Fourth Quarter Revenues Increase 7.5% to

$450.5 million; up 6.9% on Constant Currency Basis

Fourth Quarter GAAP Diluted EPS of $0.78;

Adjusted Diluted EPS of $1.36 up 18.3%

2014 Guidance Ranges for Constant Currency

Revenue Growth of 7% to 9% and Adjusted Diluted EPS of $5.35

to $5.55 Reaffirmed

Teleflex Incorporated (NYSE: TFX) today announced financial

results for the fourth quarter and full year ended December 31,

2013.

Fourth quarter 2013 net revenues were $450.5 million, an

increase of 7.5% over the prior year period. Excluding the impact

of foreign currency fluctuations, fourth quarter 2013 net revenues

increased 6.9% over the prior year period.

Fourth quarter 2013 GAAP diluted earnings per share from

continuing operations were $0.78, as compared to $0.72 in the prior

year period. Fourth quarter 2013 adjusted diluted earnings per

share from continuing operations were $1.36, as compared to $1.15

in the prior year period, an increase of 18.3%.

“Teleflex delivered a strong finish to 2013, both in terms of

constant currency revenue growth and adjusted earnings per share

achievement,” said Benson Smith, Chairman, President and Chief

Executive Officer. “Our fourth quarter performance was aided by the

contribution from the acquisitions of Vidacare and LMA

International, an improvement in the average selling price of

products, the introduction of new products to the marketplace and

one additional shipping day in the quarter as compared to the prior

year period.”

Added Mr. Smith, “As we turn to 2014, Teleflex is

well-positioned to continue to exceed industry revenue growth rates

and expand adjusted operating margin and earnings per share due to

recently concluded dealer negotiations, the acquisition of

Vidacare, the introduction of new products to the market, and the

continued integration of the LMA business.”

FOURTH QUARTER NET REVENUE BY PRODUCT GROUP AND

SEGMENT

Product Group Revenues

Critical Care fourth quarter 2013 net revenues were $316.7

million, an increase of 10.6% compared to the prior year period.

Excluding the impact of foreign currency fluctuations, fourth

quarter 2013 net revenues increased 10.2% compared to the prior

year period. The increase in constant currency revenue was due to

higher sales of anesthesia, interventional, vascular and urology

products. The growth in sales of anesthesia products was primarily

due to the contribution from the LMA International business

(“LMA”), which was acquired in October of 2012. The growth in sales

of vascular and interventional access products was primarily due to

the contribution from the Vidacare Corporation business

(“Vidacare”), which was acquired in December of 2013. Constant

currency sales growth was partially offset by a decline in sales of

respiratory products.

Surgical Care fourth quarter 2013 net revenues were $80.5

million, an increase of 5.2% compared to the prior year period.

Excluding the impact of foreign currency fluctuations, fourth

quarter 2013 net revenues increased 4.0% compared to the prior year

period. The increase in constant currency revenue was due to higher

sales of ligation, access and suture products, partially offset by

a decline in sales of general surgical instrument and chest

drainage products.

Cardiac Care fourth quarter 2013 net revenues were $19.2

million, a decrease of 6.0% compared to the prior year period on

both an as-reported and constant currency basis. The decrease in

revenue was due to a decline in sales of intra-aortic balloon

pumps.

OEM and Development Services (“OEM”) fourth quarter 2013 net

revenues were $34.1 million, a decrease of 4.8% compared to the

prior year period. Excluding the impact of foreign currency

fluctuations, fourth quarter 2013 net revenues decreased 5.7%

compared to the prior year period. The decrease in constant

currency revenue was primarily due to a decline in sales of

catheter and performance fiber products.

Three Months Ended % Increase/

(Decrease)

December 31,2013

December 31,2012

ConstantCurrency

ForeignCurrency

TotalChange

(Dollars in millions) Critical Care $ 316.7 $ 286.5 10.2 % 0.4 %

10.6 % Surgical Care 80.5 76.5 4.0 % 1.2 % 5.2 % Cardiac Care 19.2

20.4 (6.0 %) — (6.0 %) OEM 34.1 35.7 (5.7 %) 0.9 %

(4.8 %) Total $ 450.5 $ 419.1 6.9 % 0.6 % 7.5 %

Segment Revenues

Americas fourth quarter 2013 net revenues were $212.4 million,

an increase of 6.2% compared to the prior year period. Excluding

the impact of foreign currency fluctuations, fourth quarter 2013

net revenues increased 6.6% compared to the prior year period. The

increase in constant currency revenue was largely due to LMA and

Vidacare product sales, new product sales and price increases,

partially offset by lower sales volume of existing products as

compared to the fourth quarter of 2012.

