Second Quarter Revenues of $473.6 million,

Up 4.8% Versus Prior Year Period; Up 5.0% on Constant Currency

Basis

Second Quarter GAAP Diluted EPS of $1.25, Up

34.4% Over the Prior Year Period

Second Quarter Adjusted Diluted EPS of

$1.89, up 33.1%

Reaffirmed 2016 Guidance Ranges for

As-Reported Revenue Growth of 3.0% to 4.0% and Constant Currency

Revenue Growth of 5.0% to 6.0%

Raised 2016 Guidance Range for GAAP Diluted

EPS from $5.32 to $5.37 to $5.34 to $5.41

Raised 2016 Guidance Range for Adjusted

Diluted EPS from $7.10 to $7.25 to $7.20 to $7.32

Teleflex Incorporated (NYSE: TFX) (the “Company”) today

announced financial results for the second quarter ended June 26,

2016.

Second quarter 2016 net revenues were $473.6 million, an

increase of 4.8% compared to the prior year period. Excluding the

impact of foreign currency exchange rate fluctuations, second

quarter 2016 net revenues increased 5.0% over the year ago

period.

Second quarter 2016 GAAP diluted earnings per share from

continuing operations increased 34.4% to $1.25, as compared to

$0.93 in the prior year period. Second quarter 2016 adjusted

diluted earnings per share from continuing operations increased

33.1% to $1.89, compared to $1.42 in the prior year period.

“As we anticipated, Teleflex's second quarter GAAP and constant

currency revenue growth reflected improving trends on both a

year-over-year and sequential basis, led by our key North American

strategic business units,” said Benson Smith, Chairman and Chief

Executive Officer. “The revenue growth performance in the quarter

positions the Company to achieve our previously provided full year

2016 GAAP and constant currency revenue growth guidance ranges. In

addition, we were particularly pleased with our strong earnings per

share performance for the quarter, which was primarily due to our

continued expansion of gross and operating margins."

Added Smith, "Based on this performance and our outlook for the

remainder of the year, we are increasing our full year GAAP

earnings per share guidance range from $5.32 to $5.37 to $5.34 to

$5.41 and our adjusted diluted earnings per share guidance range

from $7.10 to $7.25 to $7.20 to $7.32."

SECOND QUARTER NET REVENUE BY SEGMENT

The following table provides information regarding net revenues

in each of the Company's reportable operating segments and all of

its other operating segments for the three months ended June 26,

2016 and June 28, 2015 on both a GAAP and constant currency basis.

The discussion below the table of the principal factors behind

changes in net revenues for the three months ended June 26, 2016 as

compared to the prior year period applies to both GAAP revenue and

constant currency revenue, although GAAP revenue also was affected

by foreign currency exchange rate fluctuations, as indicated in the

"Foreign Currency" column of the table.

Three Months Ended %

Increase/ (Decrease) June 26, 2016 June

28, 2015

Constant

Currency

Foreign

Currency

Total

Change

(Dollars in millions) Vascular North America $ 88.2 $ 81.2 8.8 %

(0.2) % 8.6 % Surgical North America 43.1 40.5 6.8 % (0.3) % 6.5 %

Anesthesia North America 49.2 45.6 8.2 % (0.3) % 7.9 % EMEA 131.7

129.1 1.3 % 0.7 % 2.0 % Asia 63.2 62.1 3.6 % (1.7) % 1.9 % OEM 40.3

37.9 5.9 % 0.4 % 6.3 % All Other 57.9 55.7 5.4 %

(1.4) % 4.0 % Total $ 473.6 $ 452.1 5.0 % (0.2) % 4.8 %

Vascular North America second quarter 2016 net revenues were

$88.2 million, an increase of 8.6% compared to the prior year

period. Excluding the impact of foreign currency fluctuations,

second quarter 2016 net revenues increased 8.8% compared to the

prior year period. The increase in revenue was largely due to

higher sales volumes of existing products, price increases and an

increase in new product sales.

Surgical North America second quarter 2016 net revenues were

$43.1 million, an increase of 6.5% compared to the prior year

period. Excluding the impact of foreign currency fluctuations,

second quarter 2016 net revenues increased 6.8% compared to the

prior year period. The increase in revenue was largely due to an

increase in new product sales, higher sales volumes of existing

products and price increases.

