Second Quarter Revenues of $528.6 million,

up 11.6% Versus Prior Year Period; up 12.9% on Constant Currency

Basis

Second Quarter GAAP Diluted EPS of $1.67, up

33.6% Over Prior Year Period

Second Quarter Adjusted Diluted EPS of

$2.04, up 7.9% Versus Prior Year Period

Raised 2017 Guidance Range for GAAP Revenue

Growth from a Range of 10.0% to 11.5% to a Range of 11.5% to

13.0%

Reaffirmed 2017 Guidance Range for Constant

Currency Revenue Growth of 12.5% to 14.0%

Raised 2017 Guidance for GAAP Diluted EPS

from a Range of $5.59 to $5.66 to a Range of $5.91 to $5.98

Raised 2017 Guidance for Adjusted Diluted

EPS from a Range of $8.05 to $8.23 to a Range of $8.20 to

$8.35

Teleflex Incorporated (NYSE: TFX) (the “Company”) today

announced financial results for the second quarter ended July 2,

2017.

Second quarter 2017 net revenues were $528.6 million, an

increase of 11.6% compared to the prior year period. Excluding the

impact of foreign currency exchange rate fluctuations, second

quarter 2017 net revenues increased 12.9% over the year ago

period.

Second quarter 2017 GAAP diluted earnings per share from

continuing operations increased 33.6% to $1.67, as compared to

$1.25 in the prior year period. Second quarter 2017 adjusted

diluted earnings per share from continuing operations increased

7.9% to $2.04, compared to $1.89 in the prior year period.

“During the second quarter of 2017, Teleflex continued to

achieve solid results across our strategic business units and

geographies, positioning us to reaffirm our full year constant

currency revenue growth guidance range, while enabling us to once

again increase our full year 2017 GAAP and adjusted earnings per

share guidance ranges,” said Benson Smith, Chairman and Chief

Executive Officer. “Setting aside the impact of Vascular Solutions

and one fewer shipping day in the quarter as compared to the second

quarter of 2016, Teleflex posted solid growth on a constant

currency basis, driven by strong performance in our OEM, Vascular

North America, Surgical North America and EMEA segments. In

addition, Vascular Solutions continues to perform in-line with our

expectations and the integration activities associated with this

acquisition remain on-track. Also within the quarter, we made

significant progress with our distributor to direct conversion in

China, and as such, we anticipate an acceleration in revenue growth

in the second half of the year in China, as compared to the

headwind we experienced during the first half of 2017."

Added Mr. Smith, "During the second quarter of 2017, we

continued to execute on our margin expansion initiatives,

delivering solid gross and operating margins. Finally, the Company

continued to generate strong cash flow, enabling us to repay

borrowings equivalent to approximately ten percent of the Vascular

Solutions purchase price within only a few months after closing the

transaction."

SECOND QUARTER NET REVENUE BY SEGMENT

The following table provides information regarding net revenues

in each of the Company's reportable operating segments and all of

its other operating segments for the three months ended July 2,

2017 and June 26, 2016 on both a GAAP and constant currency basis.

The discussion below the table of the principal factors behind

changes in net revenues for the three months ended July 2, 2017 as

compared to the prior year period applies to both GAAP revenue and

constant currency revenue, although GAAP revenue also was affected

by foreign currency exchange rate fluctuations, as indicated in the

"Foreign Currency" column of the table.

