Second Quarter Revenues of $452.1 million,

down 3.4% over prior year period; up 4.7% on Constant Currency

Basis

Second Quarter GAAP Diluted EPS of $0.93,

down 10.6% over the prior year period

Second Quarter Adjusted Diluted EPS of

$1.42, down 6.0%, reflecting unfavorable impact from foreign

exchange of approximately 20%

2015 Constant Currency Revenue and Adjusted

Diluted EPS Guidance Reaffirmed

Teleflex Incorporated (NYSE: TFX) (the “Company”) today

announced financial results for the second quarter ended June 28,

2015.

Second quarter net revenues were $452.1 million, a decrease of

3.4% over the second quarter 2014. Excluding the impact of foreign

currency fluctuations, second quarter net revenues increased 4.7%

over the year ago quarter.

Second quarter GAAP diluted earnings per share from continuing

operations decreased 10.6% to $0.93, as compared to $1.04 in the

prior year period. Second quarter adjusted diluted earnings per

share from continuing operations decreased 6.0% to $1.42, compared

to $1.51 in the prior year period.

“During the second quarter of 2015, Teleflex continued its solid

operating performance, building upon the results realized earlier

this year,” said Benson Smith, Chairman, President and Chief

Executive Officer. “Once again, we generated mid-single digit

constant currency revenue growth and achieved adjusted earnings per

share ahead of our previous expectations. In fact, adjusted

earnings per share would have been higher during the second quarter

of 2015 had it not been for foreign exchange, which impacted

results negatively by approximately 20% as compared to the second

quarter of 2014."

Added Smith, "In addition, during the second quarter, we

continued to make progress in our strategic initiatives, including

the acquisition of a distribution partner of Teleflex's Surgical

products in Australia, the acquisition of exclusive North American

distribution rights to the AutoFuser® range of disposable pain

control pumps, and the receipt of FDA market clearance for its

Arrow® Endurance™ Extended Dwell Peripheral Catheter System. Based

on our results for the first half of 2015, Teleflex remains on

target to achieve our previously provided constant currency revenue

growth and adjusted diluted earnings per share guidance for

2015.”

SECOND QUARTER NET REVENUE BY SEGMENT AND GEOGRAPHY

Effective April 1, 2015, the Company reorganized certain of its

businesses to better leverage the Company's resources. As a result,

the Company realigned its operating segments. Specifically, the

Company's Anesthesia/Respiratory North America operating segment

was divided into two operating segments, Anesthesia North America

and Respiratory North America. Additionally, the businesses

comprising the Company's former Specialty operating segment (which

was not a reportable segment and, therefore, was included in the

"All other" category in the Company's presentation of segment

information) were transferred to the Anesthesia North America,

Vascular North America and Respiratory North America operating

segments.

As a result of the operating segment changes described above,

the Company has the following six reportable operating segments:

Vascular North America, Anesthesia North America, Surgical North

America, EMEA, Asia and OEM. In connection with its presentation of

segment information, the Company will continue to present certain

operating segments, including, among others, the Respiratory North

America operating segment, in the "All other" category. All prior

comparative periods have been restated to reflect these

changes.

Vascular North America second quarter net revenues were $81.2

million, an increase of 5.1% compared to the second quarter 2014.

Excluding the impact of foreign currency fluctuations, second

quarter net revenues increased 5.6% compared to the year ago

quarter. The increase in constant currency revenue was largely due

to higher sales volume of existing products, somewhat offset by a

decrease in new product sales.

Surgical North America second quarter net revenues were $40.5

million, an increase of 6.7% compared to the second quarter 2014.

Excluding the impact of foreign currency fluctuations, second

quarter net revenues increased 7.8% compared to the year ago

quarter. The increase in constant currency revenue was largely due

to new product sales, MiniLap product sales and price

increases.

Anesthesia North America second quarter net revenues were $45.6

million, a decrease of 0.3% compared to the second quarter 2014.

Excluding the impact of foreign currency fluctuations, second

quarter net revenues increased 0.2% compared to the year ago

quarter. The increase in constant currency revenue was largely due

to new product sales, somewhat offset by lower sales volume of

existing products and price decreases.