Anesthesia North America second quarter 2016 net revenues were

$49.2 million, an increase of 7.9% compared to the prior year

period. Excluding the impact of foreign currency fluctuations,

second quarter 2016 net revenues increased 8.2% compared to the

prior year period. The increase in revenue was largely due to

higher sales volumes of existing products and an increase in new

product sales.

EMEA second quarter 2016 net revenues were $131.7 million, an

increase of 2.0% compared to the prior year period. Excluding the

impact of foreign currency fluctuations, second quarter 2016 net

revenues increased 1.3% compared to the prior year period. The

increase in revenue was largely due to higher sales volumes of

existing products and an increase in new product sales, somewhat

offset by a decline in the average selling prices of products.

Asia second quarter 2016 net revenues were $63.2 million, an

increase of 1.9% compared to the prior year period. Excluding the

impact of foreign currency fluctuations, second quarter 2016 net

revenues increased 3.6% compared to the prior year period. The

increase in revenue was largely due to higher sales volumes of

existing products.

OEM and Development Services (“OEM”) second quarter 2016 net

revenues were $40.3 million, an increase of 6.3% compared to the

prior year period. Excluding the impact of foreign currency

fluctuations, second quarter 2016 net revenues increased 5.9%

compared to the prior year period. The increase in revenue was

largely due to an increase in new product sales and higher sales

volumes of existing products.

OTHER FINANCIAL HIGHLIGHTS AND KEY PERFORMANCE

METRICS

Depreciation expense, amortization of intangible assets and

deferred financing charges for the first six months of 2016

aggregated $64.6 million compared to $60.6 million for the prior

year period.

Cash and cash equivalents at June 26, 2016 were $476.5 million

compared to $338.4 million at December 31, 2015.

Net accounts receivable at June 26, 2016 were $273.5 million

compared to $262.4 million at December 31, 2015.

Net inventories at June 26, 2016 were $338.5 million compared to

$330.3 million at December 31, 2015.

2016 OUTLOOK

The Company reaffirmed its estimates that revenues for full year

2016 are expected to increase 3.0% to 4.0% over prior year on a

GAAP basis, and 5.0% to 6.0% on a constant currency basis.

The Company increased its full year 2016 GAAP diluted earnings

per share from continuing operations guidance from a range of $5.32

to $5.37 to a range of $5.34 to $5.41. This new range represents an

increase of 8.8% to 10.2% over 2015. In addition, the Company

increased its full year 2016 adjusted diluted earnings per share

from continuing operations guidance from a range of $7.10 to $7.25

to a range of $7.20 to $7.32. This new range represents an increase

of 13.7% to 15.6% over 2015, which reflects our expectation that

foreign currencies will have an approximately neutral impact on

adjusted earnings per share.

FORECASTED 2016 CONSTANT CURRENCY

REVENUE GROWTH RECONCILIATION

Low High

Forecasted 2016 GAAP revenue growth 3.0 % 4.0 %

Estimated impact of foreign currency fluctuations 2.0 %

2.0 % Forecasted 2016 constant currency

revenue growth 5.0 % 6.0 %

FORECASTED 2016 ADJUSTED EARNINGS PER

SHARE RECONCILIATION

Low High Diluted earnings

per share attributable to common shareholders $ 5.34 $ 5.41

Restructuring, impairment charges and special items, net of tax $

0.83 $ 0.86 Intangible amortization expense, net of tax $

0.95 $ 0.97 Amortization of debt discount on convertible

notes, net of tax $ 0.08 $ 0.08

Adjusted diluted earnings per share $ 7.20 $

7.32

CONFERENCE CALL WEBCAST AND ADDITIONAL INFORMATION

As previously announced, Teleflex will comment on its financial

results on a conference call to be held today at 8:00 a.m. (ET).

The call will be available live and archived on the company’s

website at www.teleflex.com and the accompanying

presentation will be posted prior to the call. An audio replay will

be available until August 2, 2016 at 11:59pm (ET), by calling

855-859-2056 (U.S./Canada) or 404-537-3406 (International),

Passcode: 47983139.

