UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

(RULE

14d–100)

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

ANADIGICS,

INC.

(Name of Subject Company (Issuer))

ALOHA ACQUISITION SUB, INC.

(Name of Filing Person (Offeror))

ALOHA HOLDING COMPANY, INC.

(Name of Filing Person (Parent of Offeror))

GAAS LABS, LLC

(Name of

Filing Person (Other Person))

COMMON STOCK, $0.01 PAR VALUE

(Title of Class of Securities)

032515108

(CUSIP Number of

Class of Securities)

John L. Ocampo

President

GaAs Labs, LLC

Aloha Holding Company, Inc.

Aloha Acquisition Sub, Inc.

28013 Arastradero Road

Los

Altos, California 94022

(408) 387-7756

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

With a copy to:

Jason Day

Jeffrey A.

Beuche

Perkins Coie LLP

1900 Sixteenth Street, Suite 1400

Denver, Colorado 80202

(303) 291-2300

CALCULATION OF

FILING FEE

|

|

|

| Transaction Valuation (1) |

|

Amount of Filing Fee (2) |

| $32,261,090.75 |

|

$3,248.70 |

| |

| (1) |

Estimated solely for purposes of calculating the amount of the filing fee. The transaction valuation was calculated by adding the sum of (A) 88,836,561 outstanding shares of common stock, par value $0.01 per share

(“Shares”), of ANADIGICS, Inc. (“Anadigics”), (B) 8,542 Shares subject to issuance pursuant to outstanding options with an exercise price less than the offer price of $0.35 per Share,

(C) 3,044,442 Shares subject to issuance pursuant to outstanding time-based restricted stock units, and performance-based restricted stock units earned prior to the end of the offer, and (D) up to 285,000 Shares issuable with

respect to the current offering period under Andigics’s Employee Stock Purchase Plan, with such sum multiplied by the offer price of $0.35 per Share. The calculation of the filing fee is based on information provided by Anadigics as of

November 20, 2015. |

| (2) |

The filing fee was calculated in accordance with Rule 0-11 of the Securities Exchange Act of 1934, as amended, and Fee Rate Advisory #1 for fiscal year 2016, issued August 27, 2015, by multiplying the transaction

value by .0001007. |

| ¨ |

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing. |

|

|

|

| Amount Previously Paid: N/A |

|

Filing Party: N/A |

| Form of Registration No.: N/A |

|

Date Filed: N/A |

| ¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| |

x |

Third-party tender offer subject to Rule 14d-1. |

| |

¨ |

Issuer tender offer subject to Rule 13e-4. |

| |

¨ |

Going-private transaction subject to Rule 13e-3. |

| |

¨ |

Amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is

a final amendment reporting the results of the tender offer. ¨

If applicable,

check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| |

¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| |

¨ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

This Tender Offer Statement on Schedule TO (this “Schedule TO”) is filed by GaAs Labs,

LLC, a California limited liability company (“GaAs Labs”), Aloha Holding Company, Inc., a Delaware corporation (“Aloha”) and wholly-owned subsidiary of GaAs Labs, and Aloha Acquisition Sub, Inc., a

Delaware corporation (“Purchaser”) and a wholly-owned subsidiary of Aloha. This Schedule TO relates to the offer by Purchaser to purchase all of the outstanding shares of common stock, par value $0.01 per share (the

“Shares”), of ANADIGICS, Inc., a Delaware corporation (“Anadigics”), at a price of $0.35 per Share, net to the seller in cash, without interest, less any applicable withholding taxes, upon the terms

and subject to the conditions set forth in the Offer to Purchase, dated November 24, 2015 (as it may be amended or supplemented, the “Offer to Purchase”), and the related Letter of Transmittal (as it may be amended or

supplemented, the “Letter of Transmittal,” and together with the Offer to Purchase, the “Offer”), copies of which are attached to this Schedule TO as Exhibits (a)(1)(A) and (a)(1)(B), respectively.

Pursuant to General Instruction F to Schedule TO, the information contained in the Offer to Purchase, including all schedules and annexes to the Offer to Purchase, is hereby expressly incorporated in this Schedule TO by reference in response to

Items 1 through 11 of this Schedule TO and is supplemented by the information specifically provided for in this Schedule TO. The Agreement and Plan of Merger, dated as of November 11, 2015, by and among Aloha, Purchaser, and Anadigics, a copy

of which is attached as Exhibit (d)(1) to this Schedule TO, is incorporated in this Schedule TO by reference with respect to Items 4 through 6 and Item 11 of this Schedule TO.

| Item 1. |

Summary Term Sheet. |

The information set forth in the section of the Offer to Purchase entitled

“Summary Term Sheet” is incorporated herein by reference.

| Item 2. |

Subject Company Information. |

(a) The subject company and issuer of the securities subject to the Offer

is ANADIGICS, Inc., a Delaware corporation. The principal executive offices of Anadigics are located at 141 Mt. Bethel Road, Warren, New Jersey 07059 and the telephone number is (908) 668-5000.

(b) This Schedule TO relates to all of the outstanding shares of common stock, par value $0.01 per share, of Anadigics. Anadigics has advised Purchaser and

Aloha that, as of November 20, 2015, there were 88,836,561 Shares outstanding. The information set forth in the “Introduction” to the Offer to Purchase is incorporated herein by reference.

(c) The information set forth in Section 6 of the Offer to Purchase entitled “Price Range of Shares; Dividends” is incorporated herein by

reference.

| Item 3. |

Identity and Background of Filing Person. |

(a), (b), (c) This Schedule TO is filed by Purchaser,

Aloha and GaAs Labs. The information set forth in Section 8 of the Offer to Purchase entitled “Certain Information Concerning Purchaser, Aloha and GaAs Labs” and in Annex A to the Offer to Purchase is incorporated herein by reference.

| Item 4. |

Terms of the Transaction. |

(a) The information set forth in the “Summary Term Sheet,” the

“Introduction” and Sections 1, 2, 3, 4, 5, 11, 13 and 15 of the Offer to Purchase entitled “Terms of the Offer,” “Acceptance for Payment and Payment for Shares,” “Procedures for Accepting the Offer and Tendering

Shares,” “Withdrawal Rights,” “Certain Material U.S. Federal Income Tax Consequences of the Offer and the Merger,” “The Merger Agreement; Other Agreements,” “Certain Effects of the Offer” and

“Conditions to the Offer,” respectively, is incorporated herein by reference.

| Item 5. |

Past Contacts, Transactions, Negotiations and Agreements. |

(a), (b) The information set forth in

the “Summary Term Sheet,” the “Introduction” and Sections 8, 10, 11 and 12 of the Offer to Purchase entitled “Certain Information Concerning Purchaser, Aloha and GaAs Labs,” “Background of

the Offer; Past Contacts, Transactions, Negotiations and Agreements with Anadigics,” “The Merger Agreement; Other Agreements” and “Purpose of the Offer; Plans for

Anadigics,” respectively, is incorporated herein by reference.

| Item 6. |

Purposes of the Transaction and Plans or Proposals. |

(a), (c)(1) through (7) The information set

forth in the “Summary Term Sheet,” the “Introduction” and Sections 10, 11, 12, 13 and 14 of the Offer to Purchase entitled “Background of the Offer; Past Contacts, Transactions, Negotiations and Agreements with

Anadigics,” “The Merger Agreement; Other Agreements,” “Purpose of the Offer; Plans for Anadigics,” “Certain Effects of the Offer” and “Dividends and Distributions,” respectively, is incorporated herein by

reference.

| Item 7. |

Source and Amount of Funds or Other Consideration. |

(a), (b), (d) The information set forth in the

“Summary Term Sheet” and Section 9 of the Offer to Purchase entitled “Source and Amount of Funds” is incorporated herein by reference.

| Item 8. |

Interest in Securities of the Subject Company. |

(a), (b) The information set forth in

Section 8 of the Offer to Purchase entitled “Certain Information Concerning Purchaser, Aloha and GaAs Labs” and in Annex A to the Offer to Purchase is incorporated herein by reference.

| Item 9. |

Persons/Assets, Retained, Employed, Compensated or Used. |

(a) The information set forth in

Section 17 of the Offer to Purchase entitled “Fees and Expenses” is incorporated herein by reference.