EMEA fourth quarter 2013 net revenues were $144.9 million, an

increase of 9.2% compared to the prior year period. Excluding the

impact of foreign currency fluctuations, fourth quarter 2013 net

revenues increased 5.2% compared to the prior year period. The

increase in constant currency revenue was due to LMA and Vidacare

product sales, price increases including the benefit of selling

direct to customers in some markets versus selling to a third party

distributor and higher sales volume of existing products as

compared to the fourth quarter of 2012.

Asia fourth quarter 2013 net revenues were $59.1 million, an

increase of 17.1% compared to the prior year period. Excluding the

impact of foreign currency fluctuations, fourth quarter 2013 net

revenues increased 21.6% compared to the prior year period. The

increase in constant currency revenue was due to LMA product sales,

higher sales volume of existing products and price increases.

Three Months Ended % Increase/

(Decrease)

December 31,2013

December 31,2012

ConstantCurrency

ForeignCurrency

TotalChange

(Dollars in millions) Americas $ 212.4 $ 200.1 6.6 % (0.4 %) 6.2 %

EMEA 144.9 132.8 5.2 % 4.0 % 9.2 % Asia 59.1 50.5 21.6 % (4.5 %)

17.1 % OEM 34.1 35.7 (5.7 %) 0.9 % (4.8 %) Total $

450.5 $ 419.1 6.9 % 0.6 % 7.5 %

FULL YEAR RESULTS

Net revenues for the full year 2013 were $1.696 billion, an

increase of 9.4% compared to the prior year period. Excluding the

impact of foreign currency fluctuations which had a positive impact

of 0.4%, net revenues for 2013 increased 9.0% compared to 2012.

GAAP diluted earnings per share from continuing operations were

$3.46 for the full year 2013, as compared to a loss per share of

($4.47) in the prior year period. The financial results for 2012

reflect a goodwill impairment charge of $315.1 million, net of tax,

or $7.71 per share, incurred in the first quarter of 2012.

Adjusted diluted earnings per share from continuing operations

for the full year of 2013 were $5.03, an increase of 13.5% over the

prior year.

OTHER FINANCIAL HIGHLIGHTS AND KEY PERFORMANCE

METRICS

Depreciation expense and amortization of intangible assets and

deferred financing costs for full year 2013 were $107.9 million

compared to $94.9 million for the prior year period.

Cash and cash equivalents at December 31, 2013 were $432.0

million compared to $337.0 million at December 31, 2012.

Net accounts receivable at December 31, 2013 were $295.3 million

compared to $298.0 million at December 31, 2012.

Net inventories at December 31, 2013 were $333.6 million

compared to $323.3 million at December 31, 2012.

Net debt obligations at December 31, 2013 were $902.7 million

compared to $692.7 million at December 31, 2012. During the fourth

quarter of 2013, as a result of the Company meeting a contingent

conversion threshold related to the Company’s stock price, the

Company’s convertible notes have been classified as a current

liability as of December 31, 2013. The determination of whether or

not the convertible notes are convertible must continue to be

performed on a quarterly basis until maturity or conversion.

Consequently, the convertible notes may not be convertible in

future quarters, and therefore may again be classified as long-term

debt, if the contingent conversion threshold is not met in such

quarters.

2014 OUTLOOK

The Company reaffirmed full year 2014 financial estimates as

follows:

Constant currency revenue growth between 7% and 9% for the full

year 2014.

Adjusted diluted earnings per share in the range of $5.35 to

$5.55.

