TIDMTYM

RNS Number : 6962N

Tertiary Minerals PLC

20 May 2015

20 May 2015

TERTIARY MINERALS PLC

(the "Company")

HALF-YEARLY REPORT 2015

Tertiary Minerals plc, the AIM traded company building a

strategic position in the fluorspar sector, announces its unaudited

interim results for the six months ended 31 March 2015.

Operational Highlights:

Storuman Fluorspar Project, Sweden:

-- Application for Exploitation (Mine) Permit progressing.

-- Primary stage of stakeholder consultation completed.

-- Metallurgical testwork optimisation now in final stage on

Upper Horizon mineralisation and continuing on Lower Horizon.

MB Fluorspar Project, Nevada, USA:

-- Landholding expanded - 57 additional claims staked.

-- Phase 3 drilling results completed - 2,516 metres drilled in 9 RC holes.

-- New "Western Area" defined by 700m step-out hole 14MBRC027, intersected:

o 307.8m grading 8.4% CaF(2) from 59.44m depth, including:

-- 141.7m grading 11.5% CaF(2) of continuous mineralisation from

225.55m depth;

-- 70.10m grading 16.6% CaF(2) from 59.44m, total of several

higher grade intersections above 15% CaF(2) .

o Mineralisation continuing at end of hole (516m).

-- Multiple thick intersections of higher grade fluorspar

mineralisation continuing laterally and at depth demonstrate

potential to add substantially to the existing Mineral Resource

base.

-- New Mineral Resource Estimate in progress.

Financial Results - Summary:

-- Group Loss for the six month period - GBP221,576 (six months

to 31 March 2014: GBP84,134) comprises:

o Administration costs of GBP209,230 (which includes non-cash

share based payments of GBP36,159)

o Pre-licence (reconnaissance) costs totalling GBP1,640

o Impairments to net assets of GBP12,180

o Interest income of GBP1,474.

-- 13,479,035 ordinary shares were issued during the reporting period as follows;

o Placing of 13,207,547 shares at 2.65p per share on 31 March

2015 to raise GBP350,000 before expenses

o Issue of 71,488 shares to non-executive directors in lieu of

fees at a price of 4p per share

o Issue of 200,000 shares pursuant to the exercise of warrants

at a price of 2.375p per share.

Enquiries

Tertiary Minerals plc

Patrick Cheetham, Executive

Chairman

Richard Clemmey, Managing

Director +44 (0)845 868 4580

SP Angel Corporate Finance

LLP

Nominated Adviser & Joint

Broker

Ewan Leggat

Katy Birkin +44 (0) 20 3470 0470

Beaufort Securities Ltd

Joint Broker

Saif Janjua +44 (0)20 7382 8300

Yellow Jersey PR Limited

Dominic Barretto

Kelsey Traynor +44 (0)7768 537 739

Chairman's Statement

I am delighted to be reporting our results for the six month

period ended 31 March 2015, a period of significant operational

progress for the Company.

Our most advanced project is the Storuman fluorspar deposit in

Sweden where we have a JORC compliant Indicated and Inferred

Mineral Resource of 27.8 million tonnes grading 10.21% (CaF(2) )

fluorspar and where in summer last year we submitted our

application for an Exploitation (Mine) Permit. This application has

progressed through various primary stakeholder consultation and

comment stages. The County Administration Board of Västerbotten has

given approval for the Mining Concession area, where they believe

mining and reindeer husbandry can co-exist, however objections have

been received from the Sami reindeer husbandry community. The

Mining Inspector, who will make the final decision, will need to

take these opinions into consideration prior to making a decision

which we expect within the next few months. In the meantime our

minerals processing testwork is progressing onto final locked cycle

tests for the Upper Horizon mineralisation whilst still looking to

optimise the process route for the Lower Horizon.

Whilst the Storuman Project is a key asset for the Company, the

size of the Storuman Mineral Resource Estimate has already been

surpassed by that defined last year at our MB Project where the

JORC compliant Indicated and Inferred Mineral Resource was

estimated at 38.4 million tonnes grading 10.4% fluorspar (CaF(2) )

in the Southern and Central areas of the deposit.

Without doubt the main development this reporting period has

been the success of the Phase 3 drill programme at the MB Project,

Nevada. This included a "wildcat" step-out hole located more than

700m to the west of the existing Mineral Resource boundary testing

a conceptual target for higher grade fluorspar closer to the

interpreted source of mineralisation. This hole, in what is now

called the 'Western Area', struck over 300m of fluorspar

mineralisation including 70m grading 16.6% CaF(2) from 59.44m in

several higher grade intersections. It ended in mineralisation at

516m depth. Two further holes located approximately 140m from the

western boundary of the Central Area of the existing Mineral

Resource and 420m to the east of this step-out hole also

encountered multiple thick intersections of fluorspar continuing at

depth.