| Item 10. |

Financial Statements. |

(a), (b) Not Applicable.

| (c) |

The information set forth in the Offer to Purchase is incorporated herein by reference. |

| Item 11. |

Additional Information. |

(a) The information set forth in the “Summary Term Sheet” and

Sections 8, 10, 11, 12 and 16 of the Offer to Purchase entitled “Certain Information Concerning Purchaser, Aloha and GaAs Labs,” “Background of the Offer; Past Contacts, Transactions, Negotiations and Agreements with Anadigics,”

“The Merger Agreement; Other Agreements,” “Purpose of the Offer; Plans for Anadigics” and “Certain Legal Matters,” respectively, is incorporated herein by reference.

|

|

|

| Exhibit No. |

|

Description |

|

|

| (a)(1)(A) |

|

Offer to Purchase, dated November 24, 2015. |

|

|

| (a)(1)(B) |

|

Form of Letter of Transmittal. |

|

|

| (a)(1)(C) |

|

Form of Notice of Guaranteed Delivery. |

|

|

| (a)(1)(D) |

|

Form of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees. |

|

|

| (a)(1)(E) |

|

Form of Letter to Clients for Use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees. |

|

|

| (a)(1)(F) |

|

Summary Advertisement as published in The New York Times on November 24, 2015. |

|

|

| (d)(1) |

|

Agreement and Plan of Merger, dated as of November 11, 2015, among Aloha, Purchaser and Anadigics (incorporated by reference to Exhibit 2.1 of Anadigics’s Current Report on Form 8-K filed on November 12, 2015 (File No.

000-25662)). |

|

|

|

| Exhibit No. |

|

Description |

|

|

| (d)(2) |

|

Guarantee, dated as of November 11, 2015, by GaAs Labs in favor of Anadigics. |

|

|

| (d)(3) |

|

Mutual Non-Disclosure and Standstill Agreement, dated as of September 15, 2015, between GaAs Labs and Anadigics. |

|

|

| (d)(4) |

|

Exclusivity Agreement, dated as of October 20, 2015, between GaAs Labs and Anadigics. |

|

|

| (g) |

|

Not applicable. |

|

|

| (h) |

|

Not applicable. |

| Item 13. |

Information Required by Schedule 13E-3. |

Not Applicable.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

Dated: November 24, 2015

|

|

|

| ALOHA ACQUISITION SUB, INC. |

|

|

| By: |

|

/s/ John L. Ocampo |

| Name: John L. Ocampo |

| Title: President |

|

| ALOHA HOLDING COMPANY, INC. |

|

|

| By: |

|

/s/ John L. Ocampo |

| Name: John L. Ocampo |

| Title: President |

|

| GAAS LABS, LLC |

|

|

| By: |

|

/s/ John L. Ocampo |

| Name: John L. Ocampo |

| Title: President |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| (a)(1)(A) |

|

Offer to Purchase, dated November 24, 2015. |

|

|

| (a)(1)(B) |

|

Form of Letter of Transmittal. |

|

|

| (a)(1)(C) |

|

Form of Notice of Guaranteed Delivery. |

|

|

| (a)(1)(D) |

|

Form of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees. |

|

|

| (a)(1)(E) |

|

Form of Letter to Clients for Use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees. |

|

|

| (a)(1)(F) |

|

Summary Advertisement as published in The New York Times on November 24, 2015. |

|

|

| (d)(1) |

|

Agreement and Plan of Merger, dated as of November 11, 2015, among Aloha, Purchaser and Anadigics (incorporated by reference to Exhibit 2.1 of Anadigics’s Current Report on Form 8-K filed on November 12, 2015 (File No.

000-25662)). |

|

|

| (d)(2) |

|

Guarantee, dated as of November 11, 2015, by GaAs Labs in favor of Anadigics. |

|

|

| (d)(3) |

|

Mutual Non-Disclosure and Standstill Agreement, dated as of September 15, 2015, between GaAs Labs and Anadigics. |

|

|

| (d)(4) |

|

Exclusivity Agreement, dated as of October 20, 2015, between GaAs Labs and Anadigics. |

|

|

| (g) |

|

Not applicable. |

|

|

| (h) |

|

Not applicable. |

Exhibit (a)(1)(A)

Offer to Purchase For Cash

All Outstanding Shares of Common Stock

of

ANADIGICS, INC.

at

$0.35 Net

Per Share

by

ALOHA ACQUISITION SUB, INC.,

a wholly-owned subsidiary of

ALOHA HOLDING COMPANY, INC.

THE OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT 11:59 P.M., NEW YORK CITY

TIME, ON DECEMBER 23, 2015, UNLESS THE OFFER IS EXTENDED.

The Offer (as defined herein) is being made pursuant to the Agreement and Plan of Merger, dated as of November 11, 2015 (as it may be

amended, modified or supplemented from time to time in accordance with its terms, the “Merger Agreement”), by and among Aloha Holding Company, Inc., a Delaware corporation (“Aloha”), Aloha Acquisition

Sub, Inc., a Delaware corporation (“Purchaser”) and a wholly-owned subsidiary of Aloha, and ANADIGICS, Inc., a Delaware corporation (“Anadigics”). Purchaser is offering to purchase all of the

outstanding shares of common stock, par value $0.01 per share, of Anadigics (the “Shares”), at a price of $0.35 per Share (the “Offer Price”), net to the seller in cash, without interest, less any

applicable withholding taxes, upon the terms and subject to the conditions set forth in this offer to purchase (this “Offer to Purchase”) and the related letter of transmittal (the “Letter of

Transmittal”), which, together with any amendments or supplements hereto and thereto, collectively constitute the “Offer.”

Pursuant to the Merger Agreement, as soon as practicable following the consummation of the Offer and subject to the satisfaction or waiver of

the remaining conditions set forth in the Merger Agreement, Purchaser will merge with and into Anadigics (the “Merger”), with Anadigics continuing as the surviving corporation in the Merger and as a wholly-owned subsidiary of

Aloha. At the effective time of the Merger (the “Effective Time”), each Share then outstanding (other than (i) Shares then held by Aloha, Purchaser, Anadigics or their respective subsidiaries and (ii) Shares that

are held by any stockholders of Anadigics who properly demand appraisal in connection with the Merger as described in Section 16 — “Certain Legal Matters; Regulatory Approvals — Appraisal Rights”) will be converted

into the right to receive the Offer Price, without interest, less any applicable withholding taxes. Under no circumstances will interest be paid with respect to the purchase of Shares pursuant to the Offer, regardless of any extension of the Offer

or any delay in making payment for Shares.

THE BOARD OF

DIRECTORS OF ANADIGICS UNANIMOUSLY RECOMMENDS THAT YOU TENDER ALL OF YOUR SHARES IN THE OFFER.

After careful consideration,

the Board of Directors of Anadigics (the “Anadigics Board”) unanimously (1) determined that the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger, are advisable, fair

to and in the best interests of Anadigics and its stockholders, (2) approved, and declared advisable, the Merger Agreement, the Offer, the Merger and the transactions contemplated by the Merger Agreement in accordance with the requirements of

Delaware law and (3) resolved to recommend that Anadigics’s stockholders accept the Offer and tender their Shares to Purchaser pursuant to the Offer.

The Offer is not subject to any financing condition. The Offer is conditioned upon: (a) there being validly tendered and not

properly withdrawn prior to 11:59 P.M., New York City time, on December 23, 2015 (the “Expiration Date,” unless Purchaser extends the Offer pursuant to and in accordance with the terms of the Merger Agreement, in which

event “Expiration Date” will mean the latest time and date at which the Offer, as so

extended by us, will expire) (not including Shares tendered pursuant to guaranteed delivery procedures and not actually delivered prior to the Expiration Date) the number of Shares which, when

added to any Shares owned by Aloha or any of its subsidiaries, would represent at least a majority of the outstanding Shares of Anadigics, and (b) other customary conditions as set forth in Annex I to the Merger Agreement have been satisfied or

waived. See Section 15 — “Conditions to the Offer.” After the consummation of the Offer and subject to the satisfaction or waiver of the remaining conditions set forth in the Merger Agreement, Aloha, Purchaser and Anadigics

will cause the Merger to become effective as soon as practicable without a meeting of stockholders of Anadigics in accordance with Section 251(h) of the General Corporation Law of the State of Delaware (the “DGCL”).