EMEA second quarter net revenues were $129.1 million, a decrease

of 16.5% compared to the second quarter 2014. Excluding the impact

of foreign currency fluctuations, second quarter net revenues

increased 1.7% compared to the year ago quarter. The increase in

constant currency revenue was largely due to higher sales volume of

existing products and an increase in new product sales, somewhat

offset by price decreases.

Asia second quarter net revenues were $62.1 million, a decrease

of 0.8% compared to the second quarter 2014. Excluding the impact

of foreign currency fluctuations, second quarter net revenues

increased 9.4% compared to the year ago quarter. The increase in

constant currency revenue was largely due to price increases,

increased sales volume of existing products, product sales

resulting from the acquisition of Human Medics Co. Ltd., and an

increase in new product sales.

OEM and Development Services (“OEM”) second quarter net revenues

were $37.9 million, an increase of 3.6% compared to the second

quarter 2014. Excluding the impact of foreign currency

fluctuations, second quarter net revenues increased 7.5% compared

to the year ago quarter. The increase in constant currency revenue

was largely due to higher sales volume of existing products and an

increase in new product sales.

Three Months Ended % Increase/

(Decrease) June 28, 2015 June 29, 2014

ConstantCurrency

ForeignCurrency

TotalChange

(Dollars in millions) Vascular North America $ 81.2 $ 77.2 5.6 %

(0.5 %) 5.1 % Surgical North America 40.5 38.0 7.8 % (1.1 %) 6.7 %

Anesthesia North America 45.6 45.7 0.2 % (0.5 %) (0.3 %) EMEA 129.1

154.7 1.7 % (18.2 %) (16.5 %) Asia 62.1 62.5 9.4 % (10.2 %) (0.8 %)

OEM 37.9 36.6 7.5 % (3.9 %) 3.6 % All Other 55.7 53.4

6.0 % (1.7 %) 4.3 % Total $ 452.1 $ 468.1 4.7 % (8.1 %) (3.4 %)

OTHER FINANCIAL HIGHLIGHTS AND KEY PERFORMANCE

METRICS

Depreciation expense, amortization of intangible assets and

deferred financing costs for the first six months of 2015

aggregated $60.6 million compared to $63.8 million for the prior

year period.

Cash and cash equivalents at June 28, 2015 were $325.0 million

compared to $303.2 million at December 31, 2014.

Net accounts receivable at June 28, 2015 were $286.4 million

compared to $273.7 million at December 31, 2014.

Net inventories at June 28, 2015 were $347.1 million compared to

$335.6 million at December 31, 2014.

Net debt obligations at June 28, 2015 were $816.7 million

compared to $801.4 million at December 31, 2014.

2015 OUTLOOK

The Company continues to estimate that constant currency revenue

growth will be between 4% and 6%. On a GAAP basis, revenues are

expected to be flat to down 2% versus the prior year due to the

unfavorable impact of foreign currency fluctuations.

The Company also continues to estimate that adjusted diluted

earnings per share from continuing operations will be between $6.10

and $6.35, representing an increase of 6.3% to 10.6% over the prior

year. Consistent with our previous expectations, we anticipate that

foreign currency fluctuations will negatively impact adjusted

earnings per share in 2015 by approximately 15%. The Company has

updated its full year 2015 GAAP diluted earnings per share from

continuing operations range from $4.13 to $4.28 to a range of $4.23

to $4.38, reflecting an expected reduction in 2015 forecasted

restructuring, impairment charges and special items, net of

tax.

FORECASTED 2015 CONSTANT CURRENCY

REVENUE GROWTH RECONCILIATION

Low High Forecasted 2015 GAAP

revenue growth (2 %)

-

Estimated impact of foreign currency fluctuations 6 %

6

% Forecasted 2015 constant currency revenue growth 4

% 6 %

FORECASTED 2015 ADJUSTED EARNINGS PER

SHARE RECONCILIATION

Low High Diluted earnings per

share attributable to common shareholders $ 4.23 $ 4.38

Restructuring, impairment charges and special items, net of tax $

0.80 $ 0.85 Intangible amortization expense, net of tax $

0.90 $ 0.95 Amortization of debt discount on convertible

notes, net of tax $ 0.17 $ 0.17

Adjusted diluted earnings per share $ 6.10 $ 6.35

CONFERENCE CALL WEBCAST AND ADDITIONAL INFORMATION

As previously announced, Teleflex will comment on its financial

results on a conference call to be held today at 8:00 a.m. (ET).