FORECASTED 2014 CONSTANT CURRENCY

REVENUE GROWTH RECONCILIATION

Low

High

Forecasted 2014 GAAP revenue growth

6.0%

8.0%

Foreign exchange

1.0%

1.0%

Forecasted 2014 constant currency revenue

growth

7.0%

9.0%

FORECASTED 2014 ADJUSTED EARNINGS PER

SHARE RECONCILIATION

Low High Forecasted 2014 diluted

earnings per share attributable to common shareholders $3.60 $3.75

Restructuring, impairment charges and special items, net of

tax $0.65 $0.70 Intangible amortization expense, net of tax

$0.93 $0.93 Amortization of debt discount on convertible

notes, net of tax $0.17 $0.17 Forecasted 2014

adjusted diluted earnings per share $5.35 $5.55

CONFERENCE CALL WEBCAST AND ADDITIONAL INFORMATION

As previously announced, Teleflex will comment on its financial

results on a conference call to be held today at 8:00 a.m. (ET).

The call will be available live and archived on the company’s

website at www.teleflex.com and the accompanying

presentation will be posted prior to the call. An audio replay will

be available until February 28, 2014 at 11:59pm (ET), by calling

888-286-8010 (U.S./Canada) or 617-801-6888 (International),

Passcode: 68453301.

ADDITIONAL NOTES

Constant currency revenue and growth exclude the impact of

translating the results of international subsidiaries at different

currency exchange rates from period to period.

Certain financial information is presented on a rounded basis,

which may cause minor differences.

Product group results and commentary exclude the impact of

discontinued operations, items included in restructuring and

impairment charges, and losses and other charges set forth in the

condensed consolidated statements of income and in the

Reconciliation of Consolidated Statement of Income Items set forth

below.

NOTES ON NON-GAAP FINANCIAL MEASURES

This press release includes certain non-GAAP financial measures,

which include:

Adjusted diluted earnings per share. This measure excludes,

depending on the period presented (i) the effect of charges

associated with our restructuring programs, as well as goodwill and

other asset impairment charges; (ii) loss on extinguishment of

debt; (iii) the gain or loss on sales of businesses and assets;

(iv) losses and other charges related to acquisition costs, the

reversal of liabilities related to certain contingent consideration

arrangements and a previously announced stock keeping unit

rationalization program, the establishment of a litigation reserve

and a litigation verdict against the Company with respect to a

non-operating joint venture; (v) amortization of the debt discount

on the Company’s convertible notes; (vi) charges associated with

the amortization of additional interest expense related to an

interest rate swap terminated in 2011; (vii) intangible

amortization expense; and (viii) tax benefits resulting from the

resolution of prior years’ tax matters and the filing of prior

years’ amended tax returns. In addition, the calculation of diluted

shares within adjusted earnings per share gives effect to the

anti-dilutive impact of the Company’s convertible note hedge

agreements, which reduce the potential economic dilution that

otherwise would occur upon conversion of the Company’s senior

subordinated convertible notes (under GAAP, the anti-dilutive

impact of the convertible note hedge agreements is not reflected in

diluted shares).

Constant currency revenue. This measure excludes the impact of

translating the results of international subsidiaries at different

currency exchange rates from period to period.

Management believes these measures are useful to investors

because they eliminate items that do not reflect Teleflex’s

day-to-day operations. In addition, management believes that the

calculation of non-GAAP diluted shares is useful to investors

because it provides insight into the offsetting economic effect of

the convertible note hedge against conversions of the convertible

notes. Management uses these financial measures for internal

managerial purposes, when publicly providing guidance on possible

future results, and to assist in our evaluation of period-to-period

comparisons. These financial measures are presented in addition to

results presented in accordance with generally accepted accounting

principles (“GAAP”) and should not be relied upon as a substitute

for GAAP financial measures. Tables reconciling these non-GAAP

measures to the most directly comparable GAAP measures are set

forth below.

RECONCILIATION OF CONSOLIDATED

STATEMENT OF INCOME ITEMS

Dollars in millions, except per share

amounts

Quarter Ended – December 31, 2013

Costof

goodssold

Selling,general

andadministrativeexpenses

Research

anddevelopmentexpenses

Restructuringand

otherimpairmentcharges

Interestexpense,net

Incometaxes

Net

income(loss)attributable

tocommonshareholdersfrom

continuingoperations

Diluted earningsper

shareavailable tocommonshareholders

Shares used incalculation

ofGAAP andadjustedearnings

pershare

GAAP Basis $ 225.6 $ 143.8 $ 17.9 $ 9.2 $ 14.2 $ 4.6 $ 35.1 $ 0.78

45,033 Adjustments

Restructuring and other impairment

charges

— — — 9.2 — 1.7 7.6 $ 0.17 —

Losses and other charges (A)