Three Months Ended %

Increase/ (Decrease) July 2, 2017 June

26, 2016

ConstantCurrency

ForeignCurrency

TotalChange

(Dollars in millions) Vascular North America $ 93.5 $

88.2 6.3 % (0.2 ) % 6.1 % Surgical North America 44.7 43.1 4.0 %

(0.3 ) % 3.7 % Anesthesia North America 49.1 49.2 (0.1 ) % (0.1 ) %

(0.2 ) % EMEA 132.0 131.7 3.2 % (3.0 ) % 0.2 % Asia 64.0 63.2 3.1 %

(1.8 ) % 1.3 % OEM 45.1 40.3 12.5 % (0.5 ) % 12.0 % All Other

100.2 57.9 73.1 % (0.1 ) % 73.0

% Total $ 528.6 $ 473.6 12.9 % (1.3 ) %

11.6 %

Vascular North America second quarter 2017 net revenues were

$93.5 million, an increase of 6.1% compared to the prior year

period. Excluding the impact of foreign currency exchange rate

fluctuations, second quarter 2017 net revenues increased 6.3%

compared to the prior year period. The increase in constant

currency revenue is primarily attributable to an increase in sales

volumes of existing products, which reflects the unfavorable impact

of one less shipping day in the second quarter 2017, and an

increase in new product sales.

Surgical North America second quarter 2017 net revenues were

$44.7 million, an increase of 3.7% compared to the prior year

period. Excluding the impact of foreign currency exchange rate

fluctuations, second quarter 2017 net revenues increased 4.0%

compared to the prior year period. The increase in constant

currency revenue is primarily attributable to an increase in new

product sales and price increases. Sales volumes of existing

products, which were marginally higher than in the prior year

period, were adversely affected by the impact of one less shipping

day in the second quarter 2017.

Anesthesia North America second quarter 2017 net revenues were

$49.1 million, a decrease of 0.2% compared to the prior year

period. Excluding the impact of foreign currency exchange rate

fluctuations, second quarter 2017 net revenues decreased 0.1%

compared to the prior year period. The decrease in constant

currency revenue is primarily attributable to a decrease in sales

volumes of existing products, which reflects the unfavorable impact

of one less shipping day in the second quarter 2017, partially

offset by an increase in net revenues generated by an acquired

business and an increase in new product sales.

EMEA second quarter 2017 net revenues were $132.0 million, an

increase of 0.2% compared to the prior year period. Excluding the

impact of foreign currency exchange rate fluctuations, second

quarter 2017 net revenues increased 3.2% compared to the prior year

period. The increase in constant currency revenue is primarily

attributable to an increase in sales volumes of existing products,

despite the unfavorable impact of one less shipping day in the

second quarter 2017, and an increase in new product sales.

Asia second quarter 2017 net revenues were $64.0 million, an

increase of 1.3% compared to the prior year period. Excluding the

impact of foreign currency exchange rate fluctuations, second

quarter 2017 net revenues increased 3.1%. The increase in constant

currency revenue is primarily attributable to price increases and

an increase in new product sales. Increases in sales volumes of

existing products were more than offset by volume declines

resulting from the distributor to direct sales conversion in

China.

OEM and Development Services (“OEM”) second quarter 2017 net

revenues were $45.1 million, an increase of 12.0% compared to the

prior year period. Excluding the impact of foreign currency

exchange rate fluctuations, second quarter 2017 net revenues

increased 12.5% compared to the prior year period. The increase in

constant currency revenue is primarily attributable to net revenues

generated by an acquired business and an increase in sales volumes

of existing products.

All Other second quarter 2017 net revenues were $100.2 million,

an increase of 73.0% compared to the prior year period. Excluding

the impact of foreign currency exchange rate fluctuations, second

quarter 2017 net revenues increased 73.1% compared to the prior

year period. The increase in constant currency revenue is primarily

attributable to net revenues generated by sales of Vascular

Solutions' products.

OTHER FINANCIAL HIGHLIGHTS AND KEY PERFORMANCE

METRICS

Depreciation expense, amortization of intangible assets and

deferred financing charges for the first six months of 2017 totaled

$72.3 million compared to $64.6 million for the prior year

period.

Cash and cash equivalents at July 2, 2017 were $676.2 million

compared to $543.8 million at December 31, 2016.

Net accounts receivable at July 2, 2017 were $303.7 million

compared to $272.0 million at December 31, 2016.

