(Editor's Note: This item originally appeared earlier today. It

is being sent to run on additional wires.)

By Jennifer Maloney

The future of protein could be a meal worm, a fungus, an obscure

plant or a run-of-the-mill pea.

"If we look around the world, there's a big consumer trend on

more protein," says Mehmood Khan, vice chairman and chief

scientific officer at PepsiCo Inc. "The question is: How are we

going to do this in a manner that's sustainable? Protein isn't

cheap. And animal protein has the greatest footprint on the

planet."

The maker of Cheetos, Rice-A-Roni and Quaker Oats this year

issued a request for proposals on "novel protein sources" for its

snacks and beverages. PepsiCo is focused primarily on plant-based

proteins but said it would also consider insects or mycoprotein --

an ingredient made from fermented fungus.

Indeed, companies from startups to conglomerates are expanding

their portfolios to serve consumers concerned not just about what

they eat, but how their food is grown.

More U.S. consumers are looking for healthy, minimally processed

ingredients sourced in a way that is kind to the environment.

While U.S. per capita consumption of meat and poultry combined

grew 6% from 2014 to 2016, according to the U.S. Department of

Agriculture, consumption of meat substitutes is also growing. U.S.

retail-store sales of products using meat substitutes climbed 16%

over the same period to $700 million in 2016, according to research

firm Euromonitor International. The firm projects that meat

substitutes, including frozen, refrigerated and shelf-stable

products, will reach $863 million in annual U.S. sales by 2021.

Packaged foods labeled "vegan" represented $9.7 billion in

global retail sales last year and are projected to reach $11.8

billion by 2021, according to Euromonitor.

"The consumer is demanding more and more plant-based solutions,"

says Ethan Brown, chief executive of Beyond Meat, a Los

Angeles-area company that uses peas to make burger patties with a

texture, taste and sizzle similar to ground beef. The company last

year sold a 5% stake to Tyson Foods Inc., the largest U.S. meat

company by sales. Tyson, which raised some eyebrows with the move,

said at the time that investing in plant-based protein would help

it meet consumer demand for more choice and keep tabs on

innovations.

Nestlé SA last month agreed to acquire Sweet Earth Foods, a Moss

Landing, Calif., company that substitutes plant for meat proteins

in meals such as curries, stir fries, breakfast wraps, burgers and

pasta. Nestlé didn't disclose the terms of the deal.

As shoppers look for healthy, natural ingredients, big food

companies are investing in startups that offer alternatives to

traditional dairy products as well.

Kellogg Co.'s venture-capital fund in January announced an

investment in Kuli Kuli, an Oakland, Calif., company that makes

smoothie mixes and bars from the protein-rich leaves of the moringa

tree, cultivated in West Africa, the Caribbean and elsewhere.

General Mills Inc.'s venture-capital fund, too, has invested in

such companies as Kite Hill, a producer of nut-milk-based cheeses

and yogurts; and Purely Elizabeth, which sells granola and hot

cereal made with ingredients such as kaniwa, a protein-rich seed

grown in South America.

Alternatives to traditionally raised animal products are coming

from some surprising sources. Take jackfruit, for example. It isn't

high in protein, but when cooked it has a texture similar to pulled

pork. Then there's Memphis Meats Inc., which is developing

technology to grow meat from self-reproducing animal cells. Cargill

Inc. invested in the company in August.

PepsiCo's request, posted on a website that helps match projects

with researchers, notes that the company has already done

"extensive work" on ingredients including soy, moringa, duckweed,

cricket powder and mealworm powder. But don't expect a Quaker

cricket bar soon. The company says that "extensive work" could mean

reading the research literature on a given subject.

The company has set goals for lowering the amounts of sugar, fat

and sodium in its products and is shifting its portfolio to include

more of what it calls "everyday nutrition" products containing

whole grains, fruits, vegetables, dairy and protein. These

products, such as overnight oats, granola and hummus-based sandwich

spreads, now represent 27% of PepsiCo's net revenue.

In its search for new protein sources, the company says it is

looking for ingredients that are affordable, easy to pronounce and

have minimal impact on the flavor and texture of a drink or

snack.

"Ask anybody who enjoys cooking," says Dr. Khan, a former

endocrinologist. "Take anything with protein; if you mishandle it,

it either curdles, denatures, gels, tastes bad. It is not easy to

cook with."

In some cases, PepsiCo has taken a conventional ingredient and

given it a new form.

The company's latest innovation is a patented process that makes

oats soluble in water so they can be consumed as a protein-rich

beverage. The resulting drinks don't have the viscosity or

granularity one might expect from mixing oats and water, PepsiCo

says. The company is developing products made with "SoluOats" for

the U.S. and other markets that vary by seasoning, flavoring and

texture. Some may include additional protein from dairy.

Food companies are also looking for ingredients that address

concerns that meat production -- because of the amount of land,

water and energy it requires -- won't meet the world's growing

protein needs.

That's where the use of insects could come in.

Mohammed Ashour, chief executive of a Texas company called

Aspire Food Group, is aiming to introduce American palates to

insects -- a protein source consumed by two billion people around

the world.

"We are growing in numbers and we are growing in appetite," Mr.

Ashour says of the world's population, noting that raising

livestock requires much more water, land and fossil fuels per pound

of meat produced than insect farming does. "We have to start

shifting how the world's resources are used."

In a newly expanded indoor facility in Austin, Aspire produces a

cricket powder that is used in protein bars, cookies and dog

treats. The company also makes whole-roasted crickets, a crunchy

snack that comes in flavors such as Texas BBQ and sour cream and

onion. The roasted crickets were a hit this year at the Seattle

Mariners' Safeco Field, where concession stands served them in a

4-ounce cup with chile-lime seasoning for $4. Aspire is now in

talks with an NBA team, Mr. Ashour says.

"There's definitely a psychological hurdle," he says. "A lot of

insects are just simply gross to look at. This isn't an overnight

shift."

Meanwhile, Beyond Meat is exploring protein sources beyond the

humble pea.

"People don't like to eat the same thing every day," Mr. Brown

says. A mix of proteins can create a better mouthfeel and a more

complete amino-acid profile. The company is also looking to

increase the stability of its amino acid supply by diversifying the

crops it uses.

Among other crops, it is considering lentils, mung beans,

mustard seeds and lupin beans, a legume eaten in the Mediterranean.

The company's next product will likely use a combination of protein

sources.

---

Ms. Maloney is a reporter for The Wall Street Journal in New

York. She can be reached at jennifer.maloney@wsj.com.

(END) Dow Jones Newswires

October 16, 2017 13:53 ET (17:53 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

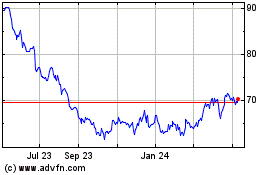

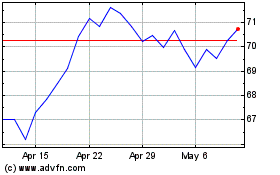

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024