A summary of the principal terms of the Offer appears on pages i through viii below. You should read this entire Offer to Purchase and the

Letter of Transmittal carefully before deciding whether to tender your Shares into the Offer.

The Information Agent for the Offer is:

Georgeson Inc.

480 Washington Blvd., 26th Floor

Jersey City, NJ 07310

All Holders

Call Toll Free: (866) 413-5899

November 24, 2015

IMPORTANT

Any stockholder of Anadigics wishing to tender all or any portion of its Shares to Purchaser pursuant to the Offer should, prior to the

Expiration Date, (i) complete and execute the Letter of Transmittal that is enclosed with this Offer to Purchase in accordance with the instructions contained therein, and mail or deliver the Letter of Transmittal together with the certificates

representing your Shares and any other required documents, to Computershare Trust Company, N.A., in its capacity as depositary for the Offer (the “Depositary”), (ii) if applicable, tender your Shares by book-entry

transfer by following the procedures described in Section 3 — “Procedures for Accepting the Offer and Tendering Shares — Book-Entry Transfer” or (iii) if applicable, request that your broker, dealer,

commercial bank, trust company or other nominee effect the transaction for the stockholder. A stockholder who holds Shares registered in the name of a broker, dealer, commercial bank, trust company or other nominee must contact such nominee in order

to tender such Shares to Purchaser pursuant to the Offer.

Any stockholder of Anadigics who wishes to tender Shares pursuant to the Offer

and the certificates representing such Shares are not immediately available, or such stockholder cannot comply in a timely manner with the procedures for tendering Shares by book-entry transfer or such stockholder cannot deliver all required

documents to the Depositary prior to the Expiration Date, may tender such Shares to Purchaser pursuant to the Offer by following the procedures for guaranteed delivery described in Section 3 — “Procedures for Accepting the Offer

and Tendering Shares — Guaranteed Delivery.”

*****

Georgeson Inc., the information agent for the Offer (the “Information Agent”), may be contacted at the address and

telephone numbers set forth above and on the back cover of this Offer to Purchase for questions and/or requests for additional copies of this Offer to Purchase, the Letter of Transmittal, the notice of guaranteed delivery and other tender offer

materials free of charge. Stockholders may also contact their broker, dealer, commercial bank, trust company or other nominee for assistance.

This Offer to Purchase and the Letter of Transmittal contain important information, and you should read both carefully and in their

entirety before making a decision with respect to the Offer.

The Offer has not been approved or disapproved by the U.S. Securities

and Exchange Commission (“SEC”) or any state securities commission, nor has the SEC or any state securities commission passed upon the fairness or merits of or upon the accuracy or adequacy of the information contained in this Offer to

Purchase. Any representation to the contrary is unlawful.

TABLE OF CONTENTS

SUMMARY TERM SHEET

| Securities Sought: |

All of the outstanding shares of common stock, par value $0.01 per share (the “Shares”), of ANADIGICS, Inc., a Delaware corporation (“Anadigics”). |

| Price Offered Per Share: |

$0.35 per Share, net to the seller in cash, without interest, less any applicable withholding taxes (the “Offer Price”). |

| Scheduled Expiration Date: |

11:59 P.M., New York City time, on December 23, 2015, unless the Offer is extended or terminated. |

| Purchaser: |

Aloha Acquisition Sub, Inc., a Delaware corporation (“Purchaser”) and a wholly-owned subsidiary of Aloha Holding Company, Inc., a Delaware corporation (“Aloha”).

|

| Anadigics Board Recommendation: |

After careful consideration, the Board of Directors of Anadigics (the “Anadigics Board”) unanimously (1) determined that the Merger Agreement (as defined below) and the transactions contemplated

thereby, including the Offer and the Merger (each as defined below), are advisable, fair to and in the best interests of Anadigics and its stockholders, (2) approved, and declared advisable, the Merger Agreement, the Offer, the Merger and the

transactions contemplated by the Merger Agreement in accordance with the requirements of Delaware law and (3) resolved to recommend that Anadigics’s stockholders accept the Offer and tender their Shares to Purchaser pursuant to the Offer.

|

The following are answers to some questions that you, as a stockholder of Anadigics, may have about the Offer. This

summary term sheet highlights selected information from this offer to purchase (this “Offer to Purchase”) and may not contain all of the information that is important to you and is qualified in its entirety by the more

detailed descriptions and explanations contained in this Offer to Purchase and the related letter of transmittal (the “Letter of Transmittal”), which, together with any amendments or supplements hereto and thereto,

collectively constitute the “Offer.” To better understand the Offer and for a complete description of the terms of the Offer, you should read this Offer to Purchase, the Letter of Transmittal and the other documents to

which we refer you carefully and in their entirety. Questions or requests for assistance may be directed to Georgeson Inc., our information agent (the “Information Agent”), at the address and telephone numbers set

forth for the Information Agent on the back cover of this Offer to Purchase. Unless otherwise indicated in this Offer to Purchase or the context otherwise requires, all references in this Offer to Purchase to “we,”

“our” or “us” refer to Purchaser.

Who is offering to buy my Shares?

Our name is Aloha Acquisition Sub, Inc. and we are a wholly-owned subsidiary of Aloha. We were formed for the purpose of making the Offer and

thereafter consummating the merger (the “Merger”) with and into Anadigics, with Anadigics continuing as the surviving corporation in the Merger and as a wholly-owned subsidiary of Aloha. To date, we have not carried on any

activities other than those related to our formation, the Merger Agreement, the Offer and the Merger.

Aloha is a corporation incorporated

under the laws of the State of Delaware, and a wholly-owned subsidiary of GaAs Labs, LLC (“GaAs Labs”). GaAs Labs, a California limited liability company, is a private company focused on investing in companies supplying high

performance semiconductors and related devices for RF, microwave and related applications in commercial communications, satellite and defense-related markets. See the “Introduction” and Section 8 — “Certain Information

Concerning Purchaser, Aloha and GaAs Labs.”

i

How many Shares are you offering to purchase in the Offer?

We are making the Offer to purchase all of the outstanding Shares of Anadigics on the terms and subject to the conditions set forth in this

Offer to Purchase and the Letter of Transmittal. See the “Introduction” and Section 1 — “Terms of the Offer.”

Why

are you making the Offer?

We are making the Offer pursuant to the Agreement and Plan of Merger, dated as of November 11, 2015, by

and among Aloha, Anadigics and us (as it may be amended, modified or supplemented from time to time in accordance with its terms, the “Merger Agreement”), in order to acquire control of, and ultimately following the Merger,

the entire equity interest in, Anadigics, while allowing Anadigics’s stockholders an opportunity to receive the Offer Price by tendering their Shares in the Offer. If the Offer is consummated, subject to the satisfaction or waiver of the

remaining conditions set forth in the Merger Agreement, we, Aloha and Anadigics will consummate the Merger as soon as practicable thereafter in accordance with the General Corporation Law of the State of Delaware (the

“DGCL”). At the effective time of the Merger (the “Effective Time”), Anadigics will become a wholly-owned subsidiary of Aloha. See Section 12 — “Purpose of the Offer; Plans for

Anadigics.”

How much are you offering to pay and what is the form of payment? Will I have to pay any fees or commissions?

We are offering to pay $0.35 per Share, net to the seller in cash, without interest, less any applicable withholding taxes.

If you are the record owner of your Shares and you directly tender your Shares to us in the Offer, you will not have to pay brokerage fees,

commissions or similar expenses. If you own your Shares through a broker, dealer, commercial bank, trust company or other nominee and such nominee tenders your Shares on your behalf, such nominee may charge you a fee for doing so. You should consult

with your broker, dealer, commercial bank, trust company or other nominee to determine whether any charges will apply. See the “Introduction,” Section 1 — “Terms of the Offer” and Section 2 —

“Acceptance for Payment and Payment for Shares.”

What does the Anadigics Board recommend?

After careful consideration, the Anadigics Board unanimously (1) determined that the Merger Agreement and the transactions contemplated

thereby, including the Offer and the Merger, are advisable, fair to and in the best interests of Anadigics and its stockholders, (2) approved, and declared advisable, the Merger Agreement, the Offer, the Merger and the transactions contemplated

by the Merger Agreement in accordance with the requirements of Delaware law and (3) resolved to recommend that Anadigics’s stockholders accept the Offer and tender their Shares to Purchaser pursuant to the Offer.