Net inventories at July 2, 2017 were $368.5 million compared to

$316.2 million at December 31, 2016.

2017 OUTLOOK

The Company raised its full year 2017 GAAP revenue growth

guidance range from 10.0% to 11.5% to a range of 11.5% to 13.0%

over the prior year. The Company's previous 2017 GAAP revenue

growth guidance range reflected the anticipated 2.5% unfavorable

impact of foreign currency exchange rate fluctuations. The

Company's current 2017 GAAP revenue growth guidance range reflects

an anticipated 1.0% unfavorable impact of foreign currency exchange

rate fluctuations. On a constant currency basis, the Company

reaffirmed its estimate that revenues for full year 2017 will

increase 12.5% to 14.0%. The forecasted revenue growth includes the

impact of Vascular Solutions' product sales, which are expected to

contribute approximately 8.5% to 9.0% to our revenue growth on a

GAAP and constant currency basis.

The Company raised its full year 2017 GAAP diluted earnings per

share from continuing operations guidance from a range of $5.59 to

$5.66 to a range of $5.91 to $5.98. The Company raised its full

year 2017 adjusted diluted earnings per share from continuing

operations guidance from a range of $8.05 to $8.23 to a guidance

range of $8.20 to $8.35.

Forecasted 2017 Constant Currency Revenue

Growth Reconciliation

Low High Forecasted 2017 GAAP

revenue growth 11.5 % 13.0 % Estimated impact

of foreign currency exchange rate fluctuations 1.0 %

1.0 % Forecasted 2017 constant currency revenue

growth 12.5 % 14.0 %

Forecasted 2017 Adjusted Earnings Per

Share Reconciliation

Low High Diluted earnings per

share attributable to common shareholders $5.91 $5.98

Restructuring, impairment charges and special items, net of tax

$0.96 $1.00 Intangible amortization expense, net of tax

$1.32 $1.35 Amortization of debt discount on convertible

notes, net of tax $0.01 $0.02 Adjusted

diluted earnings per share $8.20 $8.35

CONFERENCE CALL WEBCAST AND ADDITIONAL INFORMATION

As previously announced, Teleflex will comment on its financial

results on a conference call to be held today at 8:00 a.m. (ET).

The call will be available live and archived on the company’s

website at www.teleflex.com and

the accompanying presentation will be posted prior to the call. An

audio replay will be available until August 10, 2017 at 11:59pm

(ET), by calling 855-859-2056 (U.S./Canada) or 404-537-3406

(International), Passcode: 56173289.

ADDITIONAL NOTES

References in this release to the impact of foreign currency

exchange rate fluctuations on adjusted diluted earnings per share

include both the impact of translating foreign currencies into U.S.

dollars and the impact of foreign currency exchange rate

fluctuations on foreign currency denominated transactions.

In the discussion of segment results, "new products" refers to

products we have sold for 36 months or less, and "existing

products" refers to products we have sold for more than 36

months.

Certain financial information is presented on a rounded basis,

which may cause minor differences.

Segment results and commentary exclude the impact of

discontinued operations.

NOTES ON NON-GAAP FINANCIAL MEASURES

This press release includes certain non-GAAP financial measures,

which include:

Adjusted diluted earnings per share. This non-GAAP measure is

based upon diluted earnings per share, adjusted to exclude,

depending on the period presented (i) restructuring and other

impairment charges; (ii) certain losses and other charges,

including, for 2017, costs related to the Company's acquisition of

Vascular Solutions, facility consolidation costs and income

associated with a litigation settlement and, for 2016, charges

primarily related to facility consolidation costs; (iii)

amortization of the debt discount on the Company’s convertible

notes; (iv) intangible amortization expense; (v) tax benefits

resulting primarily from the expiration of applicable statutes of

limitations for prior year returns, the resolution of audits, the

filing of amended returns with respect to prior tax years and/or

tax law changes affecting the Company's deferred tax liability; and

(vi) loss on extinguishment of debt. In addition, the calculation

of diluted shares within adjusted earnings per share gives effect

to the anti-dilutive impact of the Company’s convertible note hedge

agreements, which reduce the potential economic dilution that

otherwise would occur upon conversion of the Company’s senior

subordinated convertible notes (under GAAP, the anti-dilutive

impact of the convertible note hedge agreements is not reflected in

diluted shares).

