By Don Clark

Employees at private-equity firm Carlyle Group used to wait

several minutes to hours for its computer systems to churn out some

financial reports. Now such tasks are often completed in seconds,

thanks to new-wave data-storage hardware from a startup called

Tintri Inc. it began installing a year and a half ago.

"I could not believe the difference," said Alan Thompson,

Carlyle's vice president of global information-technology

services.

Such testimonials are becoming commonplace as one of Silicon

Valley's least-sexy sectors turns into one of its hottest.

Technology for helping companies store data--the high-tech

equivalent of filing cabinets--has become crucial to speeding

operations to make companies nimbler. The change is giving storage

gear a bigger claim on corporate information-technology

dollars.

Well-funded storage startups are pressuring technology giants

like International Business Machines Corp., Hewlett-Packard Co.,

Dell Inc., EMC Corp. and NetApp Inc. Some newcomers are targeting

specific incumbents, which have responded by buying or building new

kinds of storage hardware.

"It's a knife fight," said Jeremy Burton, EMC's president of

products and marketing, referring to the competitive

environment.

Venture capitalists pumped more than $6 billion into 96 startups

selling storage-related hardware, software and services between

2010 and the first half of 2015, according to CB Insights.

Some, like Pure Storage Inc., are exploiting a shift from disk

drives to faster flash memory chips. The Silicon Valley startup

recently filed to go public after reaching a $3 billion private

valuation last year.

Others are combining computing and storage in multipurpose boxes

for other speed and cost advantages. Two such companies, Nutanix

Inc. and SimpliVity Corp., have also topped billion-dollar

valuations.

One reason: Companies will spend more than $40 billion in 2015

on storage hardware alone, research firm International Data Corp.

estimates. Many of the vendors--whose systems typically cost from

tens of thousands of dollars to hundreds of thousands--had exhibits

at VMware Inc.'s annual conference in San Francisco over the past

week.

At the same time, computers, mobile devices and other gadgets

are generating a rising flood of data that must be stored on

company premises or on cloud services. An IDC study, sponsored by

EMC, last year estimated that the volume of digital bits from all

sources will grow 40% a year into the next decade.

Companies like Pure, Kaminario, Violin Memory Inc. and SolidFire

Inc. have responded with systems that store data on flash memory

rather than hard drives, which have spinning disks and electrical

motors that are prone to mechanical failures and consume more

energy than semiconductors. Data stored on such chips can be

retrieved about 20 times faster than from drives, estimates Andy

Walls, a 34-year veteran of IBM who is chief technology officer and

chief architect of its flash-based systems business. Flash "is

changing the landscape and changing it dramatically," he said.

Blackline Inc. is a believer. The accounting-software company

began installing flash-based storage equipment from the Boston-area

startup Kaminario in November. Alain Avakian, Blackline's chief

technology officer, said the technology sped up its website

operations by 30% to 40%; data starts transferring in less than a

thousandth of a second--more than 60 times faster than the

company's prior storage hardware. "The speed was incredible," he

said.

Makers of disk drives--a technology that emerged in the late

1950s--have had decades longer to drive down costs compared to

flash memory, which began reaching huge commercial volumes in the

past decade after it became a mainstay of smartphones. Though it

has steadily fallen in price, flash technology remains more

expensive per byte of data stored. A 1 terabyte drive based on the

newer technology, for example, retails for about $500, compared

with $50 for a comparable hard drive.

So some storage startups, including Tegile Inc., Reduxio Systems

Ltd., and Nimble Storage Inc., offer a mix of flash and disk drives

to provide both increased speed with large storage capacities.

Other startups, such as Nutanix and SimpliVity, are borrowing

techniques from large cloud services to combine servers and storage

in "hyperconverged" hardware that can be simpler to use and faster

than using separate boxes.

Many companies say their technical advantages have less to do

with the hardware they sell than the software that comes with it,

which handles chores like optimizing performance and backing up

data. Some new vendors, in fact, only sell software, betting on the

appeal of low-cost commodity servers packed with flash chips or

disk drives. Software-only startups include Scality Inc.,

PernixData Inc. and Formation Data Systems.

Vendors also point to a more subtle issue: labor. Many companies

with traditional storage systems employ staffers to manage backups

and maximize performance by distributing data to various devices.

Newer devices are designed to eliminate or automate many such

tasks.

"You don't need to do that anymore," said Joris Vuffray, head of

networking and systems management at the Switzerland-based lottery

operator Swisslos, describing his experience with Nutanix gear.

The startups are pushing ahead despite a move by many companies

to rent computing services from the likes of IBM, Google and

Amazon.com Inc., reducing their need to buy and own their own

storage hardware.

Pure, which has raised $470 million in funding, has hired away

dozens of EMC sales people to aid its effort to target the storage

giant's customers.

EMC has lodged lawsuits alleging theft of trade secrets and

patent infringement against Pure, which denies the claims and

accuses EMC of violating its own intellectual property. Litigation

is still pending. EMC also bought two flash-based startups.

Revenue from EMC's mature disk-based hardware has been declining

lately. But Mr. Burton predicted sales of flash-based hardware will

reach $1 billion this year, outselling the top three or four rival

vendors combined.

Write to Don Clark at don.clark@wsj.com

Access Investor Kit for "NIRI Demo Co"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US4592001014

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 04, 2015 19:43 ET (23:43 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

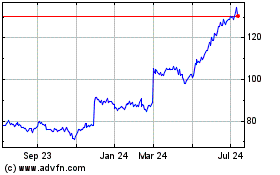

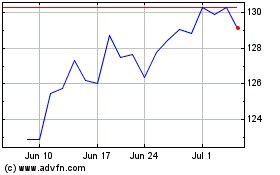

NetApp (NASDAQ:NTAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

NetApp (NASDAQ:NTAP)

Historical Stock Chart

From Apr 2023 to Apr 2024