A description of the reasons for the Anadigics Board’s adoption of the Offer and the Merger is set forth in Anadigics’s

Solicitation/Recommendation Statement on Schedule 14D-9 (the “Schedule 14D-9”) that is being filed with the Securities and Exchange Commission (the “SEC”) and, together with this Offer to

Purchase, the Letter of Transmittal and other related materials, mailed to Anadigics’s stockholders in connection with the Offer. See the “Introduction” to this Offer to Purchase.

What are the most significant conditions to the Offer?

The Offer is subject to several customary conditions including, among others, satisfaction of the Minimum Condition.

The term “Minimum Condition” is defined in Section 15 — “Conditions to the Offer”, and

generally requires that there is validly tendered and not withdrawn immediately prior to the Expiration Date (as defined

ii

below) of the Offer that number of Shares which, when added to the Shares owned by Aloha or any of its subsidiaries (if any), would represent at least a majority of the Shares outstanding of

Anadigics (assuming conversion or exercise of all derivative securities convertible or exercisable immediately prior to the Expiration Date, regardless of the conversion or exercise price), excluding for the purposes of this condition any Shares

tendered pursuant to guaranteed delivery procedures and not actually delivered prior to the Expiration Date. The Minimum Condition would be satisfied if at least 44,883,579 Shares are validly tendered and not properly withdrawn prior to the

Expiration Date.

The Offer is also subject to a number of other important conditions. A more detailed discussion of the conditions to

consummate the Offer is contained in Section 15 — “Conditions to the Offer.”

Is the Offer subject to any financing condition?

No. The Offer is not subject to any financing condition.

What percentage of Shares do you or your affiliates currently own?

None of us, Aloha, GaAs Labs or any of their respective affiliates currently own any Shares.

Do you have the financial resources to make payment?

Yes. Aloha, through GaAs Labs, will provide us with sufficient funds to purchase all Shares validly tendered in the Offer and will provide

funding to consummate the Merger (which includes, among other things, payment to acquire the remaining Shares in the Merger and payment in respect of outstanding in-the-money options and certain restricted stock unit awards of Anadigics), and to pay

related transaction fees and expenses. Aloha and GaAs Labs expect to fund such cash requirements from their available cash on hand. In addition, GaAs Labs entered into a guarantee in favor of Anadigics pursuant to which GaAs Labs agreed to

unconditionally and irrevocably guarantee the payment obligations and liabilities of Aloha and Purchaser under the Merger Agreement up to $32.2 million. See Section 11 — “The Merger Agreement; Other Agreements — Guarantee.”

The Offer is not subject to any financing condition. We estimate that we will need approximately $33.5 million to purchase all

Shares pursuant to the Offer, to fund any payments to consummate the Merger and to pay related transaction fees and expenses. See Section 9 — “Source and Amount of Funds.”

Is your financial condition relevant to my decision to tender my Shares in the Offer?

No. We do not think that our financial condition is relevant to your decision whether to tender Shares and accept the Offer because:

| |

• |

|

the consummation of the Offer is not subject to any financing condition; |

| |

• |

|

the Offer is being made for all outstanding Shares solely for cash; |

| |

• |

|

we, through Aloha and its parent company, GaAs Labs, will have sufficient funds, through available cash, to purchase all Shares validly tendered and not properly withdrawn pursuant to the Offer, and to provide funding

to consummate the Merger and related transaction fees and expenses; and |

| |

• |

|

if the Offer is consummated, we will acquire all remaining Shares in the Merger for the same cash price as was paid in the Offer (i.e., the Offer Price). |

See Section 9 — “Source and Amount of Funds” and Section 11 — “The Merger Agreement; Other

Agreements.”

iii

How long do I have to decide whether to tender my Shares in the Offer?

Unless we extend the Offer, you will have until 11:59 P.M., New York City time, on December 23, 2015 (the “Expiration

Date,” unless we extend the Offer pursuant to and in accordance with the terms of the Merger Agreement, in which event “Expiration Date” will mean the latest time and date at which the Offer, as so extended by us, will expire)

to tender your Shares in the Offer. Further, if you cannot deliver everything that is required in order to make a valid tender by that time, you may still participate in the Offer by using the guaranteed delivery procedure that is described later in

this Offer to Purchase by the Expiration Date. See Section 1 — “Terms of the Offer” and Section 3 — “Procedures for Accepting the Offer and Tendering Shares.”

Can the Offer be extended and under what circumstances?

Yes, the Offer can be extended. In some cases, we are required to extend the Offer beyond the initial Expiration Date, but in no event will we

be required to extend the Offer beyond the End Date (as defined below).

Pursuant to the Merger Agreement, we are required to extend the

Offer:

| |

• |

|

for successive periods of ten business days each (or such shorter period as agreed by Aloha and Anadigics), but not beyond February 9, 2016 (the “End Date”), in order to permit the

satisfaction of all remaining conditions (subject to our right to waive any condition in the Offer, other than the Minimum Condition, in accordance with the Merger Agreement), if at any scheduled Expiration Date, any condition to the Offer has not

been satisfied or waived (other than the Minimum Condition, which we may not waive without the prior written consent of Anadigics); or |

| |

• |

|

for any period or periods required by applicable law or any interpretation or position of the SEC or its staff or NASDAQ Stock Market, LLC (“NASDAQ”) or its staff, provided that we are not

obligated to extend the Offer beyond the End Date. |

If we extend the Offer, such extension will extend the time that you

will have to tender your Shares. See Section 1 — “Terms of the Offer.”

How will I be notified if the Offer is extended?

If we extend the Offer, we will inform the Depositary of that fact and will make a public announcement of the extension no later than

9:00 a.m., New York City time, on the next business day after the previously scheduled Expiration Date.

If we elect to provide a

subsequent offering period as described below, a public announcement of such election will be made no later than 9:00 a.m., New York City time, on the next business day following the Expiration Date. See Section 1 — “Terms

of the Offer.”

How do I tender my Shares?

To tender your Shares, you must deliver the certificates representing your Shares, together with a properly completed and duly completed Letter

of Transmittal (or, in the case of book-entry transfer of Shares, either such Letter of Transmittal or an Agent’s Message (as defined in Section 3 — “Procedures for Accepting the Offer and Tendering Shares — Valid

Tender of Shares”) in lieu of such Letter of Transmittal), and any other documents required by the Letter of Transmittal, to the Depositary prior to the Expiration Date. If your Shares are held in street name (i.e., through a broker, dealer,

commercial bank, trust company or other nominee), your Shares can be tendered by such nominee through the Depositary. If you are unable to deliver any required document or instrument to the Depositary prior to the Expiration Date, you may still

participate in the Offer by having a broker, a bank or any other fiduciary that is an eligible guarantor institution guarantee that the missing items will be received by the Depositary by using the enclosed notice of guaranteed delivery (the

“Notice of Guaranteed Delivery”). For the tender to be valid, however, the Depositary must receive the Notice of Guaranteed Delivery

iv

prior to the Expiration Date and must then receive the missing items within three NASDAQ trading days after the date of execution of such Notice of Guaranteed Delivery. See

Section 3 — “Procedures for Accepting the Offer and Tendering Shares.”

Until what time may I withdraw previously tendered

Shares?

Shares tendered into the Offer may be withdrawn at any time prior to the Expiration Date. Thereafter, tenders of Shares are

irrevocable, except that they may also be withdrawn after January 23, 2016 which is the 60th day from the commencement of the Offer, unless such Shares have already been accepted for payment by us pursuant to the Offer. If you tendered

your Shares by giving instructions to a broker, dealer, commercial bank, trust company or other nominee, you must instruct such nominee to arrange for the withdrawal of your Shares. See Section 4 — “Withdrawal Rights.” You

may not withdraw Shares tendered during any subsequent offering period that we may elect to provide. See Section 4 — “Withdrawal Rights.”

How do I properly withdraw previously tendered Shares?