Phase 3 drilling was successful in joining up the mineralisation

in the Southern and Central areas of the Mineral Resource and it is

highly probable that these areas are also continuous with the newly

discovered Western Area and the mineralisation still remains open

in most directions and at depth. We now look forward to the results

of the modelling of the Phase 3 results and expect to see an

increase in the size of the already large existing Mineral

Resource.

Further resource estimation work is in progress, as is planning

for further drilling and geophysical exploration aimed at a better

understanding of the scale of the mineralised system currently

being evaluated.

The MB Project is exciting, world-class in its scope, and just

one of three geographically strategic fluorspar assets controlled

by the Company and so it is unfortunate that recent results

coincide with cyclical lows in mining markets and commodity

prices.

Many commentators believe that we are at the bottom of the

current cycle and we look forward to a market recovery where we

anticipate the value of the business we are building will be

reflected in a substantial re-rating of the Company.

Patrick L Cheetham

Executive Chairman

20 May 2015

Consolidated Income Statement

for the six months to 31 March 2015

Six months Six months Twelve

to 31 to 31 months

March March to 30

2015 2014 September

Unaudited Unaudited 2014

Audited

GBP GBP GBP

---------------------------------- ----------- ----------- -----------

Pre-licence exploration

costs 1,640 7,100 9,214

Impairment of deferred

exploration costs 12,180 - 3,254

Non-cash movement of

liability under Equity

Swap Agreement - (72,708) (72,708)

Administrative expenses 209,230 152,104 423,459

---------------------------------- ----------- ----------- -----------

Operating loss (223,050) (86,496) (363,219)

Interest receivable 1,474 2,362 4,412

Loss on ordinary activities

before taxation (221,576) (84,134) (358,807)

Tax on loss on ordinary - - -

activities

---------------------------------- ----------- ----------- -----------

Loss for the period attributable

to equity holders of

the parent (221,576) (84,134) (358,807)

================================== =========== =========== ===========

Loss per share - basic

and fully diluted (pence)

(note 2) (0.13) (0.05) (0.22)

================================== =========== =========== ===========

Consolidated Statement of Comprehensive Income

for the six months to 31 March 2015

Six months Six months Twelve

to to months

31 March 31 March to

2015 2014 30 September

Unaudited Unaudited 2014

Audited

GBP GBP GBP

-------------------------------- ----------- ----------- --------------

Loss for the period (221,576) (84,134) (358,807)

-------------------------------- ----------- ----------- --------------

Other comprehensive

income

Items that will not

be reclassified subsequently

to the income statement:

Movement in valuation

of available for sale

investment (112,702) (28,349) (61,896)

-------------------------------- ----------- ----------- --------------

(112,702) (28,349) (61,896)

-------------------------------- ----------- ----------- --------------

Items that could be

reclassified subsequently

to the income statement:

Foreign exchange translation

differences on foreign

currency net investments

in subsidiaries (39,406) (62,794) (161,845)

-------------------------------- ----------- ----------- --------------

(39,406) (62,794) (161,845)

-------------------------------- ----------- ----------- --------------

Total comprehensive

loss for the period

attributable to the

equity holders of

the parent (373,684) (175,277) (582,548)

================================ =========== =========== ==============

Company Registration Number 03821411

Consolidated Statement of Financial Position

at 31 March 2015

As at As at As at

31 March 31 March 30 September

2015 2014 2014

Unaudited Unaudited Audited

GBP GBP GBP

-------------------------------- ------------ ------------ --------------

Non-current assets

Intangible assets 3,370,694 2,853,140 3,051,724

Property, plant & equipment 7,584 5,943 8,856

Available for sale investment 148,222 273,173 239,626

-------------------------------- ------------ ------------ --------------

3,526,500 3,132,256 3,300,206

-------------------------------- ------------ ------------ --------------

Current assets

Receivables 430,626 84,561 115,732

Cash and cash equivalents 339,793 914,748 942,890

770,419 999,309 1,058,622

-------------------------------- ------------ ------------ --------------

Current liabilities

Trade and other payables (124,556) (207,292) (171,550)

(124,556) (207,292) (171,550)