Constant currency revenue growth. This non-GAAP measure is based

upon net revenues, adjusted to eliminate the impact of translating

the results of international subsidiaries at different currency

exchange rates from period to period.

Management believes these measures are useful to investors

because they eliminate items that do not reflect Teleflex’s

day-to-day operations and, as a result, they facilitate comparisons

of financial results exclusive of items that can fluctuate in a

manner that may not reflect the performance of our business. In

addition, management believes that the calculation of non-GAAP

diluted shares is useful to investors because it provides insight

into the offsetting economic effect of the convertible note hedge

against conversions of the convertible notes. Management uses these

financial measures for internal managerial purposes, when publicly

providing guidance on possible future results, and to assist in our

evaluation of period-to-period comparisons. These financial

measures are presented in addition to results presented in

accordance with generally accepted accounting principles (“GAAP”)

and should not be relied upon as a substitute for GAAP financial

measures. Tables reconciling historical adjusted diluted earnings

per share to historical GAAP earnings per share are set forth

below. A table reconciling historical constant currency net

revenues to GAAP net revenues is set forth above under “Second

Quarter Net Revenues by Segment.” Tables reconciling forecasted

2017 constant currency revenue growth and forecasted 2017 adjusted

earnings per share to their respective most directly comparable

forecasted GAAP measures are set forth above under “2017

Outlook.”

RECONCILIATION OF CONSOLIDATED

STATEMENT OF INCOME ITEMS

Dollars in millions, except per share

amounts

Quarter Ended - July 2, 2017

Cost of goods sold

Selling, general and administrative

expenses

Research and development

expenses

Restructuring and other impairment

charges

(Gain) loss on sale of business and

assets

Interest expense, net

Loss on extinguishment of debt,

net

Income taxes

Net income (loss) attributable to

common shareholders from continuing operations

Diluted earnings per share available to

common shareholders

Shares used in calculation of GAAP and

adjusted earnings per share

GAAP Basis $238.3 $158.9 $20.3 $0.9 — $19.7 $0.0 $12.1 $78.4 $1.67

46,818 Adjustments

Restructuring and other impairment

charges

— — — 0.9 — — — 0.5 0.3 $0.01 —

Losses and other charges, net (A)

5.0 (6.3 ) 0.3 — — — — (0.4 ) (0.5 ) ($0.02 ) —

Amortization of debt discount on

convertible notes

— — — — — 0.4 — 0.1 0.2 $0.01 —

Intangible amortization expense

— 22.5 0.1 — — — — 6.5 16.1 $0.34 —

Tax adjustment (B)

— — — — — — — — — — —

Loss on extinguishment of debt, net

— — — — — — 0.0 0.0 0.0 $0.00 —

Shares due to Teleflex under note hedge

(C)

— — — — — — — — — $0.02 (501 )

Adjusted basis

$233.3 $142.7 $19.8 — — $19.4 — $18.8 $94.6 $2.04 46,317

Quarter Ended - June 26, 2016

Cost of goods sold

Selling, general and administrative

expenses

Research and development

expenses

Restructuring and other impairment

charges

(Gain) loss on sale of business and

assets

Interest expense, net

Loss on extinguishment of debt,

net

Income taxes

Net income (loss) attributable to

common shareholders from continuing operations

Diluted earnings per share available to

common shareholders

Shares used in calculation of GAAP and

adjusted earnings per share

GAAP Basis $217.2 $143.0 $15.5 ($0.1) ($0.4 ) $11.8 $19.3 $8.0

$59.1 $1.25 47,246 Adjustments

Restructuring and other impairment

charges

— — — (0.1 ) — — — 0.1 (0.2 ) ($0.00) —

Losses and other charges, net (A)