To properly withdraw any of your previously tendered Shares, you must deliver a written notice of withdrawal with the required information (as

specified in this Offer to Purchase and in the Letter of Transmittal) to the Depositary while you still have the right to withdraw Shares. If you tendered your Shares by giving instructions to a broker, dealer, commercial bank, trust company or

other nominee, you must instruct such nominee to arrange for the proper withdrawal of your Shares. You may not withdraw Shares tendered during any subsequent offering period that we may elect to provide. See Section 4 —

“Withdrawal Rights.”

Have any stockholders previously agreed to tender their Shares?

No. We have not entered into any agreements with any stockholders of Anadigics under which those stockholders have agreed to tender Shares in

the Offer.

Prior to the consummation of the Offer, will the Shares continue to be listed on NASDAQ?

Pursuant to a NASDAQ delisting notice received by Anadigics in June 2015, the Shares may be delisted from NASDAQ as early as December 15,

2015, prior to the consummation of the Offer, unless NASDAQ grants an extension or Anadigics regains compliance with the minimum bid price requirement prior to such date. See Section 13 — “Certain Effects of the Offer —

Stock Listing.”

Upon the successful consummation of the Offer, will Shares continue to be publicly traded?

If the Shares are not delisted from NASDAQ prior to the consummation of the Offer as described above, and if all of the conditions to the Offer

are satisfied or waived (see Section 15 — “Conditions to the Offer”) and we purchase all tendered Shares, prior to the Merger becoming effective, there may then be so few remaining stockholders and publicly-held Shares that

such Shares will no longer be eligible to be traded on the NASDAQ or any other securities exchange and there may not be a public trading market for such Shares. Following the consummation of the Offer and subject to the satisfaction of the remaining

conditions set forth in the Merger Agreement, we, Aloha and Anadigics will consummate the Merger as soon as practicable in accordance with Section 251(h) of the DGCL. Following consummation of the Merger, no Shares will be publicly owned, and

Anadigics will deregister with the SEC and will no longer be a public company. See Section 13 — “Certain Effects of the Offer.” Because the Merger will be governed by Section 251(h) of the DGCL, no stockholder vote will

be required to consummate the Merger. We do not expect there to be a significant period of time between the consummation of the Offer and the consummation of the Merger.

If you do not consummate the Offer, will you nevertheless consummate the Merger?

No. None of us, Aloha or Anadigics are under any obligation to pursue or consummate the Merger if the Offer has not been earlier consummated.

v

Will there be a subsequent offering period?

Subject to the provisions of Section 251(h) of the DGCL and our obligation to consummate the Merger as soon as practicable following the

consummation of the Offer and satisfaction of the remaining conditions set forth in the Merger Agreement, we may elect to provide a subsequent offering period (and one or more extensions thereof) of not less than three business days nor more than

twenty business days, during which time Anadigics’s stockholders whose Shares have not been tendered prior to the Expiration Date (or whose Shares were tendered and later withdrawn prior to the Expiration Date) may tender, but not withdraw,

their Shares and receive the Offer Price. See Section 1 — “Terms of the Offer” and Section 4 — “Withdrawal Rights.”

What is the difference between an extension of the Offer and a subsequent offering period?

If the Offer is extended, no Shares will be accepted or paid for until following the Expiration Date (as so extended), and you will be able to

withdraw your Shares until the Expiration Date.

A subsequent offering period, if one is provided, would occur after the time we accept

for payment Shares tendered in the Offer (the “Acceptance Time”) and after we have become obligated to pay for all Shares that were validly tendered and not properly withdrawn prior to the Expiration Date. Shares that are

validly tendered during a subsequent offering period will be accepted and paid for promptly after they are received and cannot be withdrawn. See Section 1 — “Terms of the Offer” and Section 4 —

“Withdrawal Rights.”

If I object to the price being offered, will I have appraisal rights?

Appraisal rights are not available to the holders of Shares in connection with the Offer. However, if the Merger is consummated, the holders of

Shares immediately prior to the Effective Time who (i) did not tender their Shares in the Offer, (ii) follow the procedures set forth in Section 262 of the DGCL and (iii) do not thereafter withdraw their demand for appraisal of

such Shares or otherwise lose their appraisal rights, in each case in accordance with the DGCL, will be entitled to have their Shares appraised by the Delaware Court of Chancery and receive payment of the “fair value” of such Shares,

exclusive of any element of value arising from the accomplishment or expectation of the Merger, together with a fair rate of interest, as determined by such court. The “fair value” could be more or less than, or the same as, the Offer

Price or the consideration payable in the Merger (which is equivalent in amount to the Offer Price). See Section 16 — “Certain Legal Matters — Appraisal Rights.” Concurrently with the commencement of the Offer, Anadigics is

distributing the Schedule 14D-9, which contains important information regarding how a holder of Shares may exercise its appraisal rights.

If I decide

not to tender my Shares, how will the Offer affect my Shares?

Following the consummation of the Offer and subject to the satisfaction

or waiver of the remaining conditions set forth in the Merger Agreement, we, Aloha and Anadigics will consummate the Merger as soon as practicable. If the Merger is consummated, then stockholders who did not tender their Shares into the Offer will

receive the same amount of cash per Share that they would have received had they tendered their Shares into the Offer (i.e., the Offer Price), subject to any appraisal rights properly exercised by such stockholders in accordance with Delaware law.

Therefore, if the Merger takes place, the only difference to you between tendering your Shares into the Offer and not tendering your Shares into the Offer would be that, if you tender your Shares, you may be paid earlier and no appraisal rights will

be available. No interest will be paid for Shares acquired in the Merger.

Furthermore, following the consummation of the Offer until the

Effective Time, there may then be so few remaining stockholders and publicly held Shares that such Shares will no longer be eligible to be traded on the NASDAQ or any other securities exchange and there may not be a public trading market for such

Shares. See the “Introduction” and Section 13 — “Certain Effects of the Offer.”

Because the Merger

will be governed by Section 251(h) of the DGCL, no stockholder vote will be required to consummate the Merger. We do not expect there to be a significant period of time between the consummation

vi

of the Offer and the consummation of the Merger. See Section 11 — “The Merger Agreement; Other Agreements” and Section 12 — “Purpose of the Offer;

Plans for Anadigics — Purpose of the Offer.”

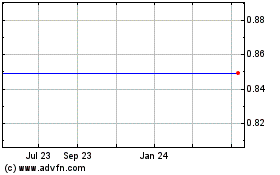

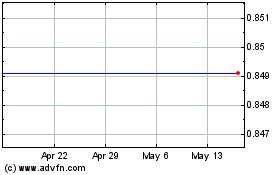

What is the market value of my Shares as of a recent date?

On November 11, 2015, the last full trading day before the execution of the Merger Agreement and the Offer was announced, the closing

price of the Shares on NASDAQ was $0.24 per Share. On November 23, 2015, the last full day of trading before the commencement of the Offer, the closing price of the Shares on NASDAQ was $0.34 per Share. We encourage you to obtain a recent

quotation for Shares in deciding whether to tender your Shares. See Section 6 — “Price Range of Shares; Dividends.”

If I

tender my Shares, when and how will I get paid?

If the conditions to the Offer as set forth in Section 15 —

“Conditions to the Offer” are satisfied or waived and we consummate the Offer and accept your Shares for payment, you will be entitled to promptly receive an amount equal to the number of Shares you tendered into the Offer multiplied by

the Offer Price, net to you in cash, without interest, less any applicable withholding taxes. We will pay for your validly tendered and not properly withdrawn Shares by depositing the aggregate Offer Price therefor with the Depositary, which will

act as your agent for the purpose of receiving payments from us and transmitting such payments to you. In all cases, payment for tendered Shares will be made only after timely receipt by the Depositary of (i) certificates representing such

Shares or a confirmation of a book-entry transfer of such Shares as described in Section 3 — “Procedures for Accepting the Offer and Tendering Shares — Book-Entry Transfer,” (ii) a properly completed and duly

executed Letter of Transmittal, together with any required signature guarantees or, in the case of book-entry transfer of Shares, either such Letter of Transmittal or an Agent’s Message in lieu of such Letter of Transmittal and (iii) any

other required documents for such Shares. See Section 1 — “Terms of the Offer” and Section 2 — “Acceptance for Payment and Payment for Shares.”

What will happen to my equity awards in the Offer?