ADDITIONAL NOTES

References in this release to the impact of foreign currency on

adjusted diluted earnings per share include both the impact of

translating foreign currencies into U.S. dollars and the impact of

foreign currency exchange rate fluctuations on foreign currency

denominated transactions.

In the discussion of segment results, "new products" refers to

products we have sold for 36 months or less, and "existing

products" refers to products we have sold for more than 36

months.

Certain financial information is presented on a rounded basis,

which may cause minor differences.

Segment results and commentary exclude the impact of

discontinued operations.

NOTES ON NON-GAAP FINANCIAL MEASURES

This press release includes certain non-GAAP financial measures,

which include:

Adjusted diluted earnings per share. This measure excludes,

depending on the period presented (i) restructuring and other

impairment charges; (ii) certain losses and other charges,

including charges related to facility consolidations and

acquisitions and integration costs, net of the gain on sale of an

asset and reversal of charges related to contingent consideration

and a litigation verdict against the Company with respect to a

non-operating joint venture; (iii) amortization of the debt

discount on the Company’s convertible notes; (iv) intangible

amortization expense; (v) loss on extinguishment of debt; and (vi)

tax benefits resulting primarily from the resolution of audits of

prior year returns and tax law changes affecting the Company's

deferred tax liability. In addition, the calculation of diluted

shares within adjusted earnings per share gives effect to the

anti-dilutive impact of the Company’s convertible note hedge

agreements, which reduce the potential economic dilution that

otherwise would occur upon conversion of the Company’s senior

subordinated convertible notes (under GAAP, the anti-dilutive

impact of the convertible note hedge agreements is not reflected in

diluted shares).

Constant currency revenue growth. This measure excludes the

impact of translating the results of international subsidiaries at

different currency exchange rates from period to period.

Management believes these measures are useful to investors

because they eliminate items that do not reflect Teleflex’s

day-to-day operations. In addition, management believes that the

calculation of non-GAAP diluted shares is useful to investors

because it provides insight into the offsetting economic effect of

the convertible note hedge against conversions of the convertible

notes. Management uses these financial measures for internal

managerial purposes, when publicly providing guidance on possible

future results, and to assist in our evaluation of period-to-period

comparisons. These financial measures are presented in addition to

results presented in accordance with generally accepted accounting

principles (“GAAP”) and should not be relied upon as a substitute

for GAAP financial measures. Tables reconciling historical adjusted

diluted earnings per share to historical GAAP earnings per share

are set forth below. Tables reconciling constant currency net

revenues to GAAP net revenues and reconciling forecasted non-GAAP

measures to the most directly comparable forecasted GAAP measures

are set forth above.

RECONCILIATION OF CONSOLIDATED

STATEMENT OF INCOME ITEMS

Dollars in millions, except per share

amounts

Quarter Ended – June 26, 2016

Cost of

goods

sold

Selling,

general and

administrative

expenses

Research and

development

expenses

Restructuring

and other

impairment

charges

(Gain)

loss on

sale of

business

and

assets

Interest

expense,

net

Loss on

extinguishment

of debt, net

Income

taxes

Net income

(loss)

attributable to

common

shareholders

from

continuing

operations

Diluted

earnings per

share

available to

common

shareholders

Shares

used in

calculation

of GAAP

and

adjusted

earnings

per share

GAAP Basis $217.2 $143.0 $15.5 ($0.1 ) ($0.4 ) $11.8 $19.3

$8.0 $59.1 $1.25 47,246 Adjustments

Restructuring and other impairment charges — — — (0.1 ) — — — 0.1

(0.2 ) — — Losses and other charges, net (A) 4.0 1.2 0.0 — (0.4 ) —

— 1.9 2.9 $0.07 — Amortization of debt discount on convertible

notes — — — — — 1.4 — 0.5 0.9 $0.02 — Intangible amortization

expense — 15.9 0.1 — — — — 4.3 11.8 $0.25 — Loss on extinguishment

of debt, net — — — — — — 19.3 7.0 12.2 $0.26 — Tax adjustment (B) —

— — — — — — 0.5 (0.5 ) ($0.01 ) — Shares due to Teleflex under note

hedge (C) — — — — — — — — — $0.07 (1,675 ) Adjusted basis $213.2

$125.9 $15.3 — — $10.3 — $22.4 $86.2 $1.89 45,571

Quarter

Ended – June 28, 2015

Cost of

goods

sold

Selling,

general and

administrative

expenses

Research and

development

expenses

Restructuring

and other

impairment

charges

(Gain)