4.0 1.2 0.0 — (0.4 ) — — 1.9 2.9 $0.07 —

Amortization of debt discount on

convertible notes

— — — — — 1.4 — 0.5 0.9 $0.02 —

Intangible amortization expense

— 15.9 0.1 — — — — 4.3 11.8 $0.25 —

Tax adjustment (B)

— — — — — — — 0.5 (0.5 ) ($0.01 ) —

Loss on extinguishment of debt, net

— — — — — — 19.3 7.0 12.2 $0.26 —

Shares due to Teleflex under note hedge

(C)

— — — — — — — — — $0.07 (1,675 ) Adjusted basis $213.2 $125.9 $15.3

— — $10.3 — $22.4 $86.2 $1.89 45,571

(A) In 2017, losses and other charges, net related primarily to

income associated with a litigation settlement, somewhat offset by

costs associated with the acquisition of Vascular Solutions and

facility consolidation costs. In 2016, losses and other charges,

net related primarily to facility consolidations.

(B) The tax adjustment represents a net benefit resulting

primarily from the expiration of applicable statutes of limitations

for prior year returns, the resolution of audits, the filing of

amended returns with respect to prior tax years and/or tax law

changes affecting our deferred tax liability.

(C) Adjusted diluted shares are calculated by giving effect to

the anti-dilutive impact of the Company’s convertible note hedge

agreements, which reduce the potential economic dilution that

otherwise would occur upon conversion of the Company's convertible

notes. Under GAAP, the anti-dilutive impact of the convertible note

hedge agreements is not reflected in diluted shares.

RECONCILIATION OF CONSOLIDATED

STATEMENT OF INCOME ITEMS

Dollars in millions, except per share

amounts

Year-to-date Ended - July 2, 2017

Cost of goods sold

Selling, general and administrative

expenses

Research and development

expenses

Restructuring and other impairment

charges

(Gain) loss on sale of business and

assets

Interest expense, net

Loss on extinguishment of debt,

net

Income taxes

Net income (loss) attributable to

common shareholders from continuing operations

Diluted earnings per share available to

common shareholders

Shares used in calculation of GAAP and

adjusted earnings per share

GAAP Basis $470.7 $322.9 $38.1 $13.8 — $37.3 $5.6 $9.4 $118.7 $2.54

46,716 Adjustments

Restructuring and other impairment

charges

— — — 13.8 — — — 3.5 10.3 $0.22 —

Losses and other charges, net (A)

16.6 3.3 0.6 — — 2.1 — 7.3 15.2 $0.33 —

Amortization of debt discount on

convertible notes

—

— — — — 0.8 — 0.3 0.5 $0.01 —

Intangible amortization expense

— 41.2 0.2 — — — — 11.6 29.8 $0.64 —

Tax adjustment (B)

— — — — — — — 0.5 (0.5 ) ($0.01) —

Loss on extinguishment of debt, net

— — — — — — 5.6 2.0 3.5 $0.08 —

Shares due to Teleflex under note hedge

(C)

— — — — — — — — — $0.04 (489 )

Adjusted basis

$454.1 $278.4 $37.3 — — $34.5 — $34.7 $177.5 $3.84 46,227

Year-to-date Ended - June 26, 2016

Cost of goods sold

Selling, general and administrative

expenses

Research and development

expenses

Restructuring and other impairment

charges

(Gain) loss on sale of business and

assets

Interest expense, net

Loss on extinguishment of debt,

net

Income taxes

Net income (loss) attributable to

common shareholders from continuing operations

Diluted earnings per share available to

common shareholders

Shares used in calculation of GAAP and

adjusted earnings per share

GAAP Basis $416.9 $279.3 $27.8 $9.8 ($1.4 ) $25.5 $19.3 $10.6

$110.1 $2.29 48,014 Adjustments

Restructuring and other impairment

charges

— — — 9.8 — — — 2.4 7.4 $0.15 —

Losses and other charges, net (A)

