Telefonica Considers IPO of its O2 Unit

September 05 2016 - 4:16AM

Dow Jones News

By Jeannette Neumann and Ana García Ruiz

MADRID--Telefonica SA (TEF) is considering an initial public

offering of its British mobile operator O2 as the Spanish

telecommunications giant seeks to raise funds to whittle down its

debt.

Telefonica has already laid the groundwork for a potential IPO

of O2 and is considering other options, the company said Monday.

Telefonica would remain the main shareholder in all of the options

the Madrid-based company is considering.

The European Commission had blocked the company's sale of O2 to

CK Hutchison Holdings Ltd. (0001.HK) because the European Union's

executive branch said the deal would have resulted in higher prices

and fewer choices for U.K. customers. Telefonica executives have

been weighing their options for O2 since the sale was blocked in

May.

Telefonica said in a separate regulatory filing on Monday that

it is launching an IPO of its Telxius infrastructure unit, with a

free-float of at least 25%. The IPO is likely to happen before the

end of the year, after the company receives regulatory approval for

the deal.

Telefonica has more than 50 billion euros ($55.78 billion) in

debt, which has been a source of concern for credit-rating firms

and investors.

Telefonica shares were up 1% in Monday morning trading in

Madrid, valuing the company at EUR46 billion.

-Write to Jeannette Neumann at jeannette.neumann@wsj.com

(END) Dow Jones Newswires

September 05, 2016 04:01 ET (08:01 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

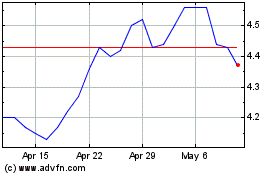

Telefonica (NYSE:TEF)

Historical Stock Chart

From Mar 2024 to Apr 2024

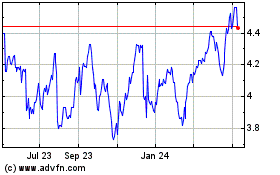

Telefonica (NYSE:TEF)

Historical Stock Chart

From Apr 2023 to Apr 2024