Nokia today announced that the French stock market authority

(Autorité des marchés financiers, "AMF") has approved Nokia's

proposed public buy-out offer in cash followed by a squeeze-out in

cash relating to the remaining securities of Alcatel-Lucent that

Nokia does not already own. As previously announced, Nokia proposes

to acquire, through a public buy-out offer in cash, all the

Alcatel-Lucent shares (the "Shares"), bonds convertible into new or

exchangeable for existing Alcatel-Lucent shares due on January 30,

2019 (the "2019 OCEANEs"), and bonds convertible into new or

exchangeable for existing Alcatel-Lucent shares due on January 30,

2020 (the "2020 OCEANEs", and together with the 2019 OCEANEs, the

"OCEANEs") it does not already own (the "Public Buy-Out Offer").

The Public Buy-Out Offer will be followed by a squeeze-out in cash

of the Shares and OCEANEs not tendered into the Public Buy-Out

Offer (the "Squeeze-Out", and together with the Public Buy-Out

Offer, the "Offer"), in accordance with the General Regulation of

the AMF.

In the Public Buy-Out Offer, Nokia is offering a consideration

of EUR 3.50 per Alcatel-Lucent Share, EUR 4.51 per 2019 OCEANE, and

EUR 4.50 per 2020 OCEANE. In the Squeeze-Out, the Shares and

OCEANEs not tendered into the Public Buy-Out Offer will be

transferred to Nokia for the same consideration as the

above-mentioned consideration of the Public-Buy-Out Offer, net of

all costs.

The Offer will be made exclusively in France, and in the United

States pursuant to an exemption from the U.S. tender offer rules

provided by Rule 14d-1(c) and, to the extent applicable, Rule

13e-4(h)(8) of the U.S. Securities Exchange Act of 1934. Holders of

Alcatel-Lucent Shares and OCEANEs located outside of France and the

United States may not participate in the Public Buy-Out Offer

except if, pursuant to the local laws and regulations applicable to

those holders, they are permitted to do so.

Nokia expects the Public Buy-Out Offer to open on September 22,

2016 and close on October 5, 2016. The Squeeze-Out will be

implemented on the trading day following the expiration date of the

Public Buy-Out Offer, which is anticipated to be on October 6,

2016. These dates are indicative and the AMF is expected to

announce the definitive timetable of the Offer on September 21,

2016, after the filing by Nokia and Alcatel Lucent of their

respective "other information" documents relating, in particular,

to their legal, financial and accounting characteristics.

Nokia and Alcatel Lucent's joint offer document (note

d'information conjointe) is available on the AMF website

(www.amf-france.org), on Nokia's website

(http://company.nokia.com/en/investors/financial-reports/filings-related-to-the-alcatel-lucent-transaction),

and on Alcatel-Lucent's website (www.alcatel-lucent.com).

Media Enquiries: Nokia Communications

Tel. +358 (0) 10 448 4900 Email: press.services@nokia.com

Investor Enquiries: Nokia Investor

Relations Tel. +358 4080 3 4080 Email:

investor.relations@nokia.com

About Nokia Nokia is a global leader in

the technologies that connect people and things. Powered by the

innovation of Bell Labs and Nokia Technologies, the company is at

the forefront of creating and licensing the technologies that are

increasingly at the heart of our connected lives. With

state-of-the-art software, hardware and services for any type of

network, Nokia is uniquely positioned to help communication service

providers, governments, and large enterprises deliver on the

promise of 5G, the Cloud and the Internet of Things.