loss on

sale of

business

and

assets

Interest

expense,

net

Loss on

extinguishment

of debt, net

Income

taxes

Net income

(loss)

attributable to

common

shareholders

from

continuing

operations

Diluted

earnings per

share

available to

common

shareholders

Shares

used in

calculation

of GAAP

and

adjusted

earnings

per share

GAAP Basis $218.8 $142.2 $13.4 $0.6 — $16.1 $10.5 $5.3 $44.8

$0.93 48,081 Adjustments Restructuring and other impairment charges

— — — 0.6 — — — 0.2 0.4 $0.01 — Losses and other charges, net (A)

3.1 (3.4 ) — — — — — 0.6 (0.9 ) ($0.03 ) — Amortization of debt

discount on convertible notes — — — — — 3.3 — 1.2 2.1 $0.04 —

Intangible amortization expense — 15.1 — — — — — 4.1 10.9 $0.23 —

Loss on extinguishment of debt, net — — — — — — 10.5 3.8 6.6 $0.14

— Tax adjustment (B) — — — — — — — 0.3 (0.3 ) ($0.01 ) — Shares due

to Teleflex under note hedge (C) — — — — — — — — — $0.10 (3,366 )

Adjusted basis $215.7 $130.6 $13.4 — — $12.8 — $15.5 $63.5 $1.42

44,715

(A) In 2016, losses and other charges, net related primarily to

facility consolidations. In 2015, adjustments to losses and other

charges, net resulted in a small decrease in adjusted net income

and diluted earnings per share because the GAAP financial

statements included reversals of charges related to contingent

consideration liabilities and a litigation verdict against the

Company with respect to a non-operating joint venture; the sum of

these reversals exceeded the sum of acquisition and integration

costs, and charges related to facility consolidations.

(B) The tax adjustment represents a net benefit resulting

primarily from (1) the resolution of audits of prior year returns

and (2) tax law changes affecting our deferred tax liability.

(C) Adjusted diluted shares are calculated by giving effect to

the anti-dilutive impact of the Company’s convertible note hedge

agreements, which reduce the potential economic dilution that

otherwise would occur upon conversion of the Company's convertible

notes. Under GAAP, the anti-dilutive impact of the convertible note

hedge agreements is not reflected in diluted shares.

RECONCILIATION OF CONSOLIDATED

STATEMENT OF INCOME ITEMS

Dollars in millions, except per share

amounts

Year-to-date Ended – June 26, 2016

Cost of

goods

sold

Selling,

general and

administrative

expenses

Research and

development

expenses

Restructuring

and other

impairment

charges

(Gain)

loss on

sale of

business

and

assets

Interest

expense,

net

Loss on

extinguishment

of debt, net

Income

taxes

Net income

(loss)

attributable to

common

shareholders

from

continuing

operations

Diluted

earnings per

share

available to

common

shareholders

Shares

used in

calculation

of GAAP

and

adjusted

earnings

per share

GAAP Basis $416.9 $279.3 $27.8 $9.8 ($1.4 ) $25.5 $19.3

$10.6 $110.1 $2.29 48,014 Adjustments

Restructuring and other impairment charges — — — 9.8 — — — 2.4 7.4

$0.15 — Losses and other charges, net (A) 6.6 1.8 0.0 — (1.4 ) — —

2.8 4.4 $0.08 — Amortization of debt discount on convertible notes

— — — — — 4.9 — 1.8 3.1 $0.06 — Intangible amortization expense —

31.2 0.2 — — — — 8.4 23.0 $0.48 — Loss on extinguishment of debt,

net — — — — — — 19.3 7.0 12.2 $0.25 — Tax adjustment (B) — — — — —

— — 5.5 (5.5 ) ($0.11 ) — Shares due to Teleflex under note hedge

(C) — — — — — — — — — $0.19 (2,648 ) Adjusted basis $410.3 $246.3

$27.6 — — $20.6 — $38.5 $154.7 $3.41 45,366

Year-to-date

Ended – June 28, 2015

Cost of

goods

sold

Selling,

general and

administrative

expenses

Research and

development

expenses

Restructuring

and other

impairment

charges

(Gain)