The call will be available live and archived on the company’s

website at www.teleflex.com and the accompanying

presentation will be posted prior to the call. An audio replay will

be available until August 6, 2015 at 11:59pm (ET), by calling

888-286-8010 (U.S./Canada) or 617-801-6888 (International),

Passcode: 52181612.

ADDITIONAL NOTES

Constant currency revenue growth excludes the impact of

translating the results of international subsidiaries at different

currency exchange rates from period to period.

In the discussion of segment results, "new products" refers to

products we have sold for 36 months or less, and "existing

products" refers to products we have sold for more than 36

months.

Certain financial information is presented on a rounded basis,

which may cause minor differences.

Segment results and commentary exclude the impact of

discontinued operations.

NOTES ON NON-GAAP FINANCIAL MEASURES

This press release includes certain non-GAAP financial measures,

which include:

Adjusted diluted earnings per share. This measure excludes,

depending on the period presented (i) the effect of charges

associated with our restructuring programs; (ii) losses and other

charges, including acquisition and integration costs, charges

related to facility consolidations, charges related to contingent

consideration liabilities and charges related to a litigation

verdict against the Company with respect to a non-operating joint

venture, net of specified reversals, including a reversal of

liabilities related to certain contingent consideration

arrangements; (iii) amortization of the debt discount on the

Company’s convertible notes; (iv) intangible amortization expense;

(v) loss on extinguishment of debt; and (vi) tax benefits resulting

from the resolution of, or expiration of the statute of limitations

with respect to, prior years’ tax matters. In addition, the

calculation of diluted shares within adjusted earnings per share

gives effect to the anti-dilutive impact of the Company’s

convertible note hedge agreements, which reduce the potential

economic dilution that otherwise would occur upon conversion of the

Company’s senior subordinated convertible notes (under GAAP, the

anti-dilutive impact of the convertible note hedge agreements is

not reflected in diluted shares).

Constant currency revenue growth. This measure excludes the

impact of translating the results of international subsidiaries at

different currency exchange rates from period to period.

Management believes these measures are useful to investors

because they eliminate items that do not reflect Teleflex’s

day-to-day operations. In addition, management believes that the

calculation of non-GAAP diluted shares is useful to investors

because it provides insight into the offsetting economic effect of

the convertible note hedge against conversions of the convertible

notes. Management uses these financial measures for internal

managerial purposes, when publicly providing guidance on possible

future results, and to assist in our evaluation of period-to-period

comparisons. These financial measures are presented in addition to

results presented in accordance with generally accepted accounting

principles (“GAAP”) and should not be relied upon as a substitute

for GAAP financial measures. Tables reconciling historical adjusted

diluted earnings per share to historical GAAP earnings per share

are set forth below. Tables reconciling constant currency net

revenues to GAAP net revenues and reconciling forecasted non-GAAP

measures to the most directly comparable forecasted GAAP measures

are set forth above.

RECONCILIATION

OF CONSOLIDATED STATEMENT OF INCOME ITEMS Dollars in

millions, except per share amounts Quarter Ended –

June 28, 2015

Cost ofgoodssold

Selling,general

andadministrativeexpenses

Researchanddevelopmentexpenses

Restructuringand

otherimpairmentcharges

Interestexpense,net

Loss onextinguishmentof

debt, net

Incometaxes

Net

income(loss)attributableto

commonshareholdersfromcontinuingoperations

Dilutedearnings

pershareavailable

tocommonshareholders

Shares

usedincalculationof GAAP

andadjustedearnings pershare

GAAP Basis $218.8 $142.2 $13.4 $0.6 $16.1 $10.5 $5.3 $44.8 $0.93

48,081 Adjustments Restructuring and other impairment charges — — —

0.6 — — 0.2 0.4 $0.01 — Losses and other charges (A) 3.1 (3.4 ) — —

— — 0.6 (0.9 ) ($0.03 ) — Amortization of debt discount on

convertible notes — — — — 3.3 — 1.2 2.1 $0.04 — Intangible

amortization expense — 15.1 — — — — 4.1 10.9 $0.23 — Loss on

extinguishment of debt, net — — — — — 10.5 3.8 6.6 $0.14 — Tax

adjustment (B) — — — — — — 0.3 (0.3 ) ($0.01 ) — Shares due to

Teleflex under note hedge (C) — — — — — — — — $0.10 (3,366 )

