Tharisa PLC Q1 FY2018 Production Report 31 December 2017 (3832B)

January 10 2018 - 2:00AM

UK Regulatory

TIDMTHS

RNS Number : 3832B

Tharisa PLC

10 January 2018

Tharisa plc

(Incorporated in the Republic of Cyprus with limited

liability)

(Registration number HE223412)

JSE share code: THA

LSE share code: THS

ISIN: CY0103562118

('Tharisa')

First quarter production report for the quarter ended 31

December 2017

Tharisa commences FY2018 with a record Q1

Highlights for the three months ended 31 December 2017

-- Successful transition to owner mining model

-- Record tonnes milled of 1 310.2 kt, up 0.8% quarter on quarter

-- Chrome recovery of 65.5% exceeds targeted recovery of 65.0%

-- Record chrome concentrate production of 365.8 kt, up 1.5% quarter on quarter

-- Record specialty chrome concentrate production of 88.1 kt, up 5.5% quarter on quarter

-- Solid PGM production of 38.8 koz

-- Record PGM recoveries at 84.3%, exceeding targeted recoveries of 80.0%

Safety

Safety remains a priority and Tharisa continues to strive for

zero harm at its operations. A LTIFR of 0.15 per 200 000 man hours

worked was recorded for the quarter.

Production update

The production update for the quarter ended 31 December 2017 is

as follows:

Quarter ended Quarter ended Quarter on Quarter ended Year

31 Dec 30 Sept quarter 31 Dec 2016 ended

2017 2017 movement 30 Sept

2017

------------------- ----------------- ---------------- --------------- --------------- --------------- ---------

Reef mined kt 1 245.3 1 300.8 (4.3) 1 229.9 5 025.1

m(3) waste/

Stripping ratio m(3) reef 7.8 6.6 18.1 9.0 7.5

Reef milled kt 1 310.2 1 299.4 0.8 1 206.4 4 916.2

PGM flotation feed kt 959.6 950.3 1.0 885.1 3 599.2

PGM rougher feed

grade g/t 1.49 1.58 (5.7) 1.52 1.56

6E PGMs produced koz 38.8 39.0 (0.5) 34.8 143.6

PGM recovery % 84.3 81.0 4.1 80.5 79.7

Average PGM

contained metal

basket price US$/oz 865 825 4.8 740 786

Average PGM

contained metal

basket price ZAR/oz 11 827 10 866 8.8 10 287 10 492

Cr O ROM grade % 18.1 18.4 (1.6) 17.5 17.8

Chrome recovery % 65.5 63.6 3.0 64.3 64.1

Chrome yield % 27.9 27.7 0.7 26.7 27.1

Chrome

concentrates

produced kt 365.8 360.5 1.5 322.2 1 331.2

Metallurgical

grade kt 277.7 277.0 0.3 245.1 1 008.1

Specialty

grades kt 88.1 83.5 5.5 77.1 323.1

Third-party

production kt 52.8 20.0 164.0 - 20.0

Metallurgical

grade chrome

concentrate

contract price US$/t CIF China 179 172 4.1 250 200

Metallurgical

grade chrome

concentrate

contract price ZAR/t CIF China 2 426 2 250 7.8 3 488 2 667

Average exchange

rate ZAR:US$ 13.6 13.2 - 13.9 13.4

------------------- ----------------- ---------------- --------------- --------------- --------------- ---------

Mining

With effect from 1 October 2017 the mine successfully

transitioned from a mining contractor model to an owner mining

model. Total reef mined from the open pit for the quarter was 1

245.3 kt, in line with the preceding quarter.

The focus during the quarter was on increased waste removal to

ensure that sufficient reef was available in the optimal blend

ahead of the processing plants. Total waste of approximately 2.7

million m(3) was moved during the quarter, 27% of which was

interburden (including top soil) at a stripping ratio of 7.8 on a

m(3) :m(3) basis. With the road diversion having been completed,

the additional shallow area was mined resulting in both lower

stripping and lower grades as oxidised ore was mined and processed.