6.6 1.8 0.0 — (1.4 ) — — 2.8 4.4 $0.08 —

Amortization of debt discount on

convertible notes

—

—

— — — 4.9 — 1.8 3.1 $0.06 —

Intangible amortization expense

— 31.2 0.2 — — — — 8.4 23.0 $0.48 —

Tax adjustment (B)

— — — — — — — 5.5 (5.5 ) ($0.11 ) —

Loss on extinguishment of debt, net

— — — — — — 19.3 7.0 12.2 $0.25 —

Shares due to Teleflex under note hedge

(C)

— — — — — — — — — $0.19 (2,648 ) Adjusted basis $410.3 $246.3 $27.6

— — $20.6 — $38.5 $154.7 $3.41 45,366

(A) In 2017, losses and other charges, net related primarily to

costs associated with the acquisition of Vascular Solutions and

facility consolidation costs, somewhat offset by income associated

with a litigation settlement. In 2016, losses and other charges,

net related primarily to facility consolidations.

(B) The tax adjustment represents a net benefit resulting

primarily from the expiration of applicable statutes of limitations

for prior year returns, the resolution of audits, the filing of

amended returns with respect to prior tax years and/or tax law

changes affecting our deferred tax liability.

(C) Adjusted diluted shares are calculated by giving effect to

the anti-dilutive impact of the Company’s convertible note hedge

agreements, which reduce the potential economic dilution that

otherwise would occur upon conversion of the Company's convertible

notes. Under GAAP, the anti-dilutive impact of the convertible note

hedge agreements is not reflected in diluted shares.

ABOUT TELEFLEX INCORPORATED

Teleflex is a global provider of medical technologies designed

to improve the health and quality of people’s lives. We apply

purpose driven innovation - a relentless pursuit of identifying

unmet clinical needs - to benefit patients and healthcare

providers. Our portfolio is diverse, with solutions in the fields

of vascular and interventional access, surgical, anesthesia,

cardiac care, urology, emergency medicine and respiratory care.

Teleflex employees worldwide are united in the understanding that

what we do every day makes a difference. For more information,

please visit teleflex.com.

Teleflex is the home of Arrow®, Deknatel®, Hudson RCI®, LMA®,

Pilling®, Rusch® and Weck® - trusted brands united by a common

sense of purpose.

CAUTION CONCERNING FORWARD-LOOKING INFORMATION

This press release contains forward-looking statements,

including, but not limited to, forecasted 2017 GAAP and constant

currency revenue growth and GAAP and adjusted diluted earnings per

share. Actual results could differ materially from those in the

forward-looking statements due to, among other things, changes in

business relationships with and purchases by or from major

customers or suppliers; delays or cancellations in shipments;

demand for and market acceptance of new and existing products; our

inability to integrate acquired businesses into our operations,

realize planned synergies and operate such businesses profitably in

accordance with our expectations; our inability to effectively

execute our restructuring programs; our inability to realize

anticipated savings from restructuring plans and programs; the

impact of healthcare reform legislation and proposals to amend the

legislation; changes in Medicare, Medicaid and third party coverage

and reimbursements; competitive market conditions and resulting

effects on revenues and pricing; increases in raw material costs

that cannot be recovered in product pricing; global economic

factors, including currency exchange rates, interest rates,

sovereign debt issues and the impact of the United Kingdom's vote

to leave the European Union; difficulties in entering new markets;

general economic conditions; and other factors described or

incorporated in our filings with the Securities and Exchange

Commission, including our most recently filed Annual Report on Form

10-K.