0.3 8.2 0.5 — — 2.5 6.5 $ 0.14 —

Amortization of debt discount on

convertible notes

— — — — 2.9 1.1 1.8 $ 0.04 — Intangible amortization expense — 13.5

— — — 4.5 9.0 $ 0.20 — Tax Adjustment (B) — — — — — 1.5 (1.5 )

($0.03 ) —

Shares due to Teleflex under note hedge

(C)

— — — — — — — $ 0.06 (2,165 ) Adjusted basis $ 225.3 $ 122.0 $ 17.3

— $ 11.3 $ 15.8 $ 58.5 $ 1.36 42,868

Quarter Ended -

December 31, 2012

Costof

goodssold

Selling,general

andadministrativeexpenses

Research

anddevelopmentexpenses

Restructuringand

otherimpairmentcharges

Interestexpense,net

Incometaxes

Net

income(loss)attributable

tocommonshareholdersfrom

continuingoperations

Diluted earningsper

shareavailable tocommonshareholders

Shares used incalculation

ofGAAP andadjustedearnings

pershare

GAAP Basis $ 219.9 $ 121.5 $ 16.3 $ 3.0 $ 14.4 $ 13.5 $ 30.4 $ 0.72

42,007 Adjustments

Restructuring and other impairment

charges

— — — 3.0 — 0.6 2.3 $ 0.06 — Losses and other charges (A) 0.5 3.0 —

— — (1.9 ) 5.4 $ 0.13 —

Amortization of debt discount on

convertible notes

— — — — 2.7 1.0 1.7 $ 0.04 — Intangible amortization expense — 12.0

— — — 4.2 7.8 $ 0.19 —

Tax adjustment (B)

— — — — — — — — —

Shares due to Teleflex under note hedge

(C)

— — — — — — — $ 0.02 (733 ) Adjusted basis $ 219.4 $ 106.5 $ 16.3 —

$ 11.7 $ 17.3 $ 47.6 $ 1.15 41,274 (A) In 2013, losses and

other charges include approximately $4.0 million, net of tax, or

$0.09 per share, primarily related to acquisition and integration

costs; $1.9 million, net of tax, or $0.04 per share related to the

establishment of a litigation reserve; and $0.6 million, net of

tax, or $0.01 per share related to costs incurred to relocate

facilities. In 2012, losses and other charges include approximately

$5.4 million, net of tax, or $0.13 per share, related to

acquisition costs. (B) The tax adjustment represents a net

benefit resulting from the resolution of, or the expiration of

statute of limitations with respect to various prior years’ U.S.

federal, state and foreign tax matters. (C) Adjusted diluted

shares are calculated by giving effect to the anti-dilutive impact

of the Company’s convertible note hedge agreements, which reduce

the potential economic dilution that otherwise would occur upon

conversion of our senior subordinated convertible notes. Under

GAAP, the anti-dilutive impact of the convertible note hedge

agreements is not reflected in diluted shares.

RECONCILIATION OF CONSOLIDATED

STATEMENT OF INCOME ITEMS

Dollars in millions, except per share

amounts

Twelve Months Ended – December 31, 2013

Costofgoodssold

Selling,general

andadministrativeexpenses

Research

anddevelopmentexpenses

Goodwillimpairment

Restructuringand

otherimpairmentcharges

Gain/(loss)on sales

ofbusinessesand assets

Loss onextinguishmentof

debt

Interestexpense,net

Incometaxes

Net income(loss)

attributableto commonshareholdersfrom

continuingoperations

Dilutedearnings pershare

availableto commonshareholders

Shares usedin

calculationof GAAP andadjustedearnings

pershare

GAAP Basis $ 857.3 $ 502.2 $ 65.0 — $ 38.5 — $ 1.3 $ 56.3 $ 23.5 $

151.3 $ 3.46 43,693 Adjustments

Restructuring and other impairment

charges

— — — — 38.5

—

— — 7.8 30.7 $ 0.71 — Loss on extinguishment of debt — — — — — —

1.3 — 0.5 0.8 $ 0.02 —

Losses and other charges (A)

2.3 1.5 0.5 — — — — — 4.9 (0.6 ) ($0.02 ) —

Amortization of debt discount on

convertible notes

— — —

—

— — — 11.3 4.1 7.2 $ 0.16 — Intangible amortization expense — 50.6

— — — — — — 17.3 33.4 $ 0.76 — Tax Adjustment (D) — — — — — — — —

11.1 (11.1 ) ($0.25 ) —

Shares due to Teleflex under note hedge

(E)

