For Immediate Release

Chicago, IL – March 26, 2012 – Zacks.com announces the list of

stocks featured in the Analyst Blog. Every day the Zacks Equity

Research analysts discuss the latest news and events impacting

stocks and the financial markets. Stocks recently featured in the

blog include Darden Restaurant (

DRI), KB Home ( KBH), Nike (

NKE), Micron Technology (MU) and Monster

Worldwide, Inc. ( MWW).

Get the most recent insight from Zacks Equity Research with the

free Profit from the Pros newsletter:

http://at.zacks.com/?id=5513

Here are highlights from Friday’s Analyst

Blog:

China Worries Sending

Market Lower?

The market appears to have lost some of its stride in the last

few days as China growth worries have come to the fore, even as

readings of the U.S. economy continue to show resilience. But

stocks don’t move in one direction only, and a period of rest and

recuperation following the impressive sprint from the October lows

shouldn’t be such a huge surprise.

Today’s trading action may not be much different from what we

have been seeing lately, though the pronounced downward bias of the

last few days may not be as apparent today given the absence of any

China headlines. The February New Home sales data on deck for

release a little later may also help sentiment a bit. But the

‘weather question’ will most likely undercut a positive surprise in

today’s housing numbers.

New Home Sales are expected to have increased again in February,

the fifth such gain in the last six months. These gains corroborate

favorable indicators elsewhere in the sector from Housing Starts

and Permit to Builder Sentiment. But this year’s unseasonably warm

winter has stoked skepticism with the housing ‘green shoots.’ In

fact, some are going to the extent of questioning even the labor

market gains of the last few months, giving weather the credit for

a fair share of the improvement.

This debate is unlikely to be settled in the February and March

data, but will get sorted out as the Spring data rolls out. I am

not buying into the weather-is-driving-the-improvement narrative,

but will nevertheless keep an open mind and let actual data settle

the argument for me. In the meantime, I think it’s only fair to

credit the economy for all positive data and not weather.

In corporate news, we got an earnings and revenue surprise from

Darden Restaurant ( DRI), the operator of Olive

Garden and Red Lobster chains, this morning. The strength this

quarter reflected the same-store sales growth at Olive Garden,

which has been struggling for a while now. As with the economic

data above, many will likely question whether the Olive Garden

improvement resulted from the measures management had put in place

or purely due to favorable weather.

Homebuilder KB Home ( KBH) came out with a

narrower than expected loss, but its order book turned out to be

weaker than expected. Nike ( NKE) and

Micron Technology (MU) reported after the close on

Thursday, with the sneaker maker swooshing past expectations while

the chipmaker coming up short.

Monster May Sell Off

According to recent news from Reuters, management at

Monster Worldwide, Inc. ( MWW) might sell a part

-- or all -- of its business.

The news led to a 2.04% jump in share price in regular trading

to close at $9.49 on March 22, 2012.

Monster had earlier retained Key Partners LLC and BofA

Merrill Lynch as its financial advisors in connection with its

review of strategic alternatives done previously.

The company is facing tough times for quite some time now and is

considering strategic alternatives to boost shareholder value in

the coming months to combat the same. Competition has intensified

over the last few years in the online employment advertising

market, which in our view has resulted in Monster losing share.

Though Monster once had a dominant position, there are now

several national competitors (i.e., CareerBuilder) as well as niche

sites (i.e., Dice, JobsintheMoney, TheLadders, SnagAJob, etc.).

Many of the cutting-edge recruiters have reduced their use of job

boards in favor of alternative social media sites, such as LinkedIn

and Twitter.

The near-term priorities for the management includes

executing on its share buyback program along with returning excess

cash to shareholders, focusing on incremental growth opportunity

with SeeMore and Government Solutions and implementing $100 million

cost savings initiative to increase marketing campaign and sales

efforts.

Want more from Zacks Equity Research? Subscribe to the free

Profit from the Pros newsletter: http://at.zacks.com/?id=5515.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous coverage is provided for a universe of 1,150 publicly

traded stocks. Our analysts are organized by industry which gives

them keen insights to developments that affect company profits and

stock performance. Recommendations and target prices are six-month

time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today:

http://at.zacks.com/?id=5517

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leon Zacks. As a PhD from MIT Len knew

he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment Research is through our

free daily email newsletter; Profit from the Pros. In short, it's

your steady flow of Profitable ideas GUARANTEED to be worth your

time! Register for your free subscription to Profit from the Pros

at http://at.zacks.com/?id=5518.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

DARDEN RESTRNT (DRI): Free Stock Analysis Report

KB HOME (KBH): Free Stock Analysis Report

MICRON TECH (MU): Free Stock Analysis Report

MONSTER WWD INC (MWW): Free Stock Analysis Report

NIKE INC-B (NKE): Free Stock Analysis Report

To read this article on Zacks.com click here.

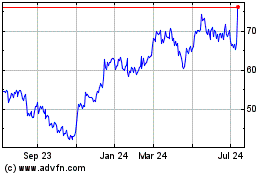

KB Home (NYSE:KBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

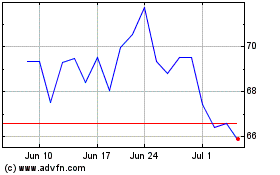

KB Home (NYSE:KBH)

Historical Stock Chart

From Apr 2023 to Apr 2024