www.nokia.com

Microsite details Further information on the

transaction can be found at: www.newconnectivity.com

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR

IN PART IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF THAT

JURISDICTION

FORWARD-LOOKING STATEMENTS

This stock exchange release contains forward-looking statements

that reflect Nokia's current expectations and views of future

events and developments. Some of these forward-looking statements

can be identified by terms and phrases such as "expect", "will" and

similar expressions. These forward-looking statements include

statements relating to: the expected filing by Nokia and Alcatel

Lucent of their "other information" documents relating, in

particular, to their legal, financial and accounting

characteristics; the expected publication by the AMF of the

timetable of the Offer; the expected opening and closing dates of

the Public Buy-Out Offer; and the implementation date of the

Squeeze-Out. These forward-looking statements are subject to a

number of risks and uncertainties, many of which are beyond our

control, which could cause actual results to differ materially from

such statements. These forward-looking statements are based on our

beliefs, assumptions and expectations of future performance, taking

into account the information currently available to us. These

statements are only predictions based upon our current expectations

and views of future events and developments. Risks and

uncertainties include: AMF's regulation of the Offer as well as

other risk factors listed from time to time in Nokia's and Alcatel

Lucent's filings with the U.S. Securities and Exchange Commission

("SEC").

The forward-looking statements should be read in conjunction

with the other cautionary statements that are included elsewhere,

including Nokia's and Alcatel Lucent's most recent annual reports

on Form 20-F, reports furnished on Form 6-K, and any other

documents that Nokia or Alcatel Lucent have filed with the SEC. Any

forward-looking statements made in this stock exchange release are

qualified in their entirety by these cautionary statements, and

there can be no assurance that the actual results or developments

anticipated by us will be realized or, even if substantially

realized, that they will have the expected consequences to, or

effects on, us or our business or operations. Except as required by

law, we undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

IMPORTANT ADDITIONAL INFORMATION

This stock exchange release relates to Nokia's Public Buy-Out

Offer followed by a Squeeze-Out for all of the ordinary shares and

OCEANE convertible bonds of Alcatel Lucent. This stock exchange

release is for informational purposes only and does not constitute

an offer to purchase or exchange, or a solicitation of an offer to

sell or exchange, any ordinary shares or OCEANE convertible bonds

of Alcatel Lucent, nor is it a substitute for Nokia and ALU's joint

offer document (note d'information conjointe) filed by Nokia with,

and which received visa No. 16-438 from the AMF on September 20,

2016 (as amended and supplemented from time to time, the "Offer

Document"). The Public Buy-Out Offer followed by a Squeeze-Out is

being made only through the Offer Document.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE OFFER

DOCUMENT AND ALL OTHER RELEVANT DOCUMENTS THAT NOKIA OR ALCATEL

LUCENT MAY FURNISHED OR FILE WITH THE SEC OR AMF WHEN THEY BECOME

AVAILABLE BECAUSE THEY CONTAIN IMPORTANT INFORMATION THAT INVESTORS

AND SECURITY HOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION

REGARDING THE PUBLIC BUY-OUT OFFER FOLLOWED BY A SQUEEZE-OUT.

The information contained in this stock exchange release must

not be published, released or distributed, directly or indirectly,

in any jurisdiction where the publication, release or distribution

of such information is restricted by laws or regulations.

Therefore, persons in such jurisdictions into which these materials

are published, released or distributed must inform themselves about

and comply with such laws or regulations. Nokia and Alcatel Lucent

do not accept any responsibility for any violation by any person of

any such restrictions.

The Offer Document and other documents referred to above, if

furnished by Nokia or Alcatel Lucent with the SEC, will be

available free of charge at the SEC's website (www.sec.gov).

Nokia and ALU's joint offer document (note d'information

conjointe) which received visa No. 16-438 from the AMF contains

detailed information with regard to the Public Buy-Out Offer

followed by a Squeeze-Out, is available on the websites of the AMF

(www.amf-france.org), Nokia (www.nokia.com) and Alcatel Lucent

(www.alcatel-lucent.com).

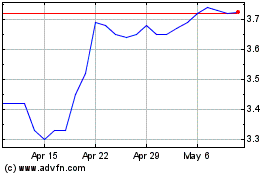

Nokia (NYSE:NOK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nokia (NYSE:NOK)

Historical Stock Chart

From Apr 2023 to Apr 2024