-------------------------------- ------------ ------------ --------------

Net current assets 645,863 792,017 887,072

-------------------------------- ------------ ------------ --------------

Net assets 4,172,363 3,924,273 4,187,278

================================ ============ ============ ==============

Equity

Called up share capital 1,877,810 1,639,662 1,743,020

Share premium account 8,810,794 8,141,354 8,622,974

Merger reserve 131,096 131,096 131,096

Share option reserve 416,693 390,344 426,721

Available for sale revaluation

reserve (260,997) (114,748) (148,295)

Foreign currency reserve (64,147) 74,310 (24,741)

Accumulated losses (6,738,886) (6,337,745) (6,563,497)

-------------------------------- ------------ ------------ --------------

Equity attributable to

the owners of the parent 4,172,363 3,924,273 4,187,278

================================ ============ ============ ==============

Consolidated Statement of Changes in Equity

Share Share Merger Share Available Foreign Accumulated Total

Capital Premium Reserve Option for sale currency losses

account reserve revaluation reserve

reserve

GBP GBP GBP GBP GBP GBP GBP GBP

At 30 September

2013 1,617,662 8,008,604 131,096 404,194 (86,399) 137,104 (6,253,611) 3,958,650

Loss for the

period - - - - - - (84,134) (84,134)

Change in fair

value - - - - (28,349) - - (28,349)

Exchange differences - - - - - (62,794) - (62,794)

---------------------- ----------- ----------- --------- --------- ------------ ---------- ------------- -----------

Total comprehensive

loss for the

period - - - - (28,349) (62,794) (84,134) (175,277)

---------------------- ----------- ----------- --------- --------- ------------ ---------- ------------- -----------

Share issue 22,000 132,750 - - - - - 154,750

Share based

payments - - - (13,850) - - - (13,850)

At 31 March

2014 1,639,662 8,141,354 131,096 390,344 (114,748) 74,310 (6,337,745) 3,924,273

Loss for the

period - - - - - - (274,673) (274,673)

Change in fair

value - - - - (33,547) - - (33,547)

Exchange difference - - - - - (99,051) - (99,051)

Total comprehensive

loss for the

period - - - - (33,547) (99,051) (274,673) (407,271)

Share issue 103,358 481,620 - - - - - 584,978

Share based

payments - - - 36,377 - - 48,921 85,298

At 30 September

2014 1,743,020 8,622,974 131,096 426,721 (148,295) (24,741) (6,563,497) 4,187,278

Loss for the

period - - - - - - (221,576) (221,576)

Change in fair

value - - - - (112,702) - - (112,702)

Exchange difference - - - - - (39,406) - (39,406)

Total comprehensive

loss for the

period - - - - (112,702) (39,406) (221,576) (373,684)

---------------------- ----------- ----------- --------- --------- ------------ ---------- ------------- -----------

Share issue 134,790 187,820 - - - - - 322,610

Share based

payments - - - (10,028) - - 46,187 36,159

At 31 March

2015 1,877,810 8,810,794 131,096 416,693 (260,997) (64,147) (6,738,886) 4,172,363

====================== =========== =========== ========= ========= ============ ========== ============= ===========

Consolidated Statement of Cash Flows

for the six months to 31 March 2015

Six months Six months Twelve

to 31 to 31 months

March March to 30

2015 2014 September

Unaudited Unaudited 2014

Audited

GBP GBP GBP

-------------------------------- ----------- ----------- -----------

Operating activity

Operating loss (223,050) (86,496) (363,219)

Depreciation charge 2,268 3,088 6,925

Impairment charge 12,180 - 3,254

Share based payment charge 36,159 (13,850) 71,449

Non-cash movement of

liability under Equity

Swap Agreement - (72,708) (72,708)

Non-cash additions to

available for sale investment (21,298) (71,271) (71,271)

(Increase)/decrease in

receivables (314,894) (3,071) (34,242)

Increase/(decrease) in

payables (46,994) (26,589) (62,331)

Net cash outflow from

operating activity (555,629) (270,897) (522,143)

-------------------------------- ----------- ----------- -----------

Investing activity

Interest received 1,474 2,362 4,412

Purchase of intangible

assets (383,886) (494,323) (788,482)

Purchase of property,

plant & equipment (996) (414) (7,176)

Net cash outflow from

investing activity (383,408) (492,375) (791,246)

-------------------------------- ----------- ----------- -----------

Financing activity

Issue of share capital

(net of expenses) 322,610 154,750 739,728

Net transfer to restricted

cash - 336,333 336,333

Net cash inflow from

financing activity 322,610 491,083 1,076,061

-------------------------------- ----------- ----------- -----------

Net (decrease)/increase

in cash and cash

equivalents (616,427) (272,189) (237,328)