loss on

sale of

business

and

assets

Interest

expense,

net

Loss on

extinguishment

of debt, net

Income

taxes

Net income

(loss)

attributable to

common

shareholders

from

continuing

operations

Diluted

earnings per

share

available to

common

shareholders

Shares

used in

calculation

of GAAP

and

adjusted

earnings

per share

GAAP Basis $425.6 $281.9 $26.3 $5.0 — $33.1 $10.5 $14.6

$83.8 $1.76 47,688 Adjustments Restructuring and other impairment

charges — — — 5.0 — — — 1.8 3.2 $0.07 — Losses and other charges,

net (A) 5.2 (2.5 ) — — — — — 1.4 1.3 $0.02 — Amortization of debt

discount on convertible notes — — — — — 6.5 — 2.4 4.1 $0.09 —

Intangible amortization expense — 29.8 — — — — — 7.9 21.9 $0.46 —

Loss on extinguishment of debt, net — — — — — — 10.5 3.8 6.6 $0.14

— Tax adjustment (B) — — — — — — — 0.2 (0.2 ) $0.00 — Shares due to

Teleflex under note hedge (C) — — — — — — — — — $0.19 (3,211 )

Adjusted basis $420.4 $254.6 $26.3 — — $26.6 — $32.1 $120.8 $2.72

44,477

(A) In 2016, losses and other charges, net related primarily to

facility consolidations. In 2015, losses and other charges, net

related primarily to acquisition and integration costs, and charges

related to facility consolidations, somewhat offset by reversals of

charges related to contingent consideration liabilities and a

litigation verdict against the Company with respect to a

non-operating joint venture.

(B) The tax adjustment represents a net benefit resulting

primarily from (1) the resolution of audits of prior year returns

and (2) tax law changes affecting our deferred tax liability.

(C) Adjusted diluted shares are calculated by giving effect to

the anti-dilutive impact of the Company’s convertible note hedge

agreements, which reduce the potential economic dilution that

otherwise would occur upon conversion of the Company's convertible

notes. Under GAAP, the anti-dilutive impact of the convertible note

hedge agreements is not reflected in diluted shares.

ABOUT TELEFLEX INCORPORATED

Teleflex is a global provider of medical technologies designed

to improve the health and quality of people’s lives. We apply

purpose driven innovation - a relentless pursuit of identifying

unmet clinical needs - to benefit patients and healthcare

providers. Our portfolio is diverse, with solutions in the fields

of vascular and interventional access, surgical, anesthesia,

cardiac care, urology, emergency medicine and respiratory care.

Teleflex employees worldwide are united in the understanding that

what we do every day makes a difference. For more information,

please visit teleflex.com.

Teleflex is the home of Arrow®, Deknatel®, Hudson RCI®, LMA®,

Pilling®, Rusch® and Weck® - trusted brands united by a common

sense of purpose.

CAUTION CONCERNING FORWARD-LOOKING INFORMATION

This press release contains forward-looking statements,

including, but not limited to, forecasted 2016 GAAP and constant

currency revenue growth and GAAP and adjusted diluted earnings per

share. Actual results could differ materially from those in the

forward-looking statements due to, among other things, conditions

in the end markets we serve, customer reaction to new products and

programs, our ability to achieve sales growth, price increases or

cost reductions; changes in the reimbursement practices of third

party payors; our ability to realize efficiencies and to execute on

our strategic initiatives; changes in material costs and

surcharges; market acceptance and unanticipated difficulties in

connection with the introduction of new products and product line

extensions; product recalls; unanticipated difficulties in

connection with the consolidation of manufacturing and

administrative functions, including as a result of difficulties

with various employees, labor representatives or regulators; the

loss of skilled employees in connection with such initiatives;

unanticipated difficulties, expenditures and delays in complying

with government regulations applicable to our businesses; the

impact of government healthcare reform legislation; our ability to

meet our debt obligations; changes in general and international

economic conditions, including fluctuations in foreign currency

exchange rates and the impact of the United Kingdom's vote to leave

the European Union; and other factors described or incorporated in

our filings with the Securities and Exchange Commission, including

our Annual Report on Form 10-K for the year ended December 31,

2015.

