay beginning two hours

after the call's completion and for at least 30 days with the

dial-in 855-859-2056 or international 404-537-3406 and Conference

ID: 68412683.

About TherapeuticsMD, Inc.

TherapeuticsMD, Inc. is an innovative healthcare company

focused on developing and commercializing products exclusively for

women. With its SYMBODA™ technology, TherapeuticsMD is

developing advanced hormone therapy pharmaceutical products to

enable delivery of bio-identical hormones through a variety of

dosage forms and administration routes. The company’s late stage

clinical pipeline includes two phase 3 product candidates: TX-001HR

for treatment of moderate-to-severe vasomotor symptoms (VMS) due to

menopause and TX-004HR for treatment of moderate-to-severe vaginal

pain during sexual intercourse (dyspareunia), a symptom of vulvar

and vaginal atrophy (VVA) due to menopause. The company also

manufactures and distributes branded and generic prescription

prenatal vitamins as well as over-the-counter prenatal vitamins

under the vitaMedMD® and BocaGreenMD® brands.

Forward-Looking Statements

This press release by TherapeuticsMD, Inc. may contain

forward-looking statements. Forward-looking statements may include,

but are not limited to, statements relating to TherapeuticsMD’s

objectives, plans and strategies as well as statements, other than

historical facts, that address activities, events or developments

that the company intends, expects, projects, believes or

anticipates will or may occur in the future. These statements are

often characterized by terminology such as “believes,” “hopes,”

“may,” “anticipates,” “should,” “intends,” “plans,” “will,”

“expects,” “estimates,” “projects,” “positioned,” “strategy” and

similar expressions and are based on assumptions and assessments

made in light of management’s experience and perception of

historical trends, current conditions, expected future developments

and other factors believed to be appropriate. Forward-looking

statements in this press release are made as of the date of this

press release, and the company undertakes no duty to update or

revise any such statements, whether as a result of new information,

future events or otherwise. Forward-looking statements are not

guarantees of future performance and are subject to risks and

uncertainties, many of which are outside of the company’s control.

Important factors that could cause actual results, developments and

business decisions to differ materially from forward-looking

statements are described in the sections titled “Risk Factors” in

the company’s filings with the Securities and Exchange Commission,

including its most recent Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q, as well as reports on Form 8-K, and include

the following: the company’s ability to maintain or increase sales

of its products; the company’s ability to develop and commercialize

its hormone therapy drug candidates and obtain additional financing

necessary therefor; whether the company will be able to prepare a

new drug application for its TX-001HR product candidate and, if

prepared, whether the FDA will accept and approve the application;

whether the FDA will approve the company’s new drug application for

its TX-004HR product candidate and whether any such approval will

occur by the PDUFA date; the length, cost and uncertain results of

the company’s clinical trials; the potential of adverse side

effects or other safety risks that could preclude the approval of

the company’s hormone therapy drug candidates; the company’s

reliance on third parties to conduct its clinical trials, research

and development and manufacturing; the availability of

reimbursement from government authorities and health insurance

companies for the company’s products; the impact of product

liability lawsuits; the influence of extensive and costly

government regulation; the volatility of the trading price of the

company’s common stock and the concentration of power in its stock

ownership. PDF copies of the company’s historical press releases

and financial tables can be viewed and downloaded at its website:

www.therapeuticsmd.com/pressreleases.aspx.

THERAPEUTICSMD, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS December 31, 2016

2015 ASSETS Current Assets: Cash $ 131,534,101

$ 64,706,355 Accounts receivable, net of allowance for doubtful

accounts of $376,374 and $81,910, respectively 4,500,699 3,049,715

Inventory 1,076,321 690,153 Other current assets 2,299,052

2,233,897 Total current assets

139,410,173 70,680,120 Fixed assets,

net 516,839 198,592 Other

Assets: Intangible assets, net 2,405,972 1,615,251 Security deposit

139,036 125,000 Prepaid expense - 1,109,883

Total other assets 2,545,008 2,850,134

Total assets $ 142,472,020 $ 73,728,846

LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Accounts

payable $ 7,358,514 $ 3,126,174 Other current liabilities

7,624,085 7,539,526 Total current liabilities

14,982,599 10,665,700

Commitments and Contingencies

Stockholders' Equity: Preferred stock - par value $0.001;

10,000,000 shares authorized; no shares issued and outstanding - -

Common stock - par value $0.001; 350,000,000 shares authorized:

196,688,222 and 177,928,041 issued and outstanding, respectively

196,688 177,928 Additional paid-in capital 436,995,052 282,712,078

Accumulated deficit (309,702,319 ) (219,826,860 )