TELEFLEX INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME

(Unaudited)

Three Months Ended Six Months Ended July 2,

2017 June 26, 2016 July 2, 2017

June 26, 2016 (Dollars and shares in

thousands, except per share) Net revenues $ 528,613 $ 473,553 $

1,016,494 $ 898,446 Cost of goods sold 238,329

217,154 470,650 416,900 Gross

profit 290,284 256,399 545,844 481,546 Selling, general and

administrative expenses 158,934 142,983 322,903 279,331 Research

and development expenses 20,278 15,472 38,105 27,825 Restructuring

charges 870 (119 ) 13,815 9,849 Gain on sale of assets —

(378 ) — (1,397 ) Income from

continuing operations before interest, loss on extinguishment of

debt and taxes 110,202 98,441 171,021 165,938 Interest expense

19,894 11,907 37,620 25,691 Interest income (161 ) (129 ) (330 )

(209 ) Loss on extinguishment of debt 11

19,261 5,593 19,261 Income from

continuing operations before taxes 90,458 67,402 128,138 121,195

Taxes on income from continuing operations 12,095

8,007 9,426 10,620 Income

from continuing operations 78,363 59,395

118,712 110,575 Operating income

(loss) from discontinued operations (566 ) 6 (848 ) (376 ) Benefit

on income (loss) from discontinued operations (206 )

(187 ) (309 ) (257 ) Income (loss) from discontinued

operations (360 ) 193

(539 ) (119 ) Net income 78,003 59,588 118,173 110,456 Less:

Income from continuing operations attributable to noncontrolling

interest — 285 —

464 Net income attributable to common shareholders $ 78,003

$ 59,303 $ 118,173 $ 109,992 Earnings

per share available to common shareholders: Basic: Income from

continuing operations $ 1.74 $ 1.36 $ 2.64 $ 2.58 Income (loss)

from discontinued operations (0.01 ) —

(0.01 ) — Net income $ 1.73 $ 1.36 $

2.63 $ 2.58 Diluted: Income from continuing

operations $ 1.67 $ 1.25 $ 2.54 $ 2.29 Loss from discontinued

operations — 0.01 (0.01 )

— Net income $ 1.67 $ 1.26 $ 2.53 $

2.29 Dividends per share $ 0.34 $ 0.34 $ 0.68 $ 0.68

Weighted average common shares outstanding Basic 44,996 43,549

44,945 42,598 Diluted 46,818 47,246 46,716 48,014 Amounts

attributable to common shareholders: Income from continuing

operations, net of tax $ 78,363 $ 59,110 $ 118,712 $ 110,111 Income

(loss) from discontinued operations, net of tax (360 )

193 (539 ) (119 ) Net income $ 78,003

$ 59,303 $ 118,173 $ 109,992

TELEFLEX INCORPORATED

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

July 2, 2017 December 31, 2016 (Dollars in

thousands) ASSETS Current assets Cash and cash

equivalents $ 676,214 $ 543,789 Accounts receivable, net 303,702

271,993 Inventories, net 368,526 316,171 Prepaid expenses and other

current assets 47,298 40,382 Prepaid taxes 11,878 8,179 Assets held

for sale — 2,879 Total current assets 1,407,618 1,183,393

Property, plant and equipment, net 369,301 302,899 Goodwill

1,854,076

1,276,720 Intangible assets, net

1,612,904

1,091,663 Deferred tax assets 1,963 1,712 Other assets 44,162

34,826 Total assets $

5,290,024

$ 3,891,213

LIABILITIES AND EQUITY Current

liabilities Current borrowings $ 112,039 $ 183,071 Accounts payable

81,973 69,400 Accrued expenses 85,050 65,149 Current portion of

contingent consideration 584 587 Payroll and benefit-related

liabilities 78,951 82,679 Accrued interest 5,294 10,450 Income

taxes payable 3,438 7,908 Other current liabilities 8,722

8,402 Total current liabilities 376,051 427,646 Long-term

borrowings 1,887,716 850,252 Deferred tax liabilities 468,034

271,377 Pension and postretirement benefit liabilities 128,335

133,062 Noncurrent liability for uncertain tax positions 18,378

17,520 Other liabilities 52,981 52,015 Total liabilities

2,931,495 1,751,872 Commitments and contingencies Convertible notes

- redeemable equity component — 1,824 Mezzanine equity —

1,824 Total shareholders' equity

2,358,529

2,137,517 Total liabilities and shareholders' equity $

5,290,024

$ 3,891,213

TELEFLEX INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited)

