Telefonica Agrees on Sale of Up to 40% of Telxius to KKR for $1.35 Billion

February 21 2017 - 4:18AM

Dow Jones News

By Ian Walker

Telefonica S.A. (TEF) said it is selling 40% of infrastructure

unit Telxius Telecom S.A.U. to private-equity firm Kohlberg Kravis

Roberts & Co. for 1.28 billion euros ($1.35 billion), the

latest move by the Spanish telecom operator to reduce its

multibillion-euro debt burden.

The deal values the business at EUR3.2 billion, equivalent to

EUR12.75 a share. The price is at the bottom end of the EUR3

billion to EUR3.7 billion indicated range set by the company on

Feb. 10 when the Spanish company announced that it had received

several offers to buy a stake in the telecommunications-tower

business.

The sale of a stake in Telxius is part of the divestment plan

that the multinational has designed to reduce its high debt.

Initially, Telefonica considering floating the business on the

stock exchange, but canceled the plan when the likely valuation

proved too far below its expectations.

Telefonica said Tuesday the sale will have no impact on the

group earnings as it consists on the sale of a minority stake.

-Write to Ian Walker at ian.walker@wsj.com; @IanWalk40289749

(END) Dow Jones Newswires

February 21, 2017 04:03 ET (09:03 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

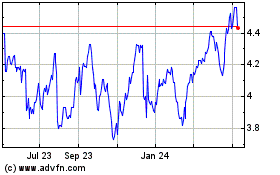

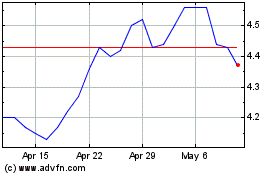

Telefonica (NYSE:TEF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Telefonica (NYSE:TEF)

Historical Stock Chart

From Apr 2023 to Apr 2024