— — — — — — — — — — $ 0.19 (1,620 ) Adjusted basis $ 855.1 $ 450.1

$ 64.5 — — — — $ 45.0 $ 69.2 $ 211.6 $ 5.03 42,073

Twelve

Months Ended - December 31, 2012

Costofgoodssold

Selling,general

andadministrativeexpenses

Research

anddevelopmentexpenses

Goodwillimpairment

Restructuringand

otherimpairmentcharges

Gain/(loss)on sales

ofbusinessesand assets

Loss onextinguishmentof

debt

Interestexpense,net

Incometaxes

Net income(loss)

attributableto commonshareholdersfrom

continuingoperations

Dilutedearnings pershare

availableto commonshareholders

Shares usedin

calculationof GAAP andadjustedearnings

pershare

GAAP Basis $ 802.8 $ 454.5 $ 56.3 $ 332.1 $ 3.0 $ 0.3 — $ 68.0 $

16.4 ($182.7 ) ($4.47 ) 40,859 Adjustments Goodwill impairment — —

— 332.1 — — — — 17.0 315.1 $ 7.71 —

Restructuring and other impairment

charges

— — — — 3.0 — — — 0.6 2.5 $ 0.06 — Gain/(loss) on sales of

businesses and assets — — — — — (0.3 ) — — — (0.3 ) ($0.01 ) — Loss

on extinguish-

ment of debt

— — — — — — — — — — — — Losses and other charges (A) 0.5 14.2 — — —

— — — — 14.6 $ 0.36 — Early termination of interest rate swap (B) —

— — — — — — 11.1 4.0 7.0 $ 0.17 —

Amortization of debt discount on

convertible notes

— — — — — — — 10.5 3.8 6.7 $ 0.16 — Intangible amortization expense

— 44.3 — — — — — — 16.0 28.3 $ 0.69 — Anti-dilutive effect on EPS

(C) — — — — — — — — — — ($0.06 ) 542

Tax adjustment (D)

— — — — — — — — 9.0 (9.0 ) ($0.22 ) —

Shares due to Teleflex under note hedge

(E)

— — — — — — — — — — $ 0.03 (275 ) Adjusted basis $ 802.3 $ 396.0 $

56.3 — — — — $ 46.5 $ 66.7 $ 182.2 $ 4.43 41,126 (A) In

2013, losses and other charges include approximately ($12.4)

million, net of tax, or ($0.28) per share, related to the reversal

of contingent consideration liabilities; $7.8 million, net of tax,

or $0.18 per share, primarily related to acquisition and

integration costs; ($0.3) million, net of tax, or ($0.01) per

share, related to a reserve reversal associated with a previously

announced stock keeping unit (“SKU”) rationalization charge; $0.8

million, net of tax, or $0.02 per share, related to a litigation

verdict against the Company with respect to a non-operating joint

venture; $1.9 million, net of tax, or $0.04 per share related to

the establishment of a litigation reserve; and $1.6 million, net of

tax, or $0.04 per share related to costs incurred to relocate

facilities. In 2012, losses and other charges include approximately

$0.2 million, net of tax related to contingent consideration

liabilities; and $14.4 million, net of tax, or $0.36 per share,

related to acquisition costs. (B) In 2011, the Company

terminated an interest rate swap that, at the date of termination,

had a notional amount of $350 million. The interest rate swap was

designated as a cash flow hedge against the term loan under our

senior credit facility. At the date of termination, the interest

rate swap was in a liability position resulting in a cash payment

by the Company to the counterparty of approximately $14.8 million,

which included $3.1 million of accrued interest. In accordance with

GAAP, the Company amortized this amount as additional interest

expense over the remainder of the original term of the interest

rate swap, which expired in September 2012. In the first nine

months of 2012, the impact of the amortization, net of tax, was

approximately $7.0 million, or $0.17 per share. (C) The

Company presents per share results using basic weighted average

shares, and separately presents diluted per share results, which

reflect with the impact of dilution on income. Under applicable

accounting guidance, if a company has a net loss from continuing

operations, as was the case for the Company in 2012, no common

shares that potentially may be issued are included in the

computation of diluted per-share amounts because such inclusion

would result in an anti-dilutive per share amount. However, the

Company had net income on an adjusted basis in 2012. Therefore,

common shares that would have a dilutive effect on adjusted net

income are deemed to be outstanding for purposes of the calculation

of 2012 adjusted diluted earnings per share. (D) The tax

adjustment represents a net benefit resulting from the resolution

of, or the expiration of statutes of limitations with respect to

various prior years’ U.S. federal, state and foreign tax matters.