Adjusted basis $215.7 $130.6 $13.4 — $12.8 — $15.5 $63.5 $1.42

44,715

Quarter Ended – June 29, 2014

Cost ofgoodssold

Selling,general

andadministrativeexpenses

Researchanddevelopmentexpenses

Restructuringand

otherimpairmentcharges

Interestexpense,net

Loss onextinguishmentof

debt, net

Incometaxes

Net

income(loss)attributableto

commonshareholdersfromcontinuingoperations

Dilutedearnings

pershareavailable

tocommonshareholders

Shares

usedincalculationof GAAP

andadjustedearnings pershare

GAAP Basis $224.0 $146.8 $14.9 $7.6 $15.9 — $10.0 $48.4 $1.04

46,392 Adjustments Restructuring and other impairment charges — — —

7.6 — — 3.5 4.2 $0.09 — Losses and other charges (A) 0.9 (1.1 ) 0.1

— — — — (0.2 ) — — Amortization of debt discount on convertible

notes — — — — 3.0 — 1.1 1.9 $0.04 — Intangible amortization expense

— 16.1 — — — — 4.4 11.7 $0.25 — Loss on extinguishment of debt, net

— — — — — — — — — — Tax adjustment (B) — — — — — — — — — — Shares

due to Teleflex under note hedge (C) — — — — — — — — $0.09 (2,714 )

Adjusted basis $223.1 $131.9 $14.8 — $12.9 — $19.0 $65.9 $1.51

43,678

(A) In 2015, losses and other charges include approximately $2.0

million, net of tax, or $0.04 per share, related to acquisition and

integration costs, and charges related to facility consolidations;

reversals included approximately ($2.7) million, net of tax, or

($0.06) per share, related to contingent consideration liabilities;

and approximately ($0.2) million, net of tax, or ($0.01) per share,

related to a litigation verdict against the Company with respect to

a non-operating joint venture. In 2014, losses and other charges

include approximately $4.2 million, net of tax, or $0.09 per share,

related to acquisition and integration costs; reversals included

approximately ($4.4) million, net of tax, or ($0.09) per share,

related to the reversal of contingent consideration

liabilities.

(B) The tax adjustment represents a net benefit resulting from

the resolution of, or the expiration of statute of limitations with

respect to various prior years’ U.S. federal, state and foreign tax

matters.

(C) Adjusted diluted shares are calculated by giving effect to

the anti-dilutive impact of the Company’s convertible note hedge

agreements, which reduce the potential economic dilution that

otherwise would occur upon conversion of our senior subordinated

convertible notes. Under GAAP, the anti-dilutive impact of the

convertible note hedge agreements is not reflected in diluted

shares.