The Offer is being made for all outstanding Shares, and not for options to purchase Shares, restricted stock unit awards or other equity awards

(collectively, “Equity Awards”). Equity Awards may not be tendered into the Offer. If you wish to tender Shares underlying Equity Awards, you must first exercise such awards (to the extent exercisable) in accordance with

their terms in sufficient time to tender the Shares received into the Offer.

Pursuant to the Merger Agreement, each option to purchase

Shares granted under any equity plan of Anadigics (each, a “Anadigics Option”) that is outstanding immediately prior to the Effective Time, whether vested or unvested, will be cancelled and, in consideration for such

cancellation, the holder of such Anadigics Option will automatically receive (as soon as practicable but in no even more than 30 days following the Effective Time) an amount in cash equal to (i) the total number of Shares subject to such

Anadigics Option, multiplied by (ii) the excess, if any, of (A) the Offer Price over (B) the per share exercise price for such Anadigics Option (less all applicable tax deductions and withholdings required by law to be withheld in

respect of such payment and without interest).

Pursuant to the Merger Agreement, each time-based restricted stock unit award, whether

vested or unvested, and each performance-based restricted stock unit award earned for 2013 performance, in each case granted under any equity plan of Anadigics (each, a “Anadigics Restricted Stock Unit Award”), that is

outstanding immediately prior to the Effective Time will be cancelled and, in consideration for such cancellation, the holder of such Anadigics Restricted Stock Unit will automatically receive (as soon as practicable but in no even more than 30 days

following the Effective Time) an amount in cash equal to (i) the total number of Shares subject to such Anadigics Restricted Stock Unit, multiplied by (ii) the Offer Price (less all applicable tax deductions and withholdings required by

law to be withheld in respect of such payment and without interest).

See Section 11 — “The Merger Agreement; Other

Agreements — The Merger Agreement — Treatment of Anadigics Options and Anadigics Restricted Stock Unit Awards.”

vii

What are the U.S. federal income tax consequences of the Offer and the Merger?

The receipt of cash by you in exchange for your Shares pursuant to the Offer or the Merger (or pursuant to the exercise of appraisal rights in

accordance with Delaware law) will be a taxable transaction for U.S. federal income tax purposes if you are a United States Holder (as defined in Section 5 — “Certain Material U.S. Federal Income Tax Consequences of the

Offer and the Merger — United States Holders”). In general, you will recognize gain or loss equal to the difference between your adjusted tax basis in Shares that you tender into the Offer or exchange in the Merger (or retain for exercise

of appraisal rights) and the amount of cash you receive for such Shares. If you are a United States Holder and you hold your Shares as a capital asset, the gain or loss that you recognize will be a capital gain or loss and will be treated as a

long-term capital gain or loss if you have held such Shares for more than one year. If you are a Non-United States Holder (as defined in Section 5 — “Certain Material U.S. Federal Income Tax Consequences of the Offer and the

Merger — Non-United States Holders”), you will generally not be subject to U.S. federal income tax on gain recognized on Shares you tender into the Offer or exchange in the Merger (or retain for exercise of appraisal rights). You

should consult your tax advisor about the particular tax consequences to you of tendering your Shares into the Offer, exchanging your Shares in the Merger or exercising appraisal rights. See Section 5 — “Certain

Material U.S. Federal Income Tax Consequences of the Offer and the Merger” for a discussion of certain material U.S. federal income tax consequences of tendering Shares in the Offer or exchanging Shares in the Merger or exercising

appraisal rights.

To whom should I talk if I have additional questions about the Offer?

You may contact Georgeson, Inc., the Information Agent for the Offer, at the address and telephone numbers listed below if you have any

questions about the Offer.

The Information Agent for the Offer is:

Georgeson Inc.

480 Washington Blvd., 26th Floor

Jersey City, NJ 07310

All Holders

Call Toll Free: (866) 413-5899

viii

To the Holders of Shares of Common Stock of ANADIGICS, Inc.:

INTRODUCTION

Aloha Acquisition Sub, Inc., a Delaware corporation (“Purchaser,” “we,”

“us,” or “our”) and a wholly-owned subsidiary of Aloha Holding Company, Inc., a Delaware corporation (“Aloha”), which is a wholly-owned subsidiary of GaAs Labs, LLC

(“GaAs Labs”), hereby offers to purchase (the “Offer”) all of the outstanding shares of common stock, par value $0.01 per share (the “Shares”), of ANADIGICS, Inc., a Delaware

corporation (“Anadigics”), at a price of $0.35 per Share (the “Offer Price”), net to the seller in cash, without interest, less any applicable withholding taxes, upon the terms and conditions set forth

in this Offer to Purchase (as it may be amended and supplemented from time to time, the “Offer to Purchase”) and in the related Letter of Transmittal (as it may be amended or supplemented from time to time, the

“Letter of Transmittal”).

The Offer is being made pursuant to the Agreement and Plan of Merger, dated

November 11, 2015 (as it may be amended and supplemented from time to time, the “Merger Agreement”), by and among Aloha, Purchaser and Anadigics. Under the Merger Agreement, after the completion of the Offer and subject

to specified conditions, Purchaser will merge with and into Anadigics (the “Merger”), with Anadigics continuing as the surviving corporation and a wholly-owned subsidiary of Aloha (the “Surviving

Corporation”). At the effective time of the Merger (the “Effective Time”), each Share then outstanding (other than (i) Shares then held by Aloha, Purchaser, Anadigics or their respective subsidiaries, and

(ii) Shares that are held by any stockholders of Anadigics who properly demand appraisal in connection with the Merger as described in Section 16 — “Certain Legal Matters — Appraisal Rights”) will be converted into

the right to receive the Offer Price, without interest, less any applicable withholding taxes. The Merger Agreement is described in detail in Section 11 — “The Merger Agreement; Other Agreements” of this Offer to Purchase.

The Offer is conditioned upon, among other things, satisfaction of the Minimum Condition (as defined below), and other customary

conditions. The term “Minimum Condition” is defined in Section 15 — “Conditions to the Offer”, and generally requires that there is validly tendered and not withdrawn immediately prior to the

Expiration Date (as defined below) of the Offer that number of Shares which, when added to the Shares owned by Aloha or any of its subsidiaries (if any), would represent at least a majority of the Shares outstanding of Anadigics (assuming conversion

or exercise of all derivative securities convertible or exercisable immediately prior to the Expiration Date, regardless of the conversion or exercise price), excluding for the purposes of this condition Shares tendered pursuant to guaranteed

delivery procedures and not actually delivered prior to the Expiration Date. See Section 15 — “Conditions to the Offer.” The Minimum Condition may not be waived without the prior written consent of Anadigics.

According to Anadigics, as of November 20, 2015, there were (a) 88,836,561 outstanding Shares, and (b) 930,595 Shares subject

to issuance pursuant to options to purchase Shares (“Anadigics Options”) exercisable under the Anadigics Equity Plans (as defined in Section 11 — “The Merger Agreement; Other Agreements — The Merger

Agreement — Treatment of Anadigics Options and Anadigics Restricted Stock Unit Awards”). Assuming that all Shares described in clause (b) in the preceding sentence are issued and that (i) no other Shares were or are issued after

November 20, 2015 and (ii) no options have been granted or expired after November 20, 2015, the Minimum Condition would be satisfied if at least 44,883,579 Shares are validly tendered and not properly withdrawn prior to the Expiration

Date.

The Offer and the withdrawal rights will expire at 11:59 P.M., New York City time, on December 23, 2015 (the

“Expiration Date”), unless the Offer is extended or the Merger Agreement has been earlier terminated in accordance with its terms. Under no circumstances will interest be paid with respect to the purchase of Shares pursuant

to the Offer, regardless of any extension of the Offer or any delay in making payment for Shares.

After careful consideration, the

Board of Directors of Anadigics (the “Anadigics Board”) unanimously (1) determined that the Merger Agreement and the transactions contemplated thereby, including the Offer

1

and the Merger, are advisable, fair to and in the best interests of Anadigics and its stockholders, (2) approved, and declared advisable, the Merger Agreement, the Offer, the Merger and the

transactions contemplated by the Merger Agreement in accordance with the requirements of Delaware law and (3) resolved to recommend that Anadigics’s stockholders accept the Offer and tender their Shares to Purchaser pursuant to the Offer.