Total stockholders' equity 127,489,421

63,063,146 Total liabilities and stockholders' equity $

142,472,020 $ 73,728,846

THERAPEUTICSMD, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

Three Months Ended December 31,

Year Ended December 31,

2016 2015 2016

2015 2014 Revenues, net $

4,487,427 $ 5,629,740 $ 19,356,450 $ 20,142,898 $ 15,026,219

Cost of goods sold 709,711 1,235,978

4,185,708 4,506,673 3,671,803

Gross profit 3,777,716 4,393,762

15,170,742 15,636,225

11,354,416 Operating expenses: Sales, general, and

administrative 16,329,146 8,631,238 51,348,414 28,721,236

22,124,072 Research and development 10,341,144 13,253,472

53,943,477 72,042,774 43,218,938 Depreciation and amortization

48,132 18,000 132,451 62,400 52,467

Total operating expenses 26,718,422

21,902,710 105,424,342 100,826,410

65,395,477 Operating loss

(22,940,706 ) (17,508,948 ) (90,253,600 )

(85,190,185 ) (54,041,061 ) Other income and

(expense) Miscellaneous income 101,438 23,991 367,317 95,719 46,569

Accreted interest 2,974 2,280 10,824 17,442 37,309 Financing costs

- - - - (260,027 ) Total other

income (expense) 104,412 26,271

378,141 113,161 (176,149 ) Loss

before income taxes (22,836,294 ) (17,482,677 ) (89,875,459 )

(85,077,024 ) (54,217,210 ) Provision for income taxes

- - - -

- Net loss $ (22,836,294 ) $ (17,482,677 ) $

(89,875,459 ) $ (85,077,024 ) $ (54,217,210 ) Loss per

share, basic and diluted: Net loss per share, basic and

diluted $ (0.12 ) $ (0.10 ) $ (0.46 ) $ (0.49 ) $ (0.36 )

Weighted average number of common shares outstanding, basic and

diluted 196,613,297 177,876,462

196,088,196 173,174,229 149,727,228

THERAPEUTICSMD, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

Year Ended December, 31, 2016

2015 2014

CASH FLOWS FROM OPERATING

ACTIVITIES Net loss $ (89,875,459 ) $ (85,077,024 ) $

(54,217,210 ) Adjustments to reconcile net loss to net cash used in

operating activities: Depreciation 77,906 29,959 28,987

Amortization of intangible assets 54,545 32,441 23,480 Provision

for (recovery of) doubtful accounts 2,524,909 22,157 (5,436 )

Share-based compensation 17,411,021 7,189,699 4,970,312

Amortization of deferred financing costs - - 260,027 Changes in

operating assets and liabilities: Accounts receivable (3,975,893 )

(917,656 ) (458,028 ) Inventory (386,168 ) 491,960 (138,495 ) Other

current assets 709,907 (773,532 ) 680,281 Other assets - (17,442 )

(37,309 ) Accounts payable 4,232,340 (3,200,955 ) 4,212,912

Deferred revenue - (522,613 ) (1,079,967 ) Other current

liabilities 84,559 3,698,887 239,450

Net cash used in operating activities (69,142,333 )

(79,044,119 ) (45,520,996 )

CASH FLOWS FROM

INVESTING ACTIVITIES Patent costs (845,266 ) (419,104 )

(586,480 ) Purchase of fixed assets (396,154 ) (165,257 ) (30,962 )

(Payment) refund of security deposit

(14,036 ) - 10,686 Net cash used in

investing activities (1,255,456 ) (584,361 )

(606,756 )

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from sale of common stock, net of costs 134,863,475

91,374,649 42,771,353 Proceeds from exercise of options 989,060

1,232,579 345,746 Proceeds from exercise of warrants 1,373,000

366,000 181,000 Net cash provided by

financing activities 137,225,535 92,973,228

43,298,099 Increase (decrease) in cash

66,827,746 13,344,748 (2,829,653 ) Cash, beginning of period

64,706,355 51,361,607 54,191,260

Cash, end of period $ 131,534,101 $ 64,706,355 $

51,361,607

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170223005400/en/

TherapeuticsMD, Inc.Investor

ContactDavid DeLucia, 561-961-1900Director, Investor

RelationsDavid.DeLucia@TherapeuticsMD.comorMedia ContactSparkBioCommAmi Knoefler,

650-739-9952Ami@SparkBioComm.com

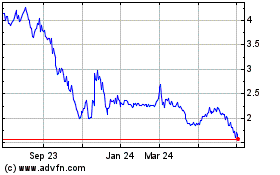

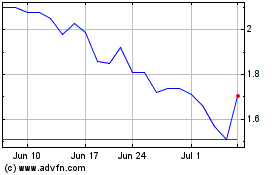

TherapeuticsMD (NASDAQ:TXMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

TherapeuticsMD (NASDAQ:TXMD)

Historical Stock Chart

From Apr 2023 to Apr 2024