RECONCILIATION

OF CONSOLIDATED STATEMENT OF INCOME ITEMS Dollars in

millions, except per share amounts Year-to-date Ended

– June 28, 2015

Cost ofgoodssold

Selling,general

andadministrativeexpenses

Researchanddevelopmentexpenses

Restructuringand

otherimpairmentcharges

Interestexpense,net

Loss onextinguishmentof

debt, net

Incometaxes

Net

income(loss)attributableto

commonshareholdersfromcontinuingoperations

Dilutedearnings

pershareavailable

tocommonshareholders

Shares

usedincalculationof GAAP

andadjustedearnings pershare

GAAP Basis $425.6 $281.9 $26.3 $5.0 $33.1 $10.5 $14.6 $83.8 $1.76

47,688 Adjustments Restructuring and other impairment charges — — —

5.0 — — 1.8 3.2 $0.07 — Losses and other charges (A) 5.2 (2.5 ) — —

— — 1.4 1.3 $0.02 — Amortization of debt discount on convertible

notes — — — — 6.5 — 2.4 4.1 $0.09 — Intangible amortization expense

— 29.8 — — — — 7.9 21.9 $0.46 — Loss on extinguishment of debt, net

— — — — — 10.5 3.8 6.6 $0.14 — Tax adjustment (B) — — — — — — 0.2

(0.2 ) — — Shares due to Teleflex under note hedge (C) — — — — — —

— — $0.19 (3,211 ) Adjusted basis $420.4 $254.6 $26.3 — $26.6 —

$32.1 $120.8 $2.72 44,477

Year-to-date Ended –

June 29, 2014

Cost ofgoodssold

Selling,general

andadministrativeexpenses

Researchanddevelopmentexpenses

Restructuringand

otherimpairmentcharges

Interestexpense,net

Loss onextinguishmentof

debt, net

Incometaxes

Net

income(loss)attributableto

commonshareholdersfromcontinuingoperations

Dilutedearnings

pershareavailable

tocommonshareholders

Shares

usedincalculationof GAAP

andadjustedearnings pershare

GAAP Basis $441.4 $287.1 $28.9 $15.4 $31.1 — $18.5 $83.5 $1.81

46,071 Adjustments Restructuring and other impairment charges — — —

15.4 — — 4.5 10.9 $0.24 — Losses and other charges (A) 0.9 (1.2 )

0.1 — — — 0.8 (1.1 ) ($0.03 ) — Amortization of debt discount on

convertible notes — — — — 6.0 — 2.2 3.8 $0.08 — Intangible

amortization expense — 32.1 — — — — 9.9 22.2 $0.48 — Loss on

extinguishment of debt, net — — — — — — — — — — Tax adjustment (B)

— — — — — — 0.2 (0.2 ) ($0.01 ) — Shares due to Teleflex under note

hedge (C) — — — — — — — — $0.15 (2,582 ) Adjusted basis $440.5

$256.3 $28.9 — $25.1 — $36.3 $118.9 $2.73 43,489

(A) In 2015, losses and other charges include approximately $3.9

million, net of tax, or $0.08 per share, related to acquisition and

integration costs, and charges related to facility consolidations;

reversals included approximately ($2.4) million, net of tax, or

($0.05) per share, related to contingent consideration liabilities;

and approximately ($0.2) million, net of tax, or ($0.01) per share,

related to a litigation verdict against the Company with respect to

a non-operating joint venture. In 2014, losses and other charges

include approximately $5.6 million, net of tax, or $0.12 per share,

related to acquisition and integration costs; reversals included

approximately ($6.7) million, net of tax, or ($0.15) per share,

related to the reversal of contingent consideration

liabilities.

(B) The tax adjustment represents a net benefit resulting from

the resolution of, or the expiration of statute of limitations with

respect to various prior years’ U.S. federal, state and foreign tax

matters.

(C) Adjusted diluted shares are calculated by giving effect to

the anti-dilutive impact of the Company’s convertible note hedge

agreements, which reduce the potential economic dilution that

otherwise would occur upon conversion of our senior subordinated

convertible notes. Under GAAP, the anti-dilutive impact of the

convertible note hedge agreements is not reflected in diluted

shares.

RECONCILIATION OF NET DEBT

OBLIGATIONS

June 28, 2015

December 31, 2014

(Dollars in thousands) Note payable and current portion of

long term borrowings $ 415,991 $ 368,401 Long term

borrowings 696,000 700,000 Unamortized debt discount 29,726

36,197 Total debt obligations 1,141,717 1,104,598

Less: cash and cash equivalents 325,010 303,236 Net debt

obligations $ 816,707 $ 801,362

ABOUT TELEFLEX INCORPORATED

Teleflex is a leading global provider of specialty medical

devices for a range of procedures in critical care and surgery. Our

mission is to provide solutions that enable healthcare providers to

improve outcomes and enhance patient and provider safety.

Headquartered in Wayne, PA, Teleflex employs approximately 12,400

people and serves healthcare providers worldwide. For additional

information about Teleflex please refer to www.teleflex.com.