A more complete description of the Anadigics Board’s reasons for authorizing and approving the Merger Agreement and the

transactions contemplated thereby, including the Offer and the Merger, is set forth in the Schedule 14D-9 that is being filed with the SEC and, together with this Offer to Purchase, the Letter of Transmittal and other related materials, mailed

to Anadigics’s stockholders in connection with the Offer. Stockholders should carefully read the information set forth in the Schedule 14D-9 in its entirety.

If you are a record owner of Shares and you tender such Shares directly to the Depositary in accordance with the terms of this Offer, we will

not charge you brokerage fees, commissions or, except as set forth in Instruction 6 in the Letter of Transmittal, stock transfer taxes on the sale of Shares pursuant to the Offer. However, if you do not complete and sign the IRS Form W-9 that

is enclosed with the Letter of Transmittal (or other applicable form), you may be subject to backup withholding at the applicable statutory rate on the gross proceeds payable to you. See Section 3 — “Procedures for Accepting the

Offer and Tendering Shares — Backup Withholding.” Stockholders with Shares held in street name by a broker, dealer, bank, trust company or other nominee should consult with such nominee to determine if they will be charged any service

fees or commissions. We will pay all charges and expenses of the Depositary and the Information Agent incurred in connection with the Offer. See Section 17 — “Fees and Expenses.”

The Merger will be governed by Section 251(h) of the DGCL. Accordingly, after the consummation of the Offer and subject to the

satisfaction or waiver of the remaining conditions set forth in the Merger Agreement, Aloha, we and Anadigics will cause the Merger to become effective as soon as practicable without a meeting of stockholders of Anadigics in accordance with

Section 251(h) of the DGCL. See Section 11 — “The Merger Agreement; Other Agreements — The Merger Agreement — Application of Section 251(h) of the DGCL.”

No appraisal rights are available to the holders of Shares in connection with the Offer. However, if the Merger is consummated, the holders of

Shares immediately prior to the Effective Time who (i) did not tender their Shares in the Offer; (ii) follow the procedures set forth in Section 262 of the DGCL and (iii) do not thereafter withdraw their demand for appraisal of

such Shares or otherwise lose their appraisal rights, in each case in accordance with the DGCL, will be entitled to have their Shares appraised by the Delaware Court of Chancery and receive payment of the “fair value” of such holder’s

Shares, exclusive of any element of value arising from the accomplishment or expectation of the Merger, together with a fair rate of interest, as determined by such court. The “fair value” could be more or less than, or equal to, the Offer

Price or the consideration payable in the Merger (which is equivalent in amount to the Offer Price). See Section 16 — “Certain Legal Matters — Appraisal Rights.”

This Offer to Purchase and the Letter of Transmittal contain important information that should be read carefully before any decision is

made with respect to the Offer.

2

THE TENDER OFFER

Upon the terms and subject to the conditions of the Offer

(including, if the Offer is extended or amended, the terms and conditions of such extension or amendment), we will accept for payment and pay for all Shares validly tendered and not properly withdrawn prior to the Expiration Date as permitted under

Section 4 — “Withdrawal Rights.”

The Offer is not subject to any financing condition. The Offer is

conditioned upon the Minimum Condition, as well as other customary conditions. See Section 15 — “Conditions to the Offer.”

We expressly reserve the right from time to time to waive any of the conditions described in Section 15 — “Conditions to

the Offer,” to increase the Offer Price or to make any other changes in the terms and conditions of the Offer, except that we will not, without the prior written consent of Anadigics, (i) decrease the Offer Price, (ii) change the form

of consideration payable in the Offer, (iii) decrease the maximum number of Shares sought to be purchased in the Offer, (iv) impose additional conditions to the Offer, (v) amend or modify any of the conditions to the Offer in a manner

that adversely affects holders of Shares generally, (vi) amend or modify the Minimum Condition or (vii) extend or otherwise change the Expiration Date in a manner other than as required or permitted by the Merger Agreement.

Pursuant to the Merger Agreement and in accordance with Rule 14d-11 under the U.S. Securities Exchange Act of 1934, as amended (the

“Exchange Act”), but in all instances subject to the provisions of Section 251(h) of the DGCL and our obligation to consummate the Merger as soon as practicable following the consummation of the Offer and satisfaction or

waiver of the remaining conditions set forth in the Merger Agreement, we may elect to provide a subsequent offering period (and one or more extensions thereof) following the Expiration Date. Because the Merger will be governed by Section 251(h)

of the DGCL, no stockholder vote will be required to consummate the Merger. Following the consummation of the Offer and subject to the satisfaction or waiver of the remaining conditions set forth in the Merger Agreement, we, Aloha and Anadigics will

consummate the Merger as soon as practicable. We do not expect there to be a significant period of time between the consummation of the Offer and the consummation of the Merger. If we elect to provide a subsequent offering period, it will be an

additional period of time, following the Expiration Date, during which stockholders may tender any Shares not previously tendered into the Offer prior to the Expiration Date (or Shares previously tendered and later withdrawn prior to the Expiration

Date) and not withdrawn. If we elect to provide a subsequent offering period, (i) it will remain open for such period or periods as we will specify of neither less than three business days nor more than 20 business days, (ii) Shares may be

tendered in the same manner as was applicable to the Offer except that any Shares tendered during such period may not be withdrawn pursuant to Rule 14d-7(a)(2) under the Exchange Act, (iii) we will immediately accept and promptly

pay for Shares as they are tendered and (iv) the price per Share will be the same as the Offer Price. For purposes of the Offer as provided under the Exchange Act, a “business day” means any day other than a Saturday, Sunday or a

U.S. federal holiday and consists of the time period from 12:01 a.m. through 12:00 midnight, New York City time.

A subsequent

offering period, if one is provided, is not an extension of the Offer. If we do elect to provide a subsequent offering period, we will make a public announcement of such election no later than 9:00 a.m., New York City time, on the next business

day after the Expiration Date.

The Merger Agreement separately provides that we are required to extend the Offer (i) for successive

periods of ten business days each, or such other number of business days as we, Aloha and Anadigics may agree, in order to permit the satisfaction of all conditions that have not been satisfied as of the scheduled Expiration Date (subject to our

right to waive any condition to the Offer (other than the Minimum Condition) in accordance with the Merger Agreement), and (ii) for the minimum period required by applicable law or any interpretation or position of the SEC or its staff or the

NASDAQ Stock Market, LLC (“NASDAQ”) or its staff, provided that we are not, under any circumstances, obligated to extend the Offer beyond February 9, 2016 (the “End Date”).

3

If we extend the Offer, are delayed in our acceptance for payment of Shares, are delayed in

payment after the time we accept for payment Shares tendered in the Offer (the “Acceptance Time”) or are unable to accept Shares for payment pursuant to the Offer for any reason, then, without prejudice to our rights under

the Offer, the Depositary may retain tendered Shares on our behalf, and such Shares may not be withdrawn except to the extent that tendering stockholders are entitled to withdrawal rights as described in this Offer to Purchase under

Section 4 — “Withdrawal Rights.” However, our ability to delay the payment for Shares that we have accepted for payment is limited by Rule 14e-1(c) under the Exchange Act, which requires us to promptly pay the consideration

offered or return the securities deposited by or on behalf of stockholders promptly after the termination or withdrawal of the Offer.

If

we make a material change in the terms of the Offer or the information concerning the Offer or if we waive a material condition of the Offer, we will disseminate additional tender offer materials and extend the Offer if and to the extent required by

Rules 14d-4(d)(1), 14d-6(c) and 14e-1 under the Exchange Act and the interpretations thereunder. The minimum period during which an offer must remain open following material changes in the terms of an offer or information concerning an offer,

other than a change in price or a change in percentage of securities sought, will depend upon the facts and circumstances, including the relative materiality of the terms or information changes and the appropriate manner of dissemination. In a

published release, the SEC has stated that, in its view, an offer should remain open for a minimum of five business days from the date the material change is first published, sent or given to stockholders, and that if material changes are made with

respect to information that approaches the significance of price and the percentage of securities sought, a minimum period of 10 business days may be required to allow for adequate dissemination to stockholders and investor response. In accordance

with the foregoing view of the SEC and applicable law, if, prior to the Expiration Date, and subject to the limitations of the Merger Agreement, we change the number of Shares being sought or the consideration offered pursuant to the Offer, and if

the Offer is scheduled to expire at any time earlier than the 10th business day from the date that notice of such change is first published, sent or given to stockholders, the Offer will be extended at least until the expiration of such

10th business day.

