By Ana García Ruiz and Jeannette Neumann

Telefónica SA's shares led losses on Spain's benchmark index

Thursday as investors eager for details on how the company plans to

whittle down its debt load came up empty-handed when it reported

second-quarter earnings.

The Spanish telecommunications giant also reaffirmed its

dividend despite calls from analysts to cut the payout to help trim

more than EUR50 billion, or around $55.3 billion, in debt.

Investors and analysts say they hope Telefónica executives

provide guidance on how the company plans to deleverage during a

conference call scheduled for 1 p.m. London time and 8 a.m. New

York time later on Thursday.

Telefónica shares were down 5.5% in midday trading in Madrid

despite second-quarter results that were broadly in line with what

analysts had expected. Analysts also noted that the decline comes

after a steady increase in Telefónica's share price over the past

month or so.

The company reported on Thursday that net profit was EUR693

million in the quarter versus EUR1.52 billion a year earlier. The

company said a decline in the currencies of Brazil, Argentina and

the U.K. versus the euro, as well as other currency fluctuations,

had shaved 9.1 percentage points off revenue in the second

quarter.

Revenue in the quarter was EUR12.72 billion, a 7.7% decline from

a year earlier. Operating income excluding depreciation and

amortization was EUR3.92 billion, a 7.1% drop.

Telefónica reiterated its targets with a dividend of EUR0.75

euros a share for 2016 because of what the company said was an

expected improvement in cash flow in the second half of the

year.

Investors have been seeking reassurance that Telefónica will

start to whittle down more than EUR50 billion in debt after the

European Commission blocked the company's sale of its British

mobile operator O2.

Telefónica had tried to sell 02 to cuts its debt load, but the

Commission said the acquisition by CK Hutchison Holdings Ltd. would

have resulted in higher prices and fewer choices for U.K.

customers, so it thwarted the sale.

Analysts at credit-rating firms warned that Telefónica still

needed to trim debt or risk a potential downgrade of its

investment-grade credit rating, which ensures that a broader range

of investors can buy its securities.

As Telefónica executives went back to the drawing board to

figure out what to do with O2 and how to protect the company's

rating, Britons voted to leave the European Union, throwing a

wrench in the company's efforts.

The week after Brexit, the telecommunications company announced

it would consolidate the British operator back into its financial

statements, no longer reporting O2's assets and liabilities as

"held for sale."

"Telefónica continues to explore different strategic

alternatives for O2 UK, to be implemented when market conditions

are deemed appropriate," the company said in a regulatory filing on

June 29.

While the regulatory, financial and economic uncertainty

unleashed by Brexit diminishes the appeal of O2, the company could

still try to sell the British operator again in the future,

analysts say. More likely, though, is that the Spanish company

seeks to deleverage by selling other assets or cutting the

dividend, analysts say.

Brexit hasn't been all bad for Telefónica, Javier Borrachero, a

telecommunications analyst at Kepler Cheuvreux, points out in a

July 11 research report.

Around 13% of the company's net debt is in pounds, he notes, and

the currency has dropped post-Brexit versus the euro.

Also, Brexit has pushed back expectations of an increase in

interest rates by the U.S. Federal Reserve, which has helped to

buoy emerging market currencies such as the Brazilian real.

Investors tend to pull money out of emerging markets if they

believe there will be higher interest rates, and therefore higher

returns, in the U.S.

Since that hasn't happened, the Argentine peso and the Brazilian

real--which had been a drag on earnings and Telefónica's share

price--have bounced back, while more market-friendly governments in

the region are also helping to brighten the outlook for the

telecommunications company, Mr. Borrachero says.

"Better macroeconomic and inflation prospects have also put an

end to the period of massive currency depreciation," Mr. Borrachero

wrote. "An increasing appetite for emerging markets risk is key for

Telefónica, as the stock is still seen as a Latin American

proxy."

On the other hand, if the Fed raises rates and that in turn

deflates emerging-market currencies, Telefónica's valuation could

suffer.

On Wednesday, the Fed held rates steady as expected but offered

little guidance on its future plans for monetary policy. Markets

had a muted reaction on Thursday.

Write to Jeannette Neumann at jeannette.neumann@wsj.com

(END) Dow Jones Newswires

July 28, 2016 07:29 ET (11:29 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

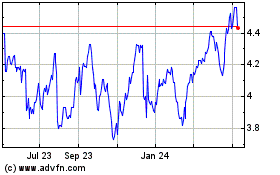

Telefonica (NYSE:TEF)

Historical Stock Chart

From Mar 2024 to Apr 2024

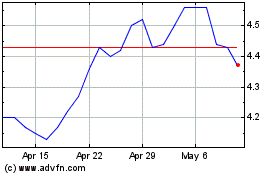

Telefonica (NYSE:TEF)

Historical Stock Chart

From Apr 2023 to Apr 2024