CAUTION CONCERNING FORWARD-LOOKING INFORMATION

This press release contains forward-looking statements,

including, but not limited to, forecasted 2015 GAAP and constant

currency revenue growth and GAAP and adjusted diluted earnings per

share. Actual results could differ materially from those in the

forward-looking statements due to, among other things, conditions

in the end markets we serve, customer reaction to new products and

programs, our ability to achieve sales growth, price increases or

cost reductions; changes in the reimbursement practices of third

party payors; our ability to realize efficiencies and to execute on

our strategic initiatives; changes in material costs and

surcharges; market acceptance and unanticipated difficulties in

connection with the introduction of new products and product line

extensions; product recalls; unanticipated difficulties in

connection with the consolidation of manufacturing and

administrative functions, including as a result of difficulties

with various employees, labor representatives or regulators; the

loss of skilled employees in connection with such initiatives;

unanticipated difficulties, expenditures and delays in complying

with government regulations applicable to our businesses; the

impact of government healthcare reform legislation; our ability to

meet our debt obligations; changes in general and international

economic conditions, including fluctuations in foreign currency

exchange rates; and other factors described or incorporated in our

filings with the Securities and Exchange Commission, including our

Annual Report on Form 10-K for the year ended December 31,

2014.

TELEFLEX INCORPORATED AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Unaudited) Three Months Ended Six Months

Ended June 28, 2015 June 29, 2014 June

28, 2015 June 29, 2014 (Dollars and shares in

thousands, except per share) Net revenues $ 452,045 $ 468,105 $

881,475 $ 906,651 Cost of goods sold 218,808 224,017

425,601 441,404 Gross profit 233,237 244,088 455,874

465,247 Selling, general and administrative expenses 142,228

146,843 281,925 287,140 Research and development expenses 13,443

14,870 26,327 28,932 Restructuring and impairment charges 580

7,623 5,028 15,403 Income from

continuing operations before interest, extinguishment of debt and

taxes 76,986 74,752 142,594 133,772 Interest expense 16,207 16,062

33,379 31,466 Interest income (154 ) (146 ) (323 ) (333 ) Loss on

extinguishment of debt 10,454 — 10,454 —

Income from continuing operations before taxes 50,479 58,836

99,084 102,639 Taxes on income from continuing operations 5,280

10,006 14,612 18,540 Income from

continuing operations 45,199 48,830 84,472

84,099 Operating loss from discontinued operations (145 )

(1,594 ) (644 ) (1,619 ) Taxes (benefit) on loss from discontinued

operations 45 (469 ) 249 (369 ) Loss from

discontinued operations (190 ) (1,125 ) (893 ) (1,250 ) Net income

45,009 47,705 83,579 82,849

Less: Income from continuing operations

attributable to noncontrolling interest

446 453 664 639 Net income attributable

to common shareholders $ 44,563 $ 47,252 $ 82,915

$ 82,210 Earnings per share available to common

shareholders: Basic: Income from continuing operations $ 1.08 $

1.17 $ 2.02 $ 2.02 Loss from discontinued operations (0.01 ) (0.03

) (0.02 ) (0.03 ) Net income $ 1.07 $ 1.14 $ 2.00

$ 1.99 Diluted: Income from continuing operations $

0.93 $ 1.04 $ 1.76 $ 1.81 Loss from discontinued operations —

(0.02 ) (0.02 ) (0.03 ) Net income $ 0.93 $ 1.02

$ 1.74 $ 1.78 Dividends per share $ 0.34 $

0.34 $ 0.68 $ 0.68 Weighted average common shares outstanding Basic

41,560 41,380 41,514 41,321 Diluted 48,081 46,392 47,688 46,071

Amounts attributable to common shareholders: Income from continuing

operations, net of tax $ 44,753 $ 48,377 $ 83,808 $ 83,460 Loss

from discontinued operations, net of tax (190 ) (1,125 ) (893 )

(1,250 ) Net income $ 44,563 $ 47,252 $ 82,915

$ 82,210

TELEFLEX INCORPORATED AND

SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited) June 28, 2015 December

