By Tim Higgins and Christina Rogers

Elon Musk has steered past Henry Ford in the minds of investors,

the latest sign that the auto industry is undergoing a seismic

shift.

Tesla Inc., the upstart Silicon Valley electric-car maker run by

Mr. Musk, has overtaken Ford Motor Inc., the automotive pioneer

that is exactly 100 years older, as the second-largest U.S. auto

maker by stock-market value.

Shares in Tesla were up 4.6% at $291.17 midday Monday, pushing

the California auto maker's market capitalization to $47.49

billion, above the Michigan company's $45 billion, according to

FactSet. The next milestone for Tesla is General Motors Co., valued

at $50.84 billion.

Tesla shares, which had already received a vote of confidence

last week with Chinese tech company Tencent Holdings Ltd. revealing

it had taken a 5% stake, were boosted by an announcement Sunday

that the auto maker's first-quarter global vehicle sales reached a

record.

The changing of the guard reflects a growing belief that

internal-combustion engines will eventually be replaced by electric

motors as the primary power source for automobiles. It is the

latest threat to Detroit's once-dominant stranglehold on personal

transportation, a role that was diminished by Japanese car

companies in the 1980s and is now being challenged by Silicon

Valley's technological might.

While Mr. Ford's Model T ushered in a wave of affordable

mobility for the middle class, Mr. Musk is promising the same with

the coming Model 3. It is a sleek, computerized $35,000 sedan that

can drive nearly the distance from New York City to Washington,

D.C., on a single charge.

Tesla is a bet that Mr. Musk -- who is 45 years old, the same

age as Mr. Ford was in 1908 when he released the Model T -- can

reshape transportation not only with electric vehicles, but with

cars that drive themselves.

Some investors believe Tesla is better positioned than auto

makers and tech giants by taking bold steps to bring advanced

self-driving technology to the roadway.

"Other auto makers really have to make this transition to

electric and autonomous, and it's almost like twice as hard for

them to get there than it is for Tesla," said Tasha Keeney, an

analyst for ARK Invest, which owns shares in Tesla, GM and Toyota

Motor Corp.

Tesla remains a shaky bet. The 13-year-old company is

unprofitable, deeply indebted and delivered just 76,000 cars last

year. Its Autopilot mode is untested as a fully autonomous feature

and has raised safety concerns.

Ford has over 20 times the annual revenue, billions of dollars

in profit and sells millions of cars each year. It isn't standing

still under Chief Executive Mark Fields, promising to deliver

self-driving cars by 2021. It is buying and investing in tech

startups: It invested $1 billion in Argo AI, a company consisting

of engineers from the autonomous vehicle programs of Uber

Technologies Inc. and Alphabet Inc.

Ford is coming off one of its most profitable periods in

history, after a restructuring effort led by former Chief Executive

Alan Mulally that eliminated brands, closed plants and streamlined

the company's global operations.

Under Mr. Fields, who took over Ford in 2014, the company has

benefited from strong truck demand but struggled to persuade

investors that brighter days are ahead, particularly as important

markets plateau. He has proposed a number of ways to reshape Ford,

but his vision is weighed down by a century-old business model that

will be expensive to reshape.

Ford is forecasting leaner results for 2017, further confirming

Wall Street's view that traditional car makers are still too

exposed to the auto industry's boom-bust cycles.

"We do not run our business based on day-to-day stock changes,"

Ford said Monday. "What we are doing is focusing our business on

what drives value creation, which is profitable growth, minimizing

risk and delivering strong returns."

Ford's market value is roughly the same as it was in late 2010,

when a newly public Tesla was valued at less than $2 billion.

Ford's stock has fluctuated since then, while Tesla's has steadily

risen and has surged more than 50% since the company acquired

SolarCity Corp. in November. The acquisition was part of Mr. Musk's

vision to have under one roof a company that could offer customers

solar roof panels, battery storage units and electric-powered cars.

It is a vision he highlighted in February when he removed the word

"Motors" from Tesla's official name.

Mr. Musk is betting that a less-expensive Model 3 will help

Tesla evolve from a luxury-car maker into one with mass-market

appeal. He is aiming to make 500,000 vehicles next year, a

projection doubted by some of his biggest supporters.

Still, Morgan Stanley autos analyst Adam Jonas has a price

target of $305 a share for Tesla, estimating the added value could

come from a ride-hailing service that Mr. Musk has hinted will work

with future vehicles. "Tesla is distinctively positioned to

commercialize an app-based, on-demand mobility service," Mr. Jonas

wrote in a note to investors.

Some old-timers disagree.

"Its market cap is based on hype and promises versus substance,"

said David Cole, an outspoken supporter and investor in Detroit

auto makers, and chairman emeritus of the Center for Automotive

Research in Ann Arbor, Mich.

Write to Tim Higgins at Tim.Higgins@WSJ.com and Christina Rogers

at christina.rogers@wsj.com

(END) Dow Jones Newswires

April 03, 2017 12:35 ET (16:35 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

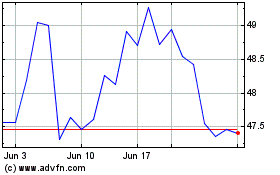

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

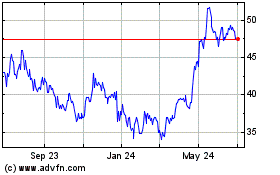

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Apr 2023 to Apr 2024