If, prior to the Expiration Date, we increase the consideration being paid for Shares, such increased

consideration will be paid to all stockholders whose Shares are purchased in the Offer, whether or not such Shares were tendered before the announcement of such increase in consideration.

Any extension, delay, termination, waiver or amendment of the Offer will be followed promptly by public announcement thereof, such

announcement in the case of an extension to be made no later than 9:00 a.m., New York City time, on the next business day after the previously scheduled Expiration Date. Subject to applicable law (including Rules 14d-4(d), 14d-6(c) and

14e-1 under the Exchange Act, which require that material changes be promptly disseminated to stockholders in a manner reasonably designed to inform them of such changes) and without limiting the manner in which we may choose to make any public

announcement, we will have no obligation to publish, advertise or otherwise communicate any such public announcement other than by issuing a press release to a national news service.

Anadigics has provided us with its stockholder list and security position listings for the purpose of disseminating the Offer to holders of

Shares. This Offer to Purchase and the Letter of Transmittal will be mailed to record holders of Shares whose names appear on Anadigics’s stockholder list and will be furnished, for subsequent transmittal to beneficial owners of Shares, to

brokers, dealers, commercial banks, trust companies and other nominees whose names, or the names of whose nominees, appear on the stockholder list or, if applicable, who are listed as participants in a clearing agency’s security position

listing.

| 2. |

Acceptance for Payment and Payment for Shares. |

Upon the terms and subject to the

conditions of the Offer (including, if the Offer is extended or amended, the terms and conditions of any such extension or amendment), we will promptly accept for payment and

4

promptly thereafter pay for all Shares validly tendered and not properly withdrawn prior to the Expiration Date pursuant to the Offer.

In all cases, payment for Shares accepted for payment pursuant to the Offer will be made only after timely receipt by the Depositary of:

| |

• |

|

the certificates evidencing such Shares (“Share Certificates”) or confirmation of a book-entry transfer of such Shares (a “Book-Entry Confirmation”) into the

Depositary’s account at The Depository Trust Company (the “Book-Entry Transfer Facility”) pursuant to the procedures set forth in Section 3 — “Procedures for Accepting the Offer and Tendering

Shares”; |

| |

• |

|

a properly completed and duly executed Letter of Transmittal, together with any required signature guarantees or, in the case of book-entry transfer of Shares, either such Letter of Transmittal or an Agent’s

Message (as defined below) in lieu of such Letter of Transmittal; and |

| |

• |

|

any other documents required by the Letter of Transmittal. |

Accordingly, tendering

stockholders may be paid at different times depending upon when Share Certificates or Book-Entry Confirmations with respect to their Shares are actually received by the Depositary.

For purposes of the Offer, we will be deemed to have accepted for payment, and thereby purchased, Shares validly tendered and not properly

withdrawn, if and when we give oral or written notice to the Depositary of our acceptance for payment of such Shares pursuant to the Offer. Upon the terms and subject to the conditions to the Offer, payment for Shares accepted for payment pursuant

to the Offer will be made by deposit of the Offer Price therefor with the Depositary, which will act as agent for tendering stockholders for the purpose of receiving payments from us and transmitting such payments to tendering stockholders of record

whose Shares have been accepted for payment. If, for any reason whatsoever, acceptance for payment of any Shares tendered pursuant to the Offer is delayed, or we are unable to accept for payment Shares tendered pursuant to the Offer, then, without

prejudice to our rights under the Offer, the Depositary may, nevertheless, on our behalf, retain tendered Shares, and such Shares may not be withdrawn, except to the extent that the tendering stockholders are entitled to withdrawal rights as

described in Section 4 — “Withdrawal Rights” and as otherwise required by Rule 14e-1(c) under the Exchange Act.

Under no circumstances will interest with respect to the Shares purchased pursuant to the Offer be paid, regardless of any extension of the

Offer or delay in making such payment.

All questions as to the validity, form, eligibility (including time of receipt) and

acceptance for payment of any tender of Shares will be determined by us in our sole discretion. We reserve the absolute right to reject any and all tenders determined by us not to be in proper form or the acceptance for payment of which may, in the

opinion of our counsel, be unlawful.

Shares tendered by a Notice of Guaranteed Delivery will not be deemed validly tendered for

purposes of satisfying the Minimum Condition unless and until Shares underlying such Notice of Guaranteed Delivery are delivered to the Depositary or unless otherwise mutually agreed by us and Anadigics.

If any tendered Shares are not accepted for payment for any reason pursuant to the terms and conditions of the Offer, or if Share Certificates

are submitted evidencing more Shares than are tendered, Share Certificates evidencing unpurchased or untendered Shares will be returned, without expense, to the tendering stockholder (or, in the case of Shares tendered by book-entry transfer into

the Depositary’s account at the Book-Entry Transfer Facility pursuant to the procedure set forth in Section 3 — “Procedures for Accepting the Offer and Tendering Shares,” such Shares will be credited to an account

maintained at the Book-Entry Transfer Facility), in each case, promptly following the expiration or termination of the Offer.

5

| 3. |

Procedures for Accepting the Offer and Tendering Shares. |

Valid Tender of

Shares. No alternative, conditional or contingent tenders will be accepted. In order for a Anadigics stockholder to validly tender Shares pursuant to the Offer, the stockholder must follow one of the following procedures:

| |

• |

|

for Shares held as physical certificates, the certificates representing tendered Shares, a properly completed and duly executed Letter of Transmittal, together with any required signature guarantees, and any other

documents required by the Letter of Transmittal, must be received by the Depositary at one of its addresses set forth on the back cover of this Offer to Purchase before the Expiration Date (unless the tender is made during a subsequent offering

period, if one is provided, in which case the certificates representing Shares, the Letter of Transmittal and other documents must be received before the expiration of such subsequent offering period); |

| |

• |

|

for Shares held in book-entry form, either a properly completed and duly executed Letter of Transmittal, together with any required signature guarantees, or an Agent’s Message in lieu of such Letter of Transmittal,

and any other required documents, must be received by the Depositary at one of its addresses set forth on the back cover of this Offer to Purchase, and such Shares must be delivered according to the book-entry transfer procedures described below

under “Book-Entry Transfer” and a Book-Entry Confirmation must be received by the Depositary, in each case before the Expiration Date (unless the tender is made during a subsequent offering period, if one is provided, in which case the

Letter of Transmittal or an Agent’s Message in lieu of such Letter of Transmittal, and other documents must be received before the expiration of such subsequent offering period); or |

| |

• |

|

the tendering stockholder must comply with the guaranteed delivery procedures described below under “Guaranteed Delivery” before the Expiration Date. |

The term “Agent’s Message” means a message transmitted by the Book-Entry Transfer Facility to, and received by,

the Depositary and forming a part of a Book-Entry Confirmation that states that the Book-Entry Transfer Facility has received an express acknowledgment from the participant in the Book-Entry Transfer Facility tendering the Shares that are the

subject of such Book-Entry Confirmation, that such participant has received and agrees to be bound by the terms of the Letter of Transmittal and that we may enforce such agreement against such participant.

Book-Entry Transfer. The Depositary will establish an account with respect to the Shares at the Book-Entry Transfer Facility for

purposes of the Offer within two business days after the date of this Offer to Purchase. Any financial institution that is a participant in the system of the Book-Entry Transfer Facility may make a book-entry delivery of Shares by causing the

Book-Entry Transfer Facility to transfer such Shares into the Depositary’s account at the Book-Entry Transfer Facility in accordance with the Book-Entry Transfer Facility’s procedures for such transfer. However, although delivery of Shares

may be effected through book-entry transfer at the Book-Entry Transfer Facility, either a properly completed and duly executed Letter of Transmittal, together with any required signature guarantees, or an Agent’s Message and any other required

documents (for example, in certain circumstances, a completed IRS Form W-9 that is included in the Letter of Transmittal) must, in any case, be received by the Depositary at one of its addresses set forth on the back cover of this Offer to