TELEFLEX INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME

(Unaudited)

Three Months Ended

Six Months Ended June 26, 2016 June

28, 2015 June 26, 2016 June 28,

2015 (Dollars and shares in thousands, except per share)

Net revenues $ 473,553 $ 452,045 $ 898,446 $ 881,475 Cost of goods

sold 217,154 218,808 416,900

425,601 Gross profit 256,399 233,237 481,546

455,874 Selling, general and administrative expenses 142,983

142,228 279,331 281,925 Research and development expenses 15,472

13,443 27,825 26,327 Restructuring charges (119 ) 580 9,849 5,028

Gain on sale of assets (378 ) — (1,397

) — Income from continuing operations before interest

and taxes 98,441 76,986 165,938 142,594 Interest expense 11,907

16,207 25,691 33,379 Interest income (129 ) (154 ) (209 ) (323 )

Loss on extinguishment of debt 19,261 10,454

19,261 10,454 Income from

continuing operations before taxes 67,402 50,479 121,195 99,084

Taxes on income from continuing operations 8,007

5,280 10,620 14,612

Income from continuing operations 59,395

45,199 110,575 84,472 Operating

income (loss) from discontinued operations 6 (145 ) (376 ) (644 )

(Benefit) taxes on loss from discontinued operations (187 )

45 (257 ) 249 Income (loss) from

discontinued operations 193 (190 ) (119

) (893 ) Net income 59,588 45,009 110,456 83,579

Less: Income from continuing operations

attributable to noncontrolling interest

285 446 464 664

Net income attributable to common shareholders $ 59,303

$ 44,563 $ 109,992 $ 82,915 Earnings

per share available to common shareholders: Basic: Income from

continuing operations $ 1.36 $ 1.08 $ 2.58 $ 2.02 Income (loss)

from discontinued operations — (0.01 )

