Tesco Loss of Market Share Declines as It Gets Boost From Larger Stores

July 26 2016 - 4:13AM

Dow Jones News

By Ian Walker

LONDON--The rate of Tesco PLC's (TSCO.LN) market share decline

is slowing as the number one grocer improves performance from its

larger stores, according to a market survey Tuesday.

Tesco's market share for the 12 weeks ended July 17 stood at

28.3%, compared with 28.5% for the comparable 12 weeks ended July

19, 2015, its slowest rate of share loss since March 2015, Kantar

Worldpanel said. Kantar monitors the household grocery purchasing

habits of 25,000 demographically representative households in the

U.K.

Tesco's sales over the period are down 0.7% to 7.16 billion

pounds ($9.41 billion).

So far, there has been no impact to prices, or shopping volumes,

from the U.K referendum to exit the European Union last month,

Kantar says.

"The nation's average shopping basket is 1.4% cheaper than a

year ago, exactly the same level of deflation as reported last

month, and it remains to be seen if the Brexit vote will bring

about any price rises this year," Fraser McKevitt, head of retail

and consumer insight at Kantar said.

Aldi and Lidl's joint market share rose to 10.7%, up from 9.6%

in the comparable 12 weeks ended July 19, 2015. Separately Aldi's

market share has risen to 6.2% in the 12 weeks ended July 17, from

5.6% for the comparable period in 2015. Lidl's market share has

risen to 4.5%, from 4% in the 12 weeks ended July 19, 2015.

Aldi's sales in the 12 weeks have grown 11% to GBP1.56 billion,

while Lidl's shares have risen 13% to GBP1.13 billion.

Upmarket retailer Waitrose's market share rose to 5.1%, from 5%

in the 12 months ended July 19, 2015, and sales climbed 1.6% at

GBP1.29 billion.

Sainsbury PLC (SBRY.LN)'s market share in the 12 weeks ended

July 17 has fallen to 16.3%, from 16.5%, while sales fell 1.1% to

GBP4.12 billion.

Asda, a subsidiary of Wal-Mart Stores Inc. (WMT), saw its market

share fall to 15.5%, from 16.4% for the comparable 12 weeks, with

sales 5.6% lower at GBP3.92 billion.

Wm Morrison Supermarkets PLC (MRW.LN)'s market share fell to

10.7%, from 10.9%, while sales were 1.8% lower at GBP2.91

billion.

"Over the latest 12 weeks beer sales did bring about some cheer

for the grocers, growing 2.8%, ahead of the overall market," Mr.

McKevitt said. "The impact was mostly felt prior to England's early

exit from the Euro 2016 football tournament, which brought with it

a rapid reversal in fortune for beer sales."

"Beer and lager were also hindered by poor early summer weather,

as were barbecue favorites like sausages, which fell by 6.3%," he

added.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

July 26, 2016 03:58 ET (07:58 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

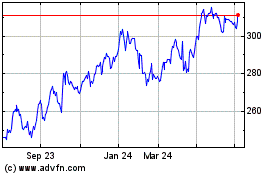

Tesco (LSE:TSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

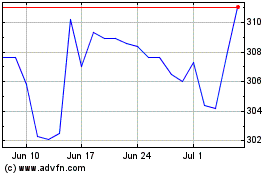

Tesco (LSE:TSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024