(E) Adjusted diluted shares are calculated by including the

anti-dilutive impact of the Company’s convertible note hedge

agreements, which reduce the potential economic dilution that

otherwise would occur upon conversion of our senior subordinated

convertible notes. Under GAAP, the anti-dilutive impact of the

convertible note hedge agreements is not reflected in diluted

shares.

RECONCILIATION OF NET DEBT

OBLIGATIONS

December 31, 2013 December 31, 2012 (Dollars

in thousands) Note payable and current portion of long-term

borrowings $ 356,287 $ 4,700 Long term borrowings 930,000

965,280 Unamortized debt discount 48,413

59,720 Total debt obligations 1,334,700 1,029,700

Less: cash and cash equivalents 431,984 337,039

Net debt obligations $ 902,716 $ 692,661

ABOUT TELEFLEX INCORPORATED

Teleflex is a leading global provider of specialty medical

devices for a range of procedures in critical care and surgery. Our

mission is to provide solutions that enable healthcare providers to

improve outcomes and enhance patient and provider safety.

Headquartered in Limerick, PA, Teleflex employs approximately

11,400 people worldwide and serves healthcare providers in more

than 150 countries. For additional information about Teleflex

please refer to www.teleflex.com.

CAUTION CONCERNING FORWARD-LOOKING INFORMATION

This press release contains forward-looking statements,

including, but not limited to, forecasted 2014 GAAP and constant

currency revenue growth and GAAP and adjusted diluted earnings per

share and the anticipated expansion of operating margins and

earnings per share as a result of recently concluded dealer

negotiations, the acquisition of Vidacare, the introduction of new

products to the market and the continued integration of the LMA

business. Actual results could differ materially from those in the

forward-looking statements due to, among other things, conditions

in the end markets we serve, customer reaction to new products and

programs, our ability to achieve sales growth, price increases or

cost reductions; changes in the reimbursement practices of third

party payors; our ability to realize efficiencies and to execute on

our strategic initiatives; changes in material costs and

surcharges; market acceptance and unanticipated difficulties in

connection with the introduction of new products and product line

extensions; product recalls; unanticipated difficulties in

connection with the consolidation of manufacturing and

administrative functions; unanticipated difficulties, expenditures

and delays in complying with government regulations applicable to

our businesses; the impact of government healthcare reform

legislation; our ability to meet our debt obligations; changes in

general and international economic conditions; and other factors

described or incorporated in our filings with the Securities and

Exchange Commission, including our Annual Report on Form 10-K for

the year ended December 31, 2012.

TELEFLEX INCORPORATED AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

INCOME

Three Months Ended December 31,

December 31, 2013 2012 (Dollars and shares

in thousands, except per share) Net revenues $

450,539 $ 419,056 Cost of goods sold 225,596

219,876 Gross profit 224,943 199,180 Selling, general and

administrative expenses 143,756 121,524 Research and development

expenses 17,876 16,263 Restructuring and other impairment charges

9,247 2,953 Income from continuing

operations before interest and taxes 54,064 58,440 Interest expense

14,339 14,621 Interest income (166 ) (247 ) Income

from continuing operations before taxes 39,891 44,066 Taxes on

income from continuing operations 4,589 13,452

Income from continuing operations 35,302

30,614 Operating loss from discontinued operations

(including loss on disposal of $21 in 2012) (459 ) (1,256 ) Tax

benefit on loss from discontinued operations (223 )

(219 ) Loss from discontinued operations (236 )

(1,037 ) Net income 35,066 29,577 Less: Income from continuing

operations attributable to noncontrolling interest 238

254 Net income attributable to common

shareholders $ 34,828 $ 29,323 Earnings per

share available to common shareholders: Basic: Income from

continuing operations $ 0.85 $ 0.74 Loss from discontinued

operations — (0.02 ) Net income $ 0.85

$ 0.72 Diluted: Income from continuing operations $

0.78 $ 0.72 Loss from discontinued operations (0.01 )

