Teleflex Gets 510(k) Clearance for Restated Indications - Analyst Blog

March 19 2014 - 3:00PM

Zacks

Teleflex Incorporated (TFX) revealed that it

has received 510(k) clearance from the U.S. Food and Drug

Administration (FDA) for its restated Indications for use of the

EZ-IO Vascular Access System. Following the announcement, shares of

the company rose 0.1% to close at $104.02 yesterday.

The restated indications will help clinicians to assess the tissue

depth and select the correct needle size for treating the patients.

For example, the restated indication for the EZ-IO 25 mm Needle Set

is recommended for use in patients weighing 3 kg or over. The 15 mm

and 45 mm needle sets should be used for patients weighing 3 to 39

kg and 40 kg or over, respectively.

EZ-IO Vascular Access System has been developed by Vidacare

Corporation, acquired by Teleflex in Dec last year. Vidacare is a

leading provider of intraosseous (IO), or inside the bone access

devices.

Teleflex posted an 18.3% rise in adjusted earnings to $1.36 per

share for the fourth quarter of 2013 from $1.15 per share in the

same quarter of 2012. With this, earnings significantly beat the

Zacks Consensus Estimate of $1.27.

Adjusted net earnings rose 22.9% to $58.5 million from $47.6

million in the year-ago quarter. Following the favorable

earnings announcement, shares of the company rose 0.8% till the

last closing date.

Net revenues went up 7.5% to $450.5 million, exceeding the Zacks

Consensus Estimate of $436 million. Excluding foreign exchange

fluctuations, net revenues rose 6.9% from the prior-year

quarter.

The increase in revenues was attributable to contribution from the

acquisitions of LMA International in Oct 2012 and Vidacare

Corporation, an increase in the average selling price of products,

launch of new products and an additional shipping day in the

reported quarter versus the same quarter of 2012.

For full year 2013, Teleflex reported a 13.5% rise in adjusted

earnings to $5.03 per share from $4.43 in 2012. Adjusted net

earnings rose 16.1% to $211.6 million from $182.2 million a year

ago. Net revenues went up 9.4% to $1,696 million. Excluding foreign

exchange fluctuations, net revenues rose 9.0% in the year.

For 2014, Teleflex anticipates revenue growth between 6.0 and 8.0%

versus 2013. In constant currency, the company expects revenues to

increase by 7.0 to 9.0%.

Teleflex also expects adjusted earnings per share in the range of

$5.35 to $5.55 for 2014. The current Zacks Consensus Estimate of

$5.51 lies within the guided range.

Currently, Teleflex carries a Zacks Rank #3 (Hold). Some

better-ranked stocks in the medical instruments industry include

Cynosure, Inc. (CYNO), Syneron Medical

Ltd. (ELOS), and ABIOMED, Inc. (ABMD).

Both Cynosure and Syneron Medical sport a Zacks Rank #1 (Strong

Buy), while ABIOMED carries a Zacks Rank #2 (Buy).

ABIOMED INC (ABMD): Free Stock Analysis Report

CYNOSURE INC-A (CYNO): Free Stock Analysis Report

SYNERON MED LTD (ELOS): Free Stock Analysis Report

TELEFLEX INC (TFX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

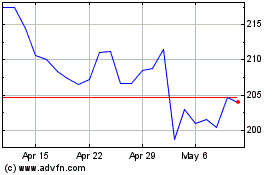

Teleflex (NYSE:TFX)

Historical Stock Chart

From Mar 2024 to Apr 2024

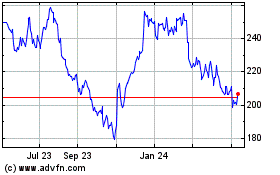

Teleflex (NYSE:TFX)

Historical Stock Chart

From Apr 2023 to Apr 2024