Tertiary Minerals PLC Director's Dealings, Warrants, TVR & Correction (6365F)

February 23 2015 - 10:05AM

UK Regulatory

TIDMTYM

RNS Number : 6365F

Tertiary Minerals PLC

23 February 2015

Tertiary Minerals plc

www.tertiaryminerals.com

("Tertiary" or "the Company")

23 February 2015

Director's Dealings, Issue of Warrants, Total Voting Rights and

Correction

Tertiary Minerals plc, the AIM traded company building a

strategic position in the fluorspar sector announces that pursuant

to terms agreed on 30 April 2014 and further to the RNS dated 20

August 2014, the non-executive directors of the Company, Donald

McAlister and David Whitehead, will be receiving a portion of their

annual fees in Tertiary Minerals ordinary shares of 1 penny each

("Ordinary Shares"), on a six monthly ongoing basis calculated with

reference to the closing mid-market price the trading day prior to

the issue of the Ordinary Shares.

On 20 February 2015, the Company resolved to issue a total of

71,488 Ordinary Shares to the non-executive directors for the

period ended 31 December 2014. The Ordinary Shares were issued at a

price of 4 pence per share, being the closing mid-market price on

19 February 2015.

The following table shows the number of Ordinary Shares issued

to the non-executive directors and their total holdings following

the issue of the Ordinary Shares:

Director Number of Ordinary Price of Ordinary Interest in % of Company's

Shares issued Shares issued total number issued share

of Ordinary capital following

Shares following Admission

Admission

Donald McAlister 21,488 4 pence 515,536 0.296%

David Whitehead 50,000 4 pence 379,003* 0.217%

Application has been made to the London Stock Exchange for

71,488 Ordinary Shares to be admitted to trading on AIM

("Admission"), and it is expected that Admission will occur on or

around 26 February 2015.

Issue of Warrants

In addition, on 20 February 2015, the Board of the Company

granted 1,700,000 warrants (the "Warrants") to an executive

director and certain employees. The grant to the executive director

of the Company was as follows:

Name Number of Warrants granted

Patrick Cheetham (Executive Chairman) 1,000,000

As a result of this issue of Warrants the total number of

warrants held by Patrick Cheetham is 6,500,000.

Each Warrant entitles the holder to subscribe for one new

ordinary share at a price of 4 pence per share, being the closing

mid-market price on 19 February 2015, and the warrants may be

exercised at any time within 4 years from 20 February 2016.

Total Voting Rights

In accordance with Financial Conduct Authority's Disclosure and

Transparency Rules ("DTR"), following the issue and Admission, the

total issued share capital of the Company with voting rights will

be 174,373,522 ordinary shares.

The above figure of 174,373,522 ordinary shares may be used by

shareholders in the Company as the denominator for the calculations

by which they will determine if they are required to notify their

interest in, or a change in their interest in, the share capital of

the Company under the DTR.

*Correction Announcement

Following the issue of Ordinary Shares being announced today Mr.

David Whitehead has a beneficial interest in 379,003 ordinary

shares representing 0.217% of the Company's issued share capital

following Admission, all of which are held by Glebekinvara

Management Services Limited ("Glebekinvara") of which David

Whitehead and his wife, Ann Whitehead, are both directors and are

both 50% beneficial shareholders.

David Whitehead's interest in ordinary shares in the Company

includes 300,000 ordinary shares of 1 penny each acquired through

the exercise of warrants on 21 February 2011 as reported by the

Company through an RNS announcement on 22 February 2011. An error

occurred in the subsequent reporting of David Whitehead's

beneficial interest in ordinary shares in the Company within the

2011 Company Annual Report where these 300,000 ordinary shares were

not disclosed. This error was carried forward in the 2012, 2013 and

2014 Annual Reports and RNS's dated 20 and 21 August 2014.

In addition, the shareholding of Mr. David Whitehead in Sunrise

Resources plc ("Sunrise") in Note 17 (Related Party Transactions),

page 42 of Tertiary's 2014 Annual Report, was incorrectly stated as

nil. Mr. David Whitehead has a beneficial interest in 250,000

ordinary shares in Sunrise which are held by Glebekinvara. As at

the date of this announcement, Tertiary holds 9.10% of Sunrise's

issued share capital.

Enquiries

Tertiary Minerals plc

Patrick Cheetham, Executive

Chairman

Richard Clemmey, Managing Director +44 (0)845 868 4580

SP Angel Corporate Finance LLP

Nominated Adviser & Joint Broker

Ewan Leggat

Katy Birkin +44 (0) 20 3470 0470

Beaufort Securities Ltd

Joint Broker

Saif Janjua +44 (0)20 7382 8300

Yellow Jersey PR Limited

Dominic Barretto

Kelsey Traynor +44 (0)7768 537 739

Notes to Editors

Tertiary Minerals plc (ticker symbol 'TYM') is an AIM-quoted

mineral exploration and development company building a significant

strategic position in the fluorspar sector. Fluorspar is an

essential raw material in the chemical, steel and aluminium

industries. Tertiary controls two significant Scandinavian projects

(Storuman in Sweden and Lassedalen in Norway) and a large deposit

of strategic significance in Nevada USA (MB Project).

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCLLFIEFVIVFIE

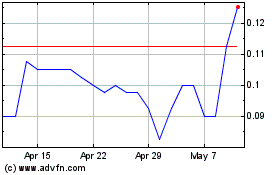

Tertiary Minerals (LSE:TYM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tertiary Minerals (LSE:TYM)

Historical Stock Chart

From Apr 2023 to Apr 2024