Tesco Pulls Unilever Products From Online Site

October 12 2016 - 6:20PM

Dow Jones News

LONDON—Tesco PLC, Britain's largest grocer, pulled products made

by Unilever PLC, the world's second-largest consumer goods

producers, from its online shopping site because of a dispute over

pricing in the wake of the pound's sharp descent, according to a

person familiar with the matter.

The high-profile spat between two of Britain's biggest and

best-known corporations threatens to move the debate over the

economic ramifications of Brexit from the halls of parliament to

the kitchen table. In recent weeks, amid a sharp selloff of the

British pound following the June 23 vote by Britons to leave the

European Union, many retailers of imported products—including wine,

electronics and cars— have raised prices.

But Tesco's decision threatens to bring the reality of the

pound's diminished buying power overseas into much sharper focus

for consumers of big-name Unilever brands like Ben & Jerry's

ice cream, Marmite spreads and Dove deodorants.

Unilever had demanded Tesco raise prices on a range of its

goods, saying they rely on imported ingredients, priced in dollars

and euros, according to a person familiar with the matter. Tesco's

Chief Executive Dave Lewis, a former Unilever executive, refused to

do so, leading to the standoff, this person said.

"We are currently experiencing availability issues on a number

of Unilever products," said a Tesco spokesman. "We hope to have

this issue resolved soon." Unilever declined to comment.

Unilever has also approached J Sainsbury PLC, Britain's second

largest grocery chain, to ask for price increases of 10% on average

on all its products, according to a person familiar with those

conversations. Sainsbury is still in discussions with Unilever,

according to this person.

The pound has fallen sharply since the summer Brexit vote. Late

Wednesday, it was trading down 0.02% on the day, and down more than

15% from it high on June 23, the day of the vote. It plumbed

three-decades lows against the dollar last week. On Wednesday, it

touched an all-time low against a basket of global currencies that

the Bank of England has tracked since the 1970s.

Economists have been warning for months about the threat of

higher consumer prices because of imported inflation related to the

pound's depreciation. Import prices surged 9.3% in August,

according to Britain's statistics agency.

But higher prices can take some time to trickle down to

consumers. Many manufacturers, protected by comfortable margins or

in an effort to defend market share, will endure the lost revenue

caused by such currency related price moves. Luxury goods makers,

for instance, have been slow to raise prices in Britain so far.

Many importers and manufacturers that depend on foreign input

costs, meanwhile, hedge currency exposure. Those hedges, though,

don't last forever. As they expire, companies have to decide

whether or not to raise prices.

Tesco's move also marks an unusually public fight between two of

Britain's best-known companies. Tesco, in addition to being

Britain's biggest grocer, competes with France's Carrefour SA, as

the world's second largest retailer behind Wal-Mart Stores Inc.

Unilever, an Anglo-Dutch firm with corporate headquarters in

London, is the world's second largest consumer goods company behind

Procter & Gamble Co.

Mr. Lewis, Tesco's CEO, is a longtime Unilever executive, who

previously headed the consumer goods company's personal care

division and was widely seen as a strong candidate to replace

Unilever CEO Paul Polman.

Under Mr. Lewis, Tesco has been working hard to stem market

share losses to discounters, like German chains Aldi and Lidl,

which have moved into Britain aggressively, consistently offering

bargain prices, including in some cases on branded products. Among

other initiatives, Mr. Lewis has cut everyday prices by 6% and

launched a range of lower-priced products in a bid to stave off

further share losses.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

October 12, 2016 18:05 ET (22:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

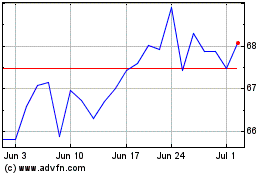

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

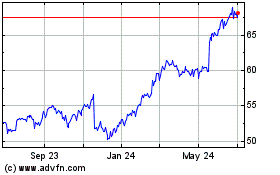

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024