Theranos Investor Riley Bechtel Steps Down From Board -- Update

December 01 2016 - 9:58PM

Dow Jones News

By Christopher Weaver and Ezequiel Minaya

Theranos Inc. said Riley Bechtel, chairman of the construction

giant Bechtel Corp., had retired as a director of the embattled

blood testing startup.

Mr. Bechtel has been replaced by Daniel Warmenhoven, former

chief executive officer of data-storage firm NetApp Inc. The

company said Mr. Bechtel "has health issues," and that the switch

was effective immediately.

Mr. Bechtel was named as an investor in Theranos in a Wall

Street Journal article earlier this week. The article identified

other wealthy individuals and families that led Theranos's most

recent funding round, including Rupert Murdoch, executive chairman

of Wall Street Journal parent News Corp.

Theranos founder Elizabeth Holmes said in a statement that the

firm is "proud to call [Mr. Bechtel] a shareholder and will miss

him on our board."

Theranos said Mr. Bechtel had joined its board in 2014. Mr.

Warmenhoven is also a board member at the closely held Bechtel

Corp.

In a statement issued by Theranos, Mr. Warmenhoven said,

"Theranos' inventions position it to meaningfully contribute to

accessible, affordable health care across a broad range of

settings."

"I have confidence in the company's return to its technology

roots, and I look forward to helping guide it to success," he

said.

The company faces serious challenges. Federal health regulators

sanctioned it in July, barring Ms. Holmes from the lab industry for

at least two years. It faces lawsuits by investors and patients and

civil and criminal federal probes.

The company is appealing the sanctions. It has said the suits

are without merit and that it is cooperating in the

investigations.

In October, it closed it lab testing operations. Ms. Holmes said

at the time the company would focus on developing new lab devices

to sell commercially that would enable cheaper blood tests to be

done on small samples.

On Thursday, the company also announced that it was retiring its

board of counselors structure as part of "an ongoing evolution and

consolidation of the company's corporate advisory framework." The

move is effective Jan. 1. A call seeking further detail wasn't

immediately returned.

Members of the scrapped counselors group were once part of the

board of directors but were shifted to the newly created body in

2015 after critics said that while influential former government

officials, they offered little in expertise in the sector.

The advisers included former U.S. cabinet members Henry A.

Kissinger and George P. Shultz, as well as former U.S.

senators.

It was the grandson of Mr. Shultz, a former secretary of state,

who was the first of Theranos' employees to raise concerns with

state regulators of the company's lab practices.

Write to Christopher Weaver at christopher.weaver@wsj.com and

Ezequiel Minaya at ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

December 01, 2016 21:43 ET (02:43 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

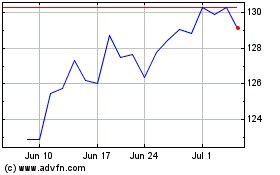

NetApp (NASDAQ:NTAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

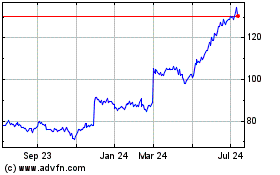

NetApp (NASDAQ:NTAP)

Historical Stock Chart

From Apr 2023 to Apr 2024