The Stores That Cater To The 0.1%, Not The 1% Shops -- WSJ

March 16 2017 - 3:02AM

Dow Jones News

By Matthew Dalton

PARIS -- An elegant stone façade just off the Champs Élysées

hides what may be the world's most elite liquor store.

Spirits maker Moët Hennessy has turned a Parisian apartment into

a discreet, invitation-only boutique for its best clients and those

of its parent, luxury giant LVMH Moët Hennessy Louis Vuitton.

Decades-old bottles of limited edition Dom Pérignon champagne,

costing thousands of dollars each, lie in a temperature-controlled

closet made of crystal glass. A display case holds massive "

Nebuchadnezzar" bottles of Cheval Blanc, each containing almost

four gallons of the ultraexpensive Saint-Émilion wine.

The apartment, opened a year ago, is part of an intensifying

effort by luxury firms to pamper their best-heeled customers,

hoping the ultra-rich can bolster growth amid a cloudier

outlook.

For years, the luxury industry relied on Asia and globe-trotting

shoppers from China's emerging upper middle class to fuel annual

growth rates of more than 10%. But Chinese policies to keep

shoppers from spending large sums overseas, combined with terror

attacks in Europe, have hit the industry hard. Global luxury

spending didn't grow in 2016, the first such stall since the

world-wide financial crisis.

Some of that pressure has eased as terror fears have ebbed, but

sales growth this year is expected to be just 2% to 3%. Amid that

new normal, luxury firms are conjuring up ever-more-extravagant

perks to woo the super-wealthy.

This clientele isn't the 1% of the world's richest people. It is

the top 0.1%, a group that already makes up a disproportionate

percentage of sales for the industry. According to research firm

Wealth-X, an even more rarified group -- the roughly 211,000 people

around the world with individual net worth of more than $30 million

-- account for about 19% of total luxury-market spending. Their

wealth is expected to surge in the coming years, growing 9%

annually through 2020, Wealth-X says.

"This VIP-management side of the business is getting more and

more important," said Luca Solca, luxury-industry analyst with

Exane BNP Paribas. "A happy few are doing really well."

Harrods, the swanky London department store, has private areas

akin to hotel suites that wealthy clients can rent for their

entourages. Customers can hire chefs to cook meals for powering

through day-long shopping sprees.

High-end menswear firm Stefano Ricci flies its tailors to

clients around the world to make custom suits. Each suit costs

between $10,000 and $20,000, and customers are expected to purchase

at least five for a tailor to make the trip, says Filippo Ricci,

the family-owned company's creative director. The Ricci family

recently opened a country house near its headquarters in Florence

where it hosts top-spending clients, even allowing them to drive

the family's collection of vintage cars.

"Our mission is to maximize the feel-good factor of these

people," said Thomas Mesmin, who started a company that designs

specialized shopping trips to Paris for the ultrawealthy. "We want

them to be in the perfect mood to buy products."

Luxury firms hope brand loyalty nurtured among these influential

consumers will spread to their social circles and eventually

trickle down to the broader public.

"The impact is much more on the desirability of the brands and

the image of the company than purely financial," said Marc

Fourcade, private-sales manager at Moët Hennessy, who conceived of

the Paris apartment.

At a starting price of roughly EUR15,000 ($16,000), clients can

spend a few hours dining and sampling Moët Hennessy wines and

Cognacs. The bill can soar from there.

A personalized barrel of Château d'Yquem, a renowned sweet wine,

goes for EUR100,000. The barrel contains the equivalent of 300

bottles. That amounts to something of a bargain for wine from an

estate that has produced single bottles selling for more than that

sum.

The boutique's sleek interior, designed by Bruno Moinard, has

custom-made furniture. For dinner, Moët Hennessy can arrange for a

celebrity chef to cook for up to 12 guests.

The apartment's liquor storeroom is stocked with Moët Hennessy's

brands: Dom Pérignon, Krug, Veuve Clicquot, Château d'Yquem, Cheval

Blanc and Ao Yun, a new Chinese wine from an estate in the

Himalayas. A closet holds a limited-edition Cognac, Hennessy 8,

made to commemorate the master blender's handover of the keys to

the house to his nephew. It comes in a crystal bottle inside a

personalized case. The price for a liter of Cognac? Mr. Fourcade

says Hennessy has been selling the bottles for tens of thousands of

dollars each.

Write to Matthew Dalton at Matthew.Dalton@wsj.com

(END) Dow Jones Newswires

March 16, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

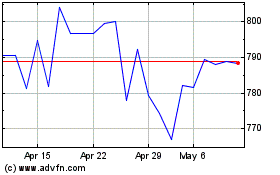

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Mar 2024 to Apr 2024

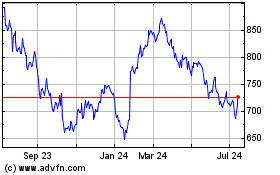

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Apr 2023 to Apr 2024