Telefónica Profit Falls Despite Latin American Sales Boost -- 2nd Update

November 06 2015 - 11:24AM

Dow Jones News

By David Román

MADRID-- Telefónica SA said it expects Europe's top antitrust

regulator will approve the planned sale of its O2 U.K. unit,

brushing aside market analysts' concern that the probe may derail

the $14 billion deal.

Speaking on Friday after the Spanish telecommunications firm

reported a third-quarter decline in net profit, Chief Financial

Officer Angel Vilá emphasized that the probe is being conducted by

the European Commission rather than the U.K. market regulator

Ofcom, which has been critical of the deal.

"We expect the deal to close in the second quarter 2016 provided

that the European Union doesn't stop the clock," Mr. Vilá told

analysts in a conference call. "We remain confident and optimistic

in the success of this deal."

The European Commission, the European Union's executive arm, is

looking into whether the sale of O2 to rival CK Hutchison Holdings

Ltd. may potentially lead to higher prices and less choice for U.K.

customers.

The sale would create the largest mobile-network operator in the

U.K. O2 is Britain's second-largest mobile operator, and Hutchison,

controlled by Hong Kong tycoon Li Ka-shing, already owns the

fourth-largest operator, Three U.K.

EU officials, including the bloc's antitrust chief, Margrethe

Vestager, had been warning that mobile-phone mergers in already

concentrated markets risked harming consumers. Scandinavian telecom

operators Telenor ASA and TeliaSonera AB abandoned plans to combine

their Danish operations in September after failing to secure

approval from EU authorities.

For Telefónica, completing the sale of O2 is a fundamental part

of a strategy focused on cutting debt while maintaining a strong

dividend policy that is a top draw for institutional investors such

as pension and investment funds. Telefónica said Friday that its

net debt, which peaked at EUR56.3 billion in 2011, has dropped

slowly and stood at EUR49.7 billion as of Sept. 30.

In a recent note to investors, analysts at Bankinter said that,

if the O2 deal is scrapped, Telefónica may be forced to switch from

a cash dividend to a less appealing scrip dividend, to be paid in

company shares.

The commission has until March 16 of next year to investigate

the proposed acquisition and decide whether to approve it or to ask

the companies for concessions to ease antitrust concerns.

Mr. Vilá said that Hutchison is leading what he called a

"constructive" discussion with the commission, with Telefónica

taking part.

He said Telefónica has considered "several possible

alternatives" to raise funds in case the sale is canceled,

including the sale of other assets like telephony towers.

Spain's economic slump in recent years has prompted Telefónica

to sell some units and focus its expansion on emerging Latin

American economies. That expansion led in the third quarter to a

11% rise in revenue to EUR11.9 billion, the company reported

Friday.

Sales in Spain, the company's largest single market, were up

0.2% to EUR3 billion, the annual growth in a given quarter in seven

years.

But third-quarter net profit was down 2% on the year, to EUR884

million, falling short of an eight-analyst consensus compiled by

FactSet that anticipated EUR1.05 billion in net profit.

The company said its operating margins narrowed in key markets,

a result of heavy investment to expand the business in Latin

America and secure premium clients in Spain and Germany.

Write to David Román at david.roman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 06, 2015 11:09 ET (16:09 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

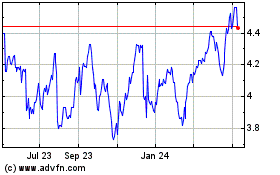

Telefonica (NYSE:TEF)

Historical Stock Chart

From Mar 2024 to Apr 2024

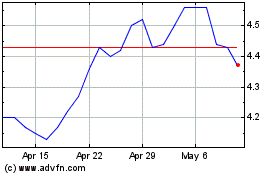

Telefonica (NYSE:TEF)

Historical Stock Chart

From Apr 2023 to Apr 2024