Six Months Ended July 2, 2017

June 26, 2016 (Dollars in thousands) Cash flows from

operating activities of continuing operations: Net income $ 118,173

$ 110,456 Adjustments to reconcile net income to net cash provided

by operating activities: Loss from discontinued operations 539 119

Depreciation expense 28,084 26,609 Amortization expense of

intangible assets 41,375 31,397 Amortization expense of deferred

financing costs and debt discount 2,825 6,554 Loss on

extinguishment of debt 5,593 19,261 Gain on sale of assets — (1,397

) Fair value step up of acquired inventory sold 10,442 — Changes in

contingent consideration (237 ) 1,242 Stock-based compensation

9,534 7,949 Deferred income taxes, net (8,779 ) (1,292 ) Other

(3,300 ) (1,970 ) Changes in operating assets and liabilities, net

of effects of acquisitions and disposals: Accounts receivable 5,071

(10,237 ) Inventories (12,187 ) (3,284 ) Prepaid expenses and other

current assets 4 238 Accounts payable and accrued expenses 6,541

(3,500 ) Income taxes receivable and payable, net (5,988 )

(657 ) Net cash provided by operating activities from

continuing operations 197,690 181,488

Cash flows from investing activities of continuing operations:

Expenditures for property, plant and equipment (36,833 ) (19,535 )

Proceeds from sale of assets 6,332 3,985 Payments for businesses

and intangibles acquired, net of cash acquired (993,459 )

(3,117 ) Net cash used in investing activities from

continuing operations (1,023,960 ) (18,667 ) Cash

flows from financing activities of continuing operations: Proceeds

from new borrowings 1,194,500 665,000 Reduction in borrowings

(228,273 ) (656,479 ) Debt extinguishment, issuance and amendment

fees (19,114 ) (8,182 ) Net proceeds from share based compensation

plans and the related tax impacts 1,305 6,593 Payments for

contingent consideration (153 ) (133 ) Dividends paid

(30,590 ) (28,998 ) Net cash provided by (used in) financing

activities from continuing operations 917,675

(22,199 ) Cash flows from discontinued operations: Net cash used in

operating activities (961 ) (1,183 ) Net cash used in

discontinued operations (961 ) (1,183 ) Effect of

exchange rate changes on cash and cash equivalents 41,981

(1,315 ) Net increase in cash and cash equivalents

132,425 138,124 Cash and cash equivalents at the beginning of the

period 543,789 338,366 Cash and cash

equivalents at the end of the period $ 676,214 $ 476,490

Non cash financing activities of continuing

operations: Settlement and exchange of convertible notes with

common or treasury stock $ 983 $ 35,197 Acquisition of treasury

stock associated with settlement and exchange of convertible note

hedge and warrant agreements $ 19,361 $ 85,895

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170803005050/en/

Teleflex IncorporatedJake ElguiczeTreasurer and Vice President

of Investor Relations610-948-2836

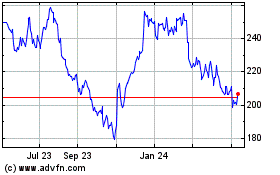

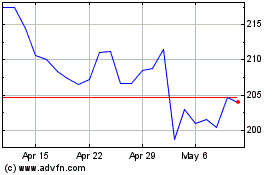

Teleflex (NYSE:TFX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Teleflex (NYSE:TFX)

Historical Stock Chart

From Apr 2023 to Apr 2024