This area has now been substantially mined through and the reef

strike length increased. The life of open pit average stripping

ratio is 9.7 on a m(3) :m(3) basis.

Processing

During the quarter, 1 310.2 kt were milled, resulting in PGM

production of 38.8 koz on a 6E basis and chrome production of 365.8

kt, 88.1 kt of which is specialty grades. This represents a 1.5%

improvement in total chrome production and a 5.5% increase in

specialty grade production quarter on quarter.

The focus on continued improvement resulted in improved PGM

recoveries at 84.3%, a new record above the targeted recoveries of

80.0%. Chrome recoveries at 65.5% also exceeded targeted recoveries

of 65.0%. With tonnes processed exceeding tonnes mined, the ore

stockpiles ahead of the processing plants were partially utilised.

As at 31 December 2017, the ore stockpiles ahead of the processing

plants totalled 242.7 kt or approximately two weeks of plant

throughput.

Market update

The average PGM contained metal basket price (per ounce) for the

three months to end 31 December 2017 was US$865 (ZAR11 827), which

was US$40 an ounce higher than the US$825 (ZAR10 866) achieved in

the quarter to end 30 September 2017. PGM basket prices continued

to reflect improvements in spot palladium and rhodium prices with

palladium comprising 16.6% and rhodium comprising 9.4% of the

Tharisa basket.

Spot palladium prices averaged US$993 per ounce in Q1 FY2018,

ending the calendar year at US$1 057 an ounce, while spot rhodium

prices averaged US$1 351 per ounce in Q1 FY2018, ending the

calendar year at US$1 470 an ounce. Spot palladium prices increased

58.0% and rhodium prices increased 52.6% in 2017.

Contracted metallurgical grade chrome concentrate prices

increased 4.1% to US$179 per tonne from US$172 per tonne in the

previous quarter due to improved liquidity and consistent stock

levels at ferrochrome and stainless steel producers in China.

Current metallurgical chrome spot prices are above US$200 per tonne

for February 2018 shipment.

As at 29 December 2017, Chinese port stock levels were at 2.2

Mt, or approximately two months' supply into the ferrochrome and

stainless steel industry. The market fundamentals for chrome remain

sound with continued growth forecast for the global stainless steel

industry.

Specialty chrome concentrates, which comprise 24.1% of Tharisa's

total chrome production, continued to attract a premium above the

contracted metallurgical chrome concentrate prices.

Outlook

Tharisa's FY2018 production guidance remains at 150 koz PGMs and

1.4 Mt chrome concentrates, of which 350 kt will be specialty grade

chrome concentrates. The near term focus will be on continued

operational improvements and the commencement of the Vision 2020

projects that will ensure Tharisa delivers 200 kozpa of PGMs and 2

Mtpa of chrome concentrates by 2020.

The above information has not been reported on or reviewed by

Tharisa's auditors.

Paphos, Cyprus

10 January 2018

JSE Sponsor

Investec Bank Limited

Investor Relations contact:

Tharisa plc

Sherilee Lakmidas

+27 11 996 3538

+27 79 276 2529

slakmidas@tharisa.com

Broker contacts:

Peel Hunt LLP (Joint Broker)

Matthew Armitt / Ross Allister

+44 207 7418 8900

BMO Capital Markets Limited (Joint Broker)

Jeffrey Couch / Neil Haycock / Thomas Rider

+44 020 7236 1010

Financial PR contacts:

Bobby Morse / Anna Michniewicz

+44(0) 20 7466 5000

tharisa@buchanan.uk.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCZKLFBVFFBBBF

(END) Dow Jones Newswires

January 10, 2018 02:00 ET (07:00 GMT)

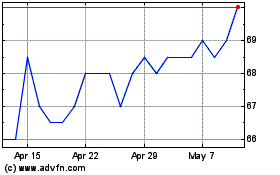

Tharisa (LSE:THS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tharisa (LSE:THS)

Historical Stock Chart

From Apr 2023 to Apr 2024