TIDMTHS

RNS Number : 8261F

Tharisa PLC

23 May 2017

Tharisa plc

(Incorporated in the Republic of Cyprus with limited

liability)

(Registration number HE223412)

JSE share code: THA

LSE share code: THS

ISIN: CY0103562118

('Tharisa')

Capital reduction and cash distribution to shareholders,

currency conversion rates and timetable

Further to the announcement on 2 February 2017 that the proposed

capital reduction and gross return of capital to shareholders of

US$0.01 per share (the Distribution) was approved by shareholders

by special resolution, shareholders are informed that the requisite

approval by the Paphos District Court was obtained, the necessary

submissions made to the Cyprus Registrar of Companies, and that the

capital reduction is now effective.

Shareholders on the principal Cyprus register will be paid in

US$, shareholders whose shares are held through Central Securities

Depositary Participants (CSDPs) and brokers and are traded on the

JSE will be paid in South African Rand (ZAR) and holders of

Depositary Interests traded on the LSE will be paid in Sterling

(GBP). The Distribution will be paid from contributed capital and

constitutes a return of capital.

The currency equivalents of the Distribution, based on the

weighted average of the South African Reserve Bank's daily rate at

approximately 10:30 (UTC +2) on 19 May 2017, are as follows:

Exchange Distribution per share

rate in payment currency

--------------- ---------------- -----------------------

South Africa ZAR 13.2874/US$ 13.2874 South African

- JSE cents per share

--------------- ---------------- -----------------------

United Kingdom GBP 0.7694/US$ 0.7694 pence per share

-- LSE

--------------- ---------------- -----------------------

The timetable for the Distribution is as follows:

Currency conversion date Friday 19 May 2017

Currency conversion rates Tuesday 23 May 2017

announced

Last day to trade cum-Distribution Tuesday 6 June 2017

rights on the JSE

Last day to trade cum-Distribution Wednesday 7 June

rights on the LSE 2017

Shares will trade ex-Distribution Wednesday 7 June

rights on the JSE from 2017

Shares will trade ex-Distribution Thursday 8 June

rights on the LSE from 2017

Record date for payment on Friday 9 June 2017

both JSE and LSE

Distribution payment date Wednesday, 14 June

2017

No dematerialisation or rematerialisation of shares within

Strate will be permitted between Wednesday 7 June 2017 and Friday 9

June 2017, both days inclusive. No transfers between registers will

be permitted between Friday 19 May 2017 and Friday 9 June 2017.

Tax implications of the Distribution

Shareholders and Depositary Interest holders should note that

information provided should not be regarded as tax advice. All

shareholders and Depositary Interest holders should consult their

brokers, CSDP and/or tax advisors with regard to how they will be

impacted by the Distribution.

South African tax residents

For tax purposes, South African shareholders are advised that

the Distribution constitutes a foreign return of capital and will

therefore have Capital Gains Tax implications for South African tax

residents.

The Distribution will first reduce the base cost of the shares

in the shareholder's hands to ZARnil, and any excess will be

treated as a capital gain at the time of receipt or accrual of the

distribution. The taxable capital gain will be calculated as

follows:

-- in the case of a natural person or special trust (as

defined), 40% of the net capital gain;

-- in any other case, 80% of the net capital gain.

UK tax residents

UK tax residents are advised that the Distribution constitutes a

foreign return of capital and that they should consult their

brokers, financial and/or tax advisors with regard to how they will

be impacted by the Distribution.

Cyprus tax residents

For Cyprus tax resident and domiciled shareholders who are

individuals, the Distribution constitutes a return of capital as it

represents an amount lower than the paid up share capital. Shares

listed on any recognised stock exchange are excluded from the

Cyprus Capital Gains Tax provisions. There are no withholding taxes

on distributions to shareholders which are Cypriot legal

persons.

Additional information required by the JSE Listing

Requirements

1. Tharisa had a total of 256 981 571 ordinary shares in issue on 19 May 2017.

2. The Distribution will be paid out of the share premium account.

Paphos, Cyprus

23 May 2017

JSE Sponsor

Investec Bank Limited

Please direct any queries to Tharisa's Transfer Secretaries

Computershare Investor Services Proprietary Limited

Registration number: 2004/003647/07

Rosebank Towers, 15 Biermann Avenue, Rosebank 2196

(PO Box 61051, Marshalltown 2107)

South Africa

Telephone +27 11 370 5000 or 0861 100 930 (South Africa toll

free)

Email enquiries Web.Queries@Computershare.co.za

Computershare Investor Services PLC

Registration number: 3498808

The Pavilions, Bridgwater Road, Bristol BS13 8AE

England, United Kingdom

Telephone +44 (0370) 702 0000

Email enquiries !UKALLDITeam2@computershare.co.uk

Cymain Registrars Limited

Registration number: HE174490

26 Vyronos Avenue, 1096 Nicosia

Cyprus

Telephone Int + 357 22104 452

Email enquiries registry@cymainregistrars.com.cy

Investor Relations contact:

Tharisa plc

Sherilee Lakmidas

+27 11 996 3538

+27 79 276 2529

slakmidas@tharisa.com

Broker contacts:

Peel Hunt LLP (Joint Broker)

Matthew Armitt / Ross Allister

+44 207 7418 8900

BMO Capital Markets Limited (Joint Broker)

Jeffrey Couch/Neil Haycock/Thomas Rider

+44 020 7236 1010

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUUVKRBAAVURR

(END) Dow Jones Newswires

May 23, 2017 02:00 ET (06:00 GMT)

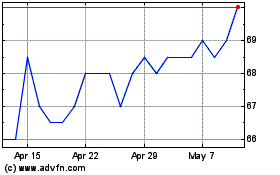

Tharisa (LSE:THS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tharisa (LSE:THS)

Historical Stock Chart

From Apr 2023 to Apr 2024