(0.02 ) Net income $ 0.77 $ 0.70 Dividends per

common share $ 0.34 $ 0.34 Weighted average common shares

outstanding: Basic 41,161 40,945 Diluted 45,033 42,007

Amounts attributable to common shareholders: Income from continuing

operations, net of tax $ 35,064 $ 30,360 Loss from discontinued

operations, net of tax (236 ) (1,037 ) Net income $

34,828 $ 29,323

TELEFLEX INCORPORATED AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(LOSS)

Twelve Months Ended December 31,

December 31, 2013 2012 (Dollars and shares

in thousands, except per share) Net revenues $

1,696,271 $ 1,551,009 Cost of goods sold 857,326

802,784 Gross profit 838,945 748,225 Selling, general

and administrative expenses 502,187 454,489 Research and

development expenses 65,045 56,278 Goodwill impairment — 332,128

Restructuring and other impairment charges 38,452 3,037 Gain on

sales of businesses and assets — (332 ) Income

(loss) from continuing operations before interest, loss on

extinguishments of debt and taxes 233,261 (97,375

)

Interest expense 56,905 69,565 Interest income (624 ) (1,571 ) Loss

on extinguishments of debt 1,250 —

Income (loss) from continuing operations before taxes 175,730

(165,369 ) Taxes on income (loss) from continuing operations

23,547 16,413 Income (loss) from continuing

operations 152,183 (181,782 ) Operating loss

from discontinued operations (including gain on disposal of $2,205

in 2012) (2,205 ) (9,207 ) Tax benefit on loss from discontinued

operations (1,770 ) (1,887 ) Loss from discontinued

operations (435 ) (7,320 ) Net income (loss) 151,748

(189,102 ) Less: Income from continuing operations attributable to

noncontrolling interest 867 955 Net

income (loss) attributable to common shareholders $ 150,881

$ (190,057 ) Earnings per share available to common

shareholders: Basic: Income (loss) from continuing operations $

3.68 $ (4.47 ) Loss from discontinued operations (0.01 )

(0.18 ) Net income (loss) $ 3.67 $ (4.65 )

Diluted: Income (loss) from continuing operations $ 3.46 $ (4.47 )

Loss from discontinued operations (0.01 ) (0.18 ) Net

income (loss) $ 3.45 $ (4.65 ) Dividends per common

share $ 1.36 $ 1.36 Weighted average common shares

outstanding: Basic 41,105 40,859 Diluted 43,693 40,859

Amounts attributable to common shareholders: Income (loss) from

continuing operations, net of tax $ 151,316 $ (182,737 ) Loss from

discontinued operations, net of tax (435 ) (7,320 )

Net income (loss) $ 150,881 $ (190,057 )

TELEFLEX INCORPORATED AND

SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

December 31, December 31, 2013

2012 (Dollars in thousands) ASSETS Current

assets Cash and cash equivalents $ 431,984 $ 337,039 Accounts

receivable, net 295,290 297,976 Inventories, net 333,621 323,347

Prepaid expenses and other current assets 39,810 28,712 Prepaid

taxes 36,504 27,160 Deferred tax assets 52,917 51,025 Assets held

for sale 10,428 7,963 Total current

assets 1,200,554 1,073,222 Property, plant and equipment, net

325,900 297,945 Goodwill 1,354,203 1,238,452 Intangible assets, net

1,255,597 1,058,792 Investments in affiliates 1,715 2,066 Deferred

tax assets 943 1,347 Other assets 70,095

61,863 Total assets $ 4,209,007 $ 3,733,687

LIABILITIES AND EQUITY Current liabilities Notes

payable $ 356,287 $ 4,700 Accounts payable 71,967 75,165 Accrued

expenses 74,868 65,064 Current portion of contingent consideration

4,131 23,693 Payroll and benefit-related liabilities 73,090 74,586

Accrued interest 8,725 9,418 Income taxes payable 23,821 16,895

Other current liabilities 22,231 5,779

Total current liabilities 635,120 275,300 Long-term borrowings

930,000 965,280 Deferred tax liabilities 514,715 418,874 Pension

and postretirement benefit liabilities 109,498 170,946 Noncurrent

liability for uncertain tax positions 55,152 61,979 Other

liabilities 48,506 59,771 Total

liabilities 2,292,991 1,952,150 Common

shareholders’ equity Common shares, $1 par value Issued: 2013 —

43,243 shares; 2012 — 43,102 shares 43,243 43,102 Additional

paid-in capital 409,338 394,384 Retained earnings 1,696,424

1,601,460 Accumulated other comprehensive loss (110,855 )