31, 2014 (Dollars in thousands) ASSETS Current

assets Cash and cash equivalents $ 325,010 $ 303,236 Accounts

receivable, net 286,371 273,704 Inventories, net 347,095 335,593

Prepaid expenses and other current assets 34,659 35,697 Prepaid

taxes 46,008 40,256 Deferred tax assets 56,294 57,301 Assets held

for sale 7,072 7,422 Total current assets 1,102,509 1,053,209

Property, plant and equipment, net 315,536 317,435 Goodwill

1,317,874 1,323,553 Intangible assets, net 1,185,517 1,216,720

Investments in affiliates 401 1,150 Deferred tax assets 1,134 1,178

Other assets 61,191 64,010 Total assets $ 3,984,162 $ 3,977,255

LIABILITIES AND EQUITY Current liabilities Current

borrowings $ 415,991 $ 368,401 Accounts payable 74,364 64,100

Accrued expenses 65,843 72,383 Current portion of contingent

consideration 5,802 11,276 Payroll and benefit-related liabilities

69,564 85,442 Accrued interest 7,991 9,169 Income taxes payable

11,700 13,768 Other current liabilities 10,631 10,360 Total current

liabilities 661,886 634,899 Long-term borrowings 696,000 700,000

Deferred tax liabilities 433,257 451,541 Pension and postretirement

benefit liabilities 161,036 167,241 Noncurrent liability for

uncertain tax provisions 50,547 50,884 Other liabilities 61,429

58,991 Total liabilities 2,064,155 2,063,556 Commitments and

contingencies Total common shareholders' equity 1,917,779 1,911,309

Noncontrolling interest 2,228 2,390 Total equity 1,920,007

1,913,699 Total liabilities and equity $ 3,984,162 $ 3,977,255

TELEFLEX INCORPORATED AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited) Six Months Ended June 28,

2015 June 29, 2014 (Dollars in thousands)

Cash Flows from Operating Activities of Continuing Operations Net

income $ 83,579 $ 82,849 Adjustments to reconcile net income to net

cash provided by operating activities: Loss from discontinued

operations 893 1,250 Depreciation expense 22,385 23,997

Amortization expense of intangible assets 29,826 32,102

Amortization expense of deferred financing costs and debt discount

8,421 7,716 Loss on extinguishment of debt 10,454 — Changes in

contingent consideration (2,293 ) (6,617 ) Stock-based compensation

7,126 5,726 Deferred income taxes, net 625 2,811 Other (6,301 )

(2,142 ) Changes in operating assets and liabilities, net of

effects of acquisitions and disposals: Accounts receivable (17,984

) 640 Inventories (16,895 ) (16,385 ) Prepaid expenses and other

current assets 921 2,407 Accounts payable and accrued expenses

(2,966 ) (1,731 ) Income taxes receivable and payable, net (8,203 )

(12,462 ) Net cash provided by operating activities from continuing

operations 109,588 120,161 Cash Flows from Investing

Activities of Continuing Operations: Expenditures for property,

plant and equipment (31,321 ) (30,850 ) Proceeds from sale of

assets and investments — 4,139 Payments for businesses and

intangibles acquired, net of cash acquired (37,559 ) (28,535 )

Investment in affiliates — (60 ) Net cash used in investing

activities from continuing operations (68,880 ) (55,306 ) Cash

Flows from Financing Activities of Continuing Operations: Proceeds

from new borrowings 288,100 250,000 Reduction in borrowings

(250,981 ) (480,000 ) Debt extinguishment, issuance and amendment

fees (8,746 ) (3,275 ) Net proceeds from share based compensation

plans and the related tax impacts 4,843 2,391 Payments to

noncontrolling interest shareholders (832 ) (1,094 ) Payments for

contingent consideration (3,989 ) — Dividends (28,234 ) (28,093 )

Net cash provided by (used in) financing activities from continuing

operations 161 (260,071 ) Cash Flows from Discontinued

Operations: Net cash used in operating activities (1,363 ) (1,531 )

Net cash used in discontinued operations (1,363 ) (1,531 ) Effect

of exchange rate changes on cash and cash equivalents (17,732 )

2,145 Net increase (decrease) in cash and cash equivalents

21,774 (194,602 ) Cash and cash equivalents at the beginning of the

period 303,236 431,984 Cash and cash equivalents at

the end of the period $ 325,010 $ 237,382

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150730005053/en/

Teleflex IncorporatedJake ElguiczeTreasurer and Vice President

of Investor Relations610-948-2836

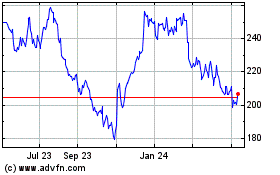

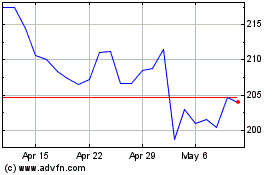

Teleflex (NYSE:TFX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Teleflex (NYSE:TFX)

Historical Stock Chart

From Apr 2023 to Apr 2024