The Best and Worst Performing Dividend ETFs of 2014

December 15 2014 - 7:00AM

ETFDB

2014 took investors on another wild ride, as markets continued

their impressive bull run. Despite a slump in October that had many

calling for a prolonged correction, equities resumed their bullish

pattern and are up over 12% for the year. It was also a year where

dividend-paying ETFs remained in the limelight. Though the Fed has

hinted at raising rates, there still is no definitive timeline for

when rates will climb from their near-zero levels. With that in

mind, investors have been searching for yield to add a steady

income stream to their portfolios [for more ETF news and analysis subscribe to our

free ETFdb Daily Roundup].

Below, we outline the best and worst performing dividend ETFs

this year. Note that the funds chosen are classified as

dividend-focused and not simply ones that pay a dividend.

The Best Performers google.load('visualization', '1', {packages:

['corechart']}); function drawVisualization() { // Create and

populate the data table. var data =

google.visualization.arrayToDataTable([ ['ETF', 'YTD

Performance',], ['ETRACS Monthly Pay 2x Leveraged Dow Jones Select

Dividend Index ETN (DVYL)', 28.0], ['ETRACS Monthly Pay 2x

Leveraged S&P Dividend ETN (SDYL)', 27.1], ['S&P 500 High

Dividend Portfolio (SPHD)', 19.9], ['Ultra Dividend Fund (RDIV)',

19.7], ['SuperDividend U.S. ETF (DIV)', 19.2], ['Sector Dividend

Dogs ETF (SDOG)', 17.0], ['High Yield Dividend Achievers (PEY)',

16.2], ['S&P 500 Aristocrats ETF (NOBL)', 15.6], ['Equity

Income Fund (DHS)', 15.5], ['Value Line Dividend Index Fund (FVD)',

15.2], ]); var formatter = new google.visualization.NumberFormat(

{suffix: "%"}); formatter.format(data,1); var options = {

title:"Best Performing Dividend ETFs of 2014", width:600,

height:400, hAxis: {title: ""}, colors: ["green"] }; // Create and

draw the visualization. new

google.visualization.ColumnChart(document.getElementById('visualization105372')).

draw(data, options); } google.setOnLoadCallback(drawVisualization);

With equity markets charging forward, two leveraged funds take

the top spot in 2014. Note that while these funds can provide

stellar returns in bear markets, they have the potential for big

losses in bear stretches. All 10 of these ETFs outperformed

the SPDR S&P 500 ETF (SPY), all while providing a

dividend-focused strategy for investors [see also The Best and

Worst Performing Dividend ETFs of 2013].

The Worst Performers google.load('visualization', '1', {packages:

['corechart']}); function drawVisualization() { // Create and

populate the data table. var data =

google.visualization.arrayToDataTable([ ['ETF', 'YTD

Performance',], ['Global Natural Resources Fund (GNAT)', -15.0],

['Low Volatility Emerging Markets Dividend ETF (HILO)', -9.8],

['Emerging Markets Equity Income Fund (DEM)', -8.3], ['Commodity

Country Equity Fund (CCXE)', -7.5], ['Europe SmallCap Dividend Fund

(DFE)', -7.5], ['International SmallCap Fund (DLS)', -7.2],

['iShares Emerging Markets Dividend ETF (DVYE)', -5.8], ['Australia

Dividend Fund (AUSE)', -4.3], ['SPDR S&P Emerging Markets

Dividend ETF (EDIV)', -4.1], ['S&P Global Dividend

Opportunities Index ETF (LVL)', -3.9], ]); var formatter = new

google.visualization.NumberFormat( {suffix: "%"});

formatter.format(data,1); var options = { title:"Worst Performing

Dividend ETFs of 2014", width:600, height:400, hAxis: {title: ""},

colors: ["red"] }; // Create and draw the visualization. new

google.visualization.ColumnChart(document.getElementById('visualization105378')).

draw(data, options); } google.setOnLoadCallback(drawVisualization);

The U.S. may have had a relatively strong year, but the story

was completely different overseas. None of the 10 worst

performers were U.S.-focused funds, but instead honed in on

emerging markets or other countries overseas.

The table below lists each ETF in the above charts:

ETF YTD Return

|

| ETRACS Monthly Pay 2x Leveraged Dow Jones Select Dividend Index

ETN (DVYL) |

28.00% |

| ETRACS Monthly Pay 2x Leveraged S&P Dividend ETN

(SDYL) |

27.12% |

| S&P 500 High Dividend Portfolio (SPHD) |

19.88% |

| Ultra Dividend Fund (RDIV) |

19.67% |

| SuperDividend U.S. ETF (DIV) |

19.16% |

| Sector Dividend Dogs ETF (SDOG) |

16.99% |

| High Yield Dividend Achievers (PEY) |

16.20% |

| S&P 500 Aristocrats ETF (NOBL) |

15.55% |

| Equity Income Fund (DHS) |

15.53% |

| Value Line Dividend Index Fund (FVD) |

15.22% |

| S&P Global Dividend Opportunities Index ETF

(LVL) |

-3.85% |

| SPDR S&P Emerging Markets Dividend ETF (EDIV) |

-4.10% |

| Australia Dividend Fund (AUSE) |

-4.34% |

| iShares Emerging Markets Dividend ETF (DVYE) |

-5.80% |

| International SmallCap Fund (DLS) |

-7.15% |

| Europe SmallCap Dividend Fund (DFE) |

-7.52% |

| Commodity Country Equity Fund (CCXE) |

-7.54% |

| Emerging Markets Equity Income Fund (DEM) |

-8.31% |

| Low Volatility Emerging Markets Dividend ETF (HILO) |

-9.78% |

| Global Natural Resources Fund (GNAT) |

-14.97% |

Follow me on

Twitter @JaredCummans.

[For more ETF analysis, make sure to

sign up for our free ETF newsletter]

Disclosure: No positions at time of

writing.

Click here to read the original article on ETFdb.com.

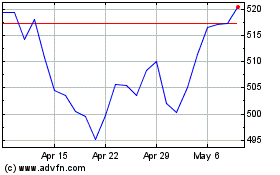

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Mar 2024 to Apr 2024

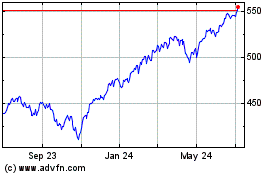

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Apr 2023 to Apr 2024