(132,048 ) 2,038,150 1,906,898 Less: Treasury stock, at cost

124,623 127,948 Total common

shareholders’ equity 1,913,527 1,778,950

Noncontrolling interest 2,489 2,587

Total equity 1,916,016 1,781,537

Total liabilities and equity $ 4,209,007 $ 3,733,687

TELEFLEX INCORPORATED AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH

FLOWS

Twelve Months Ended December 31,

December 31, 2013 2012 (Dollars in

thousands) Cash Flows from Operating Activities of Continuing

Operations: Net income (loss) $ 151,748 $ (189,102 ) Adjustments to

reconcile net income to net cash provided by operating activities:

Loss from discontinued operations 435 7,320 Depreciation expense

42,368 36,204 Amortization expense of intangible assets 50,608

44,264 Amortization expense of deferred financing costs and debt

discount 14,959 14,416 Loss on extinguishments of debt 1,250 —

Impairment of long-lived assets 3,460 — In-process research and

development impairment 7,381 — Change in contingent consideration

(12,642 ) 263 Stock-based compensation 11,871 8,623 Gain on sales

of businesses and assets — (332 ) Goodwill impairment — 332,128

Deferred income taxes, net (8,925 ) (39,178 ) Other (8,700 ) (3,776

)

Changes in operating assets and

liabilities, net of effects of acquisitions and disposals:

Accounts receivable (1,294 ) (2,932 ) Inventories (8,931 ) (1,970 )

Prepaid expenses and other current assets (5,926 ) 9,595 Accounts

payable and accrued expenses (684 ) (1,412 ) Income taxes

receivable and payable, net (7,107 ) (20,258 ) Net

cash provided by operating activities from continuing operations

229,871 193,853 Cash Flows from

Investing Activities of Continuing Operations: Expenditures for

property, plant and equipment (63,580 ) (65,394 ) Payments for

businesses and intangibles acquired, net of cash acquired (309,008

) (369,444 ) Proceeds from sales of businesses and assets, net of

cash sold — 66,660 Investments in affiliates (50 )

(80 ) Net cash used in investing activities from continuing

operations (372,638 ) (368,258 ) Cash Flows from

Financing Activities of Continuing Operations: Proceeds from

long-term borrowings 680,000 — Repayment of long-term borrowings

(375,000 ) — Debt extinguishment, issuance and amendment fees

(6,400 ) — Decrease in notes payable and current borrowings — (706

) Proceeds from stock compensation plans 7,609 9,003 Payments to

noncontrolling interest shareholders (736 ) — Payments for

contingent consideration (16,958 ) (17,596 ) Dividends

(55,917 ) (55,589 ) Net cash provided by (used in) financing

activities from continuing operations 232,598

(64,888 ) Cash Flows from Discontinued Operations: Net cash used in

operating activities (3,327 ) (7,799 ) Net cash used in investing

activities — (2,351 ) Net cash used in

discontinued operations (3,327 ) (10,150 ) Effect of

exchange rate changes on cash and cash equivalents 8,441

2,394 Net increase (decrease) increase in cash

and cash equivalents 94,945 (247,049 ) Cash and cash equivalents at

the beginning of the period 337,039 584,088

Cash and cash equivalents at the end of the period $ 431,984

$ 337,039

Teleflex IncorporatedJake ElguiczeTreasurer and Vice President

of Investor Relations610-948-2836

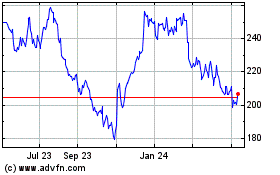

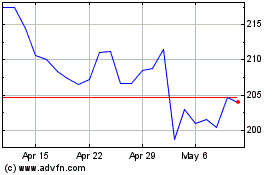

Teleflex (NYSE:TFX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Teleflex (NYSE:TFX)

Historical Stock Chart

From Apr 2023 to Apr 2024