— (0.02 ) Net income $ 1.36 $ 1.07 $

2.58 $ 2.00 Diluted: Income from continuing

operations $ 1.25 $ 0.93 $ 2.29 $ 1.76 Income (loss) from

discontinued operations 0.01 — —

(0.02 ) Net income $ 1.26 $ 0.93 $ 2.29

$ 1.74 Dividends per share $ 0.34 $ 0.34 $ 0.68 $

0.68 Weighted average common shares outstanding Basic 43,549 41,560

42,598 41,514 Diluted 47,246 48,081 48,014 47,688 Amounts

attributable to common shareholders: Income from continuing

operations, net of tax $ 59,110 $ 44,753 $ 110,111 $ 83,808 Income

(Loss) from discontinued operations, net of tax 193

(190 ) (119 ) (893 ) Net income $ 59,303

$ 44,563 $ 109,992 $ 82,915

TELEFLEX INCORPORATED

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

June 26, 2016 December 31, 2015

(Dollars in thousands) ASSETS Current assets Cash and

cash equivalents $ 476,490 $ 338,366 Accounts receivable, net

273,530 262,416 Inventories, net 338,465 330,275 Prepaid expenses

and other current assets 35,841 34,915 Prepaid taxes 30,369 30,895

Assets held for sale 7,026 6,972 Total current assets

1,161,721 1,003,839 Property, plant and equipment, net 314,665

316,123 Goodwill 1,301,348 1,295,852 Intangible assets, net

1,175,098 1,199,975 Investments in affiliates 244 152 Deferred tax

assets 1,985 2,341 Other assets 45,146 53,492 Total

assets $ 4,000,207 $ 3,871,774

LIABILITIES AND EQUITY

Current liabilities Current borrowings $ 173,952 $ 417,350 Accounts

payable 72,787 66,305 Accrued expenses 63,396 64,017 Current

portion of contingent consideration 7,453 7,291 Payroll and

benefit-related liabilities 71,059 84,658 Accrued interest 5,688

7,480 Income taxes payable 12,957 8,059 Other current liabilities

16,512 8,960 Total current liabilities 423,804

664,120 Long-term borrowings 907,930 641,850 Deferred tax

liabilities 317,327 315,983 Pension and postretirement benefit

liabilities 143,992 149,441 Noncurrent liability for uncertain tax

positions 26,415 40,400 Other liabilities 59,171

48,887 Total liabilities 1,878,639 1,860,681 Commitments and

contingencies Total common shareholders' equity 2,119,350 2,009,272

Noncontrolling interest 2,218 1,821 Total equity

2,121,568 2,011,093 Total liabilities and equity $

4,000,207 $ 3,871,774

TELEFLEX INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited)

Six Months Ended June 26,

2016 June 28, 2015 (Dollars in

thousands) Cash flows from operating activities of continuing

operations: Net income $ 110,456 $ 83,579 Adjustments to reconcile

net income to net cash provided by operating activities: Loss from

discontinued operations 119 893 Depreciation expense 26,609 22,385

Amortization expense of intangible assets 31,397 29,826

Amortization expense of deferred financing costs and debt discount

6,554 8,421 Loss on extinguishment of debt 19,261 10,454 Gain on

sale of assets (1,397 ) — Changes in contingent consideration 1,242

(2,293 ) Stock-based compensation 7,949 7,126 Deferred income

taxes, net (1,292 ) 625 Other (1,970 ) (6,301 ) Changes in

operating assets and liabilities, net of effects of acquisitions

and disposals: Accounts receivable (10,237 ) (17,984 ) Inventories

(3,284 ) (16,895 ) Prepaid expenses and other current assets 238

921 Accounts payable and accrued expenses (3,500 ) (2,966 ) Income

taxes receivable and payable, net (657 ) (8,203 ) Net

cash provided by operating activities from continuing operations

181,488 109,588 Cash flows from

investing activities of continuing operations: Expenditures for

property, plant and equipment (19,535 ) (31,321 ) Proceeds from

sale of assets 3,985 — Payments for businesses and intangibles

acquired, net of cash acquired (3,117 ) (37,559 ) Investment in

affiliates — — Net cash used in

investing activities from continuing operations (18,667 )

(68,880 ) Cash flows from financing activities of continuing

operations: Proceeds from new borrowings 665,000 288,100 Reduction

in borrowings (656,479 ) (250,981 ) Debt extinguishment, issuance

and amendment fees (8,182 ) (8,746 ) Net proceeds from share based

compensation plans and the related tax impacts 6,593 4,843 Payments

to noncontrolling interest shareholders — (832 ) Payments for

contingent consideration (133 ) (3,989 ) Dividends paid

(28,998 ) (28,234 ) Net cash (used in) provided by financing

activities from continuing operations (22,199 ) 161

Cash flows from discontinued operations: Net cash used in

operating activities (1,183 ) (1,363 ) Net cash used

in discontinued operations (1,183 ) (1,363 ) Effect

of exchange rate changes on cash and cash equivalents (1,315

) (17,732 ) Net increase in cash and cash equivalents

138,124 21,774 Cash and cash equivalents at the beginning of the

period 338,366 303,236 Cash and cash

equivalents at the end of the period $ 476,490 $ 325,010

Non cash financing activities of

continuing operations:

Settlement and exchange of convertible

notes with common or treasury stock

35,197

38

Acquisition of treasury stock associated

with settlement and exchange of convertible note hedge and warrant

agreements

85,895

71

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160728005296/en/

Teleflex IncorporatedJake ElguiczeTreasurer and Vice President

of Investor Relations610-948-2836

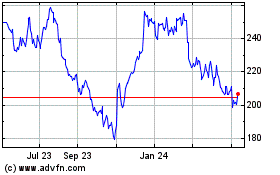

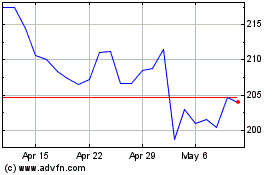

Teleflex (NYSE:TFX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Teleflex (NYSE:TFX)

Historical Stock Chart

From Apr 2023 to Apr 2024