Cash and cash equivalents

at start of period 942,890 1,187,612 1,187,612

Exchange differences 13,330 (675) (7,394)

Cash and cash equivalents

at end of period 339,793 914,748 942,890

================================ =========== =========== ===========

Notes to the Interim Statement

1. Basis of preparation

The consolidated interim financial information has been prepared

in accordance with the accounting policies that are expected to be

adopted in the Group's full financial statements for the year

ending 30 September 2015 which are not expected to be significantly

different to those set out in Note 1 of the Group's audited

financial statements for the year ended 30 September 2014. These

are based on the recognition and measurement principles of IFRS in

issue as adopted by the European Union (EU) and are effective at 30

September 2015 or are expected to be adopted and effective at 30

September 2015. The financial information has not been prepared

(and is not required to be prepared) in accordance with IAS 34. The

accounting policies have been applied consistently throughout the

Group for the purposes of preparation of this financial

information.

The financial information in this statement relating to the six

months ended 31 March 2015 and the six months ended 31 March 2014

has neither been audited nor reviewed by the Auditors, pursuant to

guidance issued by the Auditing Practices Board. The financial

information presented for the year ended 30 September 2014 does not

constitute the full statutory accounts for that period. The Annual

Report and Financial Statements for the year ended 30 September

2014 have been filed with the Registrar of Companies. The

Independent Auditors' Report on the Annual Report and Financial

Statement for the year ended 30 September 2014 was unqualified,

although did draw attention to matters by way of emphasis in

relation to going concern, and did not contain a statement under

498(2) or 498(3) of the Companies Act 2006.

The directors prepare annual budgets and cash flow projections

that extend beyond 12 months from the date of this report. These

projections include the proceeds of future fundraising necessary

within the next 12 months to meet the Company's and Group's planned

discretionary project expenditures and to maintain the Company and

Group as a going concern. Although the Company has been successful

in raising finance in the past, there is no assurance that it will

obtain adequate finance in the future. This represents a material

uncertainty related to events or conditions which may cast

significant doubt on the entity's ability to continue as a going

concern and, therefore, that it may be unable to realise its assets

and discharge its liabilities in the normal course of business.

However, the directors have a reasonable expectation that they will

secure additional funding when required to continue meeting

corporate overheads and exploration costs for the foreseeable

future and therefore believe that the going concern basis is

appropriate for the preparation of the financial statements.

2. Loss per share

Loss per share has been calculated on the attributable loss for

the period and the weighted average number of shares in issue

during the period.

Six months Six months Twelve

to 31 to 31 months

March March to 30 September

2015 2014 2014

Unaudited Unaudited Audited

------------------------- ------------ ------------ -----------------

Loss for the period

(GBP) (221,576) (84,134) (358,807)

Weighted average shares

in issue (No.) 174,341,529 162,290,390 165,522,417

Basic loss per share

(pence) (0.13) (0.05) (0.22)

========================= ============ ============ =================

The loss attributable to ordinary shareholders and the weighted

average number of ordinary shares used for the purpose of

calculating diluted earnings per share are identical to those used

to calculate the basic earnings per ordinary share. This is because

the exercise of share warrants would have the effect of reducing

the loss per ordinary share and is therefore not dilutive under the

terms of IAS33.

3. Share capital

During the six months to 31 March 2015 the following share

issues took place:

An issue of 71,488 1p ordinary shares at 4p per share to two

directors, in satisfaction of directors' fees, for a total

consideration of GBP2,860 (20 February 2015).

An issue of 200,000 1p ordinary shares at 2.375p per share,

being a share warrant exercise, for a total consideration of

GBP4,750 (9 March 2015).

An issue of 13,207,547 1p ordinary shares at 2.65p per share, by

way of placing, for a total consideration of GBP315,000 net of

expenses (31 March 2015). These shares became paid up on 17April

2015 and the amount due is reflected in receivables.

4. Interim report

Copies of this interim report are available from Tertiary

Minerals plc, Silk Point, Queens Avenue, Macclesfield, Cheshire,

SK10 2BB, United Kingdom. It is also available on the Company's

website at www.tertiaryminerals.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR QKLFFEEFXBBK

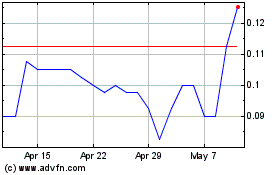

Tertiary Minerals (LSE:TYM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tertiary Minerals (LSE:TYM)

Historical Stock Chart